US excludes steel, aluminum, gold from reciprocal tariffs

Steel, aluminum and a long list of other metals won’t be subject to “reciprocal” tariffs, the White House said on Wednesday, in a move that provides relief to domestic buyers and suggests the administration is exercising some caution around commodities where the US is heavily reliant on imports.

The long list of exemptions to the cascade of duties captures all base metals, precious metals including gold, as well as niche materials. That means that tariffs on steel, aluminum and, eventually, copper won’t be stacked on top of the newly-announced country levies.

By leaving out vital metals, the administration lessens the risk of price dislocations of the kind seen across the global copper market in recent weeks. But it does not remove uncertainty around the handling of commodities in future.

A senior White House official said critical minerals — a cluster of materials deemed to be of special strategic value — were among products where President Donald Trump was potentially looking to launch tariff investigations under Section 232 of the Trade Expansion Act.

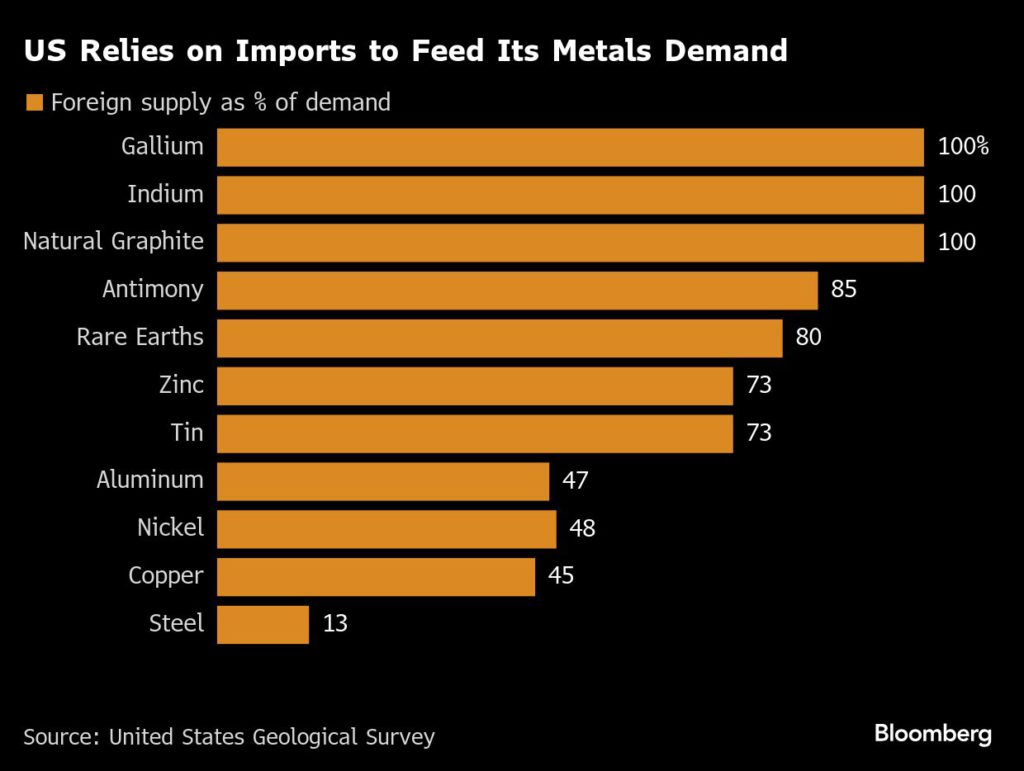

The US is highly dependent on imports for many metals in which China dominates the supply chain, and Trump has made clear his interest in boosting US access to critical minerals, rare earths in particular. Any tariffs would need to be set against the risk of choking off flows to domestic manufacturers.

The US relies on imports for 80% of its rare earths, nearly three-quarters of its zinc and tin, and more than half of its lithium, for example, according to the US Geological Survey. When it comes to steel, there is less reliance on overseas supplies, which makes it arguably easier to impose tariffs on imports.

China has yet to respond in full detail to Wednesday’s blitz, but its answer to US measures so far has been concentrated in curbing exports of minor but vital metals, where its strong grip on production can be used as a trade weapon.

US steelmakers have traded broadly higher this year, outpacing the larger market, as the tariffs helped boost prices of the metal. But the moves come at a price. Demand has been weak amid lackluster construction markets, stubborn inflation and high borrowing costs.

Nucor Corp., the largest American steelmaker, Steel Dynamics Inc. and United States Steel Corp. have warned investors of lackluster earnings results for the first quarter.

Performance for aluminum companies has been more uneven. Shares of Century Aluminum Co. are up about 2% for the year, while Alcoa Corp. is down more than 18%, with much of it’s aluminum produced outside the US.

(By Joe Deaux)

No comments:

Post a Comment