Rookie trader kills himself after seeing a negative balance of more than $700,000 in his Robinhood account

Published: June 18, 2020 By Shawn Langlois

It's a scary time to be a rookie trader. GETTY

The stock market, particularly in its current state, is no place for amateurs.

Sullimar Capital analyst Bill Brewster delivered that message to followers in a heartbreaking Twitter TWTR, -0.90% thread in which he shared a family member’s tragic foray into trading.

Here’s the full story

Alex Kearns, just 20 years old, left this note, which Forbes posted on Wednesday: “How was a 20 year old with no income able to get assigned almost a million dollars worth of leverage?”

Robinhood declined to share any details of the trading account and how such outsized losses piled up but did say that the company was aware of the situation.

“All of us at Robinhood are deeply saddened to hear this terrible news and we reached out to share our condolences with the family,” the spokesperson told MarketWatch on Sunday.

Here’s a screenshot of his account:

The balance displayed in red, as Forbes explained, may not have represented uncollateralized indebtedness at all, but rather a temporary balance until his option trades settled.

The death serves as a reminder that trading stocks can have devastating real-life consequences. This has perhaps never been more true than when it comes to using borrowed cash to leverage positions in a stock market where the Dow Jones Industrial Average DJIA, -0.15% can be down almost 2,000 points one session, like last week, then rebound nearly 500 points the next.

Inexperienced traders have been cited as a driving factor in the big bounce of the market’s late-March lows and the recent volatility. Deutsche Bank analyst Parag Thatte suggests that Wall Street professionals are being forced to chase amateurs who continue to bid up equities.

Read:It’s like the Wild West with ‘get-rich-quick crowd’ vs. Wall Street pros, but it’s too easy to blame retail investors for ‘rampant speculation’

CNBC’s Jim Cramer last week also addressed the dangers of the current climate.

“It got too easy, and now we all have to suffer as the get-rich-quick crowd gets blown out,” he said on his “Mad Money” show, describing the current environment as one of “rampant speculation.”

20-Year-Old Robinhood Customer Dies By Suicide After Seeing A $730,000 Negative Balance

Sergei Klebnikov Forbes Staff 6/18/2020 Antoine Gara Forbes Staff

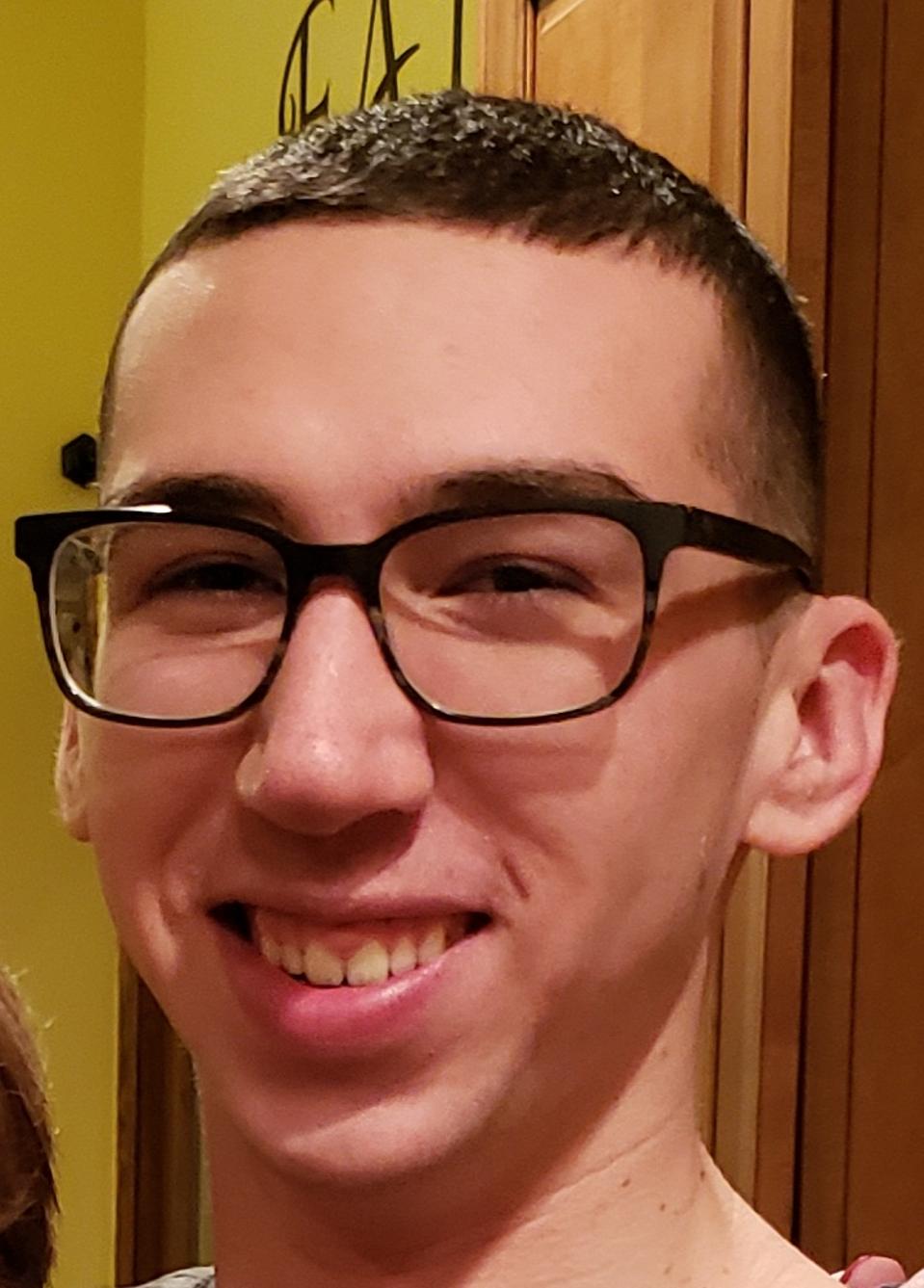

Alexander E. Kearns. KEARNS FAMILY

With additional reporting by John Dobosz and Jeff Kauflin

The note found on his computer by his parents on June 12, 2020, asked a simple question. “How was a 20 year old with no income able to get assigned almost a million dollars worth of leverage?” The tragic message was written by Alexander E. Kearns, a 20-year-old student at the University of Nebraska, home from college and living with his parents in Naperville, Illinois. Earlier that day, Kearns took his own life.

Like so many others, Kearns took up stock investing during the pandemic, signing up with Millennial-focused brokerage firm Robinhood, which offers commission-free trading, a fun and easy-to-use mobile app and even awards new customers free shares of stock. During the first quarter of 2020, Robinhood added a record 3 million new accounts to its platform. As the Covid-19 stock market swung wildly, Kearns had begun experimenting, trading options. His final note, filled with anger toward Robinhood, says that he had “no clue” what he was doing.

In fact, a screenshot from Kearns’ mobile phone reveals that while his account had a negative $730,165 cash balance displayed in red, it may not have represented uncollateralized indebtedness at all, but rather his temporary balance until the stocks underlying his assigned options actually settled into his account.

Silicon Valley-based Robinhood is not sharing details of Kearns’ account, citing privacy concerns: “All of us at Robinhood are deeply saddened to hear this terrible news and we reached out to share our condolences with the family over the weekend.”

It’s impossible to know all of the factors contributing to suicide, especially in young people. Still, the tragic demise of Alexander Kearns is a cautionary tale of the serious risks associated with the race to the bottom in the brokerage business. Robinhood, E-Trade, TD Ameritrade, Charles Schwab, Interactive Brokers, Fidelity and even Merrill Lynch have all embraced commission-free trading and zero-minimum balances in an effort to attract younger customers, many of whom have little understanding of the securities and markets they are dabbling in.

“I thought everything was going fine,” says Bill Brewster, Kearns’ cousin-in-law and a research analyst at Chicago-based Sullimar Capital Group. His father said he was loving the markets and really enjoying investing, Brewster told Forbes, “and then on Friday night, we got this call from his mom, and he had died.”

Kearns apparently fell into despair late Thursday night after looking at his Robinhood account, which appeared to have $16,000 in it but also showed a cash balance of negative $730,165. In his final note, seen by Forbes, Kearns insisted that he never authorized margin trading and was shocked to find his small account could rack up such an apparent loss.

“When he saw that $730,000 number as a negative, he thought that he had blown up his entire future,” says Brewster. “I mean this is a kid that when he was younger was so conscious about savings.”

Although Robinhood won’t release the details of his account, it‘s possible that Kearns was trading what’s known as a “bull put spread.” Put options give buyers the right to sell the stock at the strike price anytime until expiration, while put-sellers are on the hook to buy the underlying stock at the strike price, if assigned. This happens automatically at expiration if the price of the underlying stock closes that day at a price one penny or more below the strike price.

In Kearns’ note, he says that the puts he bought and sold “should have cancelled out,” because normally a bull put spread involves selling put options at a higher strike price, and buying puts at a lower strike price, both with the same expiration. The trade generates a net credit, which the options trader keeps if the stock price stays above the higher strike price through expiration. It’s generally considered a limited risk strategy because the simultaneous purchase and sale of put options means the maximum loss on a per-share basis is the difference between the strike prices, less the amount earned when the puts are sold initiating the trade.

There can be wrinkles, however, when the price of the underlying stock at expiration is between the two strike prices, or in the case of early assignment, which may have occurred in Kearns’ account.

Here’s an example of how a bull put spread could produce an unexpectedly large stock position in your portfolio. On June 16, Amazon (AMZN) trades at $2,615 per share. If you’re neutral to bullish on Amazon, you could sell put options that expire on July 17 with a $2,615 strike price for $28 per option. To limit your risk, the other leg of the trade is to purchase puts at a lower strike price, $2,610, for a cost of $26. That two-dollar differential (multiplied by 100) generates $200 for every contract you sell. Do three contracts and you generate $600. If Amazon closes on July 17 above $2,615, you’re in the clear and keep all of the proceeds, as both puts expire worthless. If the stock closes below $2610, you will encounter your maximum loss of $900: $5.00 (difference between strike prices) minus $2.00 (proceeds earned up front) times three contracts.

When the stock closes between the two strike prices, the put you bought at the lower strike price expires worthless, but the one you sold is in the money and legally binds you to buy the stock at the strike price. In the case of three contracts of $2,615 Amazon puts, that would be $784,500 to purchase 300 shares. Over a weekend, say, you may see a –$784,500 debit to buy the stock, but you would not see the stock among your holdings until Monday.

Kearns may not have realized that his negative cash balance displaying on his Robinhood home screen was only temporary and would be corrected once the underlying stock was credited to his account. Indeed it’s not uncommon for cash and buying power to display negative after the first half of options are processed but before the second options are exercised—even if the portfolio remains positive.

“Tragically, I don’t even think he made that big of a mistake. This is an interface issue, they have slick interfaces. Confetti popping everywhere,” says Brewster referring to the shower of colorful confetti Robinhood routinely deploys after customers make trades. “They try to gamify trading and couch it as investment.”

Says Robinhood: “We are committed to continuously improving our platform and are reviewing our options offering to determine if any changes may be appropriate.”

If you or someone you know is thinking about suicide, please call the National Suicide Prevention Lifeline at 800-273-TALK (8255) or text the Crisis Text Line at 741-741.

Sergei Klebnikov

I am a New York—based reporter for Forbes covering breaking news, with a focus on financial topics. Previously, I wrote about investing for Money Magazine

Antoine Gara

I’m a staff writer and associate editor at Forbes, where I cover finance and investing. My beat includes hedge funds, private equity, fintech, mutual funds, mergers,

'Robinhood is not behind the rally,’ Barclays says as retail demand surges

Ethan Wolff-Mann Senior Writer Yahoo Finance June 12, 2020

Unemployment may be at 13.3% — and maybe even up to 5 percentage points higher — but retail investors, the regular folks of the investing world, are jumping into the market, channelling their inner Warren Buffett to be greedy when others are fearful.

Many narratives have emerged both on Wall Street and in the financial media that these new investors, using zero-cost brokerages like Robinhood to trade stocks, could be joining the Federal Reserve and the government’s coronavirus response in pushing the stock market up.

But in a research note circulated to clients Friday, Barclays said no, “Robinhood is not behind the rally.” Using the popular Robintrack database that offers insight on most popular positions and changes, analysts from Barclays Investment Sciences wrote that since March 2020, when the market bottomed out, stocks have generally done worse when Robinhood users get interested.

“We have seen the opposite of the conventional wisdom—all else equal, more Robinhood customers moving into a stock has corresponded to lower returns, rather than higher,” the analysts wrote.

Though the Robinhood user holdings of S&P 500 ETF jumped in-line with the market’s gains, spikes in holdings of those ETFs didn’t correspond with spikes in the market.

If there isn’t a relationship between Robinhood activity and the overall market, what about individual stocks?

“It is undeniable that there are many examples of big stock gains coming along with big increases in Robinhood customer holdings. For example, Amazon has been a strong performer, gaining 45% since mid-March 2020 vs roughly flat for the S&P 500,” the Barclays note said. “But just because two things happen at the same time doesn’t mean one causes the other.”

Furthermore, they wrote, low-performing stocks have also seen big bumps.

“COTY has been the worst performing name in the S&P 500 since mid-March 2020. But the number of Robinhood accounts that hold COTY has increased sixfold, a much bigger gain than that for Amazon,” the note said.

UKRAINE - 2020/05/02: In this photo illustration a Robinhood logo seen displayed on a smartphone. (Photo Illustration by Igor Golovniov/SOPA Images/LightRocket via Getty Images)

Still, many disagree

Influential investor and billionaire Jeffrey Gundlach, speaking in an online presentation this week, said there was "something unnerving that's going on in this rally," and it "seems to be driven by a lot of rampant speculation."

Yes, Gundlach was talking about Robinhood. The “bond king” brought up a chart from Robintrack data and pointed to the rise of accounts and activity to the coronavirus lockdown, with a particular acceleration when the stimulus checks hit.

To Gundlach, this is an explanation, or at least part of one, to what’s driving the market, especially in the big tech stocks, because money just isn't flowing from institutional investors.

Other market watchers, like analysts at Goldman Sachs, have highlighted surges in new accounts, noting the "continued surge in retail investor trading activity has helped boost the growth stocks most popular with hedge funds."

Deutsche Bank’s Parag Thatte, who also looked at Robintrack data, mused that there seems to be a lot of evidence that retail investors are getting in on this rally and, like, Gundlach, saw flows markedly different for retail investors than other groups. In particular, Thistle noted that Robinhood accounts holding mega cap stocks (at least $200 billion market cap) rose by 50% during the lockdown.

Robinhood is not Vanguard

The focus on Robinhood activity makes some sense given the company’s role as a disruptor. It established free trades — making others do the same — and is pretty, modern, and millennial- and mobile-friendly. But does it deserve the constant callouts in analyst notes?

Maybe, since its data is available via Robintrack, which might be useful to someone. And anecdotally, its 3 million accounts added so far this year (as of May 4) and its adoption of fractional shares mean that a lot of people may end up using the app.

But is Robinhood activity enough to move the market? Judging from the popularity of the ability to buy less than a share at a time — the volumes just might not be that big. Although Robinhood’s assets under management is not public, it likely is miniscule compared to the big players of retail money: BlackRock, Vanguard, Fidelity, and Schwab.

However, what if Robinhood’s popularity is a proxy for something else?

Nicholas Colas, a former hedge fund manager who writes the DataTrek newsletter, said Google Trends will tell you what the retail market is thinking. “It’s certainly a thing,” he wrote. “If you use Google Trends, look at search volumes for ‘buy stocks’ over the last year. Huge interest pickup.”

One likely scenario is the internalized message of “buy low, sell high,” something that my colleague Myles Udland has also wondered. That, combined with everybody knowing the Buffett aphorism about when to be greedy might have affected some people’s behavior.

It sure worked for 401(k) shops like Fidelity, Vanguard, and T. Rowe Price, who told their investors to “stay the course”: Most of them followed the advice.

Just like how people didn’t panic and sell their 401(k)s holdings, perhaps they saw stocks with prices that seemed really low and decided to jump in.

Colas also pointed out that while it’s hard to know the effects of fractional share ownership — you can own less than a share on SoFi, Robinhood, Schwab, and others — it might have an outsized effect, especially given people aren’t always shy about using margin on these platforms.

This, he added, “probably” has contributed to the market run-up.

“The system isn’t really tuned to accommodate lots of small orders,” he wrote. “Market making algos only know the recent past, so seeing higher order volumes and fewer limit orders suddenly appear may have had an impact.”

Robinhood users have increasingly become interested in struggling stocks that are even going bankrupt, like J.C. Penney and Hertz, wading past day-trading into outright speculation given the volatility of these companies’ prices.

In addition to trading with bankrupt companies, a Sundial Capital Research note that examined Robinhood user behavior found a 13.1% rise in accounts with short ETF positions versus a 1.2% drop in accounts that had their long counterpart and a 13.1% rise in short ETFs, the largest net difference in two years.

“Maybe Robinhood will stick around and this can develop into a reliable indicator of retail sentiment,” wrote Sundial Capital’s CEO Jason Goepfert. “More likely, volatility will pick up, users will move on to their regular jobs and sports betting, and interest in the platform will wane.”

--

I’m a staff writer and associate editor at Forbes, where I cover finance and investing. My beat includes hedge funds, private equity, fintech, mutual funds, mergers,

'Robinhood is not behind the rally,’ Barclays says as retail demand surges

Ethan Wolff-Mann Senior Writer Yahoo Finance June 12, 2020

Unemployment may be at 13.3% — and maybe even up to 5 percentage points higher — but retail investors, the regular folks of the investing world, are jumping into the market, channelling their inner Warren Buffett to be greedy when others are fearful.

Many narratives have emerged both on Wall Street and in the financial media that these new investors, using zero-cost brokerages like Robinhood to trade stocks, could be joining the Federal Reserve and the government’s coronavirus response in pushing the stock market up.

But in a research note circulated to clients Friday, Barclays said no, “Robinhood is not behind the rally.” Using the popular Robintrack database that offers insight on most popular positions and changes, analysts from Barclays Investment Sciences wrote that since March 2020, when the market bottomed out, stocks have generally done worse when Robinhood users get interested.

“We have seen the opposite of the conventional wisdom—all else equal, more Robinhood customers moving into a stock has corresponded to lower returns, rather than higher,” the analysts wrote.

Though the Robinhood user holdings of S&P 500 ETF jumped in-line with the market’s gains, spikes in holdings of those ETFs didn’t correspond with spikes in the market.

If there isn’t a relationship between Robinhood activity and the overall market, what about individual stocks?

“It is undeniable that there are many examples of big stock gains coming along with big increases in Robinhood customer holdings. For example, Amazon has been a strong performer, gaining 45% since mid-March 2020 vs roughly flat for the S&P 500,” the Barclays note said. “But just because two things happen at the same time doesn’t mean one causes the other.”

Furthermore, they wrote, low-performing stocks have also seen big bumps.

“COTY has been the worst performing name in the S&P 500 since mid-March 2020. But the number of Robinhood accounts that hold COTY has increased sixfold, a much bigger gain than that for Amazon,” the note said.

UKRAINE - 2020/05/02: In this photo illustration a Robinhood logo seen displayed on a smartphone. (Photo Illustration by Igor Golovniov/SOPA Images/LightRocket via Getty Images)

Still, many disagree

Influential investor and billionaire Jeffrey Gundlach, speaking in an online presentation this week, said there was "something unnerving that's going on in this rally," and it "seems to be driven by a lot of rampant speculation."

Yes, Gundlach was talking about Robinhood. The “bond king” brought up a chart from Robintrack data and pointed to the rise of accounts and activity to the coronavirus lockdown, with a particular acceleration when the stimulus checks hit.

To Gundlach, this is an explanation, or at least part of one, to what’s driving the market, especially in the big tech stocks, because money just isn't flowing from institutional investors.

Other market watchers, like analysts at Goldman Sachs, have highlighted surges in new accounts, noting the "continued surge in retail investor trading activity has helped boost the growth stocks most popular with hedge funds."

Deutsche Bank’s Parag Thatte, who also looked at Robintrack data, mused that there seems to be a lot of evidence that retail investors are getting in on this rally and, like, Gundlach, saw flows markedly different for retail investors than other groups. In particular, Thistle noted that Robinhood accounts holding mega cap stocks (at least $200 billion market cap) rose by 50% during the lockdown.

Robinhood is not Vanguard

The focus on Robinhood activity makes some sense given the company’s role as a disruptor. It established free trades — making others do the same — and is pretty, modern, and millennial- and mobile-friendly. But does it deserve the constant callouts in analyst notes?

Maybe, since its data is available via Robintrack, which might be useful to someone. And anecdotally, its 3 million accounts added so far this year (as of May 4) and its adoption of fractional shares mean that a lot of people may end up using the app.

But is Robinhood activity enough to move the market? Judging from the popularity of the ability to buy less than a share at a time — the volumes just might not be that big. Although Robinhood’s assets under management is not public, it likely is miniscule compared to the big players of retail money: BlackRock, Vanguard, Fidelity, and Schwab.

However, what if Robinhood’s popularity is a proxy for something else?

Nicholas Colas, a former hedge fund manager who writes the DataTrek newsletter, said Google Trends will tell you what the retail market is thinking. “It’s certainly a thing,” he wrote. “If you use Google Trends, look at search volumes for ‘buy stocks’ over the last year. Huge interest pickup.”

One likely scenario is the internalized message of “buy low, sell high,” something that my colleague Myles Udland has also wondered. That, combined with everybody knowing the Buffett aphorism about when to be greedy might have affected some people’s behavior.

It sure worked for 401(k) shops like Fidelity, Vanguard, and T. Rowe Price, who told their investors to “stay the course”: Most of them followed the advice.

Just like how people didn’t panic and sell their 401(k)s holdings, perhaps they saw stocks with prices that seemed really low and decided to jump in.

Colas also pointed out that while it’s hard to know the effects of fractional share ownership — you can own less than a share on SoFi, Robinhood, Schwab, and others — it might have an outsized effect, especially given people aren’t always shy about using margin on these platforms.

This, he added, “probably” has contributed to the market run-up.

“The system isn’t really tuned to accommodate lots of small orders,” he wrote. “Market making algos only know the recent past, so seeing higher order volumes and fewer limit orders suddenly appear may have had an impact.”

Robinhood users have increasingly become interested in struggling stocks that are even going bankrupt, like J.C. Penney and Hertz, wading past day-trading into outright speculation given the volatility of these companies’ prices.

In addition to trading with bankrupt companies, a Sundial Capital Research note that examined Robinhood user behavior found a 13.1% rise in accounts with short ETF positions versus a 1.2% drop in accounts that had their long counterpart and a 13.1% rise in short ETFs, the largest net difference in two years.

“Maybe Robinhood will stick around and this can develop into a reliable indicator of retail sentiment,” wrote Sundial Capital’s CEO Jason Goepfert. “More likely, volatility will pick up, users will move on to their regular jobs and sports betting, and interest in the platform will wane.”

--

No comments:

Post a Comment