Amanda Stutt | December 6, 2024

Aerial view of part of the Reefton Goldfields in New Zealand.

Image from RUA Gold.

When New Zealand’s new government this year introduced a fast-track approvals Bill for infrastructure and mining projects to reduce permitting from what was at least two years to six months, it ushered in a new era of bustling exploration activity in a country which had a historical gold rush that rivaled California’s.

During the previous government, New Zealand’s exploration sector was halted when former Prime Minister Jacinda Arder in 2017 implemented a ‘no new mines’ policy.

Explorers are now eyeing the country as the world’s next modern mining jurisdiction — known for exceptionally high-grade gold — as the gold price rallies to historic highs.

The Reefton Goldfield on the country’s south island alone produced more than 2 million ounces of gold between 1870 and 1951. Reefton has orogenic gold deposits, analogous to Kirkland Lakes’ famed Fosterville gold deposit in Australia.

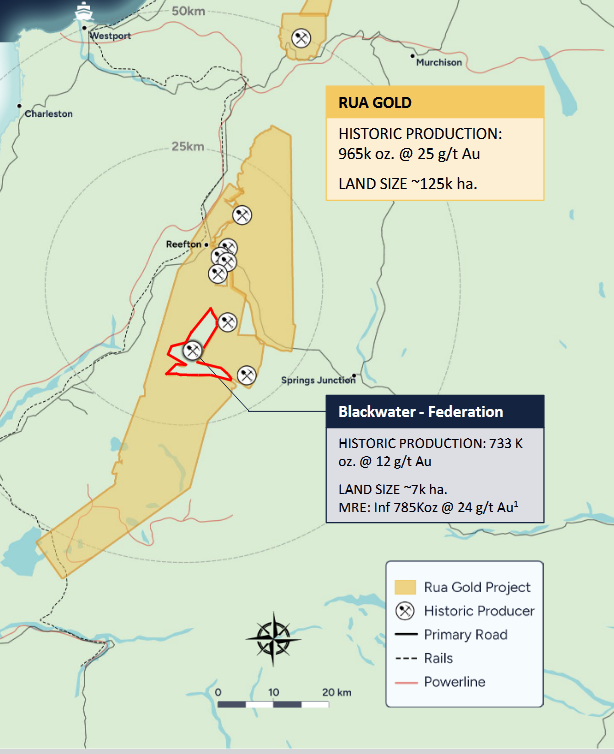

RUA Gold (TSXV: RUA), which after a year of capital raises and strategic plays amongst fierce competition, is the frontrunner, with eight historic producing mines after acquiring Reefton Resources, a 100% owned subsidiary of Siren Gold (ASX:SNG) for A$20 million, last month.

The company now controls a tenement package to cover over 95% of the Reefton Goldfield.

“We announced this deal and we said ‘we’re taking over the whole Reefton district’. That’s been our strategy,” RUA Gold’s CEO Rob Eckford told MINING.com in an interview.

When New Zealand’s new government this year introduced a fast-track approvals Bill for infrastructure and mining projects to reduce permitting from what was at least two years to six months, it ushered in a new era of bustling exploration activity in a country which had a historical gold rush that rivaled California’s.

During the previous government, New Zealand’s exploration sector was halted when former Prime Minister Jacinda Arder in 2017 implemented a ‘no new mines’ policy.

Explorers are now eyeing the country as the world’s next modern mining jurisdiction — known for exceptionally high-grade gold — as the gold price rallies to historic highs.

The Reefton Goldfield on the country’s south island alone produced more than 2 million ounces of gold between 1870 and 1951. Reefton has orogenic gold deposits, analogous to Kirkland Lakes’ famed Fosterville gold deposit in Australia.

RUA Gold (TSXV: RUA), which after a year of capital raises and strategic plays amongst fierce competition, is the frontrunner, with eight historic producing mines after acquiring Reefton Resources, a 100% owned subsidiary of Siren Gold (ASX:SNG) for A$20 million, last month.

The company now controls a tenement package to cover over 95% of the Reefton Goldfield.

“We announced this deal and we said ‘we’re taking over the whole Reefton district’. That’s been our strategy,” RUA Gold’s CEO Rob Eckford told MINING.com in an interview.

“The land package we have was 35,000 hectares with four historic mines – that’s what we’re focused on. We’ve got drill rigs turning and we’re finding gold intercepts.”

The acquisition marked the first time ever that this amount of land in Reefton Goldfield has been under one party’s control.

There are only two strongholds: OceanaGold (TSX: OGC), which operates the Waihi mine operations on the North Island and has the Globe Progress project with a 418,000-oz. deposit; and Federation Mining has the fully permitted Blackwater project with a reported 785,000-oz. deposit which it bought from OceanaGold in 2020 for $30 million.

The last minute interloper

With RUA Gold’s acquisition bid for Siren Gold in, Federation Mining, a privately held Australian company, came in days before the shareholder vote in October with a rival offer.

The move forced RUA into rapid response mode, meeting key Siren shareholders and sweetening their offer with an additional $2 million investment to secure shareholder support.

Australian Financial Review’s Street Talk reported that there was an “AustralianSuper-backed interloper on the scene at Kiwi explorer Siren Gold, capitalized at A$24 million…and the target board is doing its best to keep its presence a secret ahead of a deal vote scheduled.”

Federation Mining reportedly tabled an improved non-binding indicative bid to Siren Gold’s board, offering Siren a 17.5% share in the merged company as well as an immediate cash injection via a A$4.5 million placement at C20¢ per Siren share or a 66.6% premium to the last close.

“That was a material uplift on Federation’s original – and swiftly rejected – proposal which involved giving Siren shareholders 10%,” AFR reported.

After a flurry of last minute meetings and movies, RUA’s vision and value proposition won over 75% of Siren shareholders, and the deal proceeded.

Headlines ran that Federation Mining had “lobbed’ its bid” for Siren Gold.

Federation Mining did not respond to an emailed request for comment.

“Despite our lower number, the shareholders saw the value uplift potential, and that’s where they’ve sided with us,” Eckford said. “We’ve got a team that’s done this before multiple times. We’ve built eight mines, and we’ve founded a number of operations.”

The Reefton Goldfield vision

Eckford said RUA Gold’s vision is to become the main gold developer in the region now that the Reefton district is largely under its control.

“We are the New Zealand district roll up,” he said. “We see New Zealand as the best jurisdiction in the world. Rua will have a very aggressive drill program. We’re about to spend C$5 million in the next six months drilling out the region.

“We’re doing everything responsibly. We’re just doing things as opposed to doing nothing.”

“This creates the opportunity to develop a world-class, scalable mining operation in an area that had high-grade production and is considerably under explored at depth.”

No comments:

Post a Comment