How Renewables Could Slash Oil and Gas Production Emissions by 80%

- Electrifying upstream oil and gas production can reduce emissions by over 80%, offering a significant pathway to decarbonize the industry.

- Norway's success in utilizing renewable energy for upstream operations demonstrates the potential for widespread adoption.

- Flaring reduction and a focus on Premium Energy Basins are crucial strategies for achieving substantial emissions cuts in the oil and gas sector.

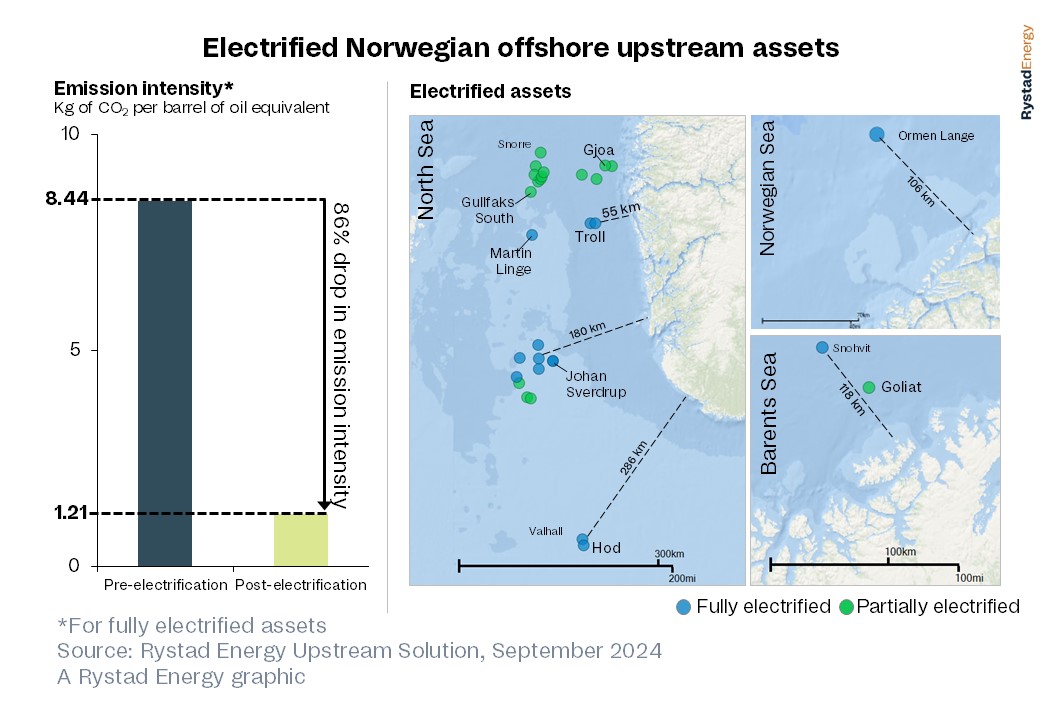

Converting upstream oil and gas production facilities to run on electricity powered by renewables or natural gas that would otherwise be flared could cut more than 80% of associated emissions, according to new research from Rystad Energy. Fully electrified rigs and other assets on the Norwegian Continental Shelf emit 1.2 kilograms of carbon dioxide per barrel of oil equivalent (kg of CO2 per boe) produced, an 86% drop from the 8.4 kg of CO2 per boe emitted by the same assets before electrification.

Norway is in a prime position that is almost unique among major oil and gas producers – it can tap into its abundant renewable energy resources, particularly hydroelectric power, to significantly reduce greenhouse gas emissions from upstream production. The country was an early mover in refitting its assets to run on clean power, and now has plans to cut emissions from the continental shelf by 70% by 2040. Most of the country’s key production sites are strategically located near potential renewable energy sources, facilitating the transition away from fossil fuels. Other producing countries may face logistical hurdles when converting assets, including significant distances from the mainland, a lack of power grid infrastructure and limited renewable power capacity.

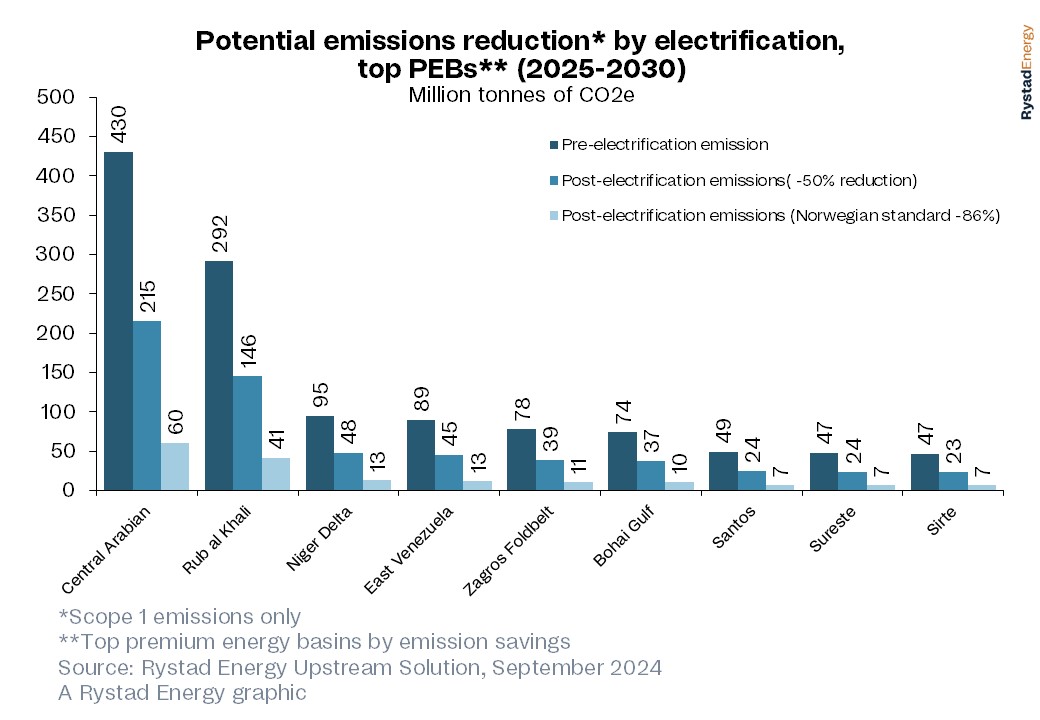

However, even a partial electrification will significantly cut emissions. Premium energy basins (PEB) – a term coined by Rystad Energy to describe oil and gas basins with ample hydrocarbon reserves and the potential to incorporate environmentally friendly practices – could hold the key. We have identified 30 such basins worldwide, which collectively contribute more than 80% of the world’s oil and gas this year and will continue to do so until 2050. If PEB assets electrify and reduce emissions by 50%, a total of 5.5 gigatonnes of carbon dioxide (Gt of CO2) would be avoided by 2050. Based on the accepted industry standard calculation, this CO2 reduction would equate to about 0.025 degrees Celsius of global warming avoided during the same period.*

As the world confronts the pressing issue of climate change, the oil and gas industry is under increasing pressure to minimize its carbon footprint and align its practices with global sustainability objectives. Where it’s possible and economically viable, electrification has great potential to lower the industry's emissions while maintaining production output. says Palzor Shenga, vice president of upstream research with Rystad Energy.

Palzor Shenga, Vice President, Upstream Research

*This calculation only includes upstream extraction emissions. It assumes that 222 GtCO2 emitted leads to 0.1°C warming, ref IPCC AR6 SPM D.1.1: "best estimate for TCRE is 0.45 degree per 1000 Gt CO2". Methane emissions are disregarded.

Learn more with Rystad Energy’s Upstream Solution.

Electrification requires careful planning, including the selection of optimal technologies, assessment of total costs and strategies to ensure a continuous energy supply, particularly in remote locations with limited grid access. Economic and financial viability must also be prioritized. A proactive approach to electrification can enhance operational efficiency and open new revenue streams through the sale of excess renewable energy.

To understand the impact of electrification on upstream emissions, we examined the potential for emission reduction in top PEBs. The 28 PEBs identified in the report offer estimated total emission savings of about 1.3 billion tonnes of CO2 between 2025 and 2030. The top 10 PEBs (by emissions savings) alone account for over 80% of these savings (Figure 3), with the Middle Eastern Rub al Khali (370 million tonnes of carbon dioxide equivalent [CO2e]) and Central Arabian (251 million tonnes of CO2e) leading the charts. Electrification in these predominantly onshore basins, if adopted more widely, would largely be driven by drawing power from a clean onshore grid.

Flaring, the practice of burning off excess natural gas that cannot be processed or sold, not only wastes a valuable resource but also emits substantial amounts of CO2 and methane into the environment. Flaring plays a major role in global emissions primarily due to the lack of economic incentives, regulatory frameworks or technical capabilities to develop gas markets and infrastructure. About 140 billion cubic meters per annum of gas has been flared globally in the last 10 years, equaling about 290 million tonnes of CO2e emissions annually. These volumes are primarily driven by major producers in North America, the Middle East and Africa. Hence, flaring avoidance can be an effective way of reducing upstream emissions for both electrified assets and assets with limited electrification potential.

- Electrifying upstream oil and gas production can reduce emissions by over 80%, offering a significant pathway to decarbonize the industry.

- Norway's success in utilizing renewable energy for upstream operations demonstrates the potential for widespread adoption.

- Flaring reduction and a focus on Premium Energy Basins are crucial strategies for achieving substantial emissions cuts in the oil and gas sector.

Converting upstream oil and gas production facilities to run on electricity powered by renewables or natural gas that would otherwise be flared could cut more than 80% of associated emissions, according to new research from Rystad Energy. Fully electrified rigs and other assets on the Norwegian Continental Shelf emit 1.2 kilograms of carbon dioxide per barrel of oil equivalent (kg of CO2 per boe) produced, an 86% drop from the 8.4 kg of CO2 per boe emitted by the same assets before electrification.

Norway is in a prime position that is almost unique among major oil and gas producers – it can tap into its abundant renewable energy resources, particularly hydroelectric power, to significantly reduce greenhouse gas emissions from upstream production. The country was an early mover in refitting its assets to run on clean power, and now has plans to cut emissions from the continental shelf by 70% by 2040. Most of the country’s key production sites are strategically located near potential renewable energy sources, facilitating the transition away from fossil fuels. Other producing countries may face logistical hurdles when converting assets, including significant distances from the mainland, a lack of power grid infrastructure and limited renewable power capacity.

However, even a partial electrification will significantly cut emissions. Premium energy basins (PEB) – a term coined by Rystad Energy to describe oil and gas basins with ample hydrocarbon reserves and the potential to incorporate environmentally friendly practices – could hold the key. We have identified 30 such basins worldwide, which collectively contribute more than 80% of the world’s oil and gas this year and will continue to do so until 2050. If PEB assets electrify and reduce emissions by 50%, a total of 5.5 gigatonnes of carbon dioxide (Gt of CO2) would be avoided by 2050. Based on the accepted industry standard calculation, this CO2 reduction would equate to about 0.025 degrees Celsius of global warming avoided during the same period.*

As the world confronts the pressing issue of climate change, the oil and gas industry is under increasing pressure to minimize its carbon footprint and align its practices with global sustainability objectives. Where it’s possible and economically viable, electrification has great potential to lower the industry's emissions while maintaining production output. says Palzor Shenga, vice president of upstream research with Rystad Energy.

Palzor Shenga, Vice President, Upstream Research

*This calculation only includes upstream extraction emissions. It assumes that 222 GtCO2 emitted leads to 0.1°C warming, ref IPCC AR6 SPM D.1.1: "best estimate for TCRE is 0.45 degree per 1000 Gt CO2". Methane emissions are disregarded.

Learn more with Rystad Energy’s Upstream Solution.

Electrification requires careful planning, including the selection of optimal technologies, assessment of total costs and strategies to ensure a continuous energy supply, particularly in remote locations with limited grid access. Economic and financial viability must also be prioritized. A proactive approach to electrification can enhance operational efficiency and open new revenue streams through the sale of excess renewable energy.

To understand the impact of electrification on upstream emissions, we examined the potential for emission reduction in top PEBs. The 28 PEBs identified in the report offer estimated total emission savings of about 1.3 billion tonnes of CO2 between 2025 and 2030. The top 10 PEBs (by emissions savings) alone account for over 80% of these savings (Figure 3), with the Middle Eastern Rub al Khali (370 million tonnes of carbon dioxide equivalent [CO2e]) and Central Arabian (251 million tonnes of CO2e) leading the charts. Electrification in these predominantly onshore basins, if adopted more widely, would largely be driven by drawing power from a clean onshore grid.

Flaring, the practice of burning off excess natural gas that cannot be processed or sold, not only wastes a valuable resource but also emits substantial amounts of CO2 and methane into the environment. Flaring plays a major role in global emissions primarily due to the lack of economic incentives, regulatory frameworks or technical capabilities to develop gas markets and infrastructure. About 140 billion cubic meters per annum of gas has been flared globally in the last 10 years, equaling about 290 million tonnes of CO2e emissions annually. These volumes are primarily driven by major producers in North America, the Middle East and Africa. Hence, flaring avoidance can be an effective way of reducing upstream emissions for both electrified assets and assets with limited electrification potential.

Renewable Energy's Rise Creates Challenges for Traditional Power Utilities

- The increasing prevalence of renewable energy sources, particularly solar power, is disrupting the traditional power industry and creating challenges for utilities.

- To remain competitive, energy companies must adopt holistic thinking, diversify their portfolios, and embrace customer-centric strategies.

- The integration of data analytics, software, and smart systems will be crucial for optimizing market performance and navigating the evolving energy landscape.

Renewable energy generation in Europe has surged over 280% since 2000 and now accounts for more than 50% of the continent’s total power generation. Solar power has seen particularly strong growth in recent years due to significant cost declines. However, the rise of renewables has also led to challenges for the power industry, as the sector’s underlying profitability declines and an increasingly competitive energy landscape emerges.

Apart from hydropower, the operational performance of most renewable power assets is determined by a combination of weather and consumption patterns, meaning they cannot be ‘market optimized’ to generate when prices are high in the way that gas power assets can, for instance. This especially hits solar power plants, as these typically generate power in the middle of the day when, although cooling systems run full throttle during summertime in Europe, demand is not sufficient of offtake generation, which leads to low realized prices. In addition, solar panels do not generate any power at night, when prices often are higher. An increasingly popular solution for asset owners is to pair intermittent renewables with power storage capabilities, such as batteries. However, these only offset the shortcoming in part. As a result, capture rates (the prices attained compared to average market prices over time) for solar power are plummeting along with increased deployment of the technology.

While initially masked by the power price response in the wake of Russia’s invasion of Ukraine and Europe’s ensuing shift away from Russian gas, wholesale power prices across Europe are increasingly under pressure from hybrid renewable projects with close-to-zero marginal costs, which in turn is undercutting the revenue potential of the region’s power market.

Meanwhile, governmental support for renewable energy is also changing. Renewable projects are underwritten through governmental support mechanisms such as contracts for difference (CfDs) and feed-in tariffs, which guarantee predictable revenue streams for renewable energy producers. However, as the cost of renewable energy technologies have decreased, these support schemes may gradually be scaled back.

Compounding this is the evolving nature of the energy landscape which has intensified competition within the sector. Europe’s power sector was previously dominated by dedicated renewable developers and utilities, but is now seeing new entrants such as oil and gas companies, power traders and innovative power demand management players. Similarly, new types of demand is emerging such as data center players requiring consistent, high-volume, 24-hour power supply.

The solution to the current challenges lies in diversification and innovation, driving balanced portfolio generation profiles and enabling market optimization. Beyond building and leveraging the full flexibility of a diversified portfolio of solar, wind, storage, and thermal generation, more customer-centric strategies are emerging. Octopus Energy is a British software and power trading company that works to balance power supply and demand through demand-side smart devices such as electric vehicle (EV) chargers, lighting systems, and heat pumps. Similarly, integrated oil and gas players such as TotalEnergies are using the knowledge attained in business-to-consumer markets through the gasoline and retail end of the business to enter the demand-side power market, mimicking their success in oil and gas.

The integration and interconnection of systems across the entire power market value chain, along with the efficient processing of large datasets and the automation of energy dispatch, are becoming essential for modern energy companies. Software and smart systems will be key to this, emphasizing advanced technical capabilities and data analytics over the traditional supply-to-market business model that utilities have traditionally subscribed to. By embracing these changes, energy companies can better position themselves for success in a rapidly changing power industry.

Geothermal Energy Could Outperform Nuclear Power

- Enhanced geothermal systems, utilizing fracking technology, could unlock vast geothermal resources and make geothermal energy widely accessible.

- Geothermal energy offers a reliable, base-load power source with zero carbon emissions, and has the potential to outperform nuclear energy.

- With strong bipartisan support and public-private investment, geothermal energy is poised for rapid growth and could play a crucial role in meeting future energy demands and combating climate change.

Geothermal is about to have its moment in the sun. Heat from the Earth’s core could provide a clean, steady, and limitless source of renewable energy to humans. The trick is finding the right technology to harness that heat.

Until very recently, geothermal energy for commercial use has only been feasible in places where that heat naturally reaches the surface of the Earth, such as geysers and hot springs. For example, Iceland gets a quarter of its energy from geothermal energy. But Iceland is a geological anomaly. Globally, geothermal energy accounts for just 0.5% of renewable energy. But now, the application of fracking technology borrowed from the oil and gas sector could totally revolutionize geothermal energy availability, and possibly even bring it to your own backyard.

Geothermal energy can be tapped anywhere and everywhere, if you have the will and the way to dig deep enough. And this could soon be possible at an economically viable scale through a method known as ‘enhanced geothermal systems’ which can tap into heat far, far below the ground. According to a 2023 report from Esquire, this technology, adapted from hydraulic fracturing used in the oil and gas industry, will “allow us to exploit the energy underfoot across the country, all with a carbon impact that is vanishingly small compared to most sources we depend on now.” These deep wells would pump out hot water, which can be used in turn to produce energy through various methods, before injecting that water back into the ground.

The potential for enhanced geothermal is massive – the Economist even projects that it could outperform nuclear energy output, while offering similar benefits. Like nuclear, geothermal operates with proven technologies, offers base-load, on-demand energy, and produces zero carbon emissions. The United States Department of Energy (DoE) has posited that geothermal energy could power up to 260 million homes nationwide by 2050.

It also has major bipartisan appeal, a huge boon to any new technologies hoping to get sizable and continued funding from government entities and private interests alike. The DoE projects that as little as $25 billion in public-private investment (less than the cost of the Vogtle nuclear power plant alone) by 2030 would allow the domestic geothermal sector to “reach liftoff” and set the industry up to reach a commercial scale by mid-century. Already, the federal government is funding research proving early-stage geothermal technology and setting the stage for the privatized acceleration of research and development.

Just this month, representatives from major oil companies and tech startups, as well as scientists and climate groups, met in Houston to kick off a $10 million series of summits focused on harnessing experience and technology gleaned from oil and gas to “build a new stalwart of the American power sector.” A bustling geothermal startup scene has cropped up in Texas as the stars align for geothermal’s meteoric rise in the United States energy mix.

Despite the groundswell of support for enhanced geothermal technologies and a bullish attitude from the private and public sectors alike, the geothermal sector still has a long way to go to achieve its potential. “As things currently stand, the geothermal sector has struggled with the common problems of emerging industries: the difficulty of raising sufficient money for projects that, however promising, have yet to prove themselves,” The Hill recently reported.

But if successful, commercial-scale geothermal energy's potential applications and impacts are nearly limitless. It would introduce a critical new source of dependable, zero-carbon power to the energy mix and provide a potential solution to some of our most pressing energy security issues. Already, pundits are positing that geothermal could feed the insatiable energy demands of Artificial Intelligence, as well as providing an avenue to cheaply produce green hydrogen, which could be essential in decarbonizing hard-to-abate sectors such as heavy-duty trucking, shipping, aviation, iron and steel, and chemicals and petrochemicals.

By Haley Zaremba for Oilprice.com

No comments:

Post a Comment