Op-Ed: U.S. Tariffs Won't Slow Down China's Clean-Energy Sector

Compared to its other export industries, China’s cleantech is much less vulnerable to Trump administration trade measures

[By Lauri Myllyvirta and Hubert Thieriot]

Clean energy technology, particularly the “new three” of solar power, batteries and electric vehicles, emerged as an important source of growth in China’s exports in 2023. Thanks to booming markets at home and abroad, clean energy has become a key driver of economic growth.

A lot of media and policymaker attention is focused on possible US and European tariffs on China’s cleantech exports, with the perception that these could be a major blow to the industry.

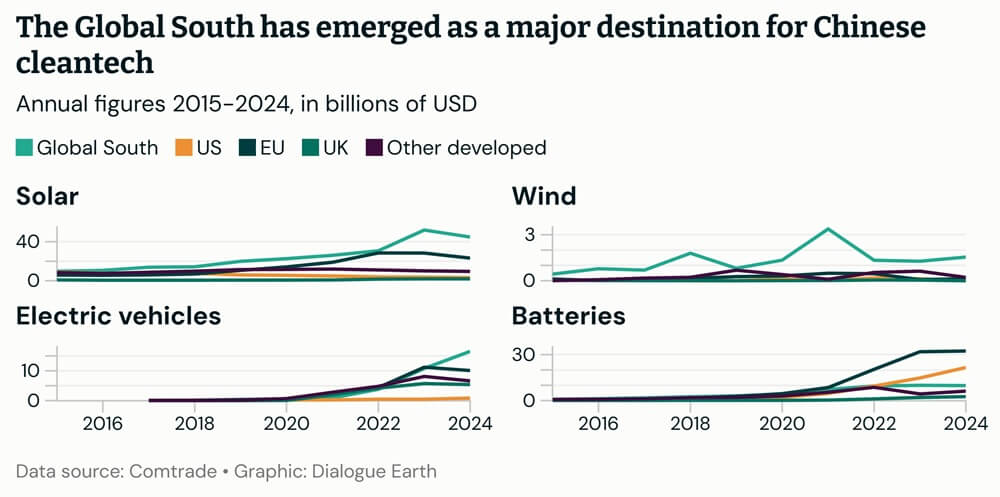

What is missing from this picture is that half of all China’s exports of solar and wind power equipment and electric vehicles (EVs) now go to the Global South, according to UN Comtrade data. Emerging and developing countries have driven most of the recent growth in export volumes.

In 2024, the value of EV exports from China to the Global South overtook those to the EU, with China’s exports to developed markets falling and those to developing markets posting strong growth.

As we will see, Global South countries collectively have been the largest importer of solar and wind power equipment from China since at least 2015, but the gap widened in 2023, when the volume of these solar imports from China grew 70% year-on-year.

The US is a niche market for China’s cleantech

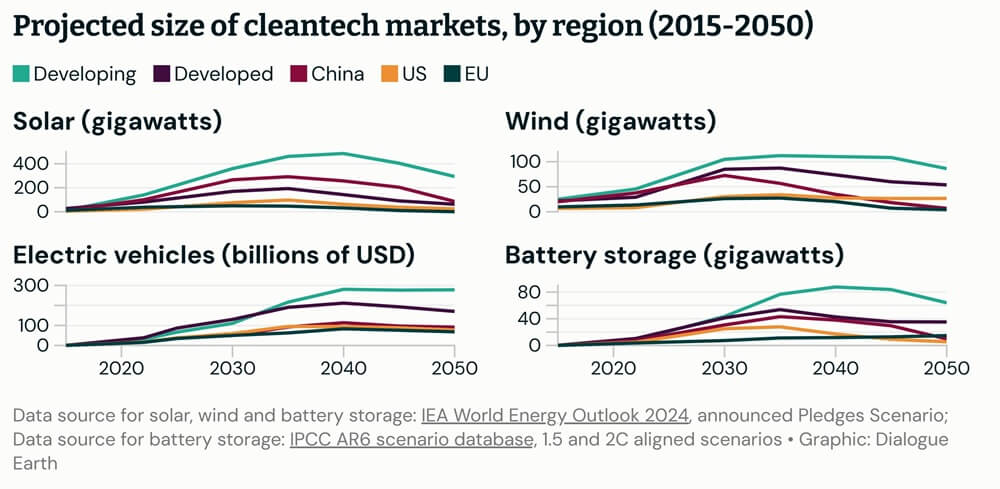

Solar and other clean energy have gone global in the past decade. In 2010-2015, 70% of solar and 50% of global wind installation occurred in developed economies. By 2023, these shares had fallen to just over 20%.

The US now represents only 7% of the global market for newly installed solar power plants, and even the European Union and the US combined make up less than 20%.

The US has imposed tariffs on imports from China for a long time and, as a result, most of its supply already comes from other producers. Only 4% of China’s total exports of solar power and wind power equipment and EVs go to the US, compared with 15% of China’s overall exports.

This means that China’s cleantech exports are much less reliant on the US in particular and western markets in general than its export industries overall. In a market where sales volumes are growing at 30% this year, the US is a footnote.

While the majority of solar, wind and EV exports already go to the Global South, the US and the EU remain the dominant importers of batteries. These are intermediate inputs into vehicle production and other manufacturing. Targeting them with high tariffs would hurt local manufacturing.

Cleantech exports to Global South are booming

The falling reliance on developed markets comes down to China’s cleantech manufacturing boom having catalysed rapid deployment of solar, wind and EVs in the Global South. Around 47% of China’s exports of these products went to the Global South in 2024, a record-high share and close to matching exports to developed countries for the first time.

From 2021 to 2024, emerging and developing markets drove 70% of the growth in China’s exports of solar, wind and EVs, with seven of the ten top growth markets located in the Global South.

Examples include solar power booms in South Africa and Pakistan, and strong growth in for example Brazil and Thailand. The five largest importers of wind power technology from China are all developing countries – South Africa, Egypt, Chile, Brazil and Uzbekistan – as are the five largest growth markets for solar: Saudi Arabia, Pakistan, Uzbekistan, Indonesia and India. Two Global South countries also feature on the list of the five largest importers of EVs – Brazil and Thailand.

This trend is expected to continue. Emerging and developing countries are expected to have a market share of 70% in solar PV and 60% in wind and in battery storage during this decade out to 2030, according to the International Energy Agency’s World Energy Outlook.

The US and other developed country markets are more significant in electric vehicles, due to high private car ownership. Yet, in the IPCC 1.5 and 2C pathways, the share of the US and the EU in global investment in electrified transportation falls from almost 50% in 2022 to 36% by 2035, with two-thirds of the market growth coming from outside these two regions. If Donald Trump’s policies slow down the electrification of the transport sector in the US, the significance of these markets will diminish further.

China’s increasing efforts to increase clean energy lending and co-operation will also stimulate demand from the Global South. Examples of this include recently announced new green energy deals with Indonesia, increased financing of renewable energy projects such as in Africa and Central Asia, and increasing share of renewable energy in projects under the Belt and Road Initiative.

Decoupling efforts will have a limited impact on China’s cleantech industry

China’s dominance in clean energy manufacturing has caused some major economies to try to diversify or decouple their supply chains from it. The US and India have clearly committed to slashing their dependence on China. Even those two markets have a very long way to go to meet their own demand without relying on the East Asian nation.

For example, the solar equipment production capacity in the world outside of China is barely sufficient to cater to the US market, meaning there is little possibility for other buyers to switch to non-Chinese supply. India is adding a significant amount of production capacity for solar cells and panels, but capacity additions in the key upstream input, polysilicon, are much more modest.

It’s entirely possible for the US and India to build their own supply chains for solar. Yet the impact on China’s cleantech industry will be limited, as the two countries’ strategy for doing this relies on high tariffs to shelter domestic production. This means that their producers won’t be able to compete overseas, surrendering this market to China.

While the US and India already have policies in place, the EU is torn between conflicting impulses. The bloc needs clean energy technology to meet climate targets, reduce reliance on imported fossil fuels and bring down energy prices. The EU is concerned about reliance on China but lacks the industrial policy framework to address the issue, and will find it hard to match the US on spending. The bankruptcy of Swedish battery maker Northvolt, dubbed “Europe’s best shot at a homegrown electric-vehicle battery champion”, made this evident. The industrial and supply-chain policies needed to reduce the EU’s reliance on cleantech imports from China could yet emerge, but the bloc can hardly afford to slow down clean energy deployment during the long period that such policies would take to yield results.

As other major economies pursue diversification, Beijing should have little to complain about. It has largely ringfenced its own domestic cleantech market – by far the largest in the world – to exclude imported products. How this has been done matters. Tariffs raise the cost of the targeted technologies and therefore have the potential to slow down the energy transition. While China has used trade barriers, the main thrust has been supporting and subsidising domestic supply of cleantech, in the process driving down prices and speeding up adoption not just in China but globally.

China has a strong self-interest in the global energy transition

Given the minor significance of the US market for China’s clean energy industry, the only real risk from the Trump administration to the industry would be if he succeeds in slowing down global climate action. This seems unlikely, as clean energy adoption is driven by economics more than altruistic global goals.

Given the important role that clean energy technology plays in the country’s economy and exports, China has a strong interest in making sure the global energy transition keeps accelerating. That will be seen in bilateral lending and diplomacy, and could also lead the country to take more forward-leaning positions in multilateral climate negotiations.

Lauri Myllyvirta is senior fellow at Asia Society Policy Institute, China Climate Hub. He is also the lead analyst of Centre for Research on Energy and Clean Air.

Hubert Thieriot is data lead at the Centre for Research on Energy and Clean Air.

This article appears courtesy of Dialogue Earth and may be found in its original form here.

_11266.jpg)

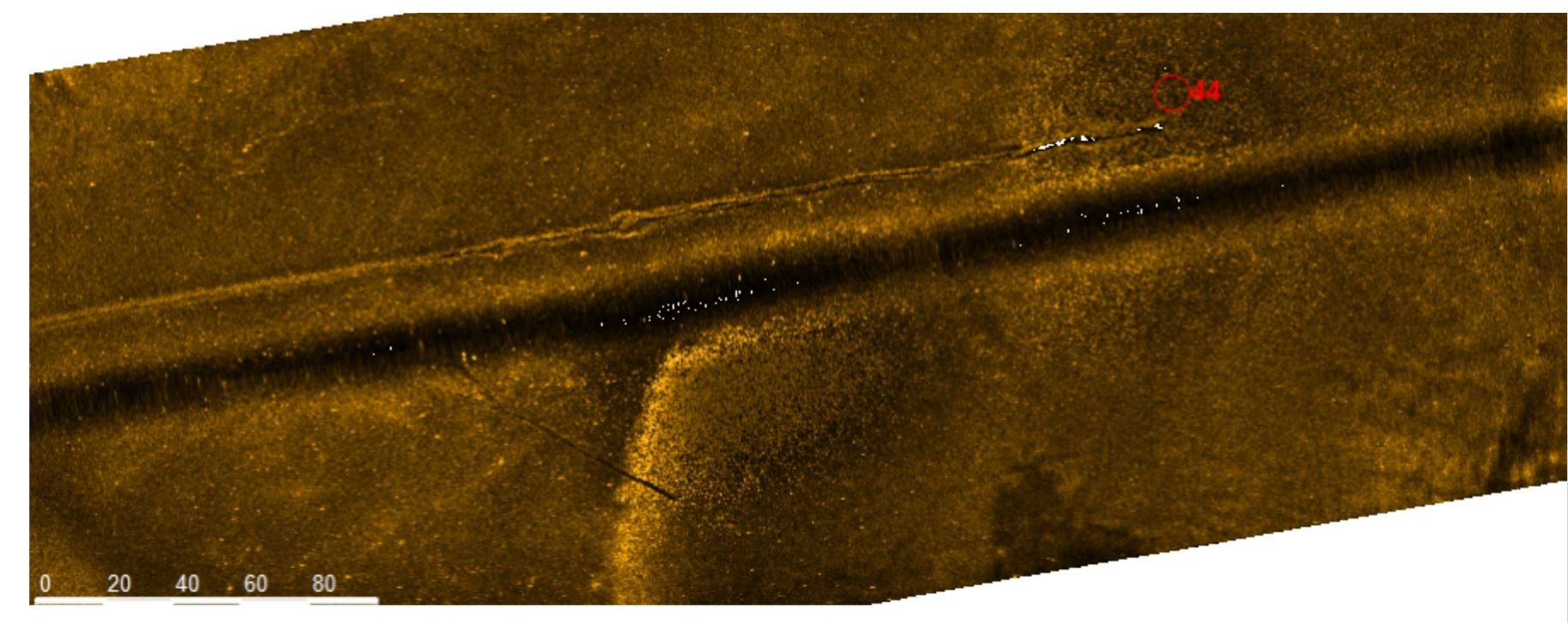

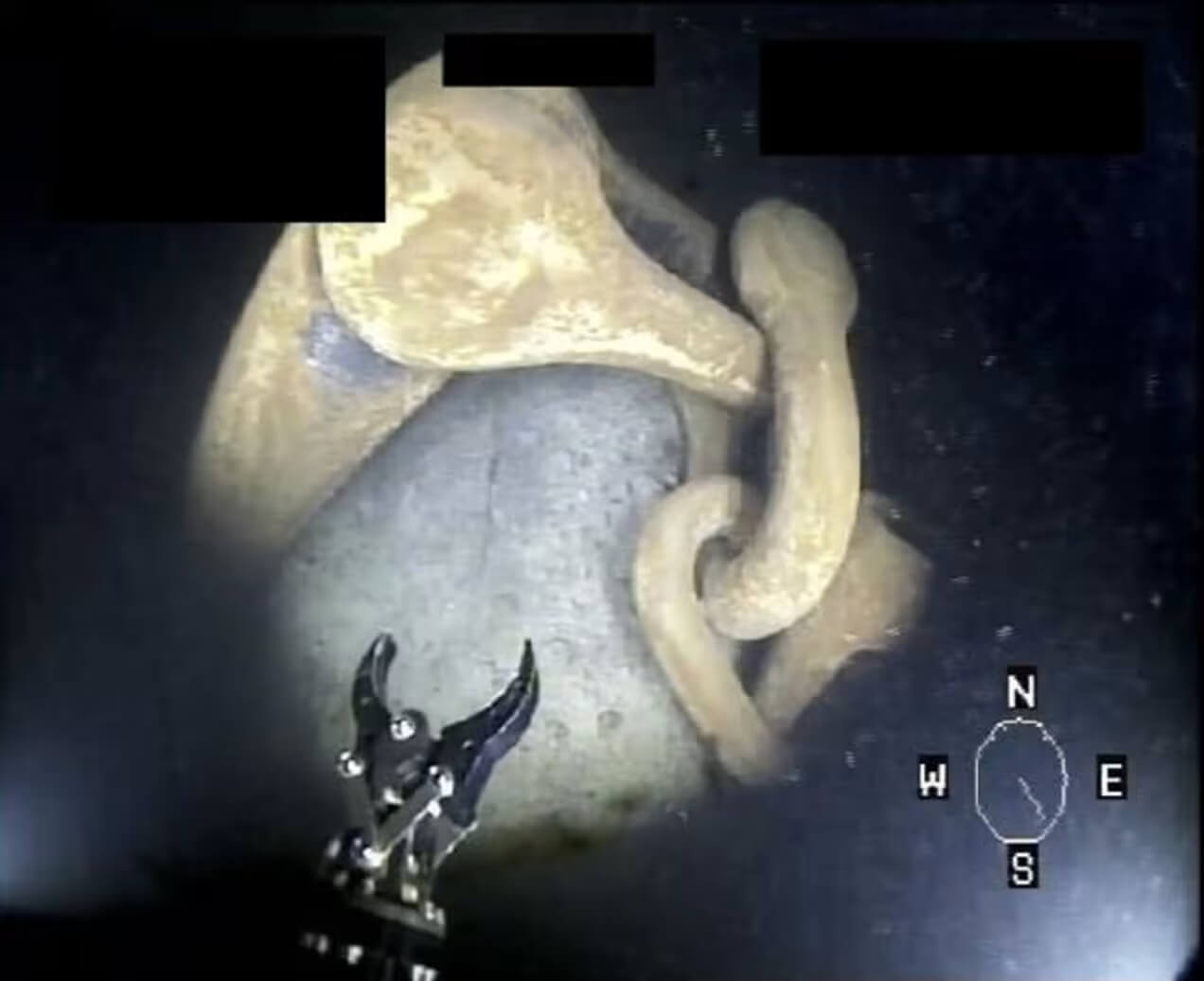

Track of the anchor drag line and the location of the lost anchor (sonar image courtesy NBI)

Track of the anchor drag line and the location of the lost anchor (sonar image courtesy NBI) Courtesy NBI

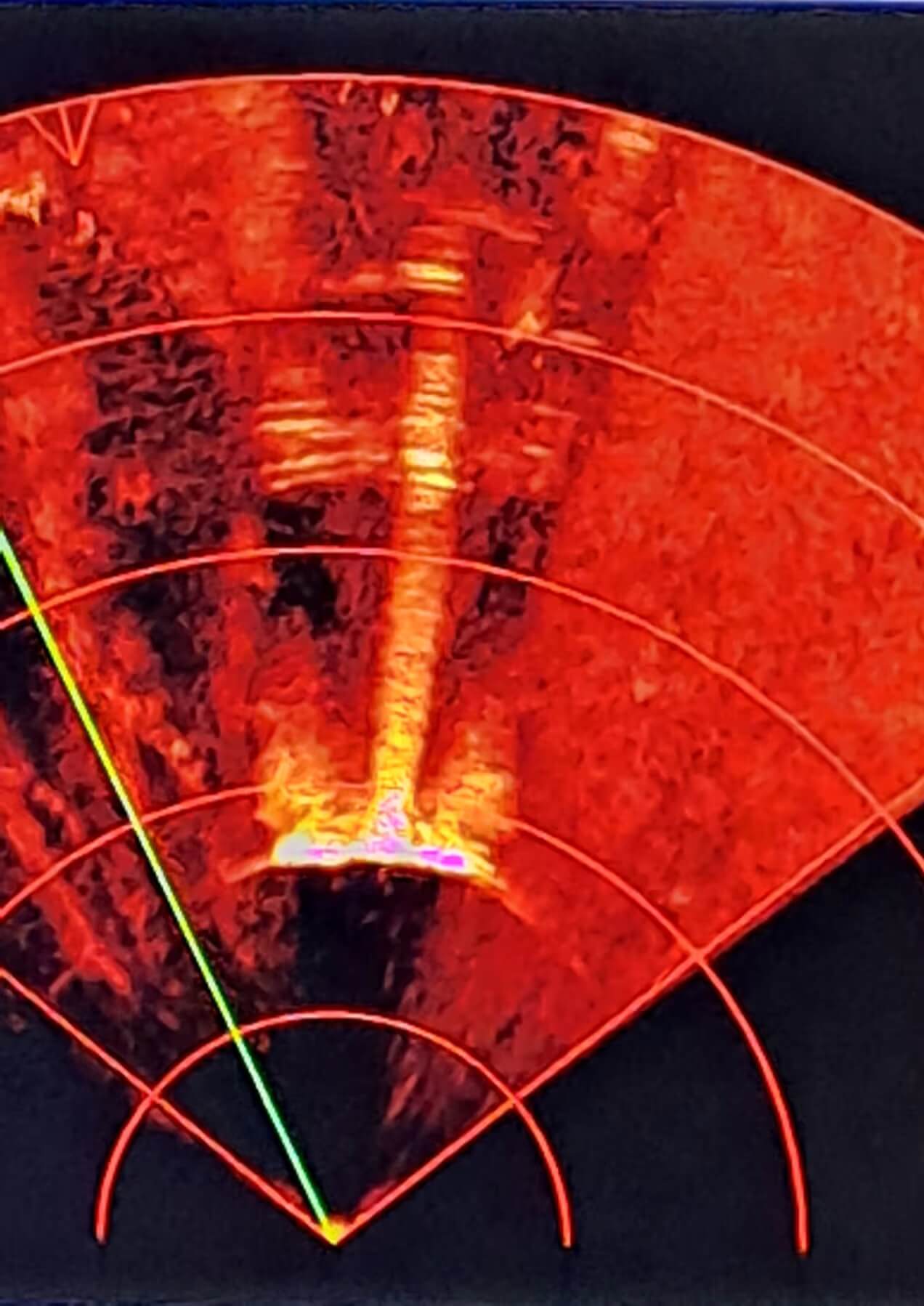

Courtesy NBI

The recovered anchor on the deck of the Belos (courtesy Finnish Border Guard)

The recovered anchor on the deck of the Belos (courtesy Finnish Border Guard)