(Kitco News) - The Constitutional Court of Guatemala has issued a ruling that nullifies a referendum and its results held in Asuncion Mita, said Bluestone Resources today.

(Kitco News) - The Constitutional Court of Guatemala has issued a ruling that nullifies a referendum and its results held in Asuncion Mita, said Bluestone Resources today.

Bluestone Resources is a Canadian-based precious metals exploration and development company. Its flagship asset is the Cerro Blanco Gold Project, a near surface mine development project, is located in Southern Guatemala in the department of Jutiapa.

The referendum was held last month. Bluestone said anti-mining groups formed a biased commission to organize a referendum that unfairly portrayed public opinion on future mining activities within the municipal limits.

The company said the courts decision invalidates the referendum.

"The ruling, of definitive nature, is based on clear evidence showing the referendum was unconstitutional," wrote the company. "The self-established commission that carried out the vote does not have the authority to hold a referendum outside of the legal framework of the municipality. The referendum was misrepresented by the commission as being valid and binding. Only the relevant national governmental agencies have the legal jurisdiction over mining licenses in Guatemala."

Bluestone was up 40% to 63 cents a share.

Bluestone Resources says Guatemala anti-

mining referendum illegal

Staff Writer | September 20, 2022 |

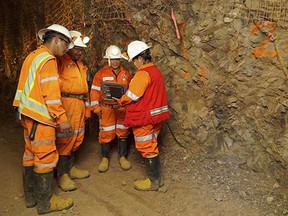

The Cerro Blanco gold project is in southeast Guatemala approximately 160km by road from the capital, Guatemala City. (Image courtesy of Bluestone Resources.)

Canada’s Bluestone Resources (TSX-V: BSR) said the results of a referendum held during the weekend that would ban mining in the Asuncion Mita municipality of Guatemala, where it is looking to develop its Cerro Blanco gold deposit, are unlikely to be enforced.

The company said that the commission behind the vote against mining activity in the area was comprised of individuals with a clear agenda and biased. It also said illegal activities were observed during the referendum held on Sunday.

“This referendum is clearly unconstitutional and filled with irregularities. We are disappointed with the actions of these groups who use these biased referendums to create doubt and uncertainty around responsible mining projects such as Cerro Blanco,” the company’s president and CEO, Jack Lundin, said in the statement.

Bluestone Resources said its legal counsel believes the results of the referendum will not be legally binding, as it went ahead despite a judge’s ruling suspending it.

The Vancouver-based company acquired Cerro Blanco from fellow Canadian miner Goldcorp in 2017 for $18 million plus shares valued at about 9.9% of Bluestone’s capital.

The miner postponeed the beginning of operations as it decided that underground extraction should be switched to open-pit.

The change in mining method responded to the results of advanced engineering and optimization work that revealed an opportunity to capitalize on the project’s near-surface, high-grade mineralization through an open-pit development scenario. In fact, the assessment showed a doubling of the gold resource ounces and production profile.

But the fact that an open-pit operation would require the use of cyanide set off the alarms of environmental groups both in Guatemala and El Salvador, who expressed concern over the potential contamination of shared freshwater bodies such as the Güija lagoon and the Lempa river. The latter is the main water source for San Salvador, the Salvadoran capital.

Bluestone said the mine’s development plans includes a cyanide destruction process to neutralise it, which should ease environmental groups’ concerns.

A feasibility study for Cerro Blanco released in February calls for an open pit gold mine with an average annual production of 197,000 ounces over its 14-year life. At peak production the operation would produce 347,000 ounces of gold a year.

Referendum over Bluestone Resources’ Cerro

Blanco project in Guatemala underway

Valentina Ruiz Leotaud | September 18, 2022 |

Cerro Blanco project area. (Image by Bluestone Resources).

The fate of Bluestone Resources’ Cerro Blanco gold-silver project is to be decided this Sunday as Guatemalans vote in a referendum to either allow the mine to go ahead or halt its development over environmental concerns.

About 28,000 people from the southern Asunción Mita municipality are expected to participate in the consultation process, which started at 7 am and ends at 5 pm local time (1 pm to 11 pm GMT).

Bluestone Resources acquired Cerro Blanco from fellow Canadian miner Goldcorp in 2017 for 18 million dollars plus shares valued at about 9.9% of Bluestone’s capital. However, the mine has not started operations as it was decided that underground extraction should be switched to open-pit.

The change in mining method responded to the results of advanced engineering and optimization work that revealed an opportunity to capitalize on the project’s near-surface, high-grade mineralization through an open-pit development scenario. In fact, the assessment showed a doubling of the gold resource ounces and production profile, which effectively tripled the NPV5% of the project to $907 million.

But the fact that an open-pit operation would require the use of cyanide set off the alarms of environmental groups both in Guatemala and El Salvador, who expressed concern over the potential contamination of shared freshwater bodies such as the Güija lagoon and the Lempa river. The latter is the main water source for San Salvador, the Salvadoran capital.

The Lempa River, which originates in Guatemala, also serves dozens of Guatemalan and Salvadoran farming communities, while hundreds of fishers fear potential negative impacts on the Güija lagoon fish populations.

Despite these concerns, Bluestone – who completed the technical, environmental, and social due diligence work in 2020 – has said it will employ treatment plants to eliminate toxic waste before discharging effluents into the Ostúa river, a tributary of the Güija lagoon and the Lempa river.

If Cerro Blanco is allowed to go ahead, management expects a peak production of 334,000 ounces and an average annual production of 231,000 ounces of gold over the life of the mine. Total life of mine production is expected to be approximately 2.4 million ounces of gold and 10.3 million ounces of silver over an initial 11-year mine life.

(With files from AFP).

Bluestone Resources stock falls after referendum against mining in Guatemala town

Bluestone said the referendum was biased, illegal and one that 'unfairly portrayed public opinion'

Bluestone Resources Inc.'s Cerro Blanco project.

PHOTO BY BLUESTONE RESOURCES

Shares of Bluestone Resources Inc. fell to their lowest price in a year for two consecutive days this week after a referendum in Guatemala, which the Vancouver-based company said was illegal, voted against any kind of mining activity in the region.

Bluestone is developing its flagship Cerro Blanco gold project in southeast Guatemala, which is expected to produce about 300,000 ounces of gold annually when completed. But in a referendum on Sunday at Asunción Mita, a town located about seven kilometres away from the project, more than 85 per cent of voters said they were against mining activities.

The miner said the referendum, in which about 8,500 people, or nearly 30 per cent of the town’s registered voters, took part in, was biased, illegal and one that “unfairly portrayed public opinion,” in a press release on Monday.

“The commission responsible for the vote is fully comprised of individuals with an anti-mining agenda,” the company said. “The referendum is against the recommendations of the central government, no entity other than the relevant federal governmental agencies have the legal jurisdiction over mining licences in Guatemala.”

Guatemala’s ministry of energy and mines supported Bluestone’s views in a statement on Tuesday and said the municipal council of Asunción Mita isn’t legally allowed to make a decision related to the installation and operation of a mining project.

However, some lawyers and activists in Guatemala have said the vote was legal since it took place as per the municipal code and the question posed to voters was not related to any specific mining installation, but on the licence for “land use and construction.”

Canadian miners have faced trouble in Guatemala in the past. For example, a court in 2017 suspended Tahoe Resources Inc.’s flagship Escobal silver mine after a non-governmental organization alleged the country’s energy ministry had violated an Indigenous group’s consultation rights. Tahoe was acquired by Canadian miner Pan American Silver Corp. in 2019, but operations at the mine have not resumed.

“I don’t know what will happen in the near future, but it is clear that Asunción Mita does not want mining projects,” Francisco Guardado, the municipal mayor, said in a press briefing on Sunday. “We do not know clearly what the legal implications are for the future … but the results of today cannot be denied.”

Pedro Cabezas, coordinator of the activist group Central American Alliance of Mining, said the issue will likely be taken to court.

“The result of the referendum will either be denied or upheld by the courts, but the process is just beginning,” he said. “A lot of people are making statements, but the truth is, in the end what’s going to prevail are the decisions of the courts.”

Nicolas Dion, an analyst at Cormark Securities Ltd. who follows Bluestone, noted the referendum, even though “illegitimate,” illustrates the “type of opposition” Bluestone is facing from anti-mining groups in the region.

“We see risk to the permitting timeline; however, believe Cerro Blanco’s merits from an employment and tax perspective will eventually triumph,” he said in a research note to clients on Tuesday. “The open-pit approach … significantly increases the project’s net present value and production profile, while reducing technical risk; however, this comes at the cost of heightened permitting and funding hurdles.”

On Monday, a day after the referendum’s results were released, shares of Bluestone hit an all-time low of 52 cents. On Tuesday, the company’s share price fell to 51 cents before closing at 52 cents, down 11.8 per cent, or seven cents, from Monday’s close. The company has a market cap of $78.6 million.

• Email: nkarim@postmedia.com | Twitter: naimonthefield

THE REAL STORY

Guatemalans strongly reject mining project in

local referendum

Mongabay Series: Latin America

Nearly 88% of participating residents voted against metallic mining in a municipal referendum in Asunción Mita, in southeastern Guatemala.

Locals fear the Cerro Blanco gold mining project would pollute soil and water sources, affecting the health of residents and crops.

There is also strong opposition in nearby El Salvador to the mine as it is located near a tributary of the Lempa River that provides water for millions of Salvadorans.

Cerro Blanco owner Bluestone Resources, the Guatemalan Ministry of Energy and Mines and a local pro-mining group contest the legality of the referendum.

ASUNCIÓN MITA, Guatemala – Cecilia López and Luz Elena González were in good spirits as they left, walking beneath blue and white plastic streamers strung across the school property in the community of Tiucal. The 24-year-old friends had just voted in a referendum on mining in the municipality of Asunción Mita, home to more than 50,000 people in southeastern Guatemala.

“This is something that affects everyone,” López told Mongabay, explaining that residents in their farming village are worried mining could pollute the water and soil, affecting onion, maize, bean and other crops.

“They say it is development, but the land is where our food comes from,” said González, a middle school teacher. “We hope the votes are no to mining.”

In a banner hanging above a street in Asunción Mita, the municipal government encourages residents to vote in a Sept. 18 referendum on mining. Image by Sandra Cuffe.

The vast majority of participating voters rejected metallic mining projects in the referendum held on September 18 in Asunción Mita. Residents are concerned about the impacts a Canadian-owned gold mining project would have on local water sources and a major river downstream in nearby El Salvador. Following the vote, however, the mining company, Guatemalan Ministry of Energy and Mines and industry groups have all contested the legality of the referendum.

Casting their ballots at the same six polling stations used in general elections, 87.98% of participating registered voters in Asunción Mita rejected mining.

Of the 8,503 participants, 7,481 residents voted against mining, 904 residents voted for it, and the remaining 118 ballots were spoiled or blank. Nearly 28% of just over 30,000 registered voters took part in the referendum, surpassing the 20-percent mark required for the results to be binding for the municipal government.

The ballots asked whether voters agreed with the installation and operation of metallic mining projects that impact natural resources and the environment in the municipality. However, this is not just a hypothetical question in Asunción Mita. A Canadian mining company was granted an exploration licence in the area 25 years ago, and another is now seeking to bring the Cerro Blanco gold mine into production.

In a Sept. 18 local referendum, residents voted on whether or not they agreed with the installation and operation of mining projects in the municipality of Asunción Mita.

Voting with families in mind

Bluestone Resources acquired the Cerro Blanco project in 2017, a decade after the Guatemalan government issued an environmental permit and exploitation license for the project. Bluestone is one of eleven Lundin Group companies involved in mining, oil and gas around the world. The plan for Cerro Blanco had been for an underground mine, but last year Bluestone announced its new plan for an open pit mine and applied to have the environmental permit amended to reflect the shift. The application is still pending. Bluestone anticipates the mine would produce 73.7 million grams (2.6 million ounces) of gold over 14 years.

Ariel Marín, a 39-year-old mechanic, hopes the company’s plans are realized. He is a member of the Asunción Mita Avanza Pro-Mining Industry Association, a local group in favor of the Cerro Blanco project. The mine would bring much-needed employment opportunities, according to Marín. Bluestone has estimated mine operations would provide jobs for 400 to 500 employees and contractors following a peak of 1,100 employees and contractors during construction.

“We are in favor of development,” Marín told Mongabay in the corridor of a school in town, where he and other Asunción Mita Avanza association members were participating as observers and scrutineers in the referendum. “We all need to support our families,” he said.

Asunción Mita residents wait their turns to vote in a local referendum on mining at outdoor tables in front of the municipal government building, on one side of the town plaza.

Image by Sandra Cuffe.

Abrahán Estrada also had his family on his mind on the day of the referendum. He was one of the first people to vote, casting his ballot against mining in a classroom with student artwork on the walls. A 68-year-old father of ten and grandfather of many, Estrada worries the mine would have serious health impacts on future generations.

“It will destroy everything and that is the legacy we would be leaving our grandchildren. Maybe we will not see it but our grandchildren would suffer,” Estrada told Mongabay.

The Cerro Blanco mining project is only roughly 6 kilometers (3.7 miles) from the town of Asunción Mita and a few villages are even closer. Heavy water use, tailings and potential for long-term acid mine drainage are all serious concerns for many residents.

Water pollution is also a concern across the border in El Salvador, just 21 kilometers (13 miles) away downstream. The Ostúa River runs south through the municipality of Asunción Mita and drains into the cross-border Lake Güija, a Ramsar wetlands site, which in turn feeds into the Lempa River that provides water for some four million Salvadorans.

In 2017, El Salvador became the first country in the world to enact a nationwide ban on metallic mining. Legislators unanimously passed the ban after years of grassroots campaigns, protests, killings of several anti-mining community leaders, and five municipal referendums. Environmental and community groups in El Salvador have been calling on their government to take a stand against the Cerro Blanco mine across the border. They also showed up to support the referendum process in Asunción Mita, where more than 150 national and international observers – most of them from El Salvador – monitored the September 18 referendum.

A banner hanging from the Catholic church on the Asunción Mita town square reads,

“I [heart] Mita! No to the mine”. Image by Sandra Cuffe.

“The decision of the people here will be critical. It is important for everyone,” Vidalina Morales, a member of the National Roundtable against Metallic Mining in El Salvador, told Mongabay in Asunción Mita, where she was an observer for the referendum. “With money one can live for a while, but with our water we live our whole lives.”

Asunción Mita residents have been organizing against mining for well over a decade and the Catholic church in the region has played a pivotal role. The pandemic slowed everything down for a while, but people sprang into action when they learned the company was trying to move forward with open-pit mining, according to María del Carmen Cifuentes, who founded a local school decades ago and is heavily involved in church activities.

“It put us on alert,” she told Mongabay. “We started with the collection of signatures to demand the consultation.”

Challenges against the referendum

Guatemala’s municipal code stipulates that residents can petition their local governments to call a referendum on matters of local importance if they gather the signatures of more than 10% of registered voters. The grassroots campaign surpassed that bar, so the municipal government established regulations for the referendum. A special commission was also set up to coordinate and oversee the referendum, comprised of three representatives of the municipal government, three from the Catholic church, and three from civil society. Cifuentes was chosen as the commission president.

Legal challenges against the process began before the referendum and will not be resolved anytime soon. Six days ahead of the vote, a regional court granted the Asunción Mita Avanza pro-mining association’s petition for an injunction against the referendum regulations. However, injunctions do not take effect until the appropriate parties are formally notified and neither the municipal government nor the special commission were notified before the referendum

.

After casting their ballots in a municipal referendum on mining in Asunción Mita, residents dip an index finger in purple ink. Image by Sandra Cuffe.

Shortly after the mayor and special commission announced the results the night of September 18, while people celebrated with firecrackers in the nearby town plaza, the first of several public statements condemning the referendum surfaced. The Asunción Mita Avanza association was the first to reject the event, calling it illegal and illegitimate despite the participation of its members and supporters as observers and official scrutineers during the referendum.

Bluestone Resources, the Guatemalan Ministry of Energy and Mines and industry groups followed with statements the next day, all referencing the legal challenge along with other arguments. Bluestone argued anti-mining groups formed a biased commission to organize a referendum that unfairly portrayed public opinion. The company made no mention of the involvement of the municipal government.

“This referendum is clearly unconstitutional and filled with irregularities. We are disappointed with the actions of these groups who use these biased referendums to create doubt and uncertainty around responsible mining projects such as Cerro Blanco,” Bluestone Resources president and CEO Jack Lundin said in the company’s September 19 statement.

Asunción Mita mayor René Francisco Guardado speaks at a press conference held Sept. 18 to announce the results of a municipal referendum on mining. Image by Sandra Cuffe.

The Guatemalan Ministry of Energy and Mines focused primarily on jurisdiction, noting in its September 19 statement that only the central government has the faculty to determine mining policy and projects. The ministry also argued that because mining projects have a clearly delineated area of influence, it is impossible for them to be a general issue affecting all municipal residents that could be the subject of a referendum under the municipal code.

The municipal government overstepped the scope of its functions, according to the Ministry of Energy and Mines.

Consultation is the heart of the issue

The special commission and municipal government never suggested the outcome of the vote would have any impact on central government decisions or mining licenses. The results would be binding only for the municipal government if more than 20% of registered voters participated. In the referendum regulations and when they announced the results, the commission and municipal government clearly expressed that the results would only be indicative of local sentiment, rather than binding, for the central government. The country’s Constitutional Court ruled as much when it upheld as valid a municipal consultation held in 2012 in Mataquescuintla, which had also been subject to a similar legal challenge.

“That referendum was the most attacked, to the point that they did exactly what they are doing now,” said Julio González, a member of Colectivo MadreSelva, a national environmentalist collective. “The issue of bindingness has been an issue of much concern for the government.”

Consultation and lack thereof has been what’s at the heart of mining conflicts in Guatemala. The Constitutional Court has suspended several mining projects, including two major operating mines, due to the state’s failure to consult with affected Indigenous peoples. The Fenix nickel mine was permitted to restart this year after a highly controversial consultation process that wrapped up under martial law amid protests and crackdowns on Indigenous Maya Q’eqchi’ community leaders. The Escobal silver mine is still on hold pending consultation with the affected Indigenous Xinka population.

María del Carmen Cifuentes, 70, is the president of the special commission for the municipal referendum on mining in Asunción Mita. Image by Sandra Cuffe.

In non-Indigenous areas, such as Asunción Mita, there is no clear duty to consult – or hold referendums. Since 2015, municipal-level consultations and referendums on mining have been held all over the country. Most have taken place in predominantly Indigenous regions, and the process has been determined by local customs. Elsewhere, as in Asunción Mita, the municipal code provisions for local referendums have been used.

National government and company backlash against referendums that could only be binding for municipal governments may seem misplaced but it is not, says González.

“There is the reason they do not clarify referendums,” he told Mongabay. “To construct any project in any place a municipal construction permit is required. So that has been the mechanism to stop projects of this nature and that is what they do not want people to know.”

Asked about the issue of municipal permits, Bluestone Resources told Mongabay in an email that “it is our understanding that a construction license would not be required. If a construction license is required, and adheres to the municipal code and abides by the law it is not permissible to withhold it.”

Asunción Mita mayor René Francisco Guardado knew ahead of time that the referendum would face legal challenges but said the municipal government was prepared for whatever is to come. Local participation and the months-long work of the special commission were crucial “to make true democracy prevail in this municipality,” Guardado told reporters the night of September 18, when the results were announced.

Banner image: A resident of Asunción Mita confirms his identity and signature to vote in a school classroom during a municipal referendum on mining. Image by Sandra Cuffe.

Related listening from Mongabay’s podcast: A conversation with Cultural Survival’s Daisee Francour and The Oakland Institute’s Anuradha Mittal on the importance of securing Indigenous land rights within the context of a global push for land privatization. Listen here:

(

(