Union workers are feeling increasingly emboldened to reject tentative agreements as they fight to join the ranks of those benefiting from the recent wave of wage gains, experts say.

“It's pretty clear to me that there is an uptick in workers rejecting agreements that have been recommended by their contract bargaining committees,” said Barry Eidlin, an associate professor of sociology at McGill University.

It’s a sign that their expectations have risen significantly over the past few years, he said, and a symptom of a more militant attitude among unionized workers.

Over the weekend, workers at a Nestlé chocolate plant in Toronto went on strike after turning down a tentative deal with the chocolate maker.

Eamonn Clarke, president of the Unifor local representing them, has noticed it’s harder these days to get a tentative agreement passed by workers.“We've been bringing good contracts back to memberships, and they've been turning them down or barely passing,” he said.

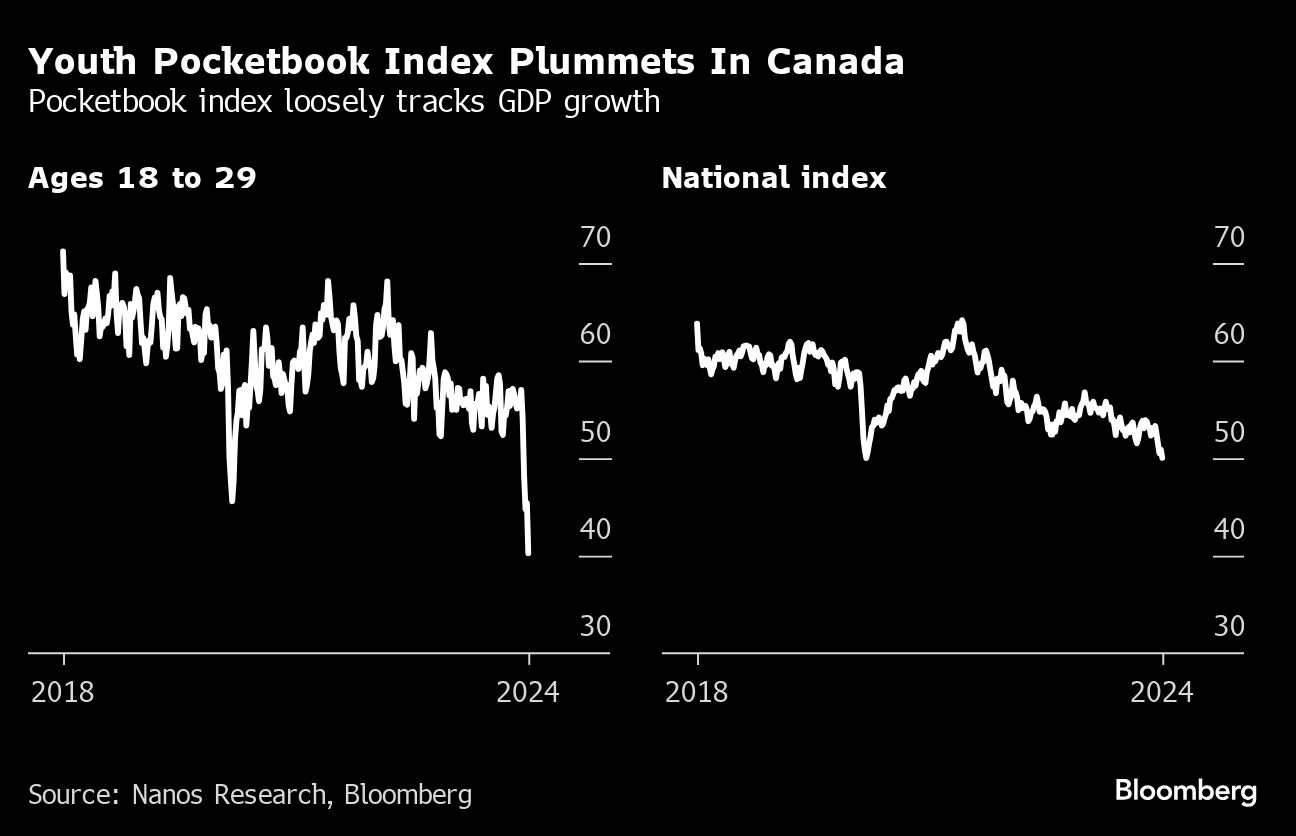

The cost of living has increased significantly, and workers’ expectations with it, said Clarke.

During a typical contract negotiation, a union bargaining team meets with company representatives to hammer out a deal. Once both sides agree to terms, the union takes that tentative agreement back to its members, who must vote to accept it before the deal is finalized.

Rejections were “few and far between” in previous years, said Larry Savage, a professor in the labour studies department at Brock University.

“They just seem much more common nowadays, as workers fight to get ahead in the context of the cost-of-living crisis,” he said, though he noted the government doesn’t have data available on tentative deal votes.

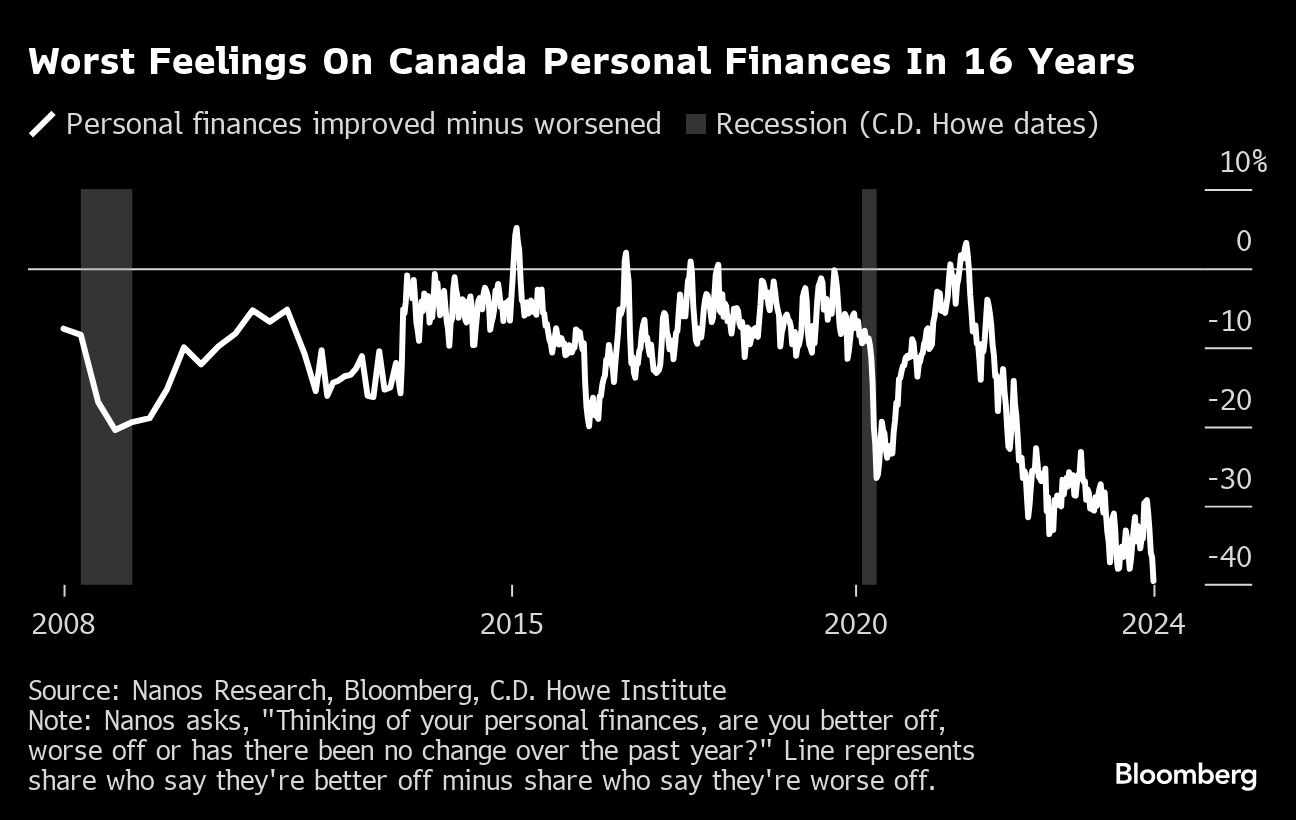

Inflation is of course a major factor in this increased willingness to push back, as Canadians grapple with double-digit inflation compared with a few years ago.

But there’s also the tighter labour market giving workers more leverage, the pandemic shining a light on “dramatic inequalities,” and a multi-decade trend of employers having the upper hand that led to an erosion of wages and good jobs, said Eidlin.

"These things have all contributed to an increase in union militancy," agreed Savage. "And I think you see that militancy playing itself out through strikes, but also through rejected tentative agreements."

There's also what Eidlin calls the “demonstration effect.” Seeing other high-profile rejections and strikes bear fruit — like with Metro, B.C. port workers, and Quebec public servants last year — shows workers that saying “no” to what they think isn’t a good enough deal is a realistic option, he said.

“I think that those things coming together have created the situation we have now and have raised expectations for workers, but also made them more willing to fight to realize those heightened expectations,” said Eidlin.

In the past, if workers rejected an agreement it was usually because they were pushing back on a bad deal, said Eidlin. But these days, workers are rejecting deals that are significantly better than previous ones, deeming them not good enough.

Employers don’t seem to quite understand just how high workers' expectations are, said Clarke. They’re bringing better offers to the table than they would have before, and are surprised when those deals are still rejected.

“Some companies were drastically under paying their employees, you know, and it's catch-up time now.”

It’s not just about wages, though — Clarke said the Nestlé workers are fighting for better job security and benefits fairness.

Another recent example came from Airbus Canada workers in Mirabel, Que., who rejected three offers before finally accepting a deal.

Workers rejecting what seems like a good deal can come as a surprise not just to the employer, but also to the union, said Savage. An overwhelming vote to reject a deal can embolden a union to fight for more, while a narrower rejection can weaken their bargaining position, he said.

"I think unions are strategically trying to deal with the failed ratifications by turning them into opportunities to bring members together, mobilize them and increase pressure on the employer through a strike," said Savage.

Though there isn’t any government data on votes over tentative agreements, the available data does point to a heightened level of union militancy in 2023, said Eidlin.

In 2023, the number of person-days not worked — a function of the number of workers who went on strike as well as how long strikes were — was more than 6.5 million. That’s up from less than two million per year, and in some cases less than one million, in the nine years preceding 2023.

This report by The Canadian Press was first published May 7, 2024.

A bird's nest logo sits on display at the Nestle SA headquarters in Vevey, Switzerland, on Wednesday, Feb. 12, 2019. Photographer: Stefan Wermuth/Bloomberg , Bloomberg

WestJet strikes deal with maintenance staff: Shortly after issuing a 72-hour lockout notice with the union that represents the company’s maintenance engineers, WestJet has struck a tentative deal that will avoid a work stoppage. The two sides had been negotiating since September while failing to meet on a number of issues including compensation, when WestJet issue the lockout notice late last week. On Monday morning, however, it was announced that the airline and the union have hammered out a tentative agreement on what would be the first collective bargaining agreement between the two sides.

Nestle workers in Toronto move to strike: Workers at a Nestle factory in Toronto have voted to strike over what their union calls “lack of improvements to their pension plan.” Unifor said in a press release that 461 members of Local 252 have voted to walk off the job over various issues, including changes to the pension and the time it takes to move to the top of the pay scale. The workers at the plant that makes KitKat, Aero, Coffee Crisp and other bars in the city’s west end previously rejected a two-year freeze on a cost of living adjustment. No talks are currently scheduled between the two sides.