While everyone is criticizing Russia, it’s easy to follow the US ‘savior’ narrative. However, what if we looked at what’s happening with oil in mind?

By:Sébastien Bischeri

Published: Feb 4, 2022,

Disclaimer to today’s article: I’m providing this analysis from a pure energy-focused perspective. I do not claim it represents THE right view, but rather one of those that won’t be as visible in the mainstream. It is interesting to add different views as pieces of the same puzzle. I am looking forward to reading yours in the comments!

Several port facilities in Germany, the Netherlands and Belgium have been the target of cyberattacks, prompting the judicial authorities to investigate the suspicions of extortion of funds at the expense of German operators in the oil sector. Indeed, it would appear that this series of computer hackings that began several days ago primarily concerns oil terminals. This is disrupting deliveries in several major European ports against a backdrop of soaring energy prices.

After jumping the day before, thanks to the strengthening of the euro against the US dollar induced by ECB President Lagarde, oil prices continued to rise during the European session on Friday. Consequently, the fall in the greenback came on top of the recovery in demand, the fall in US crude inventories and the disruptions in supply to boost the price of black gold on the climb, the two crude benchmarks evolving above the psychological mark of 90 dollars a barrel, galvanized by solid demand and tensions on the offer coming from (geo-)political risks.

Who is Provoking Who?

The situation is rather complex on the geopolitical scene, with the US claiming that Russia is planning an invasion in Ukraine, whereas the US under NATO cover sent additional troops to Eastern Europe. The question that may arise here is: who is provoking who? So far, we haven’t seen Russia placing troops in Mexico, on the border with the United States. On the other hand, the Biden administration may encounter difficulties in accepting that the Kremlin can agree to various partnerships with its European neighbors, especially regarding more favorable energy supplies. Instead, it’s in the US interest to weaken those diplomatic relations, potentially leading to additional partnerships that may arise between the EU and Putin.

And as we see the US-led narrative getting through the Western mainstream media with more aggressive, suspicious, and tense tones towards Russia, this obviously has the effect of pouring some oil on the Russian-Ukrainian fire. Furthermore, the US needs reasons to demonstrate that NATO is still alive and relevant while a number of countries are now questioning their own participation in the US-led military organisation created in 1949, even going so far as to show some doubts regarding its current motivations.

Isolating the Russian Bear

By maintaining a hostile tone towards Russia’s intentions, the US is consequently trying to isolate the Russian bear and push their European partners to blindly follow the “official narrative” (as the EU being part of NATO), which could possibly lead to new sanctions on Russia, the latter being able to retaliate by using its energy assets and capacities to deprive the EU of the Russian supplies, which currently on the gas side represent between 30% and 40% of total gas imports for Europe. Then, as a result, the Americans could start exporting more gas into Europe via Liquefied Natural Gas (LNG) shipping – which again could benefit their energy-led commercial balance – the Europeans thus becoming the losing players in this game.

As an example, we saw this week that a tanker loaded with LNG from the US will arrive at the LNG terminal in Świnoujście (Poland) at the end of this month, since Poland has LNG import capabilities which could be used to deliver US gas to Ukraine. Apparently, this is the second time (after the first one took place two years ago) that such gas deliveries are made by PGNiG, the Polish state-controlled oil and gas company, in cooperation with ERU (their strategic trading partner on the Ukrainian market).

Actually, Ukraine suspended imports of Russian gas at the end of 2015. After relying on Russian gas imports for decades, they currently increasingly depend on imports from Europe. Since Ukraine has no LNG import capabilities, such US gas deliveries have been organized via a pipeline from the Polish terminal (through re-gasified LNG).

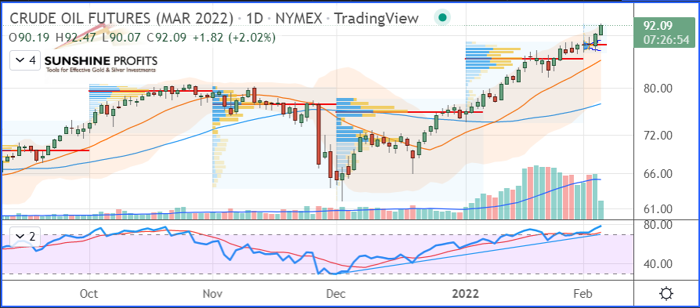

WTI Crude Oil (CLH22) Futures (March contract, daily chart)

Brent Crude Oil (BRJH22) Futures (April contract, daily chart)

RBOB Gasoline (RBH22) Futures (March contract, daily chart)

Henry Hub Natural Gas (NGG22) Futures (February contract, daily chart)

In summary, geopolitics is always complex because it relies on individual economic and strategic interests of countries. The readings also depend on different views, and since there is always a lot of noise, it often helps to take some steps back in order to analyze the global situation from a different angle.

Have a nice weekend! And remember to chime in on the conversation.

Like what you’ve read? Subscribe for our daily newsletter today, and you’ll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

* * * * *

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data’s accuracy and thoroughness.

The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits’ employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

How will the U.S. respond if Russia invades Ukraine? Implications for gold, oil and stocks

Russia has amassed over 100,000 troops near Ukraine. In response, the U.S. is bolstering its presence in the region, with the Pentagon deploying about 3,000 troops to Eastern Europe in the coming days; 1,000 of which will be moving from Germany to Romania while 2,000 will be heading to Germany and Poland from the U.S.

Michelle Makori, editor-in-chief of Kitco News, discussed the likelihood of a Russian invasion of Ukraine and the implications for the markets, as well as the most likely U.S. response with Harold Kempfer, CEO of Global Risk Intelligence & Planning and former Lieutenant Colonel of the U.S. Marine Corps, and Robert Ryan, Chief Strategist of the Commodity & Energy Strategy service at BCA Research.

Kempfer, who has done multiple tours of duty in the Middle East, said that Russia does possess the manpower to launch an invasion into Ukraine, but logistical challenges remain.

“Russia could go in. They certainly have enough troops, they have enough armor, air, certainly all the supporting arms they need in terms of missiles, artillery, so they definitely can launch an invasion. One of the things that I’ve been looking at is, do they have forward-deployed fuel,” Kempfer said. “That’s the one thing that has not been reported…their fuel supplies. With that said, recent satellite photos show they’ve been pushing a lot of new materials up towards those base camps that they have along the border. So, it looks like they’re getting ready.”

Kempfer noted that direct military action from the U.S. against Russia inside Ukraine is unlikely, but that Ukraine is already receiving intelligence and assistance in strategic planning form the U.S. and its allies.

“What we would respond with is probably pushing a lot of arms and other things to the Ukraine…I don’t see a scenario where any of the NATO partners would put military forces into the Ukraine. With that said, we have military trainers in Ukraine currently. One of the things that’s kind of missed with this is that it’s not just the forces, it’s the other things that we bring to Ukraine. We can provide them with intelligence, surveillance, reconnaissance, we can provide them with a degree of situational awareness and understanding that they wouldn’t have. The other thing is, and I don’t know if we’re doing it, I’m assuming we’re doing, is we’re probably helping them develop the defensive plan for Ukraine. I would imagine that somewhere, there’s at least one joint planning group, if not multiple joint planning groups looking at maps, looking at the latest satellite photos…and coming up with an extensive plan with counter-mechanized kill zones,” he said.

Moscow would hence be facing Ukrainian forces that are trained and briefed by U.S. military forces, with U.S.-backed Ukrainian defenses likely to “cause attrition of Russian forces,” Kempfer said.

The likely action against Russia from the West would be sanctions, Kempfer said, adding that Russian President Vladimir Putin is likely just looking for concessions at this point in time.

“I think [Putin] is going to try and get as many concessions as he can and might start trading territory for concessions. But, if he crosses that line, which is going into Ukrainian territory, there’s going to be some big sanctions,” he said.

Sanctions would cause Russian oil production to slow down, Ryan said.

“Recently, we had to downgrade our estimate of what Russia would be contributing to in the OPEC restoration of supply because it doesn’t look like they’re able to meet their quotas every month. They’re pretty much flatlined at 18 million barrels a day now. If they are subjected to another round of sanctions, again on technology and capital, they more than likely will find it increasingly difficult to restore production and grow it, which is their long-term goal,” Ryan said.

A direct attack on a NATO member is what’s needed for the U.S. to act, militarily, against Russia.

“That would require a Russian strike either on NATO territory, on a NATO country,” Kempfer said.

However, military escalations between Russia and NATO forces could happen in the Black Sea, in the worst-case scenario, Kempfer said.

“We’re looking at something down there in the maritime domain where we could possibly see navies possibly getting into some sort of confrontation,” he said. “So, I think Turkey may actually play a big role. And if there's a Turkish naval confrontation with Russian forces, somewhere in the Black Sea, I don't know where that would go.”

Aside from a direct attack against Turkey, or any other NATO member, it is highly unlikely the U.S. and its allies would intervene through direct military action against Russian forces.

“I don’t see that any of the NATO partners would want to do that either, particularly Germany,” Kempfer said.

Germany is greatly dependent on Russia for natural gas, as well as key minerals.

“There’s a tremendous amount of nickel that Russia exports. One of the reasons that Germany is so dependent on Russian natural gas is because they got rid of the coal-fired plants and after Fukushima they said, for political reasons, we’re going to get rid of the nuclear plants,” Kempfer said. “They want to go to renewables. Renewables imply that you need a lot of batteries. Batteries require things like lithium and nickel, cobalt and other things like that. Russia has a corner on the nickel market, particularly in Europe. I think it’s about 80% or something, they provide nickel to Europe. That’s huge.”

Ryan added that a direct military confrontation in the open field with the U.S. military and its NATO allies is a scenario that the Kremlin wants to avoid at all costs.

However, in the event that tensions do escalate between the U.S. and Russia, the conflict would mostly be in the cyber space, Ryan said.

“The U.S. and NATO are formidable as a military force, so if it did come down to that, I think it would be over very quickly. You would get a big spike in oil prices and then it would come down exactly as happened in the 1990 Iraq War. The caveat there is that we’re living in an age of cyber warfare, so it would not be at all surprising if Russian subs start clipping all the cables leading into Europe so the internet shuts down. You have some big cyber attack that takes down the electric grid. NATO and the U.S. would have to respond,” he said.

Markets would see immediate response should Russia indeed invade Ukraine, with crude oil taking the lead in movement, Ryan noted.

“I think when you have 100,000 troops on the border, primed..and if you see the [supply] fuel start moving in, the market will take notice. Just the pure response to that provocative kind of action probably will take crude up above $100,” he said.

The current supply situation is “extremely tight” for oil, Ryan said, and it wouldn’t take much to move the price at this point.

“If we get even the slightest disturbance in the force, as it were, you see these markets spring higher,” Ryan said. “A big part of that is the very low inventories globally, very high demand globally, and very constrained supply, globally. Something that looks like they’re rolling the tanks more than likely would just make the markets jump.”

Ryan said that in the event of escalation, safe haven assets would rally.

“I think gold would catch a bid, there would be a scramble to get it. At some point, depending on how bad things get, you’d see dollar strength limiting the rally. We’d go through $2,000 [on gold] but I don’t know how far past $2,000,” he said.

For more information on market reactions to escalating tensions in Eastern Europe, watch the video above.

Follow Michelle Makori on Twitter: @MichelleMakori (https://twitter.com/MichelleMakori)

Follow Kitco News on Twitter: @KitcoNewsNOW (https://twitter.com/KitcoNewsNOW)

No comments:

Post a Comment