It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Sunday, December 03, 2023

A BP case study: time to end FTSE 100 share buybacks?

James Beard

Fri, 1 December 2023

Share buybacks are in fashion. According to AJ Bell, at 30 September 2023, 37 FTSE 100 companies had announced £46.6bn of them during the first nine months of the year.

It’s expecting the total for 2023 to be the second-highest on record, beaten only in 2022 (£58.2bn).

Good in theory

A share buyback has the effect of increasing earnings per share (EPS).

And because nothing has changed that will affect the financial performance of the company, the price-to-earnings (P/E) ratio should remain the same.

Therefore, in theory, the share price should increase as illustrated below.

Measure

No action

Repurchase shares (cost £50m)

Earnings (£)

10m

10m

No. of shares in issue

20m

10m

Earnings per share (£)

0.5

1

P/E ratio

10

10

Share price (£)

5

10

Not so good in reality

In my opinion, this is all smoke and mirrors.

In the example, the company spent £50m of its cash that it will never get back. The value of the business should therefore go down.

In reality, a share buyback is no different to paying a dividend. But instead of giving surplus cash to shareholders, it’s spent on stock. When a share goes ex-dividend, its price falls as new holders are not entitled to the payout.

The management team will claim that a buyback is good for the owners of the business but, in my opinion, all it’s doing is increasing EPS, which is to their benefit.

Let’s look at a real example.

On page 115 of the 2022 BP (LSE:BP.) annual report, the oil giant reveals that part of the remuneration of its senior executives will be based on the growth rate of adjusted EBIDA (earnings before interest, depreciation, and amortisation) per share.

No wonder the board like share buybacks so much.

From 1 January to 24 November 2023, the company spent $7.66bn buying 1.22bn of its own shares. At current exchange rates, that’s an average of 498p a share. Not a good deal considering its current share price is around 475p.

Other ideas

If I was a shareholder, I’d rather have a bigger dividend.

This year’s payout is likely to be at least 28.42 cents (22.46p). However, the company could have increased this by 33.3p a share if it stopped buying its own shares and used the money to boost the dividend.

As a consequence, the current yield would increase from 4.7% to 11.8%.

I’m sure that would drive the share price higher.

The last year in which BP didn’t repurchase any of its shares was in 2015. Instead, shareholders received cash of 26.39p — more than they are going to get in 2023.

BP halved its dividend in 2020, blaming the pandemic. But it’s still well below its pre-Covid levels.

Forever in debt

Another way that BP could increase shareholder value is to use the money to pay down its debt, the size of which has been a concern for some investors.

At 31 December 2022, it had borrowings of $46.9bn. Reducing this by around 15% would significantly improve the company’s balance sheet. And earnings would increase due to lower interest payments.

After studying 250 companies in the S&P500 between 2004 and 2014, McKinsey & Co found there was “no correlation” between the level of share purchases and the total return to shareholders.

The research concluded that cash flow generates value, irrespective of how it’s returned to the owners.

Therefore, in my view, the time has come to end share buybacks and focus on creating real shareholder value.

The post A BP case study: time to end FTSE 100 share buybacks? appeared first on The Motley Fool UK.

UK

'Santa' and 'elf' job listings down from 2022 as retailers expect slower Christmas

Daniel O'Boyle

Fri, 1 December 2023

The number of job listings for the roles of “Santa Claus” and “Elf” is down compared to 2022, in a sign the retail sector is expecting lower footfall this Christmas (Getty Images for Hamleys)

The number of job listings for the roles of “Santa Claus” and “Elf” is down compared to 2022, in a sign the retail sector is expecting lower footfall this Christmas.

According to jobs platform Indeed, listings are down 15% from 2022, as cost of living pressures threaten to spoil the Christmas cheer this year.

But the number of jobs advertised is still above pre-pandemic levels.

Indeed’s senior UK economist Jack Kennedy added that, while overall listings have been down, retailers started their search for Father Christmas earlier this year.

“That’s possibly a reflection of the fact that hiring conditions have been challenging. So perhaps they felt that it would be prudent to get all their ducks in a row early on.”

Kennedy said Santa jobs are typically listed at around £14 an hour, but a handful were paying significantly more.

“The highest I saw was about £27 an hour at a garden centre,” he said.

Average pay is up by 4.2%, but that’s well below the 7.7% average wage growth across the nation. It's also not enough to keep up with increases in the price of a mince pie, carrot and a glass of brandy, which have risen by about 15% since last Christmas, official figures suggest.

Overall, seasonal jobs are down by 19% on last year, while searches for roles over the Christmas period are up.

Kennedy said: “Christmas hiring is peaking as we approach the holidays. Strong seasonal job interest potentially reflects cost-of-living pressures, prompting more people to look to earn extra money over the festive period.

“However, workers may find themselves facing holiday hurdles when it comes to securing a role, with jobseeker interest in seasonal roles exceeding employer demand. With retail sales down at present, employers appear more cautious this holiday season.”

'Santa' and 'elf' job listings down from 2022 as retailers expect slower Christmas

Daniel O'Boyle

Fri, 1 December 2023

The number of job listings for the roles of “Santa Claus” and “Elf” is down compared to 2022, in a sign the retail sector is expecting lower footfall this Christmas (Getty Images for Hamleys)

The number of job listings for the roles of “Santa Claus” and “Elf” is down compared to 2022, in a sign the retail sector is expecting lower footfall this Christmas.

According to jobs platform Indeed, listings are down 15% from 2022, as cost of living pressures threaten to spoil the Christmas cheer this year.

But the number of jobs advertised is still above pre-pandemic levels.

Indeed’s senior UK economist Jack Kennedy added that, while overall listings have been down, retailers started their search for Father Christmas earlier this year.

“That’s possibly a reflection of the fact that hiring conditions have been challenging. So perhaps they felt that it would be prudent to get all their ducks in a row early on.”

Kennedy said Santa jobs are typically listed at around £14 an hour, but a handful were paying significantly more.

“The highest I saw was about £27 an hour at a garden centre,” he said.

Average pay is up by 4.2%, but that’s well below the 7.7% average wage growth across the nation. It's also not enough to keep up with increases in the price of a mince pie, carrot and a glass of brandy, which have risen by about 15% since last Christmas, official figures suggest.

Overall, seasonal jobs are down by 19% on last year, while searches for roles over the Christmas period are up.

Kennedy said: “Christmas hiring is peaking as we approach the holidays. Strong seasonal job interest potentially reflects cost-of-living pressures, prompting more people to look to earn extra money over the festive period.

“However, workers may find themselves facing holiday hurdles when it comes to securing a role, with jobseeker interest in seasonal roles exceeding employer demand. With retail sales down at present, employers appear more cautious this holiday season.”

More UK households turning to debt to pay for essentials, survey shows

Anna Wise, PA Business Reporter

Fri, 1 December 2023

Nearly a fifth of households in Britain owe money after missing a repayment on credit or a loan, as consumers turn to debt to fund everyday expenses, new research has revealed.

Families in serious financial difficulty are increasingly taking on debt to pay for essentials, according to a survey from the Abrdn Financial Fairness Trust and the University of Bristol.

It comes as the cost of living continues to rise, with food prices still more than a 10th higher last month than the same time last year, according to official figures.

The survey found that 16% of households owe money due to missing at least one payment on a credit commitment, which can include a credit card, personal loan, motor finance, and buy-now-pay-later.

It is higher than the 11% who said so in a survey conducted in May this year.

Nearly two thirds of all households across the UK have some consumer debt, the survey of about 5,600 adults showed.

But middle-income households, incorporating the middle 20% of incomes among working-age households, were more likely to owe at least £5,000 across their various forms of credit than those on the lowest 20% of incomes.

It suggests the total amount of credit owed does not always relate to the level of financial difficulty that households experience – with people often using credit cards for benefits such as building credit scores and benefiting from cashback and rewards.

Meanwhile, the survey found that around 15% of households in Britain have borrowed money in the past month to cover everyday expenses such as food and bills, up from the 13% who said so in May.

The figure rises to 35% of those who are in financial difficulty.

Karen Barker, head of policy and research at Abrdn Financial Fairness Trust, said: “It is particularly worrying that many in serious financial difficulties continue to take on debt just to pay for essentials.

“This group is also more likely to borrow from friends and family, meaning their loved ones may be going without to help keep them warm and fed.”

She added that energy bills are set to rise from January, adding to the risk of those in serious financial difficulty being “forced to fall even further into debt to stay afloat”.

Anna Wise, PA Business Reporter

Fri, 1 December 2023

Nearly a fifth of households in Britain owe money after missing a repayment on credit or a loan, as consumers turn to debt to fund everyday expenses, new research has revealed.

Families in serious financial difficulty are increasingly taking on debt to pay for essentials, according to a survey from the Abrdn Financial Fairness Trust and the University of Bristol.

It comes as the cost of living continues to rise, with food prices still more than a 10th higher last month than the same time last year, according to official figures.

The survey found that 16% of households owe money due to missing at least one payment on a credit commitment, which can include a credit card, personal loan, motor finance, and buy-now-pay-later.

It is higher than the 11% who said so in a survey conducted in May this year.

Nearly two thirds of all households across the UK have some consumer debt, the survey of about 5,600 adults showed.

But middle-income households, incorporating the middle 20% of incomes among working-age households, were more likely to owe at least £5,000 across their various forms of credit than those on the lowest 20% of incomes.

It suggests the total amount of credit owed does not always relate to the level of financial difficulty that households experience – with people often using credit cards for benefits such as building credit scores and benefiting from cashback and rewards.

Meanwhile, the survey found that around 15% of households in Britain have borrowed money in the past month to cover everyday expenses such as food and bills, up from the 13% who said so in May.

The figure rises to 35% of those who are in financial difficulty.

Karen Barker, head of policy and research at Abrdn Financial Fairness Trust, said: “It is particularly worrying that many in serious financial difficulties continue to take on debt just to pay for essentials.

“This group is also more likely to borrow from friends and family, meaning their loved ones may be going without to help keep them warm and fed.”

She added that energy bills are set to rise from January, adding to the risk of those in serious financial difficulty being “forced to fall even further into debt to stay afloat”.

UK

Decarbonising industry can’t wait for ‘technologies of tomorrow’, says Tory MP

Christopher McKeon, PA Political Reporter

Fri, 1 December 2023

The UK should not wait for the “technologies of tomorrow” to decarbonise its industries, the net zero tsar has said.

Conservative MP Chris Skidmore said the UK’s industrial emissions could be more than halved using technology available “today, right at our fingertips” as he launched a series of proposals for helping industry reach net zero.

Mr Skidmore said: “Eighty per cent of the UK’s gas use comes from 8% of all businesses – mainly key industries such as steel, cement, glass and chemical refining.

“If we can take urgent action to decarbonise these sectors then we can make a huge shift towards our goals. Yet the Government hasn’t committed to a long-term and stable plan for how we can decarbonise these industries now.”

The proposals appeared in a report published on Friday, the latest in a series from Mr Skidmore’s Mission Zero Network setting out how the UK can reach net zero and following on from the Net Zero Review carried out by the former minister last year.

They include pursuing a “twin track” approach, with greater focus on electrification, digitisation and microgeneration of power alongside the Government’s existing efforts to develop hydrogen and carbon capture and storage technology.

Mr Skidmore said: “We don’t need to wait for the technologies of tomorrow to act today, especially when we could be focusing on these high-emitting sectors to reach our emissions goals for 2030, not just 2050.”

He also urged a change in policy to provide “more carrots” for industries to cut carbon emissions, saying the UK “can’t simply continue to hand out credits as if they’re some kind of indulgence”.

The report comes shortly after Rishi Sunak arrived in Dubai for the Cop28 summit, which also received a message from the King in which he said the world was “dreadfully far off” achieving its climate goals.

Mr Skidmore has recently been critical of the Government’s stance on net zero, and particularly Mr Sunak’s decision to row back from a number of climate change commitments, arguing that the UK needs a stable, long-term plan to cut emissions.

Chris Skidmore, the net zero tsar, has produced a series of reports calling for long-term plans to provide certainty around net zero (David Mirzoeff/PA)

At an event to launch Friday’s report, he reiterated calls for a “long-term, stable pathway… that’s away from the hands of the politicians”.

He said: “We’ve seen this already being developed, not just in the States with their own industrial decarbonisation issues. We’ve seen this developed in Germany with their 10-year guarantee for a hydrogen strategy that’s worth billions, not millions, and I think we’re also beginning to see it, potentially, in Keir Starmer’s own energy policy around having a green industrial mission.

“But the detail of that needs to be set out, so as we go into 2024 with a general election around the corner we need key commitments from all political parties on how they are going to provide support for industry.”

Helen Lamprell, chief legal and transformation officer at industrial software company Aveva, which supported Mr Skidmore’s report, said: “This is a complex challenge, requiring careful co-ordination right across our economy. And we must be aware that we are operating in a global market for investment.

“At Aveva we are already involved in live clean hydrogen and carbon capture and storage projects in the US, Germany, China – but here in the UK progress has been slower.

“The work of the Mission Zero Network in identifying how best to galvanise greater momentum in these sectors is so urgently needed because rising to the challenge of industrial decarbonisation is not only central to meeting the UK’s net zero commitments, but also essential to ensuring the UK maintains a competitive industrial sector into the future.”

Christopher McKeon, PA Political Reporter

Fri, 1 December 2023

The UK should not wait for the “technologies of tomorrow” to decarbonise its industries, the net zero tsar has said.

Conservative MP Chris Skidmore said the UK’s industrial emissions could be more than halved using technology available “today, right at our fingertips” as he launched a series of proposals for helping industry reach net zero.

Mr Skidmore said: “Eighty per cent of the UK’s gas use comes from 8% of all businesses – mainly key industries such as steel, cement, glass and chemical refining.

“If we can take urgent action to decarbonise these sectors then we can make a huge shift towards our goals. Yet the Government hasn’t committed to a long-term and stable plan for how we can decarbonise these industries now.”

The proposals appeared in a report published on Friday, the latest in a series from Mr Skidmore’s Mission Zero Network setting out how the UK can reach net zero and following on from the Net Zero Review carried out by the former minister last year.

They include pursuing a “twin track” approach, with greater focus on electrification, digitisation and microgeneration of power alongside the Government’s existing efforts to develop hydrogen and carbon capture and storage technology.

Mr Skidmore said: “We don’t need to wait for the technologies of tomorrow to act today, especially when we could be focusing on these high-emitting sectors to reach our emissions goals for 2030, not just 2050.”

He also urged a change in policy to provide “more carrots” for industries to cut carbon emissions, saying the UK “can’t simply continue to hand out credits as if they’re some kind of indulgence”.

The report comes shortly after Rishi Sunak arrived in Dubai for the Cop28 summit, which also received a message from the King in which he said the world was “dreadfully far off” achieving its climate goals.

Mr Skidmore has recently been critical of the Government’s stance on net zero, and particularly Mr Sunak’s decision to row back from a number of climate change commitments, arguing that the UK needs a stable, long-term plan to cut emissions.

Chris Skidmore, the net zero tsar, has produced a series of reports calling for long-term plans to provide certainty around net zero (David Mirzoeff/PA)

At an event to launch Friday’s report, he reiterated calls for a “long-term, stable pathway… that’s away from the hands of the politicians”.

He said: “We’ve seen this already being developed, not just in the States with their own industrial decarbonisation issues. We’ve seen this developed in Germany with their 10-year guarantee for a hydrogen strategy that’s worth billions, not millions, and I think we’re also beginning to see it, potentially, in Keir Starmer’s own energy policy around having a green industrial mission.

“But the detail of that needs to be set out, so as we go into 2024 with a general election around the corner we need key commitments from all political parties on how they are going to provide support for industry.”

Helen Lamprell, chief legal and transformation officer at industrial software company Aveva, which supported Mr Skidmore’s report, said: “This is a complex challenge, requiring careful co-ordination right across our economy. And we must be aware that we are operating in a global market for investment.

“At Aveva we are already involved in live clean hydrogen and carbon capture and storage projects in the US, Germany, China – but here in the UK progress has been slower.

“The work of the Mission Zero Network in identifying how best to galvanise greater momentum in these sectors is so urgently needed because rising to the challenge of industrial decarbonisation is not only central to meeting the UK’s net zero commitments, but also essential to ensuring the UK maintains a competitive industrial sector into the future.”

Ryanair finds ‘fake parts’ in aircraft engines

Chris Price

Fri, 1 December 2023

Ryanair

Ryanair has found “fake parts” in two of its aircraft engines during scheduled maintenance checks, becoming the latest airline to be impacted by a brewing scandal.

The parts were discovered during assessment in Texas and Brazil over the past few months and have since been removed from the engines, the low-cost carrier’s chief executive Michael O’Leary told Bloomberg News.

It comes as the global aviation industry is grappling with a fake parts scandal that has left airlines and regulators scrambling to assess engines and trace equipment.

Aviation regulators have accused an obscure London company called AOG Technics of supplying thousands of engine parts with faked certification documents for Airbus and Boeing models, including older-generation 737s used by Ryanair.

Delta Air Lines, American Airlines and Southwest Airlines are among the carriers reportedly that found suspect parts.

The Civil Aviation Authority said in August that it has been investigating the supply of a “large number of suspect unapproved parts” through AOG Technics.

Mr O’Leary said the Irish airline has never conducted business directly with AOG, receiving the component for two engines instead via third parties.

He added the carrier remains “largely unaffected” overall by the scandal.

Airlines were told to check their stocks of spare engine parts after reports around AOG started circulating earlier this year, according to Mr O’Leary.

The discovery of so-called fake parts comes after Ryanair was forced to make changes to its winter schedule after Boeing delayed deliveries of aircraft.

The setback prompted Mr O’Leary to say he could scrap future orders if the US aviation giant continued to miss delivery targets.

In October, he said: “It is frustrating because the demand for travel is very strong and we think there are a lot of competitors who are going to be grounding their aircraft.”

The company said to be at the centre of the scandal, AOG Technics, has been accused by US engine giant General Electric and its French business partner Safran of large-scale fraud that they allege has led to fake or old parts being falsely installed into more than a hundred engines.

AOG’s founder and owner Jose Zamora Yrala, who founded the business from a rented terraced house in Hove on the South Coast, is fighting the allegations.

Chris Price

Fri, 1 December 2023

Ryanair

Ryanair has found “fake parts” in two of its aircraft engines during scheduled maintenance checks, becoming the latest airline to be impacted by a brewing scandal.

The parts were discovered during assessment in Texas and Brazil over the past few months and have since been removed from the engines, the low-cost carrier’s chief executive Michael O’Leary told Bloomberg News.

It comes as the global aviation industry is grappling with a fake parts scandal that has left airlines and regulators scrambling to assess engines and trace equipment.

Aviation regulators have accused an obscure London company called AOG Technics of supplying thousands of engine parts with faked certification documents for Airbus and Boeing models, including older-generation 737s used by Ryanair.

Delta Air Lines, American Airlines and Southwest Airlines are among the carriers reportedly that found suspect parts.

The Civil Aviation Authority said in August that it has been investigating the supply of a “large number of suspect unapproved parts” through AOG Technics.

Mr O’Leary said the Irish airline has never conducted business directly with AOG, receiving the component for two engines instead via third parties.

He added the carrier remains “largely unaffected” overall by the scandal.

Airlines were told to check their stocks of spare engine parts after reports around AOG started circulating earlier this year, according to Mr O’Leary.

The discovery of so-called fake parts comes after Ryanair was forced to make changes to its winter schedule after Boeing delayed deliveries of aircraft.

The setback prompted Mr O’Leary to say he could scrap future orders if the US aviation giant continued to miss delivery targets.

In October, he said: “It is frustrating because the demand for travel is very strong and we think there are a lot of competitors who are going to be grounding their aircraft.”

The company said to be at the centre of the scandal, AOG Technics, has been accused by US engine giant General Electric and its French business partner Safran of large-scale fraud that they allege has led to fake or old parts being falsely installed into more than a hundred engines.

AOG’s founder and owner Jose Zamora Yrala, who founded the business from a rented terraced house in Hove on the South Coast, is fighting the allegations.

Former UK Treasury chief joins Japanese banking giant amid Government lobbying concerns

Szu Ping Chan

Fri, 1 December 2023

Sir Tom Scholar is to chair Nomura's European operations from next April

Former Treasury chief Sir Tom Scholar has been hired by Japan’s biggest investment bank Nomura but will face restrictions that prevent him from lobbying Government officials.

Sir Tom, who was sacked as Treasury permanent secretary on Kwasi Kwarteng’s first day as Chancellor, will join Nomura to chair its European operations.

However, a ministerial watchdog recommended that limitations to his role be imposed by Nomura to ensure he does not have any “unfair influence of access to government”.

The advisory committee on business appointments (Acoba), which assesses roles taken up by former ministers and civil servants, raised issues about the appointment in advice released on Friday.

In a note published alongside the announcement, Acoba said it was “concerned about a former senior HM Treasury (HMT) official advising a large financial institution, not least as a result of the access to information and influence he may be seen to offer”.

Sir Tom, who joined the Treasury in the 1990s, had served in the top role since Brexit. However, he was fired by Liz Truss’s government in September 2022 after the former Prime Minister vowed to change “Treasury orthodoxy”.

Acoba addressed his senior position in Friday’s statement: “Given Sir Tom’s role at the very centre of HMT, there are risks attached to his potential to offer unfair influence or access to government.

“This is especially relevant as Nomura has an active interest in UK government policy that is currently under discussion.

“The Committee noted there is already a relationship between the organisation and HMT and is a stakeholder in its policy work.”

Acoba’s recommended that Sir Tom should have “no direct engagement” with the government on its behalf.

Nomura said it had accepted the advice and agreed that Sir Tom would also have no involvement in lobbying officials “and its arm’s length bodies” until the end of 2024.

Acoba’s recommendations are non-binding but are designed to prevent those with insider information from engaging in lobbying.

However, the watchdog added that “significant changes in government” meant that “the opportunity for him to offer an unfair advantage is limited”.

It also noted that HMT said it had “no concerns with this appointment”.

Acoba, which is chaired by Lord Pickles, the former Conservative chairman, said: “There remains a risk he could be seen to offer Nomura unfair access and influence, particularly if he was to contact the Government on Nomura’s behalf in any capacity.

“The committee’s advice is therefore that Sir Tom should have no direct engagement with the UK government on behalf of Nomura.”

Former Conservative chairman Lord Pickles now chairs the advisory committee on business appointments - Eddie Mulholland

Although Acoba’s advice is non-binding, Nomura said it would follow its recommendations. A spokesman said: “Nomura will abide by the recommendations set out by Acoba.”

As a top investment bank, Nomura engages with HMT’s financial services teams, alongside the rest of the banking sector.

Sir Tom said he did not meet with Nomura during his time at the Treasury.

It is one of the banks responsible for buying government gilts when issued by the Debt Management Office (DMO).

Nomura’s strategy in Europe is mainly focused on dealmaking and net zero financing.

Sir Tom joined the bank on Friday and will succeed David Godfrey as its European chairman from next April.

Sir Tom said: “I am delighted to be taking on the role of chair, particularly at this pivotal moment for the Japanese economy, which brings significant growth opportunities for Nomura, both globally and in the UK.

“I look forward to steering the board and the senior management team as they navigate these exciting challenges.”

Kentaro Okuda, Nomura’s chief executive, said Sir Tom had enjoyed a “long and distinguished career in the British civil service and Nomura will no doubt benefit from his extensive knowledge and understanding of the financial sector.”

Sir Tom also served under Gordon Brown before moving to Washington as Britain’s representative at the International Monetary Fund and the World Bank, where he was stationed between 2001 and 2007.

He returned to the UK to work as Mr Brown’s chief of staff, returning to a senior post at the Treasury at the height of the financial crisis.

Sir Tom also served under Rishi Sunak when he was chancellor.

He was sacked days after Ms Truss entered office and it later emerged that he had received a £450,000 severance payment.

Szu Ping Chan

Fri, 1 December 2023

Sir Tom Scholar is to chair Nomura's European operations from next April

Former Treasury chief Sir Tom Scholar has been hired by Japan’s biggest investment bank Nomura but will face restrictions that prevent him from lobbying Government officials.

Sir Tom, who was sacked as Treasury permanent secretary on Kwasi Kwarteng’s first day as Chancellor, will join Nomura to chair its European operations.

However, a ministerial watchdog recommended that limitations to his role be imposed by Nomura to ensure he does not have any “unfair influence of access to government”.

The advisory committee on business appointments (Acoba), which assesses roles taken up by former ministers and civil servants, raised issues about the appointment in advice released on Friday.

In a note published alongside the announcement, Acoba said it was “concerned about a former senior HM Treasury (HMT) official advising a large financial institution, not least as a result of the access to information and influence he may be seen to offer”.

Sir Tom, who joined the Treasury in the 1990s, had served in the top role since Brexit. However, he was fired by Liz Truss’s government in September 2022 after the former Prime Minister vowed to change “Treasury orthodoxy”.

Acoba addressed his senior position in Friday’s statement: “Given Sir Tom’s role at the very centre of HMT, there are risks attached to his potential to offer unfair influence or access to government.

“This is especially relevant as Nomura has an active interest in UK government policy that is currently under discussion.

“The Committee noted there is already a relationship between the organisation and HMT and is a stakeholder in its policy work.”

Acoba’s recommended that Sir Tom should have “no direct engagement” with the government on its behalf.

Nomura said it had accepted the advice and agreed that Sir Tom would also have no involvement in lobbying officials “and its arm’s length bodies” until the end of 2024.

Acoba’s recommendations are non-binding but are designed to prevent those with insider information from engaging in lobbying.

However, the watchdog added that “significant changes in government” meant that “the opportunity for him to offer an unfair advantage is limited”.

It also noted that HMT said it had “no concerns with this appointment”.

Acoba, which is chaired by Lord Pickles, the former Conservative chairman, said: “There remains a risk he could be seen to offer Nomura unfair access and influence, particularly if he was to contact the Government on Nomura’s behalf in any capacity.

“The committee’s advice is therefore that Sir Tom should have no direct engagement with the UK government on behalf of Nomura.”

Former Conservative chairman Lord Pickles now chairs the advisory committee on business appointments - Eddie Mulholland

Although Acoba’s advice is non-binding, Nomura said it would follow its recommendations. A spokesman said: “Nomura will abide by the recommendations set out by Acoba.”

As a top investment bank, Nomura engages with HMT’s financial services teams, alongside the rest of the banking sector.

Sir Tom said he did not meet with Nomura during his time at the Treasury.

It is one of the banks responsible for buying government gilts when issued by the Debt Management Office (DMO).

Nomura’s strategy in Europe is mainly focused on dealmaking and net zero financing.

Sir Tom joined the bank on Friday and will succeed David Godfrey as its European chairman from next April.

Sir Tom said: “I am delighted to be taking on the role of chair, particularly at this pivotal moment for the Japanese economy, which brings significant growth opportunities for Nomura, both globally and in the UK.

“I look forward to steering the board and the senior management team as they navigate these exciting challenges.”

Kentaro Okuda, Nomura’s chief executive, said Sir Tom had enjoyed a “long and distinguished career in the British civil service and Nomura will no doubt benefit from his extensive knowledge and understanding of the financial sector.”

Sir Tom also served under Gordon Brown before moving to Washington as Britain’s representative at the International Monetary Fund and the World Bank, where he was stationed between 2001 and 2007.

He returned to the UK to work as Mr Brown’s chief of staff, returning to a senior post at the Treasury at the height of the financial crisis.

Sir Tom also served under Rishi Sunak when he was chancellor.

He was sacked days after Ms Truss entered office and it later emerged that he had received a £450,000 severance payment.

UK Train drivers vote to extend strike action

Chris Price

Fri, 1 December 2023

Aslef General Secretary Mick Whelan says his members ‘are in this for the long haul’ - James Manning/PA

Train drivers represented by the Aslef union have voted overwhelmingly to continue strike action for the next six months in their ongoing dispute over pay.

Mick Whelan, the Aslef General Secretary, warned rail operators that his members “are in this for the long haul” as the latest round of industrial action got under way on Friday.

The vote is the latest blow to travellers who have been hit with 18 months of disruption since unions began their pay dispute with the Government and train operating companies.

Aslef members began a nine-day ban on working overtime on Friday which will run alongside a series of strikes across the country, beginning on Saturday.

Unlike previous strikes, different operators will walk out on different days across the country during the wave of action.

Mr Whelan said: “Our members – who have not had a pay rise for nearly five years now – are determined that the train companies – and the Tory government that stands behind them – do the right thing.

“The cost of living has soared since the spring and summer of 2019, when these pay deals ran out. The bosses at the train companies – as well as Tory MPs and government ministers – have had increases in pay.

“It’s unrealistic – and unfair – to expect our members to work just as hard for what, in real terms, is considerably less.”

The vote for further strike actions comes a day after members of the RMT union voted to accept a pay offer in a separate dispute, bringing an end to the threat of walkouts until at least the spring.

Aslef members at 12 train operators in England were re-balloted about continuing strike action, each returning huge votes in favour on high turnouts.

Rail minister Huw Merriman said: “Following RMT members voting to overwhelmingly accept the train operators’ pay offer, Aslef is now not just the only rail union still striking but the only union not to even put an offer to its members.

“They are instead choosing to cause more misery for passengers and the hospitality sector this festive period.

“The fair and reasonable offer that’s long been on the table would bring the average train driver’s salary up to £65,000 for a 35-hour, four-day week.

“Aslef’s leadership should follow in the footsteps of all the other rail unions by doing the right thing and giving their members a say on that offer.”

A spokesman for Rail Delivery Group, which represents the operators that employ the train drivers, said the vote was “disappointing”.

Chris Price

Fri, 1 December 2023

Aslef General Secretary Mick Whelan says his members ‘are in this for the long haul’ - James Manning/PA

Train drivers represented by the Aslef union have voted overwhelmingly to continue strike action for the next six months in their ongoing dispute over pay.

Mick Whelan, the Aslef General Secretary, warned rail operators that his members “are in this for the long haul” as the latest round of industrial action got under way on Friday.

The vote is the latest blow to travellers who have been hit with 18 months of disruption since unions began their pay dispute with the Government and train operating companies.

Aslef members began a nine-day ban on working overtime on Friday which will run alongside a series of strikes across the country, beginning on Saturday.

Unlike previous strikes, different operators will walk out on different days across the country during the wave of action.

Mr Whelan said: “Our members – who have not had a pay rise for nearly five years now – are determined that the train companies – and the Tory government that stands behind them – do the right thing.

“The cost of living has soared since the spring and summer of 2019, when these pay deals ran out. The bosses at the train companies – as well as Tory MPs and government ministers – have had increases in pay.

“It’s unrealistic – and unfair – to expect our members to work just as hard for what, in real terms, is considerably less.”

The vote for further strike actions comes a day after members of the RMT union voted to accept a pay offer in a separate dispute, bringing an end to the threat of walkouts until at least the spring.

Aslef members at 12 train operators in England were re-balloted about continuing strike action, each returning huge votes in favour on high turnouts.

Rail minister Huw Merriman said: “Following RMT members voting to overwhelmingly accept the train operators’ pay offer, Aslef is now not just the only rail union still striking but the only union not to even put an offer to its members.

“They are instead choosing to cause more misery for passengers and the hospitality sector this festive period.

“The fair and reasonable offer that’s long been on the table would bring the average train driver’s salary up to £65,000 for a 35-hour, four-day week.

“Aslef’s leadership should follow in the footsteps of all the other rail unions by doing the right thing and giving their members a say on that offer.”

A spokesman for Rail Delivery Group, which represents the operators that employ the train drivers, said the vote was “disappointing”.

Fresh disruption for rail travellers as train drivers strike again

Alan Jones, PA Industrial Correspondent

Fri, 1 December 2023

Rail passengers are being warned to expect disruption over the next week because of strikes and an overtime ban by train drivers in their long-running dispute over pay.

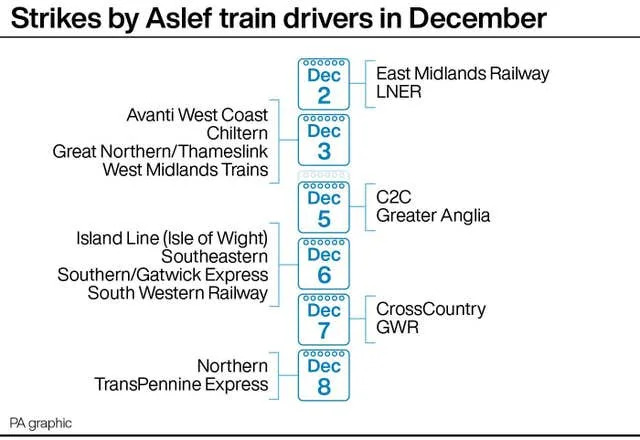

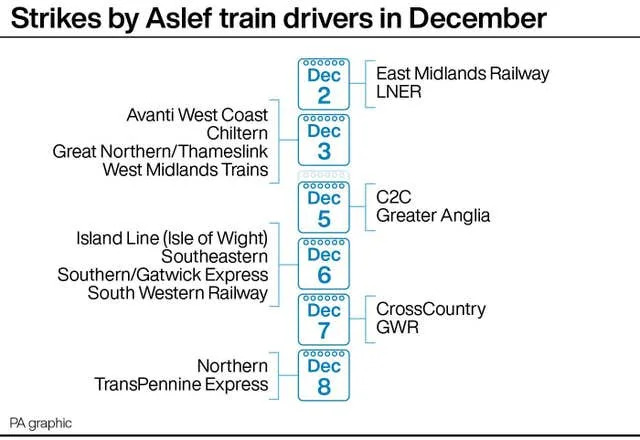

Members of Aslef at 16 train operating companies will refuse to work overtime from Friday until December 9 and will stage a series of strikes between December 2 and 8.

Train companies said they will operate as many trains as possible but there will be wide regional variations, with some operators running no services at all on strike days.

Services that are running will start later and finish much earlier than usual – typically running between 7.30am and 6.30pm.

It is likely that services on some lines will be affected on the evening before and morning after each strike between December 2 and 8 because much of the rolling stock will not be in the right depots.

Mick Whelan, Aslef’s general secretary, said: “We are going on strike again not to inconvenience passengers, but to express our disgust at the intransigence of this Government, and the bad faith shown by the private companies which employ us.

“It is clear that the Tory Government does not want to resolve this dispute. We haven’t had a meeting with Mark Harper, the Transport Secretary, since December 2022.

“We haven’t had a meeting with Huw Merriman, the rail minister, since January this year, and we haven’t heard from the employers since April.

“We are prepared to come to the table and negotiate but the train operating companies and the Tories that stand behind them are not.

“This is turning into a political, rather than an industrial, dispute. They simply can’t be bothered. They are happy to see this dispute rumble on, for passengers and businesses to suffer, and to drive Britain’s railways – once the envy of the world – into a managed decline.”

Mr Whelan told the PA news agency that Aslef members remained solidly behind the campaign of industrial action after not having had a pay rise for almost five years.

(PA Graphics)

Aslef said the rolling programme of one-day strikes and overtime ban was designed to “ratchet up the pressure” on the train operators (TOCs) and the Government.

“We are determined to win this dispute and get a significant pay rise for train drivers who have not had an increase since 2019 while the cost of living, in that time, has soared.

“Our strikes have forced TOCs to cancel services and the ban on overtime has seriously disrupted the network as none of the train companies employs enough drivers to provide a proper service – the service they have promised passengers and businesses they will deliver – without asking drivers to work their rest days.”

Aslef members will strike at East Midlands Railway and LNER on Saturday December 2; at Avanti West Coast, Chiltern, Great Northern Thameslink, and West Midlands Trains on Sunday December 3; at C2C and Greater Anglia on Tuesday December 5; at Southeastern, Southern/Gatwick Express, South Western Railway and Island Line on Wednesday December 6; at CrossCountry and Great Western Railway on Thursday December 7 and at Northern and TransPennine on Friday December 8.

A spokesperson for the Rail Delivery Group said: “This unnecessary and avoidable industrial action called by the Aslef leadership has been targeted to disrupt customers and businesses ahead of the vital festive period, where people will be attending events and catching up with friends and loved ones.

“It will also inflict further damage on an industry that is receiving up to an additional £175 million a month in taxpayer cash to keep services running, following the Covid downturn.

“The Aslef leadership are blocking a fair and affordable offer made by industry in the spring which would take average driver base salaries for a four-day week from £60,000 to nearly £65,000. We urge them to put it to its members, give Christmas back to our customers, and end this damaging industrial dispute.”

– Members of the Rail, Maritime and Transport union have voted to accept a deal to end their long-running dispute over pay and conditions.

Alan Jones, PA Industrial Correspondent

Fri, 1 December 2023

Rail passengers are being warned to expect disruption over the next week because of strikes and an overtime ban by train drivers in their long-running dispute over pay.

Members of Aslef at 16 train operating companies will refuse to work overtime from Friday until December 9 and will stage a series of strikes between December 2 and 8.

Train companies said they will operate as many trains as possible but there will be wide regional variations, with some operators running no services at all on strike days.

Services that are running will start later and finish much earlier than usual – typically running between 7.30am and 6.30pm.

It is likely that services on some lines will be affected on the evening before and morning after each strike between December 2 and 8 because much of the rolling stock will not be in the right depots.

Mick Whelan, Aslef’s general secretary, said: “We are going on strike again not to inconvenience passengers, but to express our disgust at the intransigence of this Government, and the bad faith shown by the private companies which employ us.

“It is clear that the Tory Government does not want to resolve this dispute. We haven’t had a meeting with Mark Harper, the Transport Secretary, since December 2022.

“We haven’t had a meeting with Huw Merriman, the rail minister, since January this year, and we haven’t heard from the employers since April.

“We are prepared to come to the table and negotiate but the train operating companies and the Tories that stand behind them are not.

“This is turning into a political, rather than an industrial, dispute. They simply can’t be bothered. They are happy to see this dispute rumble on, for passengers and businesses to suffer, and to drive Britain’s railways – once the envy of the world – into a managed decline.”

Mr Whelan told the PA news agency that Aslef members remained solidly behind the campaign of industrial action after not having had a pay rise for almost five years.

(PA Graphics)

Aslef said the rolling programme of one-day strikes and overtime ban was designed to “ratchet up the pressure” on the train operators (TOCs) and the Government.

“We are determined to win this dispute and get a significant pay rise for train drivers who have not had an increase since 2019 while the cost of living, in that time, has soared.

“Our strikes have forced TOCs to cancel services and the ban on overtime has seriously disrupted the network as none of the train companies employs enough drivers to provide a proper service – the service they have promised passengers and businesses they will deliver – without asking drivers to work their rest days.”

Aslef members will strike at East Midlands Railway and LNER on Saturday December 2; at Avanti West Coast, Chiltern, Great Northern Thameslink, and West Midlands Trains on Sunday December 3; at C2C and Greater Anglia on Tuesday December 5; at Southeastern, Southern/Gatwick Express, South Western Railway and Island Line on Wednesday December 6; at CrossCountry and Great Western Railway on Thursday December 7 and at Northern and TransPennine on Friday December 8.

A spokesperson for the Rail Delivery Group said: “This unnecessary and avoidable industrial action called by the Aslef leadership has been targeted to disrupt customers and businesses ahead of the vital festive period, where people will be attending events and catching up with friends and loved ones.

“It will also inflict further damage on an industry that is receiving up to an additional £175 million a month in taxpayer cash to keep services running, following the Covid downturn.

“The Aslef leadership are blocking a fair and affordable offer made by industry in the spring which would take average driver base salaries for a four-day week from £60,000 to nearly £65,000. We urge them to put it to its members, give Christmas back to our customers, and end this damaging industrial dispute.”

– Members of the Rail, Maritime and Transport union have voted to accept a deal to end their long-running dispute over pay and conditions.

Opinion

After all those dole diaries and ‘mutual obligations’, it turns out Australia’s privatised employment services don’t work

Van Badham

After all those dole diaries and ‘mutual obligations’, it turns out Australia’s privatised employment services don’t work

Van Badham

THE GUARDIAN AUS

Sat, 2 December 2023

Photograph: Jason Reed/Reuters

A parliamentary inquiry report on 30 years of privatised employment services is out and it is damning.

So it should be. Workforce Australia issues the largest spend on contracts from the government – second in amount only to defence – yet it’s been deemed inefficient, fractured, “broken”and responsible for holding back Australia’s entire economy by failing to supply the labour the country actually needs.

A massive congratulations to the neoliberal architects of this system on having a comfy, fun and lucrative three decades of experimentation at Australia’s expense, just to throw up their hands at the $9.5bn annual waste and go “whoopsie”.

Related: Australia’s broken employment services system needs public provider, parliamentary review finds

Thirty years of pointless personal “resume writing workshops” in communities where unemployment resulted from shared structural realities of collapsing industries and offshoring. Thirty years of vacuous chats with “job specialists” who were, in many cases, less qualified or experienced than the people obliged to take their advice on employment prospects in industries they knew less than nothing about. Thirty years of dole diaries and “mutual obligations” and the ridiculous insistence we constantly applied for jobs we could never do. This last caused despondency in jobseekers, frustrated employers and achieved the rare accomplishment of wasting literally everybody’s time.

I crashed headfirst into this system during several bouts of unemployment. From job rejection to job rejection (memorably, I got rejected from a job at … the Reject Shop) to the “job club” photocopying group workshops and the individual resume-writing consultations, the unique “hysteresis” that afflicts the unwillingly idle unemployed metastasised in me to a full-blown nervous breakdown. I ended up on the disability support pension and I often wonder if I’d had that breakdown – at volume – anywhere apart from the floor of the actual Centrelink office I would have been that lucky.

Sign up for Guardian Australia’s free morning and afternoon email newsletters for your daily news roundup

It was a scheme that from its outset incentivised failure; its private providers could only profit from service provision to the unemployed while there remained unemployed people to service. Handily, the report reveals they were terrible at finding people jobs. This, despite labour shortages all over Australia. A fun story made the tabloid rounds a couple of days ago in which a Tasmanian pub advertised “We are desperate for staff. Police record? Who cares. Drug habit? Join the club. Alcoholic? Don’t get me started. If I can’t find anyone before Xmas, I won’t have a business after Xmas.”

The desperate ad takes on a somewhat darker implication in consideration of the inquiry’s findings: almost 500,000 people have been using the privatised employment services for over a year. Fifty thousand people – 50,000! – had been on their books for 10 years! To paraphrase Nye Bevan: “This island is made mainly of jobs and only an organising genius could produce a shortage of them.”

Organising geniuses, or Coalition governments – because, like most things sour and unfair about the Australian economy, the privatisation of employment services is another legacy of John Howard, and the Friedmanite economic ideology of small government and trickle-down prosperity he and his fans pursued despite the inconvenient burden of observable evidence.

Full props to the leader of this inquiry, Labor’s Julian Hill, for being the first politician in a long time to stare down the elephant in the room of employment services disaster with an actual elephant gun: the description of the system as “broken”, remarkably, comes from him.

Hill’s proposal that government be returned to the centre of unemployment service is practical and cost-efficient, given the inquiry revealed private providers were spending 50% of their time not on facilitating jobs but administering their own operations. Unlike private provision, there’s no loss to government in solving unemployment jobs, either, given that the spare capacity of public servants can always be redeployed to – amazing! – servicing the evolving needs of the community.

Related: Having a constant pool of unemployed workers is deliberate policy | Van Badham

The task ahead for Labor to reform the system beyond denouncing it is unenviable, given the dehumanising twin tropes of the “dole bludger” and “fat cats” of the public service have now been in poisonous circulation since shadowy conservative thinktanks inserted them into the discourse at the time unemployment spiked during the oil shocks of the 1970s. Persuading Australians after 50 years that the unemployed are the structural consequence of deliberate policies designed to create a “reserve army of labour” and keep wages low rather than aspirational aristocrats extorting taxpayer funds to play the lute is not as easy a task as it should be.

Hill is therefore speaking carefully of retaining “mutual obligations” and work-for-the-dole as a “last resort”, which hardly satisfies the desire of those like me who long to burn it all to the ground. The long-term employment advocate Emma Dawson, from thinktank Per Capita, made the point that were mutual obligations a “genuinely mutual” meeting of individual need with government service, with tailoring of programs to provide “education and training, skills matching services and social supports such as treatment for substance abuse or mental health issues”, the language may remain but the results would be transformational.

The whole sorry saga reveals a strange paradox in which the unemployed have been collectively, uniformly punished for a structural problem, when the response to the structural problem should’ve been confronting barriers to employment by meeting individual needs. All of us, from government, to employers to, God help us, the unemployed, have instead been made to learn the lesson that the market has its limits – by smacking our faces into an economic brick wall.

Van Badham is a Guardian Australia columnist

Sat, 2 December 2023

Photograph: Jason Reed/Reuters

A parliamentary inquiry report on 30 years of privatised employment services is out and it is damning.

So it should be. Workforce Australia issues the largest spend on contracts from the government – second in amount only to defence – yet it’s been deemed inefficient, fractured, “broken”and responsible for holding back Australia’s entire economy by failing to supply the labour the country actually needs.

A massive congratulations to the neoliberal architects of this system on having a comfy, fun and lucrative three decades of experimentation at Australia’s expense, just to throw up their hands at the $9.5bn annual waste and go “whoopsie”.

Related: Australia’s broken employment services system needs public provider, parliamentary review finds

Thirty years of pointless personal “resume writing workshops” in communities where unemployment resulted from shared structural realities of collapsing industries and offshoring. Thirty years of vacuous chats with “job specialists” who were, in many cases, less qualified or experienced than the people obliged to take their advice on employment prospects in industries they knew less than nothing about. Thirty years of dole diaries and “mutual obligations” and the ridiculous insistence we constantly applied for jobs we could never do. This last caused despondency in jobseekers, frustrated employers and achieved the rare accomplishment of wasting literally everybody’s time.

I crashed headfirst into this system during several bouts of unemployment. From job rejection to job rejection (memorably, I got rejected from a job at … the Reject Shop) to the “job club” photocopying group workshops and the individual resume-writing consultations, the unique “hysteresis” that afflicts the unwillingly idle unemployed metastasised in me to a full-blown nervous breakdown. I ended up on the disability support pension and I often wonder if I’d had that breakdown – at volume – anywhere apart from the floor of the actual Centrelink office I would have been that lucky.

Sign up for Guardian Australia’s free morning and afternoon email newsletters for your daily news roundup

It was a scheme that from its outset incentivised failure; its private providers could only profit from service provision to the unemployed while there remained unemployed people to service. Handily, the report reveals they were terrible at finding people jobs. This, despite labour shortages all over Australia. A fun story made the tabloid rounds a couple of days ago in which a Tasmanian pub advertised “We are desperate for staff. Police record? Who cares. Drug habit? Join the club. Alcoholic? Don’t get me started. If I can’t find anyone before Xmas, I won’t have a business after Xmas.”

The desperate ad takes on a somewhat darker implication in consideration of the inquiry’s findings: almost 500,000 people have been using the privatised employment services for over a year. Fifty thousand people – 50,000! – had been on their books for 10 years! To paraphrase Nye Bevan: “This island is made mainly of jobs and only an organising genius could produce a shortage of them.”

Organising geniuses, or Coalition governments – because, like most things sour and unfair about the Australian economy, the privatisation of employment services is another legacy of John Howard, and the Friedmanite economic ideology of small government and trickle-down prosperity he and his fans pursued despite the inconvenient burden of observable evidence.

Full props to the leader of this inquiry, Labor’s Julian Hill, for being the first politician in a long time to stare down the elephant in the room of employment services disaster with an actual elephant gun: the description of the system as “broken”, remarkably, comes from him.

Hill’s proposal that government be returned to the centre of unemployment service is practical and cost-efficient, given the inquiry revealed private providers were spending 50% of their time not on facilitating jobs but administering their own operations. Unlike private provision, there’s no loss to government in solving unemployment jobs, either, given that the spare capacity of public servants can always be redeployed to – amazing! – servicing the evolving needs of the community.

Related: Having a constant pool of unemployed workers is deliberate policy | Van Badham

The task ahead for Labor to reform the system beyond denouncing it is unenviable, given the dehumanising twin tropes of the “dole bludger” and “fat cats” of the public service have now been in poisonous circulation since shadowy conservative thinktanks inserted them into the discourse at the time unemployment spiked during the oil shocks of the 1970s. Persuading Australians after 50 years that the unemployed are the structural consequence of deliberate policies designed to create a “reserve army of labour” and keep wages low rather than aspirational aristocrats extorting taxpayer funds to play the lute is not as easy a task as it should be.

Hill is therefore speaking carefully of retaining “mutual obligations” and work-for-the-dole as a “last resort”, which hardly satisfies the desire of those like me who long to burn it all to the ground. The long-term employment advocate Emma Dawson, from thinktank Per Capita, made the point that were mutual obligations a “genuinely mutual” meeting of individual need with government service, with tailoring of programs to provide “education and training, skills matching services and social supports such as treatment for substance abuse or mental health issues”, the language may remain but the results would be transformational.

The whole sorry saga reveals a strange paradox in which the unemployed have been collectively, uniformly punished for a structural problem, when the response to the structural problem should’ve been confronting barriers to employment by meeting individual needs. All of us, from government, to employers to, God help us, the unemployed, have instead been made to learn the lesson that the market has its limits – by smacking our faces into an economic brick wall.

Van Badham is a Guardian Australia columnist

If taxing the rich is so fraught, maybe we need a rethink

Phillip Inman

Sat, 2 December 2023

Photograph: Alamy

Taxing the better-off is not going to be easy. For one thing, no one can agree on how to go about it. Thinktanks have put forward various proposals, usually targeting individual wealth.

Voices across the political spectrum agree with the need for such a move. Free-market economists are just as worried about the excessive accumulation of personal capital as those on the left.

Wealth erodes the desire to work, and encourages the kind of nepotism that historians know sows the seeds of societal destruction. And this process can happen within a few generations when the tax on incomes is much higher than that on wealth. Last week a report from UBS bank found the latest entrants to the billionaire category gained more of their fortune from inheritance than from hard work.

Britain is not alone in becoming host to a moneyed class who live off asset gains and rents. It’s just that, as the earliest industrial nation and the most successful imperialist, it leads the pack.

A 10% surcharge on the profit from a home sale would be relatively light, given the colossal gains from selling real estate

The disagreement becomes – at least so far – insurmountable when it comes to how to tax individual wealth. In 2020, the Social Market Foundation proposed a levy on property that would bring an individual’s main home into the tax net for the first time. A 10% surcharge on the profit from selling a home would be a relatively light tax, given the colossal gains from selling real estate over the past 40 years, and would raise upwards of £400bn over 20 years, from what the SMF said was an estimated £5tn of property assets (a figure that in 2022 actually hit more than £7tn).

James Kirkup, who was head of the SMF when the proposal was made, had been political editor of the Daily Telegraph. He had strong connections in the Tory party and judged that this might be acceptable, given the tax was slight and all in the future. But he was wrong and the idea died.

Likewise, wealth tax reforms proposed by the IPPR, the Institute for Fiscal Studies, the Resolution Foundation, the TUC, the New Economics Foundation and the many others that seek to conjure more money from share-owning and property never gained traction.

In large part this is due to the competition for public attention that drives thinktank funding. Why would they coalesce around a rival’s idea? But those who support the idea of a wealth tax should agree to back a single policy programme. Without agreement based on some significant compromise, the levy will never get off the ground.

The most efficient and fairest tax is one applied to land ownership. Most economists know this, but believe the moment has passed now that property has become such a high-value asset.

A land tax would affect an ancient aristocracy that owns the most treasured and valuable of British assets, but there is also a trend for decision makers and people of influence – be they MPs, chief executives or newspaper owners – to possess expensive plots of land. These holdings would face much higher annual tax rates than under Kirkup’s tax scheme.

Homes in prime locations bought long before the property price boom of the past 25 years would attract the highest rates of land value tax.

And while there would be the promise of income tax cuts to compensate for more wealth taxes, the professional classes and property-owning retirees know they would be unlikely to benefit overall.

Taxes, of whatever kind, also have their limits in an age when the costs of government are going up every year. The nation’s crumbling infrastructure needs more cash, welfare programmes are underfunded and an ageing population is only going to become more costly. And putting up taxes every year is not good politics, even when the taxes are well designed.

Last week, the Productivity Institute produced a blueprint with the aim of showing how we can all work more effectively, generating more income and more tax from the same resources. Another answer can be found in the programmes articulated by those who argue we simply consume less as part of a “post-growth” or “degrowth” strategy.

These are radical alternatives to the solution most commonly pursued by governments – applying ever-higher surcharges on the incomes from work and a policy of borrowing that has become hugely expensive in the post-Covid era.

Tory leaders say more of the same is the answer. Labour follows suit, disagreeing only about how much of the money raised should be ploughed into the same tired system. It’s easy to see why. Public inertia is strong and thinktank solutions lack momentum.

Some collaboration among those on the left of the debate might help.

Phillip Inman

Sat, 2 December 2023

Photograph: Alamy

Taxing the better-off is not going to be easy. For one thing, no one can agree on how to go about it. Thinktanks have put forward various proposals, usually targeting individual wealth.

Voices across the political spectrum agree with the need for such a move. Free-market economists are just as worried about the excessive accumulation of personal capital as those on the left.

Wealth erodes the desire to work, and encourages the kind of nepotism that historians know sows the seeds of societal destruction. And this process can happen within a few generations when the tax on incomes is much higher than that on wealth. Last week a report from UBS bank found the latest entrants to the billionaire category gained more of their fortune from inheritance than from hard work.

Britain is not alone in becoming host to a moneyed class who live off asset gains and rents. It’s just that, as the earliest industrial nation and the most successful imperialist, it leads the pack.

A 10% surcharge on the profit from a home sale would be relatively light, given the colossal gains from selling real estate

The disagreement becomes – at least so far – insurmountable when it comes to how to tax individual wealth. In 2020, the Social Market Foundation proposed a levy on property that would bring an individual’s main home into the tax net for the first time. A 10% surcharge on the profit from selling a home would be a relatively light tax, given the colossal gains from selling real estate over the past 40 years, and would raise upwards of £400bn over 20 years, from what the SMF said was an estimated £5tn of property assets (a figure that in 2022 actually hit more than £7tn).

James Kirkup, who was head of the SMF when the proposal was made, had been political editor of the Daily Telegraph. He had strong connections in the Tory party and judged that this might be acceptable, given the tax was slight and all in the future. But he was wrong and the idea died.

Likewise, wealth tax reforms proposed by the IPPR, the Institute for Fiscal Studies, the Resolution Foundation, the TUC, the New Economics Foundation and the many others that seek to conjure more money from share-owning and property never gained traction.

In large part this is due to the competition for public attention that drives thinktank funding. Why would they coalesce around a rival’s idea? But those who support the idea of a wealth tax should agree to back a single policy programme. Without agreement based on some significant compromise, the levy will never get off the ground.

The most efficient and fairest tax is one applied to land ownership. Most economists know this, but believe the moment has passed now that property has become such a high-value asset.

A land tax would affect an ancient aristocracy that owns the most treasured and valuable of British assets, but there is also a trend for decision makers and people of influence – be they MPs, chief executives or newspaper owners – to possess expensive plots of land. These holdings would face much higher annual tax rates than under Kirkup’s tax scheme.

Homes in prime locations bought long before the property price boom of the past 25 years would attract the highest rates of land value tax.

And while there would be the promise of income tax cuts to compensate for more wealth taxes, the professional classes and property-owning retirees know they would be unlikely to benefit overall.

Taxes, of whatever kind, also have their limits in an age when the costs of government are going up every year. The nation’s crumbling infrastructure needs more cash, welfare programmes are underfunded and an ageing population is only going to become more costly. And putting up taxes every year is not good politics, even when the taxes are well designed.

Last week, the Productivity Institute produced a blueprint with the aim of showing how we can all work more effectively, generating more income and more tax from the same resources. Another answer can be found in the programmes articulated by those who argue we simply consume less as part of a “post-growth” or “degrowth” strategy.

These are radical alternatives to the solution most commonly pursued by governments – applying ever-higher surcharges on the incomes from work and a policy of borrowing that has become hugely expensive in the post-Covid era.

Tory leaders say more of the same is the answer. Labour follows suit, disagreeing only about how much of the money raised should be ploughed into the same tired system. It’s easy to see why. Public inertia is strong and thinktank solutions lack momentum.

Some collaboration among those on the left of the debate might help.

Are young people poised to slam the brake on endless economic growth?

Phillip Inman and Jem Bartholomew

The Austrian-French social philosopher André Gorz is widely credited with having coined the term degrowth in 1972, although it did not start to take off as a movement until the early 2000s.

Prof Tim Jackson, an ecological economist, says that as western governments run out of financial lifelines, they are “stumbling into a post-growth world without having a clue how to manage it”. Jackson has run the Centre for the Understanding of Sustainable Prosperity since 2016. An early adopter of degrowth, he wrote a report for the last Labour government on how to retool the economy for a changing climate. This led to his 2009 book, Prosperity without Growth, which was followed in 2021 by Post Growth – Life After Capitalism.

“We are trying to convince ourselves that we can kickstart growth again without having a transparent debate about what needs to be done,” he says.

Two events last month make his point. In Jeremy Hunt’s autumn statement, the UK chancellor glossed over a £20bn shortfall in spending on public services to free up £9bn for corporate tax cuts and £4.5bn of business subsidies, which officials hope will be spent on, among other things, greening the car industry.

A week earlier the German constitutional court had overruled the government’s plan to use special “off-balance-sheet” vehicles to circumvent strict rules constraining the annual budget. As a result, billions of euros’ worth of green projects are expected to be cancelled.

Local not national

Jackson says the momentum behind climate activism suffered a knock during the pandemic, but is recovering. More recently, a lively debate about whether the standard measure of an economy’s health – gross domestic product (GDP) – needs replacing has surprised him.

“The critique of GDP has had more traction than I would have expected,” he says. “You can see how people have come to understand that the gains from GDP growth don’t trickle down.”

Like most post-growth theorists, Jackson says the levels of inequality tolerated in rich countries and the consumption habits of the better-off must be questioned as part of an overhaul of 21st-century capitalism.

Degrowth theories take a socialistic view, stating that people want to contribute to the betterment of human society and will be better able to do that if governments offer access to a job, a basic income and universal healthcare.

Urban planner Leonora Grcheva is one of a small group of experts working for the Doughnut Economics Action Lab. Now adopted by towns and cities across Europe, doughnut economics involves calculating the impact of all policies on the social and physical environment. Aspects of life from income to housing and energy are displayed as sections on a doughnut shape, with its inner and outer edges representing a social minimum and an ecological ceiling. Finding a balance between the two is vital to ensuring wellbeing for both people and the planet.

Britain is a laggard on doughnut policies compared with many European countries, but Grcheva says a growing number of local authorities are using a dashboard – or in Cornwall council’s case, a doughnut-like decision wheel – to judge the impact of what they do.

She says the main barrier to action in the UK is the highly centralised state, which can overrule almost all local plans. Nevertheless, several community groups have joined the project to discuss investments they can make to improve the local environment.

“One of the beautiful things about doughnut economics is that it creates the space for a conversation beyond party politics,” says Grcheva.

This was the experience of the citizen assemblies commissioned in 2020 by the IPPR thinktank, and established in four corners of the UK. Tees Valley, which is overseen by Tory mayor Ben Houchen, was a participant, as were Thurrock – a Tory heartland in Essex – and the more left-leaning south Wales valleys and Aberdeen. The assemblies came to very similar conclusions about the need for more community-led development.

The Netherlands, however, is far more advanced. In spring 2020, officials in Amsterdam began to apply doughnut economics to housebuilding for a post-Covid world. Marieke van Doorninck, then the city’s deputy mayor, said the city would pass regulations obliging builders to use recycled and bio-based materials, such as wood.

Back to the stone age?

Proponents of post-growth policies say they are not a recipe for inaction, or a return to a horse-and-cart, pre-industrial age; rather they are a means of redirecting resources into investments that result in people living happier, more sustainable lives.

But pro-growth economists argue that carbon emissions can be brought down even while satisfying consumer demands for greater air travel, fancier homes and new cars.

Paul Krugman, the US Nobel prize-winning economist, is in this camp, telling degrowthers this summer that their arguments are “all wrong”. “There is no necessary relationship between economic growth and the burden we place on the environment,” Krugman wrote in the New York Times. “It’s true that the Industrial Revolution greatly increased pollution of all kinds, and countries like India that are still in the early phases of their own economic development are by and large paying a large environmental price.

“But at higher levels of development, delinking growth from environmental impact isn’t just possible in principle but something that happens a lot in practice.”

Shadow chancellor Rachel Reeves also prioritises economic growth, focusing on green jobs and lower emissions, but putting little emphasis on curbing voters’ consumption habits. Rishi Sunak listed growing the economy as one of his five priorities in January.

But Jason Hickel, whose 2020 book, Less Is More: How Degrowth Will Save the World, has received many plaudits, says there is an observable shift in the academic community towards theories of a post-growth world.

Academics in favour of degrowth argue that we need to tackle excessive consumption at its root rather than attempting to reduce its environmental impact. They dispute plans put forward by the UK Labour party, Germany’s SPD and the Democrats in the US that growth can be green.

A survey of 789 climate policy researchers by Nature magazine revealed widespread scepticism in high-income countries about the idea that as national income rises, “environmental goals prevail over economic growth”. A majority believed green growth amounted to greenwashing. However, in a separate survey, scientists in medium- and low-income countries saw green growth as a way out of poverty.

Surveys in Germany and the US have shown citizens questioning the relentless pursuit of material wealth. Earlier this year the German environment agency found 88% agreed with the statement “we must find ways of living well regardless of economic growth”, with 77% agreeing that “there are natural limits to growth and we went beyond them”. Most tellingly, 73% agreed that “we should be ready to reduce our living standards”.

The SUV, a totem of rampant consumerism, grabbed more than 50% of new car sales in Europe in the first half of 2023. Photograph: William Barton/Alamy