Michael Hiltzik

Tue, April 16, 2024 at 4:00 AM MDT·10 min read

Rep. Marjorie Taylor Greene (R-Ga.) called President Biden's student debt relief plan "completely unfair" but had her $183,500 pandemic relief debt completely forgiven. (Associated Press)

You may have noticed over the last few days that the political world is in an uproar over President Biden's dispensing of student debt relief.

It's not so much that Biden implemented the relief program at all; what got politicians and pundits in a tizzy was that he called out the GOP naysayers in the House by pointing out that many of them had received business loans via the pandemic-era Paycheck Protection Program, or PPP, that had never been paid back.

The White House tweeted out the forgiven PPP balances of 13 GOP House members critical of student loan relief, under the heading, "This you?"

The PPP helped people remain employed while the government literally shut down much of the economy,. Only an intellectual clown would compare that to what Biden is doing now with student loans.

Rep. Ralph Norman, R-S.C., recipient of $616,241 in pandemic relief

That's a really unfair comparison, the argument goes, because the PPP loans were never intended to be paid back. Under the program's terms, the loans would be forgiven if the money was used to support the workers of a small business that had been forced to close or curtail operations because of pandemic restrictions.

In other words, it's said, the PPP money was never expected to be repaid. By contrast, student loans were taken out in full expectation that they would be repaid — if not for the handouts being distributed by the White House.

"The PPP helped people remain employed while the government literally shut down much of the economy," Rep. Ralph Norman (R-S.C.), tweeted back in 2022, the first time Biden made this purportedly invidious comparison. "Only an intellectual clown would compare that to what Biden is doing now with student loans."

Norman received $616,241 from the PPP, according to the White House.

There's something to be said for the distinction made by the PPP-pocketing student relief critics, but not nearly as much as they claim. More on that in a moment.

This is just another example of how our political press is incapable of telling the forest from the trees, or how it's perennially distracted by a shiny object. (Insert your own pertinent metaphor here.)

In this case, the shiny object is the idea that it's Biden who is the hypocrite for comparing the PPP loans to student debt. This misses the bigger picture of how America's economy is structured to benefit corporations and the wealthy — that is, the patrons of the Republican political establishment — at the expense of average Americans. The pundits who are flaying the White House for making the connection are merely buying a GOP talking point.

Not only right-leaning commentators are committing this error. Not a few progressive-minded writers are complicit. Here, for instance, is Jordan Weissmann of Semaphor, usually a percipient analyst of economics and finance: "The thing about this talking point is that I know everybody in the White House, including the [communications] shop, is smart enough to know how disingenuous it is."

Read more: Column: Bidenomics has been a boon for working-class voters. Why don't they give him credit?

Let's take a closer — and a broader — look.

The comparison between student debt relief and the PPP loans first emerged in 2022, when Biden first announced his plan to forgive up to $20,000 in student debt for households with incomes of up to $125,000. The White House then issued a series of tweets targeting GOP critics of student debt relief whose PPP loans had been forgiven.

The Supreme Court invalidated Biden's original proposal in 2023. Chief Justice John G. Roberts Jr. wrote for a 6-3 conservative majority that although the law gave the secretary of Education the authority to "waive or modify" the terms of student loans, the White House had gone too far.

After that, the administration implemented a new program, the SAVE plan, that limited monthly repayments on student debt for most borrowers to as little as 5% of their income and ended payments for borrowers living near or below the federal poverty standard. After as little as 10 years, the balance on loans originally totaling $12,000 or less will be permanently forgiven.

The White House issued this roster of GOP politicians who criticized Biden's student debt relief program but got their pandemic relief loans forgiven (White House)

The issue erupted again a few days ago when Biden announced new features of his student relief program. They included waiving some accrued interest for borrowers whose balances had grown higher than their original debt, generally because their payments hadn't covered the accumulated interest — an issue that affects more than one-third of all student borrowers, and two-thirds of Black borrowers.

Critics, again mostly Republicans, weighed in again with tendentious lectures on social media about the moral imperative of meeting one's obligation to pay back a loan.

Rep. Andrew S. Clyde (D-Ga.), for instance, tweeted that Biden's latest initiative, which will relieve student borrowers of about $7.4 billion in principal and interest, would "transfer millions more in student debt onto the backs of hardworking taxpayers." Clyde called it "nothing more than a desperate attempt to buy votes with Americans’ hard-earned money."

Clyde's $156,597 PPP loan was forgiven.

That brings us back to the hypocrisy issue. It's true that students who took out education loans are expected to repay them, and that businesses that took out PPP loans were led to believe that they would be forgiven — as long as they were used to support their payrolls through business closings and cutbacks.

But things are not so simple. Critics of Biden's plan argue that the PPP loans were designed to address an acute economic disaster, which isn't the case with student loans.

The student loan burden, however, has become an economic disaster. The total amount of outstanding student loans for higher education has ballooned over the last two decades to almost $1.8 trillion today, up from about $300 billion in 2000. Those loans are carried by about 43 million borrowers.

Read more: Column: Student debt relief might cost $420 billion. That's a bargain

The burden has grown in part because the cost of higher education has exploded. That's so even at public institutions: In 1970, the average tuition at public four-year universities was $358, or about $2,958 in today's money. Since then, public university tuition and fees have grown to the point that working families can't afford them without borrowing.

At UCLA and UC Berkeley, those annual costs come to $13,401 and $14,395 for state residents, respectively. It's proper to note that the University of California was free to Californians until tuition charges were introduced under Gov. Ronald Reagan in the 1970s. Among the beneficiaries of the old system were former governor and U.S. Chief Justice Earl Warren, diplomat Ralph Bunche, L.A. Mayor Tom Bradley, and writer Maxine Hong Kingston, all children of low-income families.

Public university students today accumulate an average of $32,637 to receive a bachelor's degree. The overall average of student debt reached $37,600 in 2022, more than double the average in 2007.

The economic implications of this burden are inescapable. Households burdened by high student debt often delay or forgo homeownership and face difficulties in starting a family or building up savings. The debt load also contradicts Americans’ cherished assumptions about the value of higher education.

“The whole premise of the main higher education industry is that a college degree pays off,” Marshall Steinbaum, an expert in higher education finance at the Jain Family Institute, told me in 2022. When some people are still paying off their student loans as they approach retirement, that premise loses some of its oomph.

As for the PPP, it was nothing like the unalloyed boon that its GOP defenders portray. The members of Congress who snarfed up loans by the six or seven figures (Rep. Brett Guthrie (R-Ky.) tops the list of those called out as hypocrites by Biden with $4.4 million in forgiven loans) are beneficiaries of a program they themselves voted for.

Of the 13 on Biden's list, three (Marjorie Taylor Greene and Clyde of Georgia and Pat Fallon of Texas) hadn't yet been elected when the PPP came up for a vote in April 2020; another, Mike Kelly of Pennsylvania, didn't cast a vote. All the others on the White House roster voted in favor. The measure passed the House 388 to 5. Representatives and senators could have exempted themselves from the PPP benefits, but they didn't. Then they lined up for the goods.

Read more: Column: GOP ratchets up the hypocrisy in opposing Biden's student debt plan

Were the PPP funds invariably used as they were supposed to? There's reason to be skeptical. Greene, who received a $182,300 PPP loan in April 2020 for her family construction business, donated $250,000 to her own congressional campaign the following June and August. The government subsequently forgave $183,500, including interest.

Did any of those donations come from the PPP? We'll never know, because days before Biden took office, the Small Business Administration deleted almost all the database red flags designating potentially questionable or fraudulent loans subject to further review. That's according to the Project on Government Oversight, a watchdog group that based its findings on a government database.

As many as 2.3 million loans, including 54,000 loans of more than $1 million each, thus may have received a free pass. The red flags included signs that a recipient company had laid off workers or were ineligible to participate in the program.

The SBA's inspector general's office later disclosed that it had "substantiated an unprecedented level of fraud activity" in the PPP program, but said the mass closeout, as well as the SBA's habit of forgiving loans before reviewing them for potential fraud, would hamper the agency's ability "to recover funds for forgiven loans later determined to be ineligible."

A larger problem in the haste by politicians and pundits to flay Biden for his defense of student loan relief is that their view is too narrow. As I reported in 2022, many of the politicians wringing their hands over how student loan relief burdens ordinary taxpayers received their higher education courtesy of ordinary taxpayers — by attending public institutions at a time when they were overwhelmingly tax-supported.

That's not all. Republican fiscal policies are almost invariably aimed to benefit corporations and wealthier Americans. The 2017 tax cuts are a perfect example. The richest 20% of Americans received nearly 64% of the tax benefits. The top 1% received a reduction in their average federal tax rate of 1.5 percentage points, worth an average $32,650 a year; the lowest-income 20% got a tax rate reduction of 0.3 of a percentage point, worth $40 a year.

Student debt relief, however, overwhelmingly favors low-income borrowers. According to a 2022 study done for Sen. Elizabeth Warren (D-Mass.), $10,000 in student debt cancellation would reduce the share of people with debt by one-third among the lowest-income 20% and by one-fourth for households among the next 20%. But it would make almost no difference for the richest 10%.

Debt cancellation also would reduce racial gaps in household economics. A $10,000 debt reduction would zero out loan balances for 2 million Black families, the study said, reducing the share of Black individuals with student loans to 17% from 24%.

In other words, student debt relief is a boon for the most economically vulnerable American households. That can't be said of the PPP program, and certainly not for the GOP tax cuts.

The debate over whether it's "fair" to juxtapose student debt relief with the millions pocketed by GOP representatives and their patrons is, indeed, a story of hypocrisy. But the hypocrisy is not where our political press has claimed to find it. They should pay attention to what really drives conservatives to hate student debt relief so much.

Michael Hiltzik

Commentary on economics and more from a Pulitzer Prize winner.

This story originally appeared in Los Angeles Times.

Biden takes aim at 'runaway interest' in new student debt cancellation plan

The proposal aims to help people who owe more than they borrowed even after years of repayment.

Gabriella Cruz-Martinez

·Reporter

Updated Tue, April 16, 2024

President Joe Biden is doubling down on his student loan forgiveness promise with a new plan that would bring relief to over 30 million Americans.

The proposal announced last week would fully wipe accrued interest for 23 million student loan borrowers, eliminating college debt for 4 million Americans. Overall, 10 million borrowers would see debt relief of $5,000 or more, the White House said.

The proposal also targets a narrower group who now owe more than they originally borrowed due to “runaway interest.”

“One major aspect of the plan is that we’re helping people that owe more than they borrowed because interest can often run away from them,” US Department of Education Under Secretary James Kvaal told Yahoo Finance. “We hope to finalize these plans over the next coming months.”

The rules will be published on Wednesday and allow for public comment for 30 days.

The proposal aims to help people who owe more than they borrowed even after years of repayment.

Gabriella Cruz-Martinez

·Reporter

Updated Tue, April 16, 2024

President Joe Biden is doubling down on his student loan forgiveness promise with a new plan that would bring relief to over 30 million Americans.

The proposal announced last week would fully wipe accrued interest for 23 million student loan borrowers, eliminating college debt for 4 million Americans. Overall, 10 million borrowers would see debt relief of $5,000 or more, the White House said.

The proposal also targets a narrower group who now owe more than they originally borrowed due to “runaway interest.”

“One major aspect of the plan is that we’re helping people that owe more than they borrowed because interest can often run away from them,” US Department of Education Under Secretary James Kvaal told Yahoo Finance. “We hope to finalize these plans over the next coming months.”

The rules will be published on Wednesday and allow for public comment for 30 days.

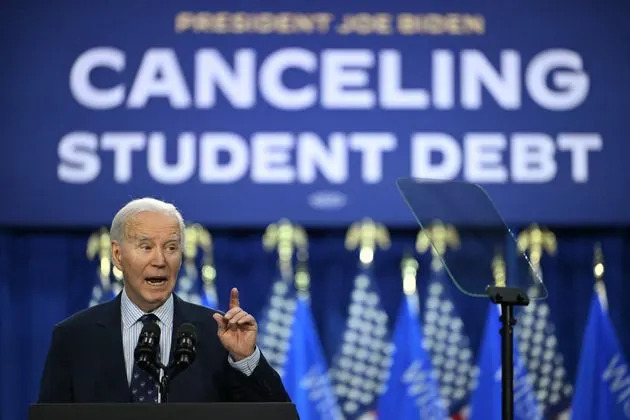

President Biden speaks about student loan debt relief at Madison Area Technical College in Madison, Wis., April 8. (AFP via Getty Images)

How do people end up owing more than they borrowed?

More than 25 million student loan borrowers owe more than they originally borrowed, even after being in repayment for decades.

That’s because of interest accrual, which can even begin during the six-month grace period on most loans.

Say you borrowed a $30,000 loan in college and entered Standard 10-year repayment at a 3.6% interest rate. Your monthly payment would be $298.06 over the next 120 months, adding up to $35,767.92.

Overall, you would have paid $5,767.92 in interest by the end of your repayment.

But with an income-driven repayment plan (IDR), which adjusts monthly payments to be affordable, the payments can be so low they don’t cover your monthly interest charges, which continue to build up.

For example, if you qualify for a $5 monthly payment under IDR, that payment would not be enough to cover your interest — resulting in negative amortization or “runaway interest.” In other words, interest would accrue more quickly than the borrower can pay down their principal and interest, the NASFAA said, resulting in the balance ballooning over time.

Additionally, under all IDR plans, any remaining balance is supposed to be forgiven on loans that aren’t fully paid at the end of the repayment period (either 20 or 25 years), but for some borrowers that didn’t happen.

Still, “runaway interest” happens well before borrowers reach the point of forgiveness on IDR plans, the NASFAA told Yahoo Finance.

Read more: Do I qualify for student loan forgiveness?

It’s ensnared many borrowers over the past decades, said Melissa Byrne, co-founder and executive director of We The 45 Million, a national advocacy group for student loan borrowers.

“An exchange for doing longer repayment terms is that for every month that you’re paying less than you would have been doing under a 10-year Standard plan, you just kept getting interest capitalized,” Byrne said. “So people saw their balances balloon from like 40 grand to a $200,000 balance over the course of the time.”

Students study in the Rice University Library in Houston, Texas. U.S. (Credit: Brandon Bell, Getty Images)

Under Biden’s new proposal, some borrowers could see up to $20,000 of their accrued interest forgiven — regardless of income. Specifically, interest accrued while the borrower was in repayment, the White House said.

This relief would be delivered automatically to all types of federal student loans, including parent loans, consolidation loans, and loans in default. It does not apply to private student loans.

Additionally, low and middle-income borrowers enrolled in any income-driven repayment plan and have an annual income of $120,000 if single, or $240,000 (for married couples who file taxes jointly) would be eligible to have their entire balance wiped since entering repayment, the Biden administration said.

Overall, the Department of Education said that over 75% of borrowers who would benefit from interest relief are recipients of Pell Grants, which are federal awards granted to undergraduate students based on economic need.

The burden of accrued interest

People gather on the campus of the University of Southern California on March 21 in Los Angeles. (Credit: Getty Images)

Biden’s new plans come seven months after the conservative-led Supreme Court struck down his first attempt at widespread student loan relief. By a vote of 6-3, the justices ruled that Biden had "overstepped" his authority when announcing plans to cancel up to $400 billion in student loans.

This time, the Biden administration is using a different approach under the legal justification of the Higher Education Act. Under that law, the education secretary can provide student loan forgiveness under certain circumstances.

“We are targeting our relief on specific problems that people are experiencing like runaway interest,” Kvaal said. “It turns out a lot of people are struggling with their loans for a lot of reasons. So we’ll be helping [them] with these plans.”

The proposal couldn’t have come at a better time for some households.

“We are struggling now to make ends meet,” said Lina Henao, a member of the nonprofit parent and family advocacy group ParentsTogether Action. “I will for sure default on loans or literally take food security off the table.”

Another parent advocate based in Michigan said she had been paying off her student loans for years to no avail, with the balance totaling $80,000 despite years of repayment.

“Student loan payments are taking a big chunk of my paycheck,” Crystal Payne said.

Who else could get forgiveness?

People rally to show support for the Biden administration's student debt relief plan in front of the Supreme Court. (Los Angeles Times via Getty Images)

Biden’s new plan targets five groups of student loan borrowers. If enacted as proposed, folks could see relief if they are part of these categories:

Borrowers with balances bigger than what they originally borrowed due to accrued interest.

Borrowers who qualify for debt cancellation under an existing government program such as Public Student Loan Forgiveness, IDR plan. or SAVE, including those who have not applied.

Borrowers who entered repayment at least 20 years ago on their undergraduate loans or over 25 years ago on their graduate loans.

Borrowers who enrolled in “low-financial-value” programs or institutions — defined as programs that failed accountability measures, closed, or left students in debt but without good job prospects. These could amount to roughly 250,000 borrowers based on closed school discharges alone, the White House said.

Borrowers experiencing financial hardship, though what is considered hardship is not yet defined.

“These historic steps reflect President Biden’s determination that we cannot allow student debt to leave students worse off than before they went to college,” said Kvaal.

Gabriella Cruz-Martinez is a personal finance and housing reporter at Yahoo Finance. Follow her on X @__gabriellacruz.

Biden unveils draft rule for his latest student debt relief plan

Bianca Quilantan

Tue, April 16, 2024

The Education Department unveiled a draft proposal on Tuesday of President Joe Biden’s latest plan to broadly cancel swaths of student loan debt for millions of borrowers.

His plan seeks to forgive unpaid interest for some 25 million Americans who now owe more on their loans than they originally borrowed. It would also help more than 2 million borrowers who’ve carried their debts for decades and another 2 million borrowers who would have qualified for existing federal programs but failed to enroll. Borrowers who attended “low-value programs” could see relief as well.

If implemented, the administration said the plan, along with its other student debt relief efforts, would apply to roughly 30 million borrowers as early as this fall.

“These distinct forms of debt relief are designed for borrowers struggling with their loans — and that’s a lot of people,” Education Undersecretary James Kvaal said in a statement. “There are 25 million borrowers whose interest is growing faster than they can pay it down. That fact alone shows how badly President Biden’s student loan relief is needed.”

Biden first announced the plan last week at a community college in Madison, Wisconsin, while other top administration officials went to other swing states to push his pitch.

The proposal, which provides targeted relief for the majority of student loan borrowers, comes as Biden looks to deliver on his campaign promise to cancel some student loan debt after his more sweeping plan was thwarted by the Supreme Court last year.

Senior administration officials have previously told reporters they’re “confident” that Biden’s new attempt is sufficiently different to pass muster before the court. The plan hinges on the Education secretary’s legal authority under the Higher Education Act, rather than the Covid-related emergency powers that were the basis for the administration’s first plan.

While Democrats and groups in support of debt relief have lauded the Biden administration’s efforts, Rep. Virginia Foxx (R-N.C.), who helms the House education panel, slammed the proposal as a “reckless and fiscally irresponsible" action.

“Mr. President, you have no legal ground to stand upon,” Foxx said. “Your scheme is not steeped in benevolence or goodwill. It is mired in utter contempt for the Supreme Court and every student, family and hardworking taxpayer in this country.”

The proposed rule will be published in the Federal Register on Wednesday with a 30-day comment period, and the department said it is still aiming to finalize its rules by the fall.

A separate draft rule focused on relief for borrowers experiencing hardship is slated for the coming months. It is expected to include proposals to grant automatic forgiveness of loans for borrowers at a high risk of default and others who “show hardship due to other indicators” like high medical and caregiving expenses.

“As President Biden said last week, our Administration is working as quickly as possible to deliver relief to as many borrowers as possible,” a department spokesperson said about the hardship proposal. “As we vigorously continue to develop the NPRM related to hardship for release in the coming months, we also are moving forward with these proposed rules today so we can begin delivering relief to borrowers as early as this fall.”

In Madison, College Students Say They’re Voting For Biden. Mostly For 1 Reason.

Tue, April 16, 2024

The Education Department unveiled a draft proposal on Tuesday of President Joe Biden’s latest plan to broadly cancel swaths of student loan debt for millions of borrowers.

His plan seeks to forgive unpaid interest for some 25 million Americans who now owe more on their loans than they originally borrowed. It would also help more than 2 million borrowers who’ve carried their debts for decades and another 2 million borrowers who would have qualified for existing federal programs but failed to enroll. Borrowers who attended “low-value programs” could see relief as well.

If implemented, the administration said the plan, along with its other student debt relief efforts, would apply to roughly 30 million borrowers as early as this fall.

“These distinct forms of debt relief are designed for borrowers struggling with their loans — and that’s a lot of people,” Education Undersecretary James Kvaal said in a statement. “There are 25 million borrowers whose interest is growing faster than they can pay it down. That fact alone shows how badly President Biden’s student loan relief is needed.”

Biden first announced the plan last week at a community college in Madison, Wisconsin, while other top administration officials went to other swing states to push his pitch.

The proposal, which provides targeted relief for the majority of student loan borrowers, comes as Biden looks to deliver on his campaign promise to cancel some student loan debt after his more sweeping plan was thwarted by the Supreme Court last year.

Senior administration officials have previously told reporters they’re “confident” that Biden’s new attempt is sufficiently different to pass muster before the court. The plan hinges on the Education secretary’s legal authority under the Higher Education Act, rather than the Covid-related emergency powers that were the basis for the administration’s first plan.

While Democrats and groups in support of debt relief have lauded the Biden administration’s efforts, Rep. Virginia Foxx (R-N.C.), who helms the House education panel, slammed the proposal as a “reckless and fiscally irresponsible" action.

“Mr. President, you have no legal ground to stand upon,” Foxx said. “Your scheme is not steeped in benevolence or goodwill. It is mired in utter contempt for the Supreme Court and every student, family and hardworking taxpayer in this country.”

The proposed rule will be published in the Federal Register on Wednesday with a 30-day comment period, and the department said it is still aiming to finalize its rules by the fall.

A separate draft rule focused on relief for borrowers experiencing hardship is slated for the coming months. It is expected to include proposals to grant automatic forgiveness of loans for borrowers at a high risk of default and others who “show hardship due to other indicators” like high medical and caregiving expenses.

“As President Biden said last week, our Administration is working as quickly as possible to deliver relief to as many borrowers as possible,” a department spokesperson said about the hardship proposal. “As we vigorously continue to develop the NPRM related to hardship for release in the coming months, we also are moving forward with these proposed rules today so we can begin delivering relief to borrowers as early as this fall.”

In Madison, College Students Say They’re Voting For Biden. Mostly For 1 Reason.

Jennifer Bendery

Wed, April 17, 2024

President Joe Biden is courting young voters with his latest student loan debt relief plans. Here he is with a Students Demand Action group in June 2023. via Associated Press

MADISON, Wis. — When President Joe Biden came to Madison Area Technical College last week, he was hoping to fire up students here about his new plans to cancel student loan debt for millions more Americans.

“I will never stop [fighting] to deliver student debt relief,” Biden vowed in remarks laying out his latest proposals. “By freeing millions of Americans from this crushing debt of student debt, it means they can finally get on with their lives instead of their lives being put on hold.”

But his speech had barely ended before students were racing out of the building for something more exciting: a solar eclipse. Dozens of teenagers and early-20-somethings gathered outside, swapping crumpled pairs of paper solar eclipse glasses with each other and staring into the sun. Nobody was talking about the president or student loans. In fact, none of these students had even gone to Biden’s event. It was invite-only.

“I think the student Senate got in?” wondered Matt, 19, a student from the nearby town of Verona. “That shit is stupid!” interrupted another student charging through, pointing at the sky and looking for a pair of glasses. That was the end of any student loan talk.

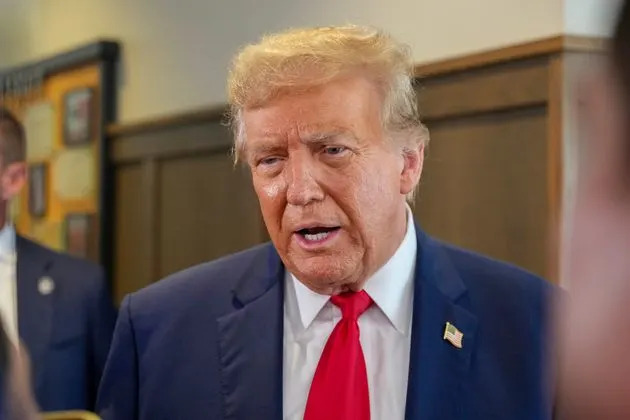

Biden picked this Madison school for his student loan speech because it checks two boxes for his presidential campaign: appealing to young voters and showing his face in Wisconsin, a swing state that will be pivotal to winning the election in November. Biden narrowly defeated former President Donald Trump here in 2020. Trump narrowly won it in 2016.

Six months before the election, both candidates are aggressively courting voters here. Beyond last week’s trip, Biden was in Milwaukee last month, fresh off his State of the Union address, pitching voters on what he’d offer in a second term. Meanwhile, the GOP chose Milwaukee as the site for its party’s nominating convention in July, and Trump stumped in Green Bay earlier this month. It was his first time in the state since 2022.

Biden’s latest visit here was also an attempt to show people who are six decades younger than him that he’s listening to their concerns. At 81, he’s faced months of scrutiny over his age and mental acuity. Trump has faced questions about his mental competency, too. But a March poll by The New York Times and Siena College showed voters more concerned about Biden’s age, even though Trump isn’t far behind at 77.

For college-aged voters in Madison, though, this didn’t seem like a dealbreaker.

“It does concern me, but it also doesn’t,” said Mack, 21, who is from Madison and planning to vote for Biden. “I wouldn’t be like, ‘Oh, that’s the reason I’m not voting for him.’”

And even if they weren’t invited to his student loan event, at least some students were paying attention to what Biden is doing on this front.

His student debt relief plans “absolutely” resonate, said Yaakov, a 21-year-old from Minneapolis. “I got a scholarship, but if I didn’t I would be $180,000 in debt.”

Even though he doesn’t have loans, “My brother, my friends, a lot of people I know are drowning in debt right now,” he added. “I got insanely lucky. Thank god someone is taking on this issue.”

Biden talked about his student loan debt relief proposals at Madison Area Technical College on April 8. Hopefully some students were invited to attend the event. ANDREW CABALLERO-REYNOLDS via Getty Images

HuffPost spent a couple of days in Madison talking to college students about the presidential election. We asked more than two dozen of them the same two questions: Do you plan to vote in November, and if so, who would you vote for and why?

There was a clear theme to their responses. Most said yes, most said they planned to vote for Biden, and most said it was because they just don’t want Trump in the White House.

“I’m going to be voting for Joe Biden because Donald Trump has proven time and again that he’s not interested in continuing democracy,” said Dylan Goldman, a 19-year-old student at the University of Wisconsin–Madison who is from Florida. “While I think Joe Biden is too old to be president, I’ve been left with no other choice.”

“I don’t know if I can say it any better,” chimed in his friend Michael Howe, 20, of Brainerd, Minnesota. “I will also be voting for Biden. I’m not a fan of Biden’s age at this point, but Trump is not that much younger and it’s the lesser of two evils at this point.”

While I think Joe Biden is too old to be president, I’ve been left with no other choice.Dylan Goldman, a 19-year-old student at the University of Wisconsin-Madison

College-aged voters tend to be “more of a wild card” in presidential elections, said Mindy Romero, director of the Center for Inclusive Democracy at the University of Southern California’s Price School of Public Policy.

They’re still trying to figure out how the process works, she said, plus trying to sort out their own political ideas from their parents’ ideas, and figure out which party they identify with, if any. They also face an information barrier, meaning if they start learning about a particular issue that is being hotly debated on a college campus — say, the Israel-Hamas war — that issue alone could be the deciding factor on whether they vote and who they vote for.

“Young people statistically are going to be Democrats, but they don’t have a track record of voting,” said Romero. “So things like Biden’s policy on Israel, for example, completely upend that.”

Young voters also tend to have low turnout. “But they are still formidable,” said Romero, who has written about how our electoral system has failed young voters. “Their sheer numbers mean they have the ability, when an election is really close, to potentially swing an election.”

The equation for these college students in Madison, in a community inhabited by relatively politically active and informed young adults, seemed to be that Trump is a greater concern than whatever problems they may have with Biden.

Students gave lots of reasons for their disdain of Trump. They also mostly requested only using their first names. One Latina student said she felt “very disrespected” by him. Her friend, who was white, said she considered herself an ally to minority groups and couldn’t vote for Trump because of his treatment of people of color. Neither cited specific things he’s said, but Trump has a long record of insulting variousminoritygroups.

“I don’t like how he took us out of the Paris Agreement,” said Jocelyn, 19, of Evanston, Illinois, referring to the international treaty on climate change adopted in 2015. “Obama put us on it, so I think it’s important to stay with it. I don’t want that to get ruined.”

Molly, 18, of Lake Forest, Illinois, said Trump’s history of denigrating “women and people with disabilities and all that, it’s just not something I align myself with.”

Jewish students at the University of Wisconsin-Madison gather for an event to pray for the Israeli hostages being held by Hamas. Some students raised concerns with Biden's response to the Middle East war. Jen Bendery

This all sounds like good news for Biden’s campaign, but students still shared concerns about his age and his handling of the Israel-Hamas war.

“I honestly never was interested in anything Biden said until he was, like, showing he was actually helping Israel with the war,” said Demi, 22, who is Jewish and from San Diego. “Now he’s stepped to the side, and I’ve stopped listening.”

Moments later, she said, “I hate to say it, but Trump has done more for the Jews.” She said she feels like Trump hasn’t wavered in his support for Israel, and that the bottom line is “the Jews want to feel safe.”

But when asked if that means she might vote for Trump, Demi replied, “I’m kind of just like, whatever my parents guide me to do. I don’t follow politics. I honestly don’t know the difference between a Democrat and a Republican.”

The fact that many of these students said they plan to vote for Biden not necessarily because of what he’s offering, but because he’s not the other guy, suggests the president has some work to do with selling them on his record. Recent national polls seem to show Biden underperforming with young voters compared to how he fared with them in 2020. They also seem to show Trump gaining support from the youth vote. There are reasons to be skeptical of these polls, but it’s still not a good sign for the Biden camp.

Romero said she sees a connection between what national polling is suggesting about young voters and what our small sampling found.

“The common denominator is that they weren’t enthusiastic about Biden,” she said. “I’m not surprised that many young people are translating their very strong reactions to Biden’s policies into potentially not voting for a Democrat, maybe even potentially voting for Trump. The only thing I’m cautioning is it’s still really early in the election.”

“The war is evolving. Policies are evolving,” added Romero. “Maybe the war stays constant, but Trump does something to change the equation.”

Donald Trump, pictured here visiting a Chick-fil-A in Atlanta, is not very popular among University of Wisconsin-Madison students. via Associated Press

Of the 26 students HuffPost interviewed at both college campuses, just one said she planned to vote for Trump. But this University of Wisconsin student didn’t know why.

“I’m sorry, I don’t really have an answer,” said Grace, 18, when asked what she liked about Trump. She requested only listing Wisconsin as where she’s from.

“I just don’t think Biden is fit to be president. I feel like he has mental issues,” she said. “I don’t think anyone should be president if that’s going on.”

Sitting nearby at a picnic table, three male students concurred that Trump was the worst possible option.

“I just think four years of Trump would be worse than four more years of Biden,” said Finn, 19, from Los Angeles. His friends laughed at how cynical he sounded.

“I know, it’s negative!” said Finn.

“It’s a negative election, though!” said Andrew, 20, of Milwaukee. “Who wanted to see this?”

If there was anything surprising about what these students had to say about the presidential election, it was their eagerness to be part of the conversation at all. Nobody declined to give an interview. Everybody had something slightly different to say. Their enthusiasm to share their ideas about what mattered to them was clear, even if it’s less clear if or how their concerns will translate at the ballot box.

Andrew, for one, spent several minutes offering his personal analysis of the Republican Party’s base of voters, what he sees as their disdain for Super PACs and then told an anecdote about how shocked he was to learn about a lobbyist group in a recent election advocating for a political candidate of a different party.

“It’s crazy! It’s just crazy, like, watching it all happen,” marveled the 20-year-old. “It’s a wild time in politics.”

No comments:

Post a Comment