Reuters | July 1, 2024

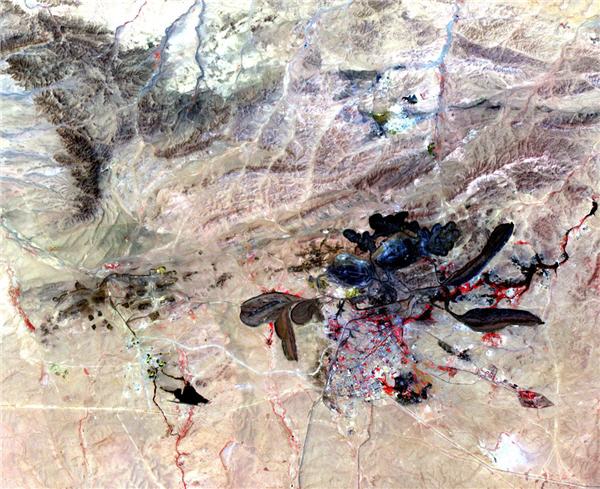

The giant mine in Bayan Obo, Inner Mongolia near Baotou City, produces the bulk of the world’s rare earths and does so as a byproduct of iron ore mining. | Source: NASA

Shares in China’s largest rare earth producers rose on Monday after Beijing announced regulations aimed at protecting supplies of the strategic minerals in the interest of national security, a move some in the market said could potentially tighten supply.

The regulations, issued on Saturday by China’s State Council, or cabinet, take effect from Oct. 1 and stipulate that rare earth resources – a group of 17 minerals used in products from magnets in electric vehicles to consumer electronics – belong to the state.

Shares in China Northern Rare Earth Group High-Tech, China Rare Earth Resources and Technology, Rising Nonferrous Metals Share and Shenghe Resources Holding jumped by 4.8%, 4.1%, 1.8% and 0.5%, respectively.

The regulations follow draft rules in early 2021, with changes including the removal of earlier language saying that companies engaged in rare earth smelting and separation could use imported supplies on top of allocated supply quotas.

“We believe there might be a further control over the smelting and separation of the imported ore,” Sinolink Securities wrote in a note.

China is the world’s dominant producer of rare earths and has taken various measures to tighten management of the industry even as Western countries try to reshape supply chains to ease dependence on Chinese supply.

Some industry players said they were seeking further clarity on the new regulations.

“What we have got so far is that it might not impact the international business much for the moment, but it’s hard to tell whether it will be the case in the future,” said an overseas rare earth buyer, declining to be named as he is not authorised to speak to media.

“It feels like there might be a trend that exports will need some specific licence, but the wording itself does not make this clear enough,” said an analyst on condition of anonymity due to the sensitivity of the matter.

Another analyst, also declining to be named, said the new regulations mean it is likely that, unlike in 2023, China will refrain from issuing a third batch of supply quota this year.

Ge Honglin, chairman of the China Nonferrous Metals Industry Association, said the regulations would reduce industry demand for non-renewable resources, extend the life of mines, and reduce environmental harm.

(Reporting by Beijing newsroom and Tony Munroe; Editing by Jan Harvey)

Aurora, seen here as the Wappen von Hamburg in 1958 (

Aurora, seen here as the Wappen von Hamburg in 1958 (