It’s possible that I shall make an ass of myself. But in that case one can always get out of it with a little dialectic. I have, of course, so worded my proposition as to be right either way (K.Marx, Letter to F.Engels on the Indian Mutiny)

Tuesday, June 20, 2023

Canada moving too slow to counter U.S. Inflation Reduction Act: industry association

Story by The Canadian Press •

OTTAWA — An industry association representing 2,500 Canadian manufacturers is criticizing the federal government for moving at what it says is too slow a pace to prevent investment from flowing south in response to the U.S. Inflation Reduction Act.

Canadian Manufacturers and Exporters says Canada is at risk of missing an important window to invest in a net-zero future that would maintain critical manufacturing operations in Canada.

The Inflation Reduction Act, signed into law by President Joe Biden last year, is the United States' most ambitious piece of climate legislation ever, offering around US$375 billion in new and extended tax credits for everything from renewable electricity generation to hydrogen production to sustainable jet fuel usage.

CME president and CEO Dennis Darby says Canadian manufacturers were encouraged by federal budget measures announced in March to counteract the U.S. legislation, but the industry is still waiting to see which investments qualify for tax credits.

The association says while it acknowledges that Ottawa is in the midst of consulting stakeholders on the structure of Budget 2023’s Inflation Reduction Act response measures, it could alleviate concerns by signalling its commitment to elements that are critical to maintaining investment in Canada.

A report from TD Economics earlier this year said Canada’s financial support for the clean energy transition is competitive with that of the legislation south of the border.

This report by The Canadian Press was first published June 20, 2023.

The Canadian Press

I love Flamin’ Hot Cheetos — as in, I will grab a bag for myself at least once a week. Even better with limón, the snack has meant so much to the Mexican-American community since they debuted on the market in the early 1990s. Like other spicy, addictive snacks popular in Mexico and Mexican communities all over the world, Flamin’ Hot Cheetos have become something that’s uniquely ours, a representation of our ingenuity and creativity, all encapsulated on our red-tipped fingers.

With my love for the chip, I, like many others, sat down to watch Flamin’ Hot, the new film directed by fellow Mexican-American Eva Longoria about the story of Richard Montañez, the Frito-Lay janitor who was long credited with inventing Hot Cheetos, after it began streaming on Hulu on June 9. Not only was it an inspiring, rags-to-riches story, it felt authentic to us. The problem? It may actually not be a true story. A 2018 Los Angeles Times investigation found that many of Montañez’s claims were either embellished or entirely fabricated; in 2021, Montañez said that all he could vouch for was what he created in his kitchen, which wasn’t the famous Hot Cheeto recipe. Even more, the film feels like a celebration of capitalism, a system that has harmed many Latine workers much like Montañez.

In Flamin’ Hot’s telling of Montañez’s story, we meet the son of Mexican immigrants, from his childhood in an abusive home, to his adolescence as a gang member, to his career jump from janitor to a multicultural marketing executive at Frito-Lay. From the fabricated capitalist fairytale portrayed in the film to the real-life facts, it’s clear that Montañez made an impact at Frito-Lay. Company records show that while it was former employee Lynne Greenfeld who invented what we know as Hot Cheetos, Montañez helped with subsequent products in the line, like Flamin’ Hot Popcorn.

Strangely enough, the film somewhat acknowledges the controversy around who made Hot Cheetos by showing a group of scientists trying to create the spice mixture in a lab, cut with scenes of Montañez and his family mixing, testing, and concocting their own blend at home with natural ingredients. Soon after, it’s hinted that Frito-Lay didn’t use Montañez’s recipe thanks to a throwaway line when the first batch of Hot Cheetos comes out of a machine.

As a viewer, the question for me then becomes: What was the point? Why contribute to the perpetuation of a trumped-up story that is simultaneously negated?

Moreover, like so many biographical dramas and cringy-inspirational movies before it, Flamin’ Hot maintains the problematic myth of picking yourself up by your bootstraps. It tells a story about one exceptional person, who went from a lower-level janitorial role to an exec position, and makes it seem that it can become true for everyone else, no matter their own challenges. In doing so, it erases the often-insurmountable societal and systematic problems that shut out millions from opportunities and economic advancement.

Rags-to-riches stories like this one celebrate systems that have historically harmed the protagonist, too. In this case, Montañez is someone who knows what it’s like to be without electricity, food, work, and basic necessities. He has first-hand experience being undervalued and exploited at work. He worked at the factory well beyond working hours to get a promotion, made his Hot Cheetos recipe on his own time and dime, and bought the snack in bulk from the store and handed them out to people in his community — all while never receiving any extra compensation for going above and beyond. And still, he’s been taught that working even harder and “thinking like a CEO,” as the movie version of Montañez says, will save him and push his family out of survival mode.

What’s more, Montañez admires the Frito-Lay CEO, who is not “like other CEOs” because he’s “nice,” overlooking the fact that he cut jobs and closed factories, wrecking the lives of people much like Montañez, in order to maintain the company’s wealth.

The film had so many chances to address the racism, xenophobia, and manipulation of the system that kept the Montañez family from the resources they needed to survive. For instance, it could have dove deeper into the story of Montañez’s wife, Judy, and the role she played in his career. As it stands, she mostly serves as a one-dimensional character, an incessant cheerleader who supports him from the sidelines. While she is not the main character, she is essential to the protagonist’s story, and she deserved more than being described as someone who “never left his side.”

But, for me, perhaps the biggest disappointment was that the film didn’t take advantage of the opportunity to critique toxic work practices and instead celebrated a superficial version of success at our community’s expense. Latines have long internalized that hard work — even if it comes at a risk to one’s physical and mental health — is the key to a better life. As the children of immigrants, many of us have come to believe, both directly and subtly, the idea that you have to work twice as hard as everyone else to move forward in this country; that having sick days, mental health days, and weekends to rest is not an option; it’s laziness.

In my own childhood, my parents told me that being sick was not an excuse to miss school; I had to “suck it up” and go anyway. This continues to follow us as we grow up and enter a workforce that discourages us from having actual lives or sustainable wellness. The film’s creators perpetuate this message, irresponsibly promoting behaviors that can harm people, especially when it would benefit us all to prioritize ourselves over our jobs. We shouldn’t have to sacrifice our wellbeing to obtain financial security. We shouldn’t have to accept workplace exploitation to climb the career ladder. And we shouldn’t have to labor to prove that we deserve to exist.

There were parts of Flamin’ Hot I enjoyed. For instance, Montañez’s cute and hilarious children elevated the film, especially when the family was working together to create the spice recipe. It was also refreshing to see the Mexican-American family openly condemn Montañez’s father, Vacho, for his abuse, violence, and machismo. Yet, these satisfying moments don’t override the damaging pull-yourself-up-by-your-bootstraps message that endorses the exploitation of workers and makes their lack of success feel like a personal failure rather than the intended outcomes of a capitalist system that hinges on so-called winners and losers, or wealthy and poor.

At the end of the day, just like in the film, it’s Frito-Lay that will ultimately benefit and make millions from our communities through this embellished 99-minute commercial. For me at least, I might be skipping the bag of Hot Cheetos this week.

Prairie Rose School Division hears call for book ban

Story by The Canadian Press •

Another Manitoba school division is facing calls to censor some books and to take greater steps to monitor the content in books that can be found on library and classroom shelves.

On Monday evening, the southern Manitoba-based Prairie Rose School Division (PRSD) held its regular board meeting in Carman, but it had to be moved from the division’s board office to the nearby Carman Collegiate to accommodate a larger than anticipated crowd.

Monday’s agenda included one delegate who spoke in favour of increased regulations over what books are available in the division’s schools and three who spoke out against any moves to ban or censor books or other literature.

Raelyn Fox, who said she is a mother to children who attend school in PRSD, spoke first on Monday, and said that lately she has been both “shocked and disgusted” by what is being made available at schools, and said some books contain what she said was “graphic sexual” content.

Fox read aloud excerpts from several books and publications during the meeting that covered issues of sexuality, and sexual and gender identity, and books that she said are not appropriate for school shelves, but are currently available in the division.

“I sit here shocked disappointed and disgusted, you and the staff hold a legal position of trust and power in relation to the students and minors that attend your school,” Fox said.

“Tonight I will signal that there has been an abuse and a breach of power by your staff, and a betrayal of parents and public trust.”

In opposition to increased monitoring of books and the removal of some from school shelves was Melissa Benner, the president of the Prairie Rose Teachers Association, which represents division teachers and staff.

Benner said she believes that free speech is a right that all Canadians hold, but she does not believe that it should allow for “bigotry and hatred” or for people or groups to decide what others can and cannot read at school.

“In a democratic society, no matter what our personal values are, all individuals have a right to voice their opinion, but hateful behaviour has no place in a civilized society and will not be tolerated,” Benner said. “All individuals also have the right to participate in and access information, and that affects their lives and their well-being.”

Benner said she has also become increasingly concerned about anti-LGBTQ rhetoric and actions she first noticed in the U.S., but seem to be spreading into some areas of southern Manitoba.

“There are many individuals who are not here tonight, because they do not feel safe. They fear being targeted bullied and harassed based on who they are,” Benner said. “And their fear is not without merit, over the past months there has been a disturbing pattern of discriminatory behaviour targeting individuals.”

She said banning books some might deem inappropriate would also be dangerous because it would lead to less critical thinking in schools and in classrooms.

“School is a place where students seek knowledge and build awareness, not just about themselves, but about the world they live in,” she said.

“Books allow us to explore different perspectives, to challenge our beliefs, and to grow intellectually.”

PRSD say trustees will discuss Monday’s delegations, and the information that came forward during Monday’s meeting at their next board meeting scheduled for June 26, and the division plans to release a statement after that meeting concludes.

— Dave Baxter is a Local Journalism Initiative reporter who works out of the Winnipeg Sun. The Local Journalism Initiative is funded by the Government of Canada.

Story by kneubauer@insider.com (Kelsey Neubauer) • Yesterday

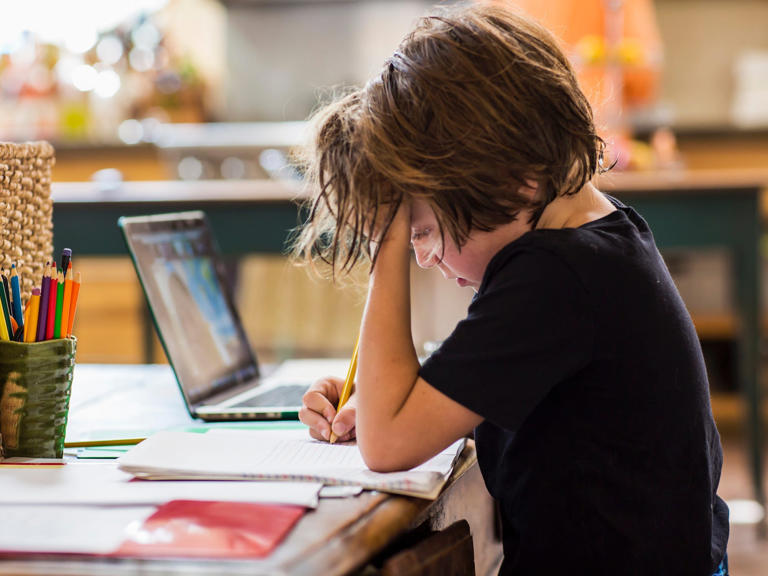

A six-year old going to school virtually — like most students did during the pandemic.

School shutdowns hit Black and Hispanic students harder than White and Asian students.

The federal government has given $190 billion to schools in the hopes of mitigating the impact.

The COVID-19 public health emergency may be officially over, but a new report shows that we're only starting to see its impact on children's education.

Standardized testing scores are down significantly, children in some districts are years behind on reading and math, and many have missed out on key periods of socialization, ProPublica reported. Remote learning and trauma relating to COVID-19 deaths both played a role in the setbacks.

As a result of this so-called learning loss, the economic fallout for those who went to school during the pandemic years could be worse than for people who worked during the Great Recession, Stanford economist Eric Hanushek said while presenting research at an event earlier this year, according to ProPublica. These students will be "punished throughout their lifetime," he said at the event.

Hanushek said that those in Grades 1 through 12 during the pandemic could expect 3% lower incomes over their lifetimes due to learning loss, in a report published May 2020 at the onset of the pandemic.

The impact has been uneven

Districts with a high rate of students experiencing poverty have been worse off, ProPublica reported. One reason it cited was that they are less likely to have books and other resources at home compared to a wealthier student.

Meanwhile, Black and Hispanic students were hurt more dramatically than White or Asian students — erasing years of progress in closing the racial learning gap throughout the US, according to the news organization. Historically, this gap has been the long-term result of policies designed to keep communities of color in low-income neighborhoods, per the Brookings Institute.

It's not just the students who will be impacted: two-thirds of a year of learning loss would lead to an over $27 billion drop in the US Gross Domestic Product — a key indicator of economic growth — over the next 80 years, according to Hanushek's report.

In an attempt to reverse the issue and get students back on track, the federal government has sent over $190 billion to schools across the country for pandemic recovery, which schools have put towards additional educational resources such as tutoring, per ProPublica.

Still, the government can't contend with a shortage of teachers, an issue that was accelerated by the pandemic and is most severe in poverty-stricken areas that need it the most. The only way to solve this, according to a December 2022 Economic Policy Institute report is to increase pay for teachers and provide more support in classrooms.

Story by Rosa Marchitelli • Yesterday

Constance McCall can't catch a break.

The Edmonton woman needed to fix her credit score after getting divorced, so she signed up for a secured credit card that promised to help her do that.

Instead, she's out thousands of dollars, and left with a credit score that's worse than when she started.

McCall, 59, is one of many cardholders stuck in the middle of a bitter legal battle between the credit card company and the bank it partnered with, Calgary-based Digital Commerce Bank, also called DC Bank.

She signed up for the Visa through Plastk Financial & Rewards after seeing it recommended on Credit Karma, a website she trusted.

Plastk promises cardholders the chance to improve their credit scores by reporting their transactions to the credit bureau Equifax.

As a secured card, the credit limit matches whatever customers prepay for a security deposit — between $300 and $10,000.

Plastk founder and CEO Motola Omobamiduro launched his company in October 2020, and partnered with Calgary-based Digital Commerce Bank. (Jenn Blair/CBC)© Provided by cbc.ca

Plastk says customers can cancel any time and get their deposit back after a two-month holding period if the account is in good standing.

After cancelling in December, McCall was expecting $4,500 to be returned in February. Without it, she's had to borrow from family and friends to pay for the basics.

"It was extremely humbling — $4,500 is not a little amount of money, especially for someone like myself. It's huge," she said.

"That was going to pay my next two months' rent, buy my food."

After Go Public brought McCall's case to the company's attention, Plastk refunded her entire deposit — four months after she was supposed to get it back.

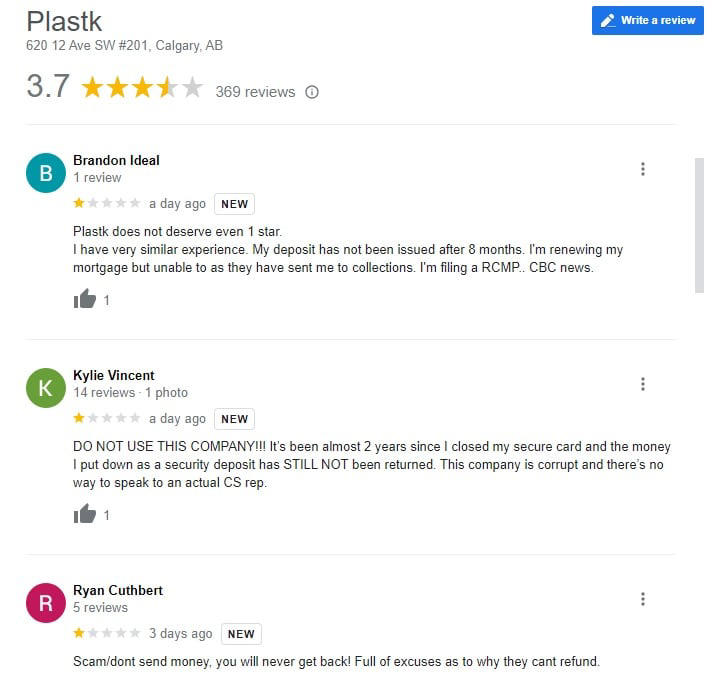

Plastk has 7,000 customers across Canada. Go Public spoke to a dozen — hundreds more have posted complaints online — who say they too are out hundreds or thousands of dollars.

Gail Henderson, an expert in consumer finance, says consumers who use secured credit cards backed by non-bank lenders need to be better protected.

Credit cards backed by bank lenders are heavily regulated by the federal Financial Consumer Agency of Canada (FCAC), she says, but cards offered by organizations that are not banks — such as Plastk — have fewer regulations and are overseen by general provincial consumer protection branches.

The FCAC warns consumers to "be careful when applying for a secured card from an unknown financial institution," and recommends checking with the institution to make sure security deposits are insured.

The agency says, in a report published in June, that non-bank consumer complaints about financial products and services have a much lower rate of resolution than those about banks.

Gail Henderson, an associate professor in the Faculty of Law at Queen’s University, is an expert in consumer finance. (Alexis Raymon/CBC)© Provided by cbc.ca

The FCAC report also said most surveyed Canadians don't understand that financial products not backed by banks have less consumer protection.

It suggested that oversight of non-bank products and services ought to be brought up to the stricter level of federally regulated banks and credit unions.

Pedro Oliveira of Hamilton cancelled his Plastk card on Feb. 12 and is still waiting for his $1,000 deposit. After failing to get a resolution with Plastk after about 100 days he filed a complaint with the Better Business Bureau, then he turned to the government — and got sent in a circle.

"I reached out to Consumer Protection Ontario," he said, "and they told me to reach out to the Financial Consumer Agency of Canada who told me to reach out to Consumer Protection Ontario."

Brian Kline of Maple Ridge, B.C., never received hiscard from Plastk after he sent a $2,500 deposit. In late October he asked to cancel his card, and is still waiting for his refund.

He too reported to the Better Business Bureau, then DC Bank, which sent him back to Plastk. Then he tried the Ombudsman for Banking Services and Investments, which said the matter isn't under its jurisdiction. He says the Better Business Bureau closed his complaint as unresolved.

DC Bank says the problem with customer refunds is not its responsibility, since it's not part of the credit agreement between Plastk and its customers. (Google maps)© Provided by cbc.ca

"In all honesty, I'm not confident in ever having my hard-earned money lawfully returned to me," he said.

Plastk CEO and founder Motola Omobamiduro says he is trying to pay customers back, but their money is being held up by DC Bank.

Plastk and DC Bank partnered in April 2020. Court documents show their dispute started about two years later when DC Bank said Plastk owed unpaid fees and wasn't providing the required funds for the bank to pay Visa.

Plastk said the bank was unfairly imposing new rules and fees and that its technology didn't always work — limiting Plastk's ability to do business.

Plastk sued for $5 million in January, and DC Bank counter-sued for $3.8 million a few weeks later.

McCall says the real shock was finding out the businessman behind Plastk is a former used car salesman with a conviction for breaking a consumer protection law.

This screen grab of Google reviews, taken on June 7, shows a few of the many online complaints from Plastk customers who say they are waiting for refunds. (Google)© Provided by cbc.ca

On Nov 4, 2021, Omobamiduro pleaded guilty and was convicted under Alberta's Consumer Protection Act for not paying off liens on trade-in vehicle sales, leaving his customers with the debt.

Go Public spoke with two former customers, who say that ruined their credit scores.

Omobamiduro says he had nothing to do with failing to pay off the liens; that it was the fault of an employee in B.C.

"It was an employee that did the deal. The partner should have flagged it and stopped it. Unfortunately it went through and as a consequence, you know, I took responsibility," he said.

Omobamiduro was ordered to pay a total of $22,993 in restitution to his auto sale customers.

McCall says, had she known about the conviction, she wouldn't have signed up for a Plastk Visa.

Go Public interviewed McCall at her home in Edmonton, where she's had trouble making rent because of the delay getting her refund. (Sam Martin/CBC)© Provided by cbc.ca

"I would have never put my own money into this person's company."

As for DC Bank, it says it's not part of customers' credit agreements with Plastk.

"Plastk is the sole party responsible for this situation," it said in a statement emailed to Go Public.

Visa Canada also isn't taking responsibility, saying through a spokesperson that financial institutions that use the its network are "accountable" to their customers and for their business practices.

McCall says she didn't know where to turn — the entire ordeal was "mind boggling."

Go Public looked into it and found a complicated web of government departments, who say they can't help and instead point consumers elsewhere.

Service Alberta and Red Tape Reduction is the regulatory authority responsible for Plastk's secured credit card.

But when Go Public asked if it received any consumer complaints involving the company, or whether the agency has taken any action on behalf of consumers it didn't answer the questions.

"One thing that's missing is a clear path for consumers when they have an issue [with non-bank secured credit cards]," said Henderson, the finance expert.

"At the provincial level, there could be more resources put into more proactive enforcement of those rules that are in place to protect consumers. I think there's also scope to strengthen those rules and regulations… all Canadians deserve access to a safe and affordable credit card."

Getting her money back was "a huge relief," McCall said. "I can pay all the people I owe and my bank credit card off. I am still broke but I owe no one."

Meanwhile, Omobamiduro says he is working on another deal, planning to move his credit card company over to another sponsoring bank.

Kaitlin Peterson is a millennial parent paying tens of thousands of dollars for day care.

She left her job when she realized day-care costs were higher than her take-home salary.

Peterson is one of many millennials grappling with what parenting looks like in today's economy.

In 2022, Kaitlin Peterson, 34, paid nearly $22,700 for preschool — for just one kid.

When her second child came around, she realized that care for both of her children would cost $500 more per month than her take-home pay as a senior librarian.

So she quit.

"It was basically like working so that my kids could go to day care, and someone else could take care of them, and still not making enough money to actually even pay for the privilege of having them being cared for by someone else," she said.

Now, she works at home full-time caring for her 7-month-old daughter, but still pays for preschool for her 3-and-½-year-old son. She expects it to cost even more this year. Her partner works full time, and another part of the reason she's even able to afford that arrangement is because her father unexpectedly passed away while she was pregnant, leaving behind money from his 401(k) that made it financially possible for her to leave work entirely.

Without that money, Peterson said she thinks that she and her family would've had to leave their home in Denver completely or tighten their budget a lot.

"I'd still rather have my dad," she said.

"He gave me a gift of sorts, but also it's an absolute travesty that the only way that I can afford to have children in this country is for my father to pass away at such a young age," Peterson added.

Kaitlin Peterson and one of her two children. Kaitlin Peterson© Provided by Business Insider

Peterson isn't alone in feeling the economic crunch. As traditional generational milestones — including owning a home, starting a family, and even retiring — feel more out of reach for the new generations rising through the workforce and parenthood, some millennials are opting out of having kids altogether.

Indeed, a recent Deloitte survey of over 22,000 Gen Zers and millennials from across the globe found that over half of respondents from both generations said they live paycheck to paycheck. A high cost of living remains their biggest concern, as ever-increasing prices weigh on already pandemic- and recession-stricken generations.

All of that has led half of responding Gen Zers and 47% of responding millennials to report that they expect starting a family to "become harder or impossible." For people like Peterson, that means navigating a mode of parenting that looks very different from that of prior generations.

"A lot of our friends don't have children, aren't married, or aren't even really with partners," she said. "It's a strange time, I think, compared to maybe some previous generations where it was just sort of expected that everyone had children."

And with homeownership out of sight — and rent high — for many, younger workers may not necessarily be able to afford to rent or buy in the areas they grew up in. Buying and renting costs have skyrocketed, outpacing wages for many.

"All of our family lives in another part of the country as well," Peterson said. "We don't really have a village of any sort. Like when our kid gets sick and we have to go to the urgent care at night, it's just us. When I went into labor with my daughter, we frantically were calling all of our friends seeing if anyone could come watch our son."

Peterson has no regrets about having kids, but understands why people opt out

Even with all of the challenges she faces as a millennial parent, Peterson said she finds immense joy in having children. "All the struggles aside, no regrets. I absolutely adore my children. They've made me a better person," she said.

But she also understands and respects why some people do not want kids. Parenthood changes your entire life, and that's not right for everyone.

"Anyone who tells you that like, 'Oh, you can just fit a kid into your life' — they're lying," Peterson said. "That's not how it works."

Peterson believes that you can have a "totally fulfilling" life without children; for her, her life is more fulfilled with them. And a major restructuring of how the US treats parents and childcare would "dramatically" change her life.

When her family rented a home, she said, her childcare costs were more than rent. It was like "paying for an additional house just for our son to go to daycare."

"As a capitalist society, we emphasize so much the work portion and we put the family aspect to the wayside, but there's still this expectation that there's going to be the continuation of family life," she said. "It's just not feasible to have both the way that things are currently set up."

All of that gets at a disconnect Peterson sees in the US: Deprioritizing childcare, making it difficult for parents to find affordable care and for care workers to earn a living wage.

"It would have to be a huge societal shift generally to make childcare affordable and for that early child development to even be an emphasis," she said. "So, in some ways, it's not enough to just talk about how do we make childcare more affordable, but how do we change as a society to truly value children, parents, and workers, all at the same time."

5 Gen Zers and millennials who make more than $100,000 say you should consider skipping that vacation. Saving and not having to worry about money is the only way to ever feel like you've 'made it.'

We asked five Gen Zers and millennials earning six figures whether they feel like they've "made it."

Some said "yes" because they don't have to worry about money and live a comfortable lifestyle.

Some said a six-figure salary could feel smaller after expenses like childcare and housing.

Many millennials and Gen Zers dream of the day they can wake up and say, "I made it." Some say a higher salary is the key to reaching this goal.

Gen Zers, the oldest of whom are 26, are just entering the workforce, while many millennials, who are 27 to 42, are well into their careers. A SmartAsset analysis of Bureau of Labor Statistics data from the third quarter of last year found that the median salary of a 25- to 34-year-old in the US was $52,156, while the median salary of a 35- to 44-year-old was $62,244.

While these salaries are higher than they were a few years ago, they're far off from what many young people hope to achieve. In 2021, Americans said they'd need to earn $122,000 a year on average to feel that they're in good financial shape, according to a survey by Personal Capital and Harris Poll that polled more than 2,000 people.

But this was before inflation surged over the past few years. With the high costs of things like housing, college, healthcare, and childcare, what's enough for young Americans to feel like they've "made it"?

We asked five Gen Zers and millennials who earned six figures last year what that money has done for them, what it hasn't done, and whether overall they feel like they've made it. Insider viewed documents to verify their incomes.

World Refugee Day, Stand in Solidarity With Palestine Refugees

| |||||||||||||||||

|

Story by Uday Rana • Yesterday

In a very short span of time, Chinese authorities put into place emergency measures to improve air quality in Beijing for the 2014 APEC conference.© Provided by Global News

Last week, large swaths of North America were choking under wildfire smoke.

Cities in both the U.S. and Canada saw a haze descend on them, spurring warnings to stay indoors and to mask up for those who had to be outdoors. And as wildfires are expected to keep wreaking havoc on air quality, the response of cities across the world to emergency levels of air pollution may offer some solutions.

Canada is not the first country to face weeks of poor air quality, and in many parts of the world residents in cities like Beijing, China; New Delhi, India; Bogota, Colombia; and Paris, France have had to innovate and adapt.

Here's how they do it.

In November 2014, Beijing played host to the 21st Asia-Pacific Economic Cooperation (APEC) conference. The city, notorious for some of the world’s worst air quality, had to clean up its air before the summit began.

In a very short span of time, the Chinese authorities put into place emergency measures to improve air quality ahead of the summit.

Production in factories around the capital city was either stopped or halted, along with slowing down construction work. Vehicular traffic was heavily curtailed, with traffic rules put in place alternating which vehicles could drive on which days.

The rule, when in place, means only vehicles with odd-numbered licence plates are allowed to drive on one day and only even-numbered ones the day after -- a move introduced in 2008 to help ease congestion and reduce pollution during the Olympics and Paralympics, according to Reuters.

When improvements in 2014 did not meet expectations, the government doubled down.

Enhanced emissions reduction measures were put into place. Iron and steel, glass and coking industries were stopped. The curbs lasted all of 11 days but appeared to yield something Beijing residents hadn’t seen in quite some time – a blue sky.

The term 'APEC Blue' caught on in China as meaning something beautiful, but fleeting.

A study in the Journal of Traffic and Transport Engineering in 2016 looked at the "odd-even" traffic measures and determined when used in 2008, it did lead to improvements -- but that they also come with a heavy impact on residents.

"Short-term traffic demand management measures can provide support for mega-events. However, based on the analysis in this paper, the degree of traffic reduction is not proportional to the number of vehicles restricted."

Even as Beijing’s air quality showed signs of improvement amid the 2014 measures, in another Asian city officials were acknowledging air quality was just as bad.

According to The Guardian newspaper, Indian authorities admitted in May 2014 that air pollution in New Delhi was comparable to that in Beijing -- a challenge that continues to hang heavy.

Every fall, the smoke from agricultural fires in the north makes its way toward New Delhi. The city’s air quality plummets around this time, mixing with its already-high base levels of pollution.

In response to rising concerns in 2016, Indian authorities rolled out a Graded Response Action Plan (GRAP) to try to tackle air quality.

The plan consists of four emergency stages, each of which corresponds to a threshold of air pollution, and the idea is simple – the worse the air quality gets, the more stringent the controls get.

The scale measures levels of what is known as particulate matter (pm) 2.5. That refers to particulate matter in the air that's either two and a half microns wide, or less.

Video: Toxic smog blankets India’s capital, forcing closure of schools

The first stage, where the levels of particulate matter (pm) 2.5 levels are between 61 and 120, the air quality is labelled “poor." In this first stage, the government imposes heavy fines on garbage burning. Authorities also sprinkle water on the streets with heavy vehicular traffic, to keep the particulate matter from dispersing up into the air as vehicles roll by.

The second stage is called the “very poor” stage, where pm 2.5 levels are between 121 and 250.

In this stage, the government cracks down on the usage of diesel-powered electricity generators. To keep cars off the streets, municipal parking fees are hiked significantly, and the frequency of buses and Delhi Metro trains increases. Children, the elderly and people with respiratory problems are advised to stay indoors.

In the “severe” category (251-250), hot mix plants, brick kilns and stone crushers are banned from operating. And when the levels of pm 2.5 cross 350 on the Air Quality Index (AQI) and the city enters the “severe plus” or “hazardous” level, all construction activity is stopped.

Heavy vehicles like trucks and tankers are banned from entering the city. Even schools are shut down, though there remain questions about the impacts of such plans.

“While these graded response systems are a necessary intervention, their impacts are questionable. They may not necessarily have the kind of impact that that we need,” said Siddharth Singh, an energy, mobility and climate policy expert and the author of the book The Great Smog of India.

The city of Bogota, Colombia also has a graded response plan, and while not facing air quality as poor as Beijing or New Delhi, the city has laid out numerous proposals over recent years to tackle air quality and pollution.

Rather than short-term proposals, many of Bogota's plans look longer-term.

In 2020, it became the first Latin American city to declare a climate emergency. An important part of Bogota’s climate plan is to replace the use of fossil fuels to reduce greenhouse gas emissions by 50 per cent by 2030.

The city pledged to stop buying any public transportation vehicles that use fossil fuels. Bogota also made commitments regarding changes in land use policy, to make communities more sustainable.

Video: Canada wildfires: Air quality a major risk for those living outside

The perspective is similar in ways to approaches taken by Paris, where Singh lives.

He says Paris has transformed its cityscape radically in a very short span of time, with markedly improved air quality in the French capital.

“Paris has actually seen quite a bit of transformation. If you see the air quality levels from 10 years ago, you will see a significant drop (in pollution levels),” he said.

“There is much-improved air quality on average and Parisians have benefited since several roads are now pedestrianized. Cars and trucks are no longer welcome on the streets, and those streets have been reclaimed by people.”

Paris’s dedicated bicycle lanes have also reduced vehicular traffic in the city, Singh said. In 2015, Paris also banned old cars to combat its infamously poor air quality.

Cities in North America, however, are more sprawled out than Delhi, Beijing or Paris and far more car-reliant, making access to public transit difficult. But they too will need to decide how to tackle air quality in the longer term.

“As North American cities grow, they must think about how they design new neighbourhoods, how they're able to ensure that there's greater public transport access, that there's more integration of renewables in urban settings," Singh said.

This year, Canada could be on track to having a record level of land burnt due to wildfires. In 2023, 2,293 wildfires have torched 3.8 million hectares of land. These fires forced more than 20,000 Canadians out of their homes.

Environmentalists say climate change has made this year’s wildfires worse.

Story by The Canadian Press •

TORONTO — A new report says the gender pay gap in Canada narrowed last year compared with 2021, but still stood at more than 20 per cent.

The survey for payroll company ADP Canada says working Canadians who self-identify as women reported earning 21 per cent less than workers who self-identify as men last year.

The report showed a gap of 24 per cent for 2021, while it stood at 21 per cent in 2020.

The survey recorded self-reported gross salaries for 2022 from both part- and full-time employees.

The average salary reported by men was $72,743, while women on average reported $57,725.

The report also says 33 per cent of men declared earnings of more than $80,000 in 2022, compared with 18 per cent of women.

The online survey by Maru Public Opinion included 1,556 employed Canadian adults who responded between March 6 and March 9.

The poll cannot be assigned a margin of error because online surveys are not considered truly random samples.

This report by The Canadian Press was first published June 20, 2023.

Story by The Canadian Press • Yesterday

OTTAWA — Conservative members of Parliament joined other parties to vote in favour of a bill that enshrines the federal government's long-term commitment to a Canada-wide early learning and child-care system.

The Liberals introduced the bill late last year as part of an effort to ensure that future federal governments would continue providing child-care funding to provinces.

The bill, which passed unanimously, also creates a national advisory council on early learning and child care.

The Liberal government earmarked $30 billion over five years in the 2021 budget to set up a long-promised national child-care program.

Agreements between Ottawa and the provinces and territories, most of which are helmed by conservative premiers, aim to reduce child-care fees to $10 a day, on average, by 2026.

The bill also has to pass in the Senate before it can become law.

This report by The Canadian Press was first published June 19, 2023.

The Canadian Press