Trump’s policies to spur further central bank gold buying

Central banks are expected to help keep gold’s stunning rally going this year with buying aimed at further diversifying reserves away from the dollar due to risks stemming from US President Donald Trump’s policies.

Russia’s invasion of Ukraine in 2022 provided the first catalyst for purchases by central banks, which have since bought more than 1,000 metric tons of gold a year, twice the annual average of the previous decade.

Spot gold hit its latest record at $3,167.57 a troy ounce on Thursday for a gain of 19% since the start of 2025 and a hefty 71% rise since the end of 2022.

In the final quarter of 2024, when Trump won the US election, central bank purchases accelerated 54% year-on-year to 333 tons, according to an estimate from the World Gold Council (WGC).

“Emerging market central banks currently hold around 10% of their assets in gold. They should really hold 30% of their assets in gold,” said BofA commodity strategist Michael Widmer.

He said that would require central banks to increase their reserves by 11,000 tons of gold and added that uncertainty about US economic policy would remain for some years to come.

“From the central banking perspective (uncertainty) means less incentive to add Treasuries into portfolios and more incentive to actually de-dollarize it,” he said.

US Treasuries and the dollars needed to buy them have previously vied with gold for safe-haven status.

Trump’s tariff policies and global trade wars, his approach to the war in Ukraine and disregard and questioning of decades-old alliances with Europe have upended the world order.

“Those central banks which had (less) gold in their holdings would be looking to add more,” said a source selling gold to central banks. “This year’s demand from central banks may be the highest in many decades.”

Fears of spiralling inflationary pressures due to companies passing on tariffs to consumers in order to protect their profit margins as well as workers seeking higher wages have also boosted gold’s role as a store of value and wealth.

“We view gold’s price strength to date, and our expectation for it to continue, as primarily being driven by investors’ and official institutions’ greater willingness to pay for its lack of credit or counterparty risk,” Macquarie analysts said in a recent note.

Central banks are the third largest category of demand for gold after the jewellery and investment sectors and account for 23% of global consumption. Usually they are price sensitive, buying on dips and curbing purchases when prices rise.

Analysts say expectations of steadily higher gold prices mean they are unlikely to postpone buying.

However, central banks may choose not to disclose their purchases, as Trump has threatened tariffs on countries seen to be actively de-dollarizing.

Official numbers reported to the International Monetary Fund reflect only 34% of the WGC’s 2024 total central bank gold demand estimate.

Data from WGC shows central banks reported adding a net 44 tons to their gold reserves in January-February with Poland and China being the largest buyers.

(By Polina Devitt; Editing by Pratima Desai and Joe Bavier)

The race to get gold bars into the US screeches to a halt

A massive arbitrage trade that has drawn tens of billions of dollars’ worth of gold and silver to the US came to an abrupt halt with Wednesday’s announcement that precious metals would be exempt from Donald Trump’s sweeping tariffs.

For several months, prices in New York have traded at large and unusual premiums to global benchmarks as traders weighed the risk that precious metals could be caught up in tariffs. The differential created an incentive for banks and traders to load planes and ships with so much bullion that it distorted US trade data in the process.

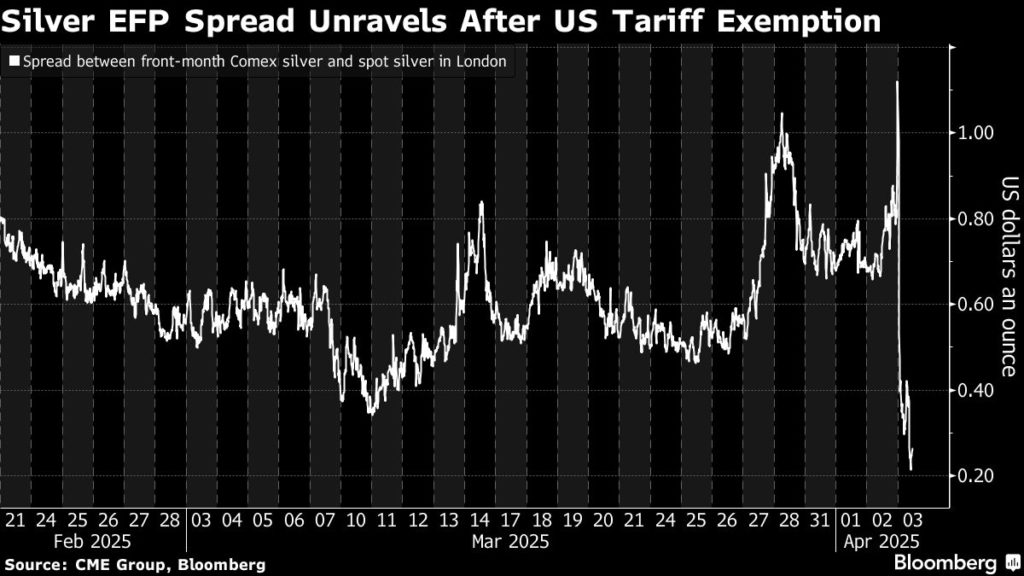

On Thursday, US premiums for precious metals tumbled after a list of exemptions from the tariffs included gold, silver, platinum and palladium. The difference between front-month Comex gold and spot gold in London dropped to $21 an ounce, from over $62 on Wednesday. For silver, the differential — known by precious metals trader as the “exchange for physical” or EFP — tumbled from more than $1 an ounce to just 8 cents.

“Yesterday’s announcement effectively puts an end to the massive flow of precious metals into the US over the last few months as the EFPs collapse,” said Anant Jatia, chief investment officer at Greenland Investment Management, a hedge fund specializing in commodity arbitrage trading.

US precious metals markets never fully priced in major tariffs, but the mere risk of them being imposed caused traders to cover short positions in the US markets, driving a persistent differential. That, in turn, created an incentive to ship physical metal to the US.

US inventories of precious metals have surged to the highest levels on record, with gold stocks up 26.5 million ounces since the end of November and silver up 174.6 million ounces — inflows that are collectively worth over $80 billion at current prices.

Imports of gold helped drive the US trade deficit to a record in January, prompting economists to exclude the precious metal from their calculation.

In February, imports of gold to the US dropped slightly, but remained extremely elevated by historical standards, trade data showed on Thursday. Inflows are likely to have remained high in March, and some may continue in April thanks to trades that were booked when the arbitrage was still open.

(By Jack Farchy)

No comments:

Post a Comment