James McCarten

The Canadian PressStaff

Tuesday, November 9, 2021

WASHINGTON -- Planning is "well underway" for bilateral treaty talks between Canada and the United States in the dispute over the Line 5 pipeline, with formal negotiations expected to begin "shortly," the federal government says in new court documents.

A proposed motion filed Friday in U.S. district court in Michigan says an initial dispute resolution session, as spelled out in the 1977 pipeline treaty between the two countries, is in the works.

"Planning for a first formal negotiating session under the treaty is well underway, and Canada expects that first session to happen shortly," reads the supplemental brief submitted by Gordon Giffin, the former U.S. ambassador to Canada who is serving as the federal government's American counsel.

"Canada hopes that these negotiations will yield a mutually satisfactory solution as between Canada and the United States regarding the interpretation, application and operation of the 1977 treaty."

Should those negotiations fail, the next stage of the dispute resolution process would be binding international arbitration, the motion says.

"Canada's decision to invoke (the treaty) reflects the importance of this matter to Canada's energy security and economic interests and its relationship with the United States."

Canada opted to formally invoke the 44-year-old treaty last month after talks involving a court-appointed mediator broke down between the state of Michigan and the pipeline's operator, Enbridge Inc.

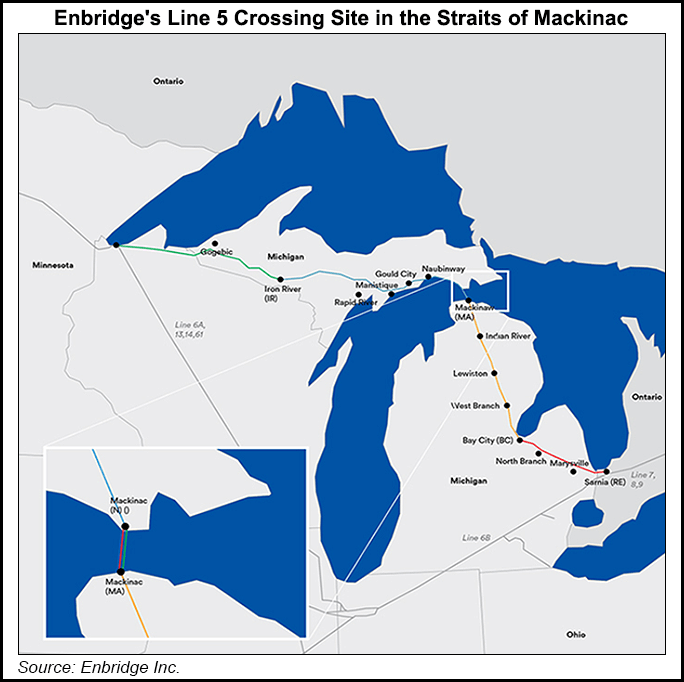

Michigan Gov. Gretchen Whitmer ordered the cross-border pipeline shut down last November for fear of an environmental disaster in the ecologically sensitive Straits of Mackinac, the waterway where the pipeline crosses the Great Lakes.

The White House has acknowledged that the U.S. Army Corps of Engineers is conducting an environmental assessment on Enbridge's plans to encase the underwater portion of the twin pipeline in a deep, fortified underground tunnel.

But spokeswoman Karine Jean-Pierre was quick to note Tuesday that the process is not an indication that President Joe Biden's administration is looking to shut down the expansion.

"Canada is a close ally and a key partner in our in energy trade as well as efforts to address the climate crisis and protect the environment," Jean-Pierre told the daily White House briefing.

"These negotiations and discussions between the two countries shouldn't be viewed as anything more than that, and certainly not an indicator that the U.S. government is considering shutdown. That is something that we're not going to do."

As to the ongoing operation of the existing pipeline, she added, that's the subject of "litigation between Enbridge and the state of Michigan" and that "we expect the U.S. and Canada to engage constructively on it."

Jean-Pierre would not respond to media reports that Biden, Prime Minister Justin Trudeau and Mexican President Andres Manuel Lopez Obrador plan to meet in Washington as early as next week, part of a long-standing commitment to rekindle their trilateral tradition of annual in-person meetings.

Officials in the Prime Minister's Office and in diplomatic circles in both Ottawa and Washington also declined to comment.

Lawyers for the state of Michigan did not immediately reply to Canada's request to file its latest motion. A Nov. 4 response to an earlier filing, however, dismisses the Canadian position as "legally unfounded."

They argue that bilateral negotiations under the pipeline treaty ultimately have no bearing on the primary legal question before U.S. District Court Judge Janet Neff: whether the case properly belongs in Federal Court.

Line 5 ferries upwards of 540,000 barrels per day of crude oil and natural gas liquids across the Canada-U.S. border and the Great Lakes by way of a twin line that runs along the lake bed beneath the straits linking Lake Michigan and Lake Huron.

Proponents call it a vital and indispensable source of energy -- particularly propane -- for several Midwestern states, including Michigan, Ohio and Pennsylvania. They also say it is a key source of feedstock for critical refineries on the northern side of the border, including those that supply jet fuel to some of Canada's busiest airports.

Critics want the line shut down, arguing it's only a matter of time before an anchor strike or technical failure triggers a catastrophic environmental disaster in one of the area's most important watersheds.

They also point to a recent pipeline rupture off the coast of California, believed to be the result of an anchor strike, as an example of the fate that could befall the straits if Line 5's operations continue.

This report by The Canadian Press was first published Nov. 9, 2021.

White House: U.S. is Not Considering Shutting Down Enbridge’s Line 5 Pipeline

WASHINGTON, Nov 9 (Reuters) – The White House said on Tuesday it is not contemplating shutting down Enbridge Inc’s (ENB.TO) Line 5 pipeline after Canada last month invoked a 1977 treaty with the United States to trigger bilateral negotiations over it.

Line 5 is at the center of a long-running environmental dispute between Calgary, Alberta-based Enbridge and the state of Michigan that has embroiled the Canadian and U.S. governments.

“We expect that both the U.S. and Canada will engage constructively in those negotiations,” White House spokesperson Karine Jean-Pierre told reporters.

She said those discussions should not be viewed as an indicator that the U.S. government was considering shutting down the pipeline.

“That is something that we’re not going to do,” she said.

The Line 5 pipeline ships 540,000 barrels per day of crude and refined products between Superior, Wisconsin, and Sarnia, Ontario, via Michigan, and is a key link in Enbridge’s Mainline network, which transports the bulk of Canadian crude exports to the United States.

Michigan Governor Gretchen Whitmer ordered Enbridge to stop operating the pipeline by May because of concerns a section running underwater in the Straits of Mackinac could leak into the Great Lakes. The company ignored that order and the two sides are in a legal battle over Line 5’s fate.

Last month, the Canadian government, which backs Enbridge, escalated the dispute by invoking the decades-old pipeline treaty with the United States to trigger negotiations.

“Line 5 is a top priority for Canada,” said Lama Khodr, a spokesperson for Canada’s foreign ministry. “Canada’s objective remains to work with the U.S. in these formal treaty negotiations to seek a solution where Line 5 remains open and operating safely.”

U.S. President Joe Biden is planning to host an in-person meeting next week with the leaders of Mexico and Canada, the first of its kind in more than five years, sources told Reuters on Tuesday.

MEG Energy CEO doesn’t expect Line 5 dispute to hurt ability to move heavy oil

CALGARY — The chief executive of MEG Energy said Tuesday he doesn’t expect the ongoing dispute between Canada and the U.S. over the Line 5 cross-border pipeline to hurt his company’s ability to move heavy oil to the U.S. Gulf Coast.

On a conference call with analysts, Derek Evans — the head of the Calgary-based energy company — said that now that Enbridge Inc.’s Line 3 replacement project is operational, MEG is less concerned about the outcome of bilateral talks over Line 5.

“Line 5 does not carry a huge amount of volume. And I think it’s about 330,000 barrels a day. It tends to be light product,” said Evans, whose company produces heavy oil from the Athabasca oilsands region of Alberta.

“With Line 3 now up and running, there actually appears to be incremental space on the light system that heavies can utilize with the way that line is now configured. So we’re even more comfortable today that the shutdown of Line 5 won’t, wouldn’t negatively impact our long-haul capacity.”

Court documents filed by the federal government say planning is well underway for bilateral talks in the dispute over the Enbridge’s cross-border pipeline. A proposed motion filed last week in U.S. District Court in Michigan says the first formal negotiating session between the two countries will happen “shortly.”

Canada decided last month to invoke a 1977 pipelines treaty between the two countries after talks broke down between the state of Michigan and Enbridge. Michigan wants the line shut down for fear of an ecological disaster in the Straits of Mackinac, the waterway where the pipeline crosses the Great Lakes.

But whatever the outcome of the talks, Canada’s oil and gas industry already scored a major win last month, when Enbridge brought its $9.3-billion Line 3 replacement project into service. The 1,765-km Line 3 added about 370,000 additional barrels per day of crude oil export capacity from Western Canada to refineries in the U.S. Midwest.

Evans added the company expects to also have additional take-away capacity when the federally owned Trans Mountain expansion project is completed, expected to be sometime in mid to late 2022.

On Monday, MEG Energy reported what Evans called “exceptional financial results” against the backdrop of strengthening global oil prices and an improvement in heavy oil differentials.

The company boosted its output forecast for the year as it reported a profit of $54 million or 17 cents per diluted share in its latest quarter compared with a loss of $9 million or three cents per share a year ago.

Revenues for the three months ended Sept. 30 were $1.09 billion, up from $533 million in the third quarter of 2020.

MEG was expected to earn 29 cents per share on $1 billion of revenue, according to financial data firm Refinitiv.

Adjusted funds flow increased to $239 million or 77 cents per share from $26 million or nine cents per share a year earlier.

Quarterly production increased 28 per cent to 91,506 barrels per day, compared with 71,516 bbls/d in the prior year quarter. As a result, it again increased its annual average production guidance, this time to 92,500 to 93,500 bbls/d from 91,000 to 93,000 bbls/d.

This report by The Canadian Press was first published Nov. 9, 2021

.Companies in this story: (TSX:MEG)

Amanda Stephenson, The Canadian Press

Enbridge Chief Stresses Importance of Oil, Natural Gas Mainstays

While promising to work toward “lower-carbon solutions,” Enbridge Inc. reported Friday that its mainstay North American oil and gas pipeline network stayed profitable and essential during the third quarter. In fact, the Calgary-based pipeline, utility and power giant grew during the period.

Current fossil fuel demand and price increases “underscore the criticality of affordable, reliable and secure energy supply for consumers and our social well-being,” said President Al Monaco. “The energy we deliver is critical to fueling quality of life in North America and globally and this will continue for decades to come.”

A major 3Q2021 landmark on Enbridge’s heritage fossil fuel side included completing the Line 3 oil pipe replacement project, adding 370,000 b/d of Canadian export capacity. During the period, Enbridge also closed on its $3 billion acquisition of the Ingleside Energy Center for U.S. oil exports. Moreover, the company augmented its natural gas pipeline network in British Columbia and New England.

Looking ahead, Enbridge anticipates a scheduled decision this month from the Canada Energy Regulator on a hotly contested proposal to convert its 3.1 million b/d oil Mainline into a contract service after 70 years as a common carrier filled by monthly bookings.

Enbridge also is devoting considerable attention to its corporate sustainable development strategy, adding alternative energy ventures to align with environmental, social and governmental initiatives

The company said its low-carbon project portfolio includes French offshore wind power projects, hydrogen blend trials in Ontario gas distribution, renewable natural gas projects that tap waste disposal sites and a pipeline solar self-power plant. In addition, the company highlighted the formation of a corporate New Energies Team, a planning partnership with Royal Dutch Shell plc and sustainability-linke” bond sales.

“Our objective is to be a differentiated energy infrastructure service provider for our customers by leading our industry on environmental, social and governance performance,” said Monaco.

Enbridge posted 3Q2021 earnings of C$682 million ($545.6 million), or C34 cents/share (27 cents), down year/year from C$990 million ($792 million), or C49 cents (39 cents).

© 2021 Natural Gas Intelligence. All rights reserved.

No comments:

Post a Comment