HYPE OVER PLANT-BASED MEAT IS DONE BUT MARKET STILL POISED FOR GROWTH: EXPERTS

, BNN Bloomberg

The fanfare around plant-based burgers, sausages and hot dogs that captured the attention of many fast-food companies and meat manufacturers might have faded, but the alternative meat market still has a long runway of growth ahead of it, experts say.

“As consumers became much more educated and the technology advanced, and then (companies) started to introduce plant-based product offerings, consumers were much more receptive to it. And the market really, for this area, increased dramatically,” said Robert Carter, managing partner at The StratonHunter Group, in a phone interview.

He said the wider distribution of plant-based products, messaging around sustainability and evolutions in the taste of such products helped drive consumer demand initially – all factors that “didn’t really exist previously.”

The plant-based meat market really started to become mainstream roughly five years ago, when fast-food chain A&W began to add vegan meat products to its menu. At the time, it was so popular that A&W sold out of its Beyond Meat burgers across Canada within weeks of its menu debut.

Fellow fast-food chains such as Burger King, Kentucky Fried Chicken, and Chipotle, among numerous others followed suit, adding plant-based offerings to their menus.

Additionally, meat manufacturers including Maple Leaf Foods Inc. expanded into the plant-based category when it bought Lightlife Foods and Field Roast Grain Meat Co. in 2017.

However, more recently, consumer demand for alternative meats have faded.

“I wouldn't call it a saturation point. We've gone through a period of trial. So we've got a whole bunch of consumers that have come in and they've tried the product. And now we've got some consumers that are kind of dropping off. … Are we getting the repeat usage? No, I don't think we're getting that repeat usage that everyone expected to take place,” Carter said.

ADJUSTING TO DEMAND

For companies that invested heavily in plant-based proteins such as Maple Leaf, Mark Petrie, an equity research analyst at CIBC Capital Markets that covers the company, said an adjustment to the current market conditions is in order.

“As the demand profile has evolved, and the [plant protein] category has proven to be a slower-growing category than what [Maple Leaf] initially anticipated, they have pivoted their strategy to right size their cost base and manufacturing capacity in an effort to achieve near-term profitability or breakeven,” he said.

Maple Leaf reported sales of its plant-based products fell 15 per cent in the second quarter compared to a year ago and said it’s restructuring the division to bring costs down significantly. The segment was the biggest drag on its bottom line.

However, Petrie doesn’t foresee Maple Leaf exiting the business because of the company’s desire to be a sustainable protein manufacturer.

For fast-food chains, Carter said sales of plant-based products will be an area that continues to grow, but not at the dramatic rate many companies were expecting.

GROWTH STILL AHEAD

Despite the current lull in consumer demand for plant-based meat, the industry overall is still likely poised for growth in the coming years.

“Essentially, the market size/opportunity did get over-hyped,” Colin Stewart, chief executive and portfolio manager at JC Clark Limited, said in an email.

“I think as new plant-based products develop (ground meat, sausages, etc.) and it is not just all about the burger, that should help broaden the market and stabilize growth.”

Stewart also said he expects Maple Leaf’s plant-based segment to become profitable within the next two years as investment spending is scaled back and costs are reduced. JC Clark holds Maple Leaf in client portfolios.

Petrie agreed in that over time, the growth trajectory of the broader industry will become more clear.

“I believe plant based still has a long term future as a category, and I think consumer tastes will continue to evolve to include more alternative proteins. But the settling out period continues,” Petrie said.

In the meantime, most fast-food restaurants that added plant-based options to their menu continue to offer them today. McDonald’s is a notable chain that ultimately removed its vegan meat offering, dubbed the P.L.T., which was short-form for plant, lettuce, tomato, after a six-month trial in Canada.

“I think everyone's expectations were so high in terms of what this was going to do and how much of a game changer it was that they're not realizing, you know, we're not going to sustain 30-40 per cent growth in these products. We've hit a level. We're going to have two, three, four per cent growth over a certain period of time. We're not going to have that dramatic growth,” Carter said.

BOB HOLMES, KNOWABLE MAGAZINE - 9/4/2022

Enlarge / A stack of plant-based Impossible Burgers.

If you’re an environmentally aware meat-eater, you probably carry at least a little guilt to the dinner table. The meat on our plates comes at a significant environmental cost through deforestation, greenhouse gas emissions, and air and water pollution—an uncomfortable reality, given the world’s urgent need to deal with climate change.

That’s a big reason there’s such a buzz today around a newcomer to supermarket shelves and burger-joint menus: products that look like real meat but are made entirely without animal ingredients. Unlike the bean- or grain-based veggie burgers of past decades, these “plant-based meats,” the best known of which are Impossible Burger and Beyond Meat, are marketed heavily toward traditional meat-eaters. They claim to replicate the taste and texture of real ground meat at a fraction of the environmental cost.

If these newfangled meat alternatives can fill a large part of our demand for meat—and if they’re as green as they claim, which is not easy to verify independently—they might offer carnivores a way to reduce the environmental impact of their dining choices without giving up their favorite recipes.

That could be a game-changer, some think. “People have been educated a long time on the harms of animal agriculture, yet the percentage of vegans and vegetarians generally remains low,” says Elliot Swartz, a scientist with the Good Food Institute, an international nonprofit organization that supports the development of alternatives to meat. “Rather than forcing people to make behavior changes, we think it will be more effective to substitute products into their diets where they don’t have to make a behavior switch.”

There’s no question that today’s meat industry is bad for the planet. Livestock account for about 15 percent of global greenhouse gas emissions both directly (from methane burped out by cattle and other grazing animals and released by manure from feedlots and pig and chicken barns) and indirectly (largely from fossil fuels used to grow feed crops). Indeed, if the globe’s cattle were a country, their greenhouse gas emissions alone would rank second in the world, trailing only China.

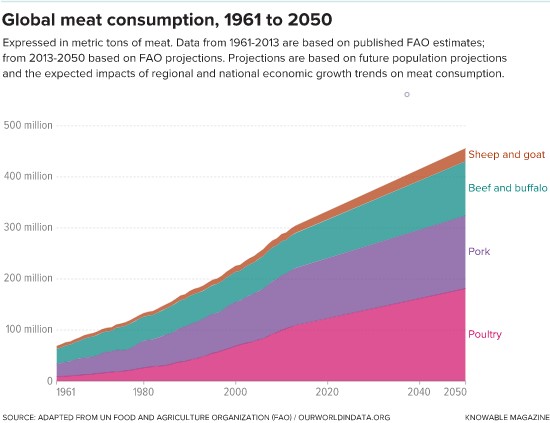

Worse yet, the United Nations projects that global demand for meat will swell by 15 percent by 2031 as the world’s increasing—and increasingly affluent—population seeks more meat on their plates. That means more methane emissions and expansion of pastureland and cropland into formerly forested areas such as the Amazon—deforestation that threatens biodiversity and contributes further to emissions.

Not all kinds of meat animals contribute equally to the problem, however. Grazing animals such as cattle, sheep, and goats have a far larger greenhouse gas footprint than non-grazers such as pigs and chickens. In large part that’s because only the former burp methane, which happens as gut microbes digest the cellulose in grasses and other forage.

Pigs and chickens are also much more efficient at converting feed into edible flesh: Chickens need less than two pounds of feed, and pigs need roughly three to five pounds, to put on a pound of body weight. (The rest goes to the energy costs of daily life: circulating blood, moving around, keeping warm, fighting germs, and the like.) Compare that to the six to 10 pounds of feed per pound of cow.

As a result, the greenhouse gas emissions of beef cattle per pound of meat are more than six times those of pigs and nearly nine times those of chicken. (Paradoxically, grass-fed cattle—often thought of as a greener alternative to feedlot beef—are actually bigger climate sinners, because grass-fed animals mature more slowly and thus spend more months burping methane.)

Building fake meat

Plant-based meats aim to improve on that dismal environmental performance. Stanford University biochemist Pat Brown, for example, founded Impossible Foods after asking himself what single step he could take to make the biggest difference environmentally. His answer: Replace meat.

To do that, Impossible and its competitors basically deconstruct meat into its component parts, then build an equivalent product from plant-based ingredients. The manufacturers start with plant protein—mostly soy for Impossible, pea for Beyond, and potato, oat, or equivalent proteins for others—and add carefully selected ingredients to simulate meat-like qualities. Most include coconut oil for its resemblance to the mouthfeel of animal fats, and yeast extract or other flavorings to add meaty flavors. Impossible even adds a plant-derived version of heme, a protein found in animal blood, to yield an even more meat-like appearance and flavor.

All this requires significant processing, notes William Aimutis, a food protein chemist at North Carolina State University, who wrote about plant-based proteins in the 2022 Annual Review of Food Science and Technology. Soybeans, for example, are typically first milled into flour, and then the oils are removed. The proteins are isolated and concentrated, then pasteurized and spray-dried to yield the relatively pure protein for the final formulation. Every step consumes energy, which raises the question: With all this processing, are these meat alternatives really greener than what they seek to replace?

To answer that question, environmental scientists conduct what’s known as a life cycle analysis. This involves taking each ingredient in the final product—soy protein, coconut oil, heme, and so forth—and tracing it back to its origin, logging all the environmental costs involved. In the case of soy protein, for example, the life cycle analysis would include the fossil fuels, water, and land needed to grow the soybeans, including fossil fuel emissions from the fertilizer, pesticides, and transportation to the processing plant. Then it would add the energy and water consumed in milling, defatting, protein extraction, and drying.

Similar calculations would apply to all the other ingredients and to the final process of assembly and packaging. Put it all together, and you end up with an estimate of the total environmental footprint of the product.Advertisement

Plant-based meats are highly processed products in which proteins, fats, starches, thickeners, flavoring agents and other ingredients are mixed and formed into foods that resemble traditional meat products such as burgers, hot dogs and chicken nuggets.

Unfortunately, not all those numbers are readily available. For many products, especially unique ones like the new generation of plant-based meats, product details are secrets closely held by the companies involved. “They will know how much energy they use and where they get their fat and protein from, but they will not disclose that to the general public,” says Ricardo San Martin, a chemical engineer who codirects the Alternative Meats Lab at the University of California, Berkeley. As a result, most life cycle analyses of plant-based meat products have been commissioned by the companies themselves, including both Beyond and Impossible. Outsiders have little way of independently verifying them.

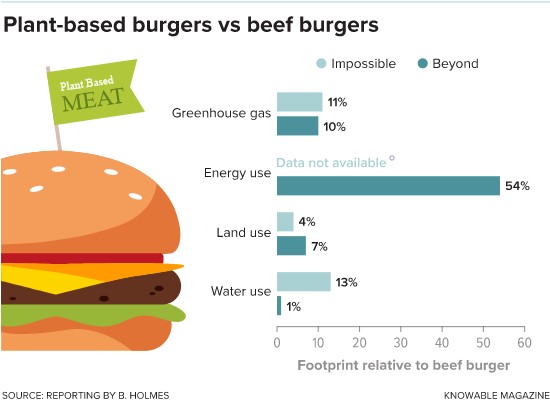

Even so, those analyses suggest that plant-based meats offer clear environmental advantages over their animal-based equivalents. Impossible’s burger, for example, causes just 11 percent of the greenhouse gas emissions that would come from an equivalent amount of beef burger, according to a study the company commissioned from the sustainability consulting firm Quantis. Beyond’s life cycle analysis, conducted by researchers at the University of Michigan, found their burger’s greenhouse gas emissions were 10 percent of those of real beef.

Indeed, when independent researchers at Johns Hopkins University decided to get the best estimates they could by combing through the published literature, they found that in the 11 life cycle analyses they turned up, the average greenhouse gas footprint from plant-based meats was just 7 percent of beef for an equivalent amount of protein. The plant-based products were also more climate-friendly than pork or chicken — although less strikingly so, with greenhouse gas emissions just 57 percent and 37 percent, respectively, of those for the actual meats.

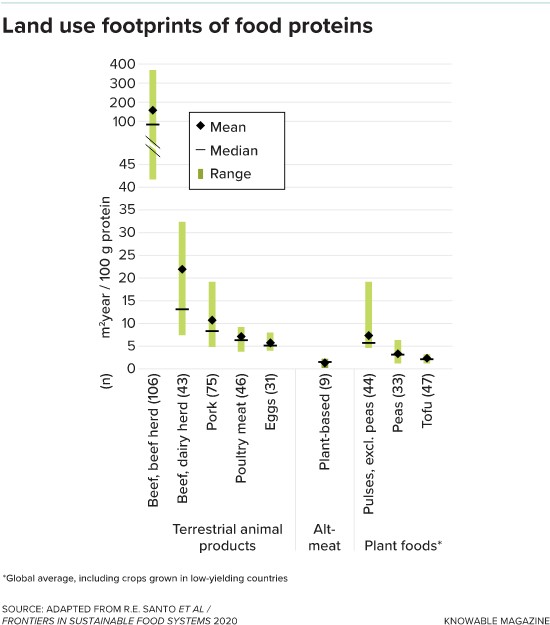

Similarly, the Hopkins team found that producing plant-based meats used less water: 23 percent that of beef, 11 percent that of pork, and 24 percent that of chicken for the same amount of protein. There were big savings, too, for land, with the plant-based products using 2 percent that of beef, 18 percent that of pork, and 23 percent that of chicken for a given amount of protein. The saving of land is important because, if plant-based meats end up claiming a significant market share, the surplus land could be allowed to revert to forest or other natural vegetation; these store carbon dioxide from the atmosphere and contribute to biodiversity conservation. Other studies show that plant-based milks offer similar environmental benefits over cow’s milk.

A caution on cultivation methods

Of course, how green plant-based meats actually are depends on the farming practices that underlie them. (The same is true for meat itself—the greenhouse gas emissions generated by a pound of beef can vary more than tenfold from the most efficient producers to the least.) Plant-based ingredients such as palm oil grown in plantations that used to be rainforests, or heavily irrigated crops grown in arid regions, cause much more damage than more sustainably raised crops. And cultivation of soybeans, an important ingredient for some plant-based meats, is a major contributor to Amazon deforestation.

However, for most ingredients it seems likely that even poorly produced plant-based meats are better, environmentally, than meat from well-raised livestock. Plant-based meats need much less soy than would be fed to actual livestock, notes Matin Qaim, an agricultural economist at the University of Bonn, Germany, who wrote about meat and sustainability in the 2022 Annual Review of Resource Economics. “The reason we’re seeing deforestation in the Amazon,” he explains, “is because the demand for food and feed is growing. When we move away from meat and more toward plant-based diets, we need less area in total, and the soybeans don’t necessarily have to grow in the Amazon.”

But green as they are, plant-based meats have a few hurdles to clear before they can hope to replace meat. For one thing, plant-based meats currently cost an average of 43 percent more than the products they hope to replace, according to the Good Food Institute. That helps to explain why plant-based meats account for less than 1 percent of meat sales in the US. Advocates are optimistic that the price will come down as the market develops, but it hasn’t happened yet. And achieving those economies of scale will take a lot of work: Even growing to a mere 6 percent of the market will require a $27 billion investment in new facilities, says Swartz.

Steak hasn’t yet been well done

In addition, all of today’s plant-based meats seek to replace ground-meat products like burgers and chicken nuggets. Whole-muscle meats like steak or chicken breast have a more complex, fibrous structure that the alt-meat companies have not yet managed to mimic outside the lab.

Part of the problem is that most plant proteins are globular in shape, while real muscle proteins tend to form long fibers. To form a textured meat-like product, scientists essentially have to turn golf balls into string, says David Julian McClements, a food scientist at the University of Massachusetts, Amherst, and an editor of the Annual Review of Food Science and Technology. There are ways to do that, often involving high-pressure extrusion or other complex technology, but so far no one has a whole-muscle product ready for market. (A fungal product, sold for decades in some countries as Quorn, is naturally fibrous, but its sales have never taken off in the US. Other companies are also working on meat substitutes based on fungal proteins.)Advertisement

The environmental impact of the two leading plant-based burgers, from Impossible Foods and Beyond Meat, is much less than a comparable beef burger, according to detailed studies commissioned by the two companies. Other experts note that these studies are difficult to verify independently because they rely on proprietary information from the companies.

McClements is experimenting with another approach to make plant-based bacon: creating separate plant-based analogs of muscle and fat, then 3D-printing the distinctive marbling of the bacon. “I think we’ve got all the elements to put it together,” he says.

Some critics also note that a shift toward plant-based meat may reinforce the industrialization of global food systems in an undesirable way. Most alternative meat products are formulated in factories, and their demand for plant proteins and other ingredients favors Big Agriculture, with its well-documented problems of monoculture, pesticide use, soil erosion, and water pollution from fertilizer runoff. Plant-based meats will reduce the impact of these unsustainable farming practices, but they won’t eliminate them unless current farming practices change substantially.

Of course, all the to-do about alternative meats overlooks another dietary option, one with the lowest environmental footprint of all: Simply eat less meat and more beans, grains, and vegetables. The additional processing involved in plant-based meats means that they generate 4.6 times more greenhouse gas than beans, and seven times more than peas, per unit of protein, according to the Hopkins researchers. Even traditional, minimally processed plant protein such as tofu beats plant-based meats when it comes to greenhouse gas. Moreover, most people in wealthy countries eat far more protein than they need, so they can simply cut back on their protein consumption without seeking out a replacement.

But that option may not appeal to the meat-eating majority today, which makes alternative meats a useful stopgap. “Would I prefer that people were eating beans and grains and tofu, and lots of fruits and vegetables? Yes,” says Bonnie Liebman, director of nutrition at the Center for Science in the Public Interest, an advocacy organization supporting healthy eating.

“But there are a lot of people who enjoy the taste of meat and are probably not going to be won over by tofu. If you can win them over with Beyond Meat, and that helps reduce climate change, I’m all for it.”

Plant-based milks

Meat isn’t the only source of animal protein with a high environmental cost. Dairy, too, causes large emissions of greenhouse gas from cud-chewing cows and sheep, and from growing feed. Here, too, plant-based alternatives, many of which are already mainstream options in the grocery store, may be an environmentally friendlier alternative—in some ways, at least.

Just how much friendlier they are, though, depends on how you measure their footprint. One option is to express environmental costs per quart of milk. By that measure, all plant-based milks shine. Soy milk, for example, requires just 7 percent as much land and 4 percent as much water as real milk, while emitting only 31 percent as much greenhouse gas. Oat milk needs 8 percent of the land and 8 percent of the water, while releasing just 29 percent as much greenhouse gas. Even almond milk often regarded as a poor choice because almond orchards guzzle so much fresh water—uses just 59 percent as much water as real milk.

But not all plant-based milks deliver the same nutrient punch. While soy milk provides almost the same amount of protein as cow’s milk, almond milk provides only about 20 percent as much—an important consideration for some. On a per-unit-protein basis, therefore, almond milk actually generates more greenhouse gas and uses more water than cow’s milk.

Bob Holmes is a science writer—and guilty omnivore—based in Edmonton, Canada.

This article originally appeared in Knowable Magazine, an independent journalistic endeavor from Annual Reviews. Sign up for the newsletter.

No comments:

Post a Comment