With Two Weeks Left and No Talks, Industry Prepares for ILA Strike

Today marks two weeks till the likely first day of a crippling strike for containers and Ro-Ro traffic at U.S. East and Gulf Coast ports as the International Longshoremen’s Association has refused to resume negotiations on the master contract. With no signs of government intervention despite urging from shippers, the industry is looking for alternatives while analysts attempt to forecast the impact.

A wide collation of 177 trade associations ranging from manufacturers to farmers, wholesalers, retailers, manufacturers, and many others in the supply chain, issued an open letter to President Joe Biden expressing “significant concern about the state of the negotiations,” saying it is “imperative” for the administration to get the sides back to the negotiating table.

The ILA, however, issued a new statement focusing entirely on wages and rehashing old wage increases, or the lack thereof, dating back to the 1990s. Citing inflation and years of low increases, the ILA says “spotty yearly increases” are history. The ILA said it will reject the USMX (United States Maritime Alliance) position on new entry wage, and calls for large increases.

The union writes that it has been preparing for over a year and the time is now to take a “stand and fight a higher level of wages.” Without indicating any willingness to resume the negotiations which have been at an impasse since June, the ILA says a strike “seems more likely.”

Terminal operators represented by the USMX have repeatedly called for a resumption of negotiations. Their statements talk of “industry-leading” wage offers, which the ILA rejects as misleading.

“A strike at this point in time would have a devastating impact on the economy, especially as inflation is on the downward trend,” the collation of trade associations predicts in its letter.

The White House and administration have not indicated that it would be stepping in during the remaining two weeks. Reuters is quoting a source today saying the administration has decided not to invoke the Taft-Hartley Act which would permit it to invoke a cooling-off period to extend negotiations. Last year, however, the White House sent the Acting Secretary of Labor, Julie Su, to assist with the contract talks on the West Coast. She was credited as being instrumental in getting an agreement after a year of negotiations and growing labor actions disrupting the ports.

It will be the first coastwide strike on the East Coast since the 1970s, leaving analysts unsure what will happen. Some are predicting massive worldwide backlogs and repercussions if the strike drags on with the carriers also forecasting a likely wide impact on an industry already under pressure from disruptions.

CMA CGM wrote to customers yesterday saying it knows there will be increasing attention on the negotiations in the next two weeks. It says it is “ready, willing, and able to provide customers with solutions and alternate modalities to keep supply chains moving as best as possible.”

The Port of Long Beach reported yesterday that it had its busiest month ever in August with a 40 percent year-over-year increase in import volumes. They cited cargo diversions and concerns about the U.S. tariff increases on China while saying they were preparing for “the uptick in shipments and continued growth through the rest of the year.”

The ILA however has already cited how it picketed ships on the West Coast that were attempting to divert cargo during its last strike.

Canadian ports might be able to take some of the U.S. volume. Analysts have also predicted that it could be a significant boost to the air cargo sector.

Cargo industry analyst Container xChange told customers today, that for container trading and leasing companies, the disruptions could lead to significant delays and port congestion, impacting equipment turnaround times. They noted shippers are in a traditional peak season but many took steps to prepare.

“While the threat of strikes looms large, it’s important to note that U.S. inventories are currently strong due to the pulling forward of orders earlier this year to avoid existing disruptions. This stockpile will act as an essential buffer, mitigating the risk of container rates spiking dramatically due to the strikes,” said Christian Roeloffs, co-founder and CEO of Container xChange. He predicted, “the overall impact will largely depend on the duration of the strikes, with prolonged disruptions having the potential to intensify the implications for supply chains, leading to more pronounced bottlenecks and greater challenges in container availability.”

Shippers Warned of Surcharges and Delays Due to Pending ILA Strike

Carriers are taking further steps to prepare for the increasing likelihood of a strike at U.S. ports along the East Coast and Gulf Coast. With no apparent progress to break the impasse between the International Longshoremen’s Association and the US Maritime Alliance, carriers are announcing surcharges to help address potential disruptions while they expect continued strength in the peak season and warn of congestion already at ports around the world.

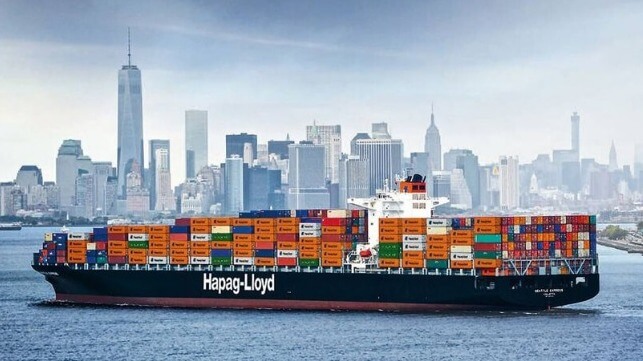

Both CMA CGM and Hapag-Lloyd followed an earlier notification by MSC Mediterranean Shipping Company informing customers of their intent to start charging surcharges for both imports and exports from the impacted ports. The Federal Maritime Commission requires a 30-day notification to customers of any additional fees.

MSC is calling it an “Emergency Operations Surcharge,” and has timed it to start on October 1 the expected first day of the coastwide strike. It applies to containers coming from Europe and ranges from $1,000 for a standard 20-foot box to $1,500 for a larger 40-foot box. CMA CGM did not give it a fancy name but in a Customer Advisory dated yesterday announced charges ranging between $800 and $1,500 for exports depending on the specifications of the box and a flat $1,500 per TEU for all imports bound for the U.S. East/Gulf Coast ports. CMA CGM’s surcharge is effective starting October 11.

Hapag introduced a new nomenclature warning a “Work Disruption Surcharge (WDS)” is coming up. They told customers the charge would go into effect on October 18 and it amounts to $1,000 per TEU on all imports.

Hapag is telling export customers that it will continue to accept bookings “as long as rail providers and terminals are accepting containers.” For importers, they are encouraging them to expedite documentation and customs clearance to “facilitate the prompt retrieval of your cargo from the terminal before any potential work stoppage.”

These warnings come as Maersk in a new market update said “there is considerable uncertainty attached to Q4 volumes,” while highlighting that its last full-year forecast was for demand growth in the range of 4 to 6 percent range. They reported global container volumes grew by 6.6 percent year-over-year in Q2 2024, supported by robust imports to North America and Latin America, and continued strong exports from the Far East Asia region.

Maersk continues to warn customers of pockets of port congestion around the world, especially impacting services in the Mediterranean and East Asia.

The carriers are universal in saying that the supply chain remains fragile and that a U.S. strike could have significant impacts. Maersk has said, “Even a short disruption could require weeks to fully resolve, leading to significant backlogs and delays.”

Analytics firm Sea-Intelligence in its analysis said that it believes the U.S. ports could have 13 percent excess capacity for October beyond the projected 2.3 Million TEU. Sea-Intelligence calculated that a 1-week strike at the beginning of October, would not be cleared until mid-November. They said a 2-week strike, would mean that U.S. ports would not be back to normal operations until 2025.

The carriers in announcing their new surcharges called them “indefinite” in their duration.

Volume Surge Continues at SoCal Ports as They Watch East Coast Developments

Southern California's two large ports, which are also the largest in the United States, each reported an ongoing surge in volumes during August and an expectation that volumes will continue to be strong. The ports believe that some cargo has been diverted while persistent strong consumer sales, a positive economy, and efforts to manage by importers, are all contributing to the increases in volumes.

Both ports had strong July results and even stronger August volumes. For Long Beach, it was the busiest month in the 113-year history of the port. Los Angeles came in just below its historic threshold of 1 million TEU reporting what it called “the busiest non-pandemic month ever at the port.”

The port executives varied on their views of the factors contributing to the continued strong increases in import volumes. They agreed it is a strong peak season while emphasizing that the ports have been successful in managing and have the capacity for further increases.

“Cargo diversions and concerns about upcoming tariffs are creating a busy peak season for us,” said Port of Long Beach CEO Mario Cordero. “We’re prepared for the uptick in shipments and continued growth through the rest of the year with a dedicated waterfront workforce, modern infrastructure, and plenty of capacity across our terminals.”

Container volume in Long Beach was up overall 34 percent to nearly 914,000 TEU. Imports were the strongest factor up 40 percent versus a year ago and 5 percent over July.

Gene Seroka, the Executive Director for the Port of Los Angeles, and George Goldman, the President and CEO of the North America division of CMA CGM, during a press briefing, conceded that there was “some front loading” and some “reallocation of volume” by customers due to the issues in the East Coast labor negotiations. They however also cited the Red Sea diversions and other factors saying the market remains very dynamic. They would not confirm that customers had started shifting cargo fearing a strike by the International Longshoremen’s Association in less than two weeks at U.S. East and Gulf Coast ports.

Los Angeles highlighted that it handled 97 containerships in August including a record 32 each with a capacity above 10,000 TEU. Imports topped 500,000 TEU for the second month in a row with imports up nearly 18 percent over last year and nearly 2 percent over July.

Seroka said he expects that the port will again handle more than a total of 900,000 TEUs in September noting they are already off to a strong start. He thinks there is still some momentum left in an already exceedingly strong peak season.

“Some of the cargo arriving now is replenishing inventories even beyond the year-end holiday season. Combined with a steady flow of manufacturing parts and components, we should continue to see elevated volume in the near term,” said Seroka.

Historically the Port of Los Angeles had a capacity of around 1 million TEU with Seroka saying they are currently running at 80 percent of capacity. He acknowledged a “micro spike” in dwell times at the railroad connections saying they were addressing those issues but that overall, the cargo velocity remains positive in the Prot of Los Angeles.

With recent advancements in technology and management cargo along with and working from lessons learned, he projects the Port of Los Angeles now has a capacity of up to approximately 1.2 million TEU per month. He points to the recent successes in managing the latest surge and is confident they will be able to handle continued growth.

For now, the Port of Los Angeles and CMA CGM said it is “wait and see” while managing the issues as they arise. They are hopeful the employers and ILA will return to the negotiations saying that even a one-day disruption would be too many in a very dynamic supply chain. They said it is critical to have all ports working efficiently as the U.S. economy continues strong.

No comments:

Post a Comment