Delta has officially responded to US Airways letter outlining its $8 billion acquisition offer. In a statement on its website, Delta CEO Gerald Grinstein says: "We received a letter from U.S. Airways this morning and will of course review it. Delta's plan has always been to emerge from bankruptcy in the first half of 2007 as a strong, stand-alone carrier. Our plan is working and we are proud of the progress Delta people are making to achieve this objective. The Bankruptcy Court has granted Delta the exclusive right to create the plan of reorganization until Feb. 15, 2007. We will continue to move aggressively towards that goal."

The Atlanta Journal-Constitution (free registration) also has posted on its website a copy of the letter sent from US Airways CEO Doug Parker to Delta's Grinstein. In that letter, Parker tells Grinstein: "I was disappointed that you declined to meet or even enter into discussions in your letter of October 17, 2006 [in response to a previous merger inquiry by US Airways]. Because the benefits of a merger of US Airways and Delta are so compelling to both of our companies' stakeholders, we believe it is important to inform them about our proposal. Therefore, we are simultaneously releasing this letter to the public."

Later in the letter, Parker adds: "This proposal presents an opportunity for Delta creditors to receive significantly higher recoveries than they can receive under any standalone plan for Delta. It is also an opportunity for US Airways shareholders to benefit from the significant upside potential of the combination. Consumers will benefit from expanded choice as well as the reach and services of a large-scale provider within the cost structure of a low-fare carrier. Our employees will benefit from a more competitive employer and our willingness to adopt highest common denominator employee costs."

Michael Perlman is a longtime professor of economics at California State University, Chico. A prolific author, his newest book is titled

Railroading Economics: The Creation of the Free Market Mythology (Monthly Review Press, 2006).

Seth Sandronsky: What did the top economists of the late 19th century grasp as the U.S. railroad industry grew?

Michael Perelman: Economists who studied the railroad industry, which was by far the dominant industry in the country, realized that competition would necessarily drive prices so low that the railroads would become bankrupt. What they saw was similar to the airline industry today. The extra costs to fly me from San Francisco to New York might cost $20 at the most on a flight that was scheduled but had empty seats. Unbridled competition would drive prices down toward $20, which was not enough to cover the fixed costs.

The economists at the time recognized that the industry's viability would require restricting market forces. They argued that the only hope for the industry was to restrict competition by allowing railroads to combine and at least collude to keep prices high.

SS: For non-economists, can you please explain what fixed costs are for industry, and the connections with prices in the marketplace?

MP: Fixed costs are expenses that do not depend on the quantity of goods or services provided. For example, in the airline industry corporations must pay interest on the debt incurred or payment on the leases for the planes that they use. Once a plane is scheduled to run, payments for the pilots and flight attendants as well as the landing fees are set, regardless of how many seats on the plane are empty. According to economic theory, the relation between fixed costs and prices is nonexistent under strong competition. Prices depend on marginal costs -- the cost of supplying one more unit. In the case of the airlines, the marginal cost of filling an empty seat is merely the extra fuel required to carry the extra weight, maybe a lunch, and the cost of handling baggage. Processing of tickets used to cost about $20 but now through computerization is practically nothing.

Fixed costs are also related to but not the same thing as long-lived capital. Economists rarely pay much attention to long-lived capital, except to applaud the concept of capital accumulation. The reason for their inattention is that capital goods require considerations of time, which complicates the simple economic models with which they are enamored. Once a company has invested in such capital goods, it is stuck with them because it will not get much for its investment on secondhand markets. Companies become desperate to utilize these capital goods as efficiently as possible. A large passenger airplane carrying only a couple people would be a disaster for the airline. They would have to do something to fill up their seats.

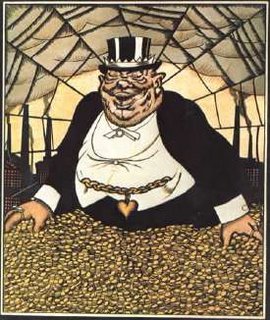

If all the airlines were in a similar situation, they would have no choice but to engage in the price war. This sort of competition occurred in the 19th century railroads. Bankruptcy became commonplace until J.P. Morgan began to organize them into large cartels to prevent competition.

Modern economics assumes away this tendency even though common sense shows that no really competitive industry today is very profitable. Profits are highest in industries protected by intellectual property or by the influence necessary to garner government contracts.

SS: What effects did the "Morganizing" of U.S. industries have on the economics profession?

MP: At first, many of the most important economists of the time applauded Morganization. They argued that a consolidated firm could be more efficient and even offer lower prices to consumers -- much like the contemporary justification of Wal-Mart. They also added that excessive competition was destructive.

Within a short period of time, the concern about excessive competition fell away, although the efficiency argument remained in vogue. After all, large corporations were coming to be common and conventional economists were not about to challenge them. After all, business forces already wielded tremendous influence in academia.

The Morgan-friendly economists introduced another argument, which fell out of fashion until it was re-adopted in the 1970s. This thesis proposed that elimination of competition was not necessarily bad because of potential competition. The idea was that if a company became too greedy and its profits soared, other companies would rush in to claim some of the profit. As a result, corporations would moderate their lust after profits, allowing the public to benefit from the lowered prices due to the efficiency of large business.

A few decades later, Joseph Schumpeter offered another wrinkle to the debate. Even if a corporation monopolized an entire sector, say, steel for example, other corporations that depended on steel could turn to other materials such as aluminum as a substitute. Using this argument, monopolistic power magically disappeared because of what economists call cross-product competition. I might mention that the dot.com era adopted Schumpeter as its patron saint because of his advocacy of the essential role of the entrepreneur.

But now, such debates have subsided. Instead, economists exude confidence that the market operates as a giant computer or even a super-brain, which allows it to ensure that business performs in the most efficient manner possible. So great is the divorce from reality that such theories persist even in the post-Enron era.