Cecilia Jamasmie | March 14, 2025 | NORTHERN MINER

Mali’s government recently seized three tonnes of gold in a dispute with Barrick. (Image of the Loulo-Gounkoto gold mining complex. Courtesy of Barrick Gold.)

Tariffs and markets swings are pushing developing countries rich in critical minerals such as cobalt, copper, gold, and lithium, to tighten their grip on their resources more than ever before, a new analysis from risk intelligence firm Verisk Maplecroft shows.

This trend, which has accelerated over the past five years, poses major challenges for mining companies and coincides with intensifying geopolitical competition for raw materials essential to global industries.

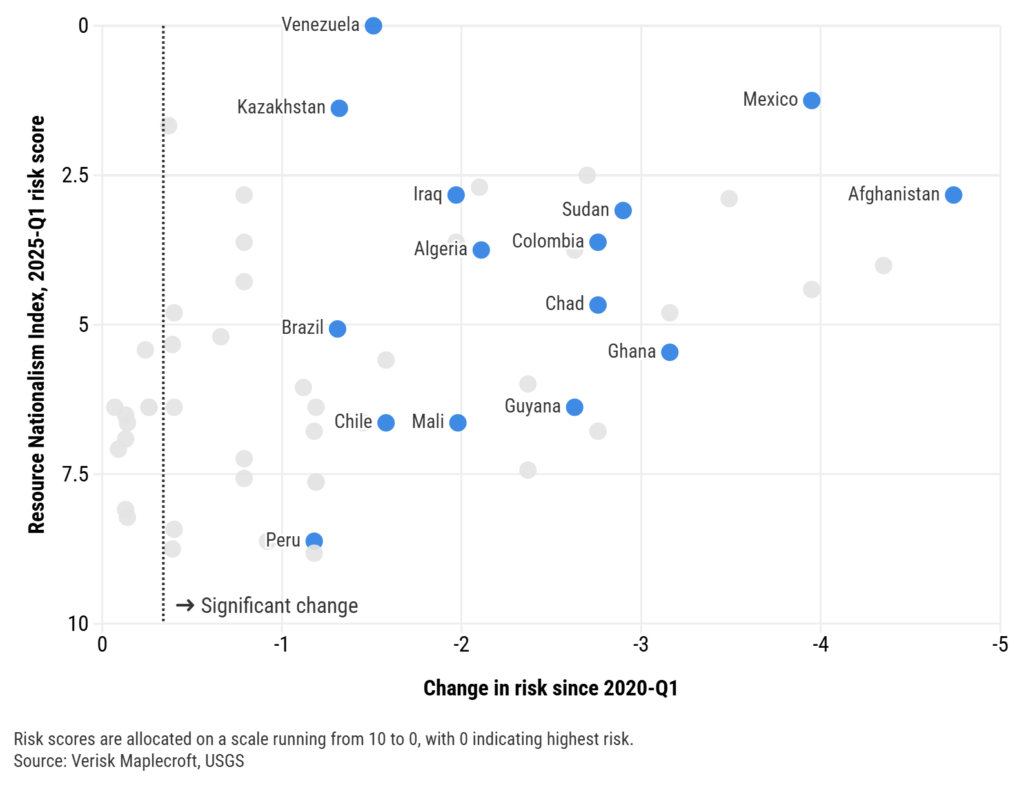

According to the Verisk Maplecroft’s annual Resource Nationalism Index (RNI), which measures government control of economic activity within the mining and energy sectors across the globe, 47 countries – including 17 major critical mineral producers – have seen a record increase in risk since 2020.

Among the 10 highest-risk jurisdictions are major oil and gas producers with a history of expropriations, nationalizations, and tax hikes. Venezuela, Russia, Mexico, Kazakhstan, and Iraq have all seen risk levels surge over the past five years.

Minerals geopolitics

Mineral-rich nations are using their leverage to secure greater economic benefits, a shift with far-reaching consequences.

“If this momentum continues, disruptions to the supply of critical minerals for renewables, technology, and defence industries are likely,” Jimena Blanco, chief analyst at Verisk Maplecroft, says. “Supply chain risks could drive up costs, slow innovation, and create vulnerabilities in national security and global competitiveness.”

As Western democracies work to secure mineral supplies, resource-rich developing nations are employing various strategies to maximize their bargaining power. Some are pursuing outright state control, while others are imposing tax hikes, stricter local content requirements, and policies aimed at expanding their economies beyond raw material exports.

Many are also adopting non-aligned strategies, avoiding alignment with major geopolitical blocs to maintain flexibility in negotiations.

This shift is expected to bring a wave of policy changes over the next year, affecting both producing nations and demand centres.

Copper risk

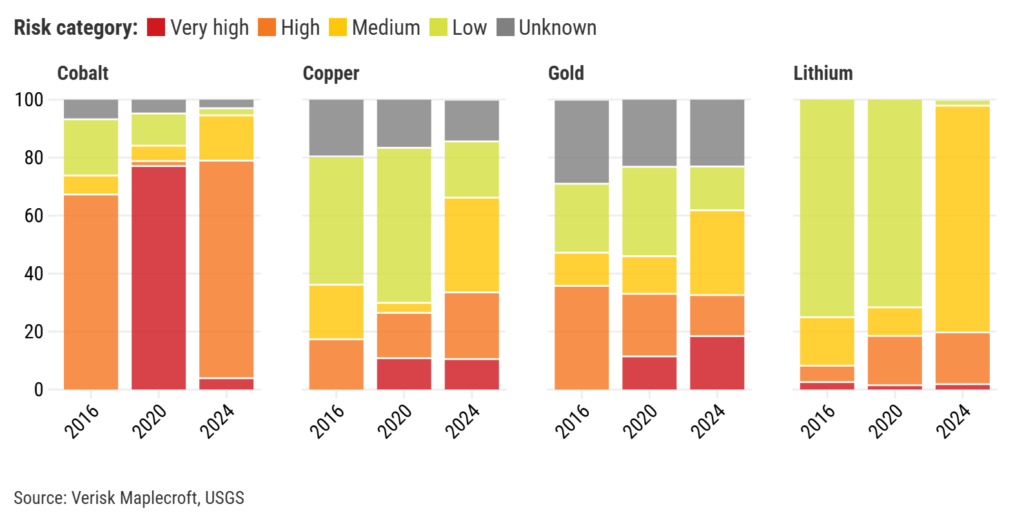

Verisk Maplecroft’s analysis integrates mineral production data with the RNI, revealing a sharp increase in risk exposure for key commodities. Over a third of global copper production now occurs in “high” or “very high” risk countries, up from just 17% in 2016.

Chile and Peru, the first and second largest copper producers, historically considered stable mining environments, have both increase state intervention in their resources.

Chile, which is also responsible for 24% of the world’s lithium production, announced in April 2023 that all lithium projects must be structured as public-private partnerships with the state holding a majority stake.

While the mining sector initially balked, companies have adapted, with more than 50 companies expressing interest in partnering with the Chilean government. Seven firms are now vying for a special contract, with final selections expected by the end of March.

Cobalt production, concentrated in the Democratic Republic of the Congo (DRC), has also seen shifting risk dynamics. While the DRC has improved in the RNI rankings, ongoing conflict threatens to reverse those gains.

Gold production, meanwhile, has become more exposed to resource nationalism, with 18% now coming from high-risk nations. In one sign of growing instability, the Malian government recently seized three tonnes of gold in a dispute with Canada’s Barrick Gold.

Trade wars

Resource nationalism is becoming a central issue in global trade tensions, particularly between the US and China. Beijing has restricted rare earth exports to the US, while Washington has responded by stockpiling critical minerals and incentivizing domestic production.

In Canada, shifting US tariffs under the Trump administration have revived calls for greater domestic investment in energy, power and mining infrastructure.

Thea Riofrancos, a political science professor and author of the forthcoming book Extraction: The Frontiers of Green Capitalism, says these developments are part of a broader trend.

Last year, the European Union signed a critical minerals deal with Rwanda, but the European Parliament later voted to suspend it. Lawmakers cited Rwanda’s support for a rebellion in the eastern Democratic Republic of Congo, where armed groups are seizing and exporting coltan, tin, tungsten, tantalum, and gold.

Meanwhile, Congolese President Félix Tshisekedi has proposed a critical minerals agreement with the US, modelled on the stalled deal with Ukraine.

“Importing countries are racing to secure minerals, using a mix of onshoring (encouraging mining within their borders) and bilateral trade agreements,” Riofrancos wrote in a Financial Times editorial.

“Producing countries are implementing export bans, establishing state-owned companies, and in some cases, nationalizing entire mineral sectors. Whether justified by the energy transition, tech industries, or military preparedness, countries everywhere want their piece of the critical mineral pie,” she concluded.

No comments:

Post a Comment