- Sam Altman-Backed Nuclear Startup Signs Major Data Center Contract

- By ZeroHedge - May 27, 2024

- Oklo has signed a non-binding letter of intent with Wyoming Hyperscale for a 10-year power purchase agreement.

- Oklo is committed to providing clean, reliable, and affordable energy solutions to meet the needs of data centers.

- The partnership with Wyoming Hyperscale underscores Oklo's commitment to advancing sustainable energy practices in the data center industry.

Sam Altman backed nuclear startup Oklo inked a deal to supply 100MW of nuclear power to data center company Wyoming Hyperscale, it was announced last week.

The news sent shares of NYSE-listed Oklo up more than 30% in trading on Friday.

The companies signed a "non-binding letter of intent outlining plans for the PPA, which will last for 10 years," according to industry publication Data Center Dynamics. This comes on top of the revelation that, last month, Oklo signed to supply up to 500MW of power to another data center, Equinix.

"Wyoming Hyperscale is building a data center campus on 58 acres of land," the report says.

Jacob DeWitte, co-founder and CEO of Oklo, commented: “As the widespread adoption of artificial intelligence increases, Oklo remains dedicated to providing clean, reliable, and affordable energy solutions to meet the needs of our data center partners.”

“Our partnership with Wyoming Hyperscale underscores our commitment to advancing sustainable energy practices and supporting high-efficiency operations within the data center industry.”

Trenton Thornock, founder of Wyoming Hyperscale, added: "Our goal is to create data centers with minimal environmental impact. This collaboration with Oklo perfectly aligns with our vision for sustainable, efficient operations. By merging sustainability with advanced technology, we are setting a new standard for the future of accelerated computing.”

As we wrote earlier this month, Oklo won shareholder approval on May 8 for its NYSE listing. The company's mission is "to provide clean, reliable, affordable energy on a global scale through the design and deployment of next-generation fast reactor technology".

Backed by investors like Jeff Bezos, Bill Gates, and Peter Thiel, the who's who of the AI revolution, nuclear fusion startups are gaining traction. Sam Altman, who invested in Oklo in 2015, believes the company is "best positioned to commercialize advanced fission energy solutions," per a July press release.

Last month, we published a lengthy report discussing why even as the AI trade may be fizzling, the "electrification" trade, aka the "Power-Up America" trade - so urgently needed to run all those electricity-gobbling data centers needed to run AI - is just getting started and has in fact outperformed substantially both the broader AI and Data-Center Equipment baskets over the past two months...

... and Altman - who teamed up with another power company, Exowatt, earlier this year to focus on clean energy for AI power -agrees: "Fundamentally today in the world, the two limiting commodities you see everywhere are intelligence, which we're trying to work on with AI, and energy," Altman told CNBC in 2021.

For those who missed it, in "The Next AI Trade," we outlined various investment opportunities for powering up America, most of which have dramatically outperformed the market. In the next iteration, we will likely add Oklo to the list of beneficiaries certainly ahead of the inevitable cascade of Buy ratings sure flood the name over the next month.

By Zerohedge.com

Q&A: The prospects for floating nuclear power plants

24 May 2024

Deputy General Director for Shipbuilding, Floating Energy and Marine Engineering at Rosatom's Atomenergomash, Vladimir Aptekarev, on the potential for floating power units.

How a 100 MW FPU might look (Image: Rosatom)

How a 100 MW FPU might look (Image: Rosatom)There seem to be a lot of proposals for, and interest in, floating nuclear power plants around the world. To be clear, these are not the same as nuclear-powered vessels, are they?

I would suggest using the term floating power unit (FPU) instead of floating nuclear power plant, to be more precise. While FPUs and nuclear-powered vessels both utilise nuclear reactors, they differ in purpose. Nuclear-powered vessels are designed for various maritime transportation tasks, whereas FPUs are non-self-propelled vessels specifically engineered to generate and supply electricity to customers. For FPU operation, coastal infrastructure is required to ensure mooring and electricity transmission onshore.

Do the reactors have to be specifically designed for a floating power unit, or are they essentially slightly adapted versions of land-based SMRs?

Based on the RITM-200 reactors, which are currently operational in new Project 22220 nuclear icebreakers, FPUs with power capacities of 100 MW and 106 MW have been designed. Developed by OKBM Afrikantov, the RITM series represents a unique advancement in reactor technology. The RITM-200 technology, developed by Russia, is a flagship small modular reactor (SMR) technology based on the evolution of Soviet pressurised water reactor technology initially tailored for icebreaker vessels. Through innovative technological advancements, their efficiency and reliability have been significantly improved. RITM reactors are versatile and can be utilised across three main domains: marine transportation, including nuclear icebreakers and nuclear-propelled cargo vessels; small-scale land-based nuclear power plants; and floating nuclear power units.

What do you think will be the key uses for floating nuclear power units?

Floating power units are specifically engineered for deployment in remote or inaccessible regions where establishing conventional power infrastructure proves impractical or costly. By supplying electricity to onshore communities or industrial facilities, FPUs offer advantages such as mobility, scalability, and reduced environmental impact compared with conventional fossil fuel-based power plants. They are increasingly recognised as a promising solution for advancing global nuclear energy. This recognition stems partly from the growing demand for sustainable power sources in remote areas and regions lacking extensive grid infrastructure. FPUs boast several advantages over alternative power generation sources. Not only are they environmentally-friendly and relatively easy to install at deployment sites, but they also address tariff concerns by ensuring stable electricity prices over extended periods. Additionally, they can facilitate heat supply to various facilities. An illustrative example of FPU deployment is the forthcoming installation of four RITM-200 floating power units at the Baimskiy Mining and Processing Plant in Chukotka. Rosatom plans to construct more than a dozen FPUs, offering ‘turnkey’ power supply solutions to coastal regions in countries across Africa, South Asia, and Latin America. These solutions, based on a build-own-operate scheme, provide stable electricity without requiring countries to invest in their own nuclear infrastructure or assume ownership of the units.

What are the safety considerations and safety benefits, compared with land-based plants, and how do you think the regulatory process will work around the world?

The safety concept of the RITM-200 reactor units is grounded in the principle of deep-layered protection, coupled with inherent safety features employing passive and active systems. These reactor units optimally integrate passive and active safety systems to ensure normal operation and stability, drawing from the operational experience of nuclear icebreakers equipped with RITM-200 reactor installations. In contrast to land-based nuclear power plants, the operation of FPUs adheres to the "green field" principle, meaning there are no activities involving nuclear fuel handling at the operational site. All fuel-related operations, including the handling of both fresh and used fuel, occur exclusively at specialised facilities within the Russian Federation. FPUs are non-self-propelled vessels housing nuclear power installations. Their design and construction comply with Russian regulations and internationally recognised maritime norms, notably the SOLAS Convention. Commissioning occurs within the territory of the Russian Federation, with licensing overseen by Rostekhnadzor and the Russian Maritime Register of Shipping, drawing from the experiences of projects like the Akademik Lomonosov. A specific regulatory and legal framework for FPUs exists solely within the Russian Federation. The host country’s government decides on FPU placement based on authorisation documents from its nuclear regulatory authority or another relevant body. There are no prohibitions on FPU operation, even abroad. However, effective FPU project implementation necessitates the adaptation of Russian project experience and collaboration among regulators across different countries.

What about the costs - will floating nuclear power plants be cheaper than land-based ones?

At the present moment, land-based nuclear power plants and floating power units represent two separate businesses. We do not sell floating power units; instead, we sell electricity generated by them. As a result of technical and economic feasibility studies, scientific research, and extensive market research in foreign countries, we have managed to adopt an extremely economically efficient and, at the same time, highly convenient principle of operation for our clients. This involves supplying electricity based on Power Purchase Agreements (PPAs) with highly predictable costs, extending up to 60 years, depending on the preferences and capabilities of the customer, without being tied to the cost or dependency on hydrocarbons. However, electricity supply is not interrupted for the entire duration of the contract, up to 60 years, which is the maximum projected operational lifespan of the floating power unit. This is achieved through the use of the RITM-200M, optimisation of the fuel cycle, with a refueling interval of 7-10 years, and the presence of a spare floating power unit in the operational "energy fleet" during the refueling and planned maintenance period when the installed power unit is sent to a specialised base in the Russian Federation. Seven power units operating worldwide, regardless of the country, can be substituted by just one floating power unit. Such a model is not only economically efficient but also eliminates the need for handling nuclear fuel in the host country of the floating power unit, following the "green field" principle. Additionally, it obviates the need for the foreign partner to create expensive infrastructure.

What sort of global demand do you think there will be in the coming years?

The demand and interest in floating power units have been increasing due to the global energy deficit. Floating power units undoubtedly possess significant commercial potential not only in Russia but also internationally, with countries in the Middle East, Southeast Asia, Africa, and Latin America already expressing interest in them. The potential international market for electricity abroad for the FPU project is currently estimated at more than 2.8 GW.

What plans does Russia have for floating nuclear power plants – what are your designs and what is the state of current projects?

The floating nuclear power plant Akademik Lomonosov has been commissioned marking a significant milestone. A project for supplying power to the Baimskiy Mining and Processing Plant is being implemented. Under a contract signed in 2021, the Machine Engineering Division of the State Atomic Energy Corporation Rosatom will supply four FPUs, each with a capacity of up to 106 MW of electric power, for the project. Of these, three FPUs will be primary units, while the fourth will serve as a backup. The project for supplying power to the Baimskiy Mining and Processing Plant will be the first "serial" reference for floating power units and the world’s first experience in electrification using a floating power unit for mineral extraction projects. In 2023, technical design work commenced for 100 MW FPUs based on the RITM-200M reactor units, developed for export with enhanced technical and economic performance suited for relatively warm climates. Currently, negotiations are in progress with several countries across different regions of the world, with some negotiations already resulting in signed agreements.

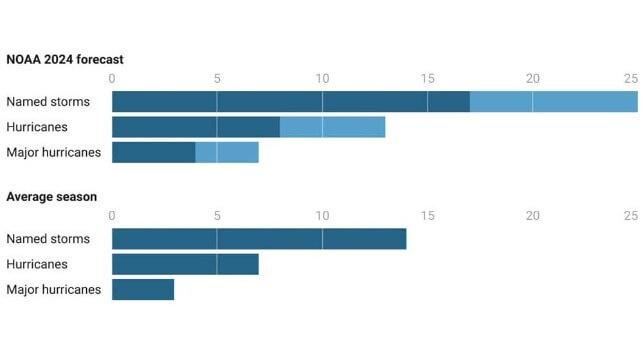

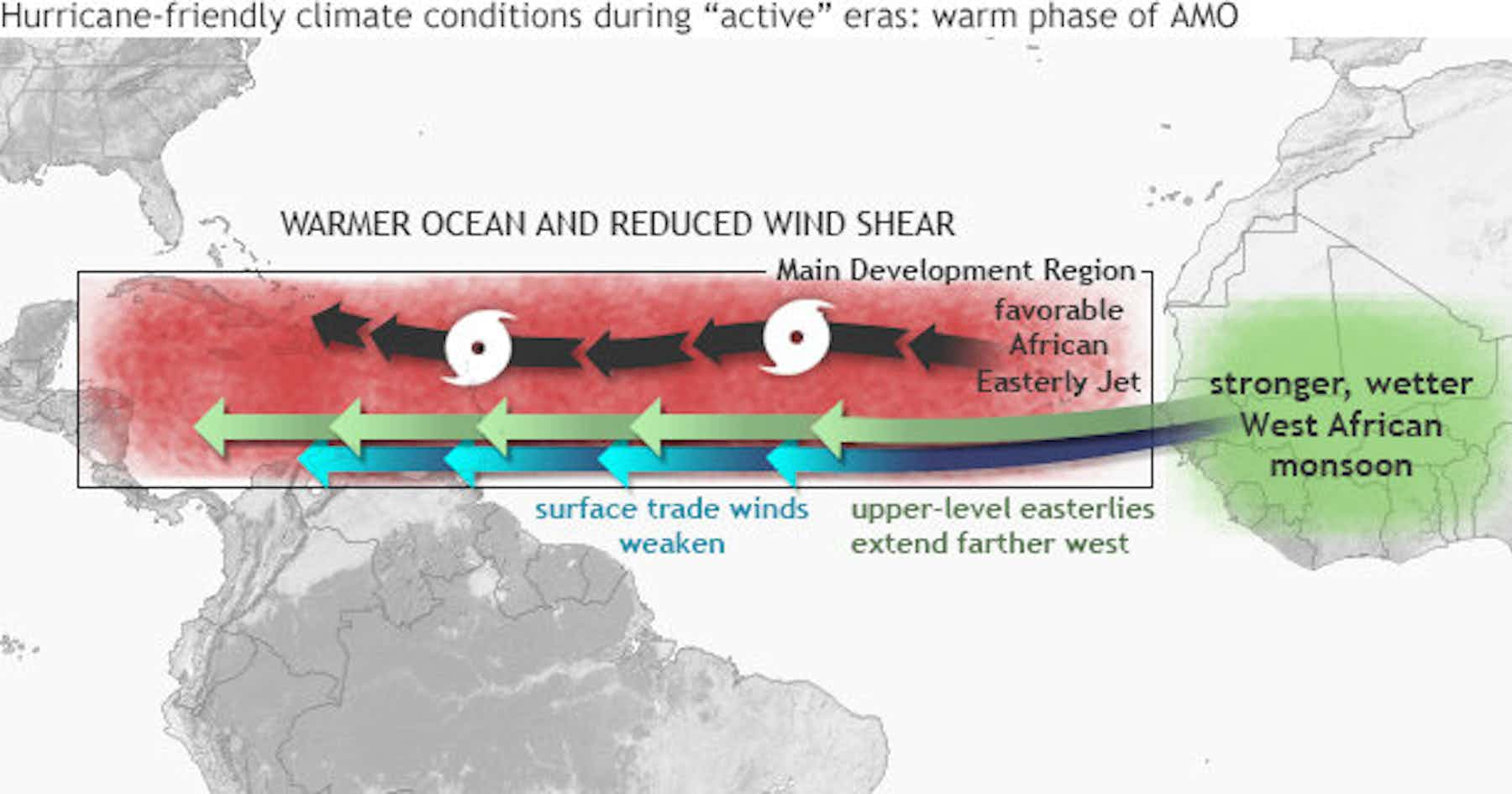

Climate patterns associated with the warm phase of the Atlantic Multidecadal Oscillation, or AMO. NOAA Climate.gov

Climate patterns associated with the warm phase of the Atlantic Multidecadal Oscillation, or AMO. NOAA Climate.gov It is also important to remember that storms can also intensify under moderately unfavorable environments as long as there is a warm ocean to fuel them. For example, the storm that eventually became Hurricane Dorian in 2019 was surrounded by dry air as it headed into the Caribbean, but it rapidly intensified into an extremely destructive Category 5 hurricane over the Bahamas.

It is also important to remember that storms can also intensify under moderately unfavorable environments as long as there is a warm ocean to fuel them. For example, the storm that eventually became Hurricane Dorian in 2019 was surrounded by dry air as it headed into the Caribbean, but it rapidly intensified into an extremely destructive Category 5 hurricane over the Bahamas.

With more than 90% of global GDP now covered by a net zero target, the growing consensus to tackle climate change is matched only by a deepening understanding of the immensity of the challenge. For the shipping industry, there’s a real urgency to reverse the 20% emissions growth of the last decade and begin the essential but expensive task of decarbonizing the global fleet, 98.8% of which, according to a

With more than 90% of global GDP now covered by a net zero target, the growing consensus to tackle climate change is matched only by a deepening understanding of the immensity of the challenge. For the shipping industry, there’s a real urgency to reverse the 20% emissions growth of the last decade and begin the essential but expensive task of decarbonizing the global fleet, 98.8% of which, according to a