Huileng Tan

INSIDER

Updated Thu, June 13, 2024

China, the world's factory, is known for producing affordable goods quickly.

But China EV makers shouldn't leverage on their price advantage in the long run as it's not sustainable, said a Bain consultant.

The EU will impose up to 48.1% tariffs on Chinese EV imports next month to protect European economies.

China has been the world's factory floor for the last 40 years, propelling it into the position of the world's second-largest economy.

This ability to make affordable products quickly is one of China's key advantages in many product categories.

However, this isn't what Chinese electric makers should be leveraging in the long run, a management consultant said on Wednesday.

"The pricing advantage will eventually run out of steam. It is product quality, technology, and brand awareness that holds the key to Chinese carmakers' success," Helen Liu, a partner at consultancy firm Bain told reporters, per the South China Morning Post.

Liu's assessment came as the European Commission announced it will impose tariffs of up to 38.1% on Chinese EV imports from next month — on top of the existing 10%.

The move follows a monthslong probe into Chinese subsidies for Chinese EV makers.

The European Commission said in its announcement that the EV value chain in China benefits from unfair subsidization that causes a "threat of economic injury" to the EU's EV makers.

The latest blow to Chinese EV makers came after President Joe Biden announced a sweeping set of tariffs in May on $18 billion worth of Chinese imports — including a 100% tax on Chinese vehicles.

Chinese EVs have nearly no presence in the US, but account for 8% of the EV market share in auto powerhouse Europe, making the industry a geopolitical hot potato.

The West hits out over China's overcapacity

In recent months, Western countries have been lining up to criticize China for its barrage of cheap exports flooding the world's markets. They say China's dumping and unfair trade practices has hurt their economies.

However, Beijing has consistently pushed back on the West's criticism that it is dumping cheap goods on the world market. Chinese authorities say the West's accusations are protectionist and aimed at containing China's economic growth.

One contentious sector of dispute between the two sides is the hot new energy sector.

China is producing a lot of new energy products as the country navigates a painful economic transition, from one reliant on real estate and low-cost manufacturing to the hot "new three" sectors of electric vehicles, lithium batteries, and solar panels.

However, the West is also eyeing these fast-rising industries.

Philip Nothard, insight and strategy director at automotive services company Cox Automotive told Business Insider's Tom Carter on Wednesday that the EU's tariff hike will not be enough to keep Chinese EV companies away from Europe.

This is because big Chinese EV players like BYD have "highly efficient" manufacturing supply chains and are very quick to adjust their strategies.

"Chinese companies have the potential to redefine electric cars so that they can convince global customers of their products' competitiveness in performance and technology," said Bain's Liu, per SCMP.

Chinese EV makers are hit with new EU tariffs

Updated Thu, June 13, 2024

China, the world's factory, is known for producing affordable goods quickly.

But China EV makers shouldn't leverage on their price advantage in the long run as it's not sustainable, said a Bain consultant.

The EU will impose up to 48.1% tariffs on Chinese EV imports next month to protect European economies.

China has been the world's factory floor for the last 40 years, propelling it into the position of the world's second-largest economy.

This ability to make affordable products quickly is one of China's key advantages in many product categories.

However, this isn't what Chinese electric makers should be leveraging in the long run, a management consultant said on Wednesday.

"The pricing advantage will eventually run out of steam. It is product quality, technology, and brand awareness that holds the key to Chinese carmakers' success," Helen Liu, a partner at consultancy firm Bain told reporters, per the South China Morning Post.

Liu's assessment came as the European Commission announced it will impose tariffs of up to 38.1% on Chinese EV imports from next month — on top of the existing 10%.

The move follows a monthslong probe into Chinese subsidies for Chinese EV makers.

The European Commission said in its announcement that the EV value chain in China benefits from unfair subsidization that causes a "threat of economic injury" to the EU's EV makers.

The latest blow to Chinese EV makers came after President Joe Biden announced a sweeping set of tariffs in May on $18 billion worth of Chinese imports — including a 100% tax on Chinese vehicles.

Chinese EVs have nearly no presence in the US, but account for 8% of the EV market share in auto powerhouse Europe, making the industry a geopolitical hot potato.

The West hits out over China's overcapacity

In recent months, Western countries have been lining up to criticize China for its barrage of cheap exports flooding the world's markets. They say China's dumping and unfair trade practices has hurt their economies.

However, Beijing has consistently pushed back on the West's criticism that it is dumping cheap goods on the world market. Chinese authorities say the West's accusations are protectionist and aimed at containing China's economic growth.

One contentious sector of dispute between the two sides is the hot new energy sector.

China is producing a lot of new energy products as the country navigates a painful economic transition, from one reliant on real estate and low-cost manufacturing to the hot "new three" sectors of electric vehicles, lithium batteries, and solar panels.

However, the West is also eyeing these fast-rising industries.

Philip Nothard, insight and strategy director at automotive services company Cox Automotive told Business Insider's Tom Carter on Wednesday that the EU's tariff hike will not be enough to keep Chinese EV companies away from Europe.

This is because big Chinese EV players like BYD have "highly efficient" manufacturing supply chains and are very quick to adjust their strategies.

"Chinese companies have the potential to redefine electric cars so that they can convince global customers of their products' competitiveness in performance and technology," said Bain's Liu, per SCMP.

Chinese EV makers are hit with new EU tariffs

Tom Carter

INSIDER

Updated Thu, June 13, 2024

The EU has imposed tariffs of up to 38.1% on Chinese EVs.

Joe Biden also launched a crackdown on Chinese EVs last month, hitting them with a 100% tax.

Trade barriers come amid fears a wave of cheap Chinese brands could take over Western markets.

The EU is cracking down on China's EV companies.

The bloc will impose tariffs as high as 38.1% on EVs imported from China to Europe from next month, the European Commission said on Wednesday.

Tesla rivals BYD will face a tariff of 17.4%, Geely 20%, and SAIC Motor 38.1%. The new tariffs are on top of the EU's existing 10% duty on imported EVs.

EV producers in China who did co-operate with the EU's ongoing investigation will face rates of 21%, while those that have not will be slapped with 38.1% import taxes.

The European Commission launched an investigation into Chinese EVs last October, examining whether state subsidies in China were keeping the price of their electric vehicles artificially low.

Its latest findings come after Joe Biden announced a sweeping set of tariffs in May on $18 billion worth of Chinese goods, including a 100% tax on Chinese vehicles.

Chinese-branded EVs have almost no presence in the US, thanks to existing trade barriers.

But in Europe, they have been making steady inroads, with Tesla rival BYD building a factory in Hungary and startups Nio and Xpeng releasing models in several European countries.

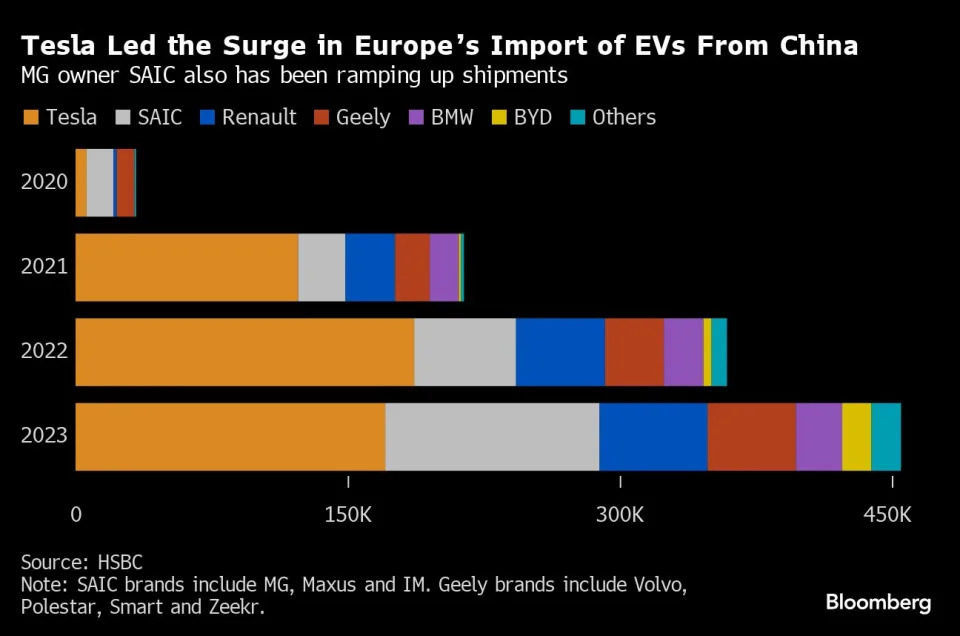

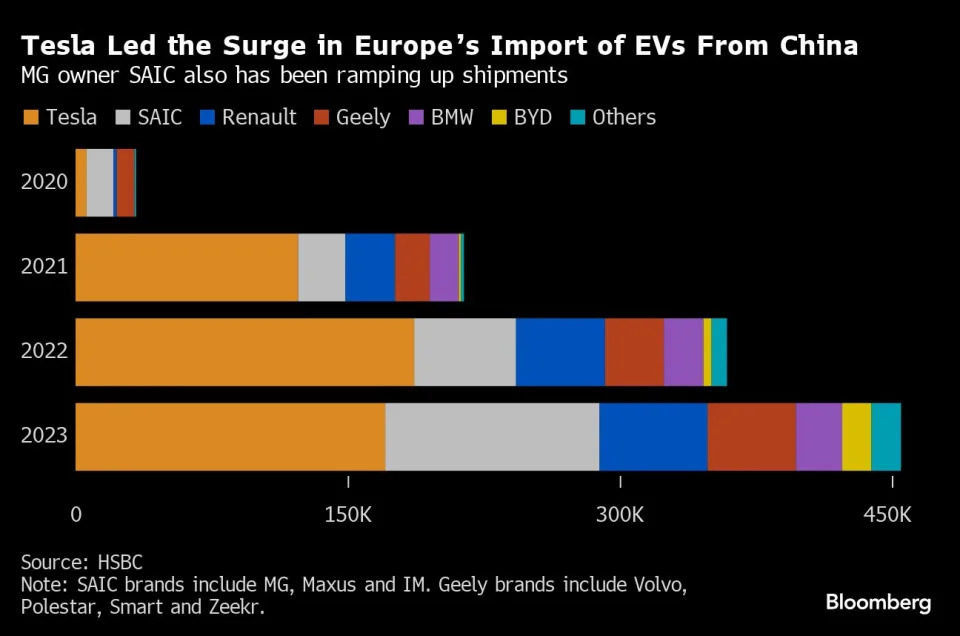

Chinese brands rose from under 1% of Europe's EV market in 2019 to 8% in 2023, according to the European Commission, and are expected to hit 15% by 2025.

Despite the crackdown, Philip Nothard, insight and strategy director at automotive services company Cox Automotive told Business Insider that the measures will not be enough to keep Chinese EV companies at bay in Europe.

"Even with tariffs, it's not going to slow the growth down," Nothard said.

"If you look at companies like BYD, they have a highly efficient manufacturing supply chain. That makes them extremely agile when it comes to changing products for different marketplaces," he added, suggesting that Chinese companies could adjust their growth plans to keep prices low even with new tariffs.

The trade barriers will also raise fears that China might retaliate with import duties of its own.

Chinese officials have hinted that the Asian superpower could impose taxes as high as 25% on imported cars in response to European and US tariffs.

The EU has imposed tariffs of up to 38.1% on Chinese EVs.

Joe Biden also launched a crackdown on Chinese EVs last month, hitting them with a 100% tax.

Trade barriers come amid fears a wave of cheap Chinese brands could take over Western markets.

The EU is cracking down on China's EV companies.

The bloc will impose tariffs as high as 38.1% on EVs imported from China to Europe from next month, the European Commission said on Wednesday.

Tesla rivals BYD will face a tariff of 17.4%, Geely 20%, and SAIC Motor 38.1%. The new tariffs are on top of the EU's existing 10% duty on imported EVs.

EV producers in China who did co-operate with the EU's ongoing investigation will face rates of 21%, while those that have not will be slapped with 38.1% import taxes.

The European Commission launched an investigation into Chinese EVs last October, examining whether state subsidies in China were keeping the price of their electric vehicles artificially low.

Its latest findings come after Joe Biden announced a sweeping set of tariffs in May on $18 billion worth of Chinese goods, including a 100% tax on Chinese vehicles.

Chinese-branded EVs have almost no presence in the US, thanks to existing trade barriers.

But in Europe, they have been making steady inroads, with Tesla rival BYD building a factory in Hungary and startups Nio and Xpeng releasing models in several European countries.

Chinese brands rose from under 1% of Europe's EV market in 2019 to 8% in 2023, according to the European Commission, and are expected to hit 15% by 2025.

Despite the crackdown, Philip Nothard, insight and strategy director at automotive services company Cox Automotive told Business Insider that the measures will not be enough to keep Chinese EV companies at bay in Europe.

"Even with tariffs, it's not going to slow the growth down," Nothard said.

"If you look at companies like BYD, they have a highly efficient manufacturing supply chain. That makes them extremely agile when it comes to changing products for different marketplaces," he added, suggesting that Chinese companies could adjust their growth plans to keep prices low even with new tariffs.

The trade barriers will also raise fears that China might retaliate with import duties of its own.

Chinese officials have hinted that the Asian superpower could impose taxes as high as 25% on imported cars in response to European and US tariffs.

Europe Needs More Cheap EVs. Tariffs Will Keep Prices High

Elisabeth Behrmann and Craig Trudell

BLOOMBERG

Thu, June 13, 2024

(Bloomberg) -- The European Union needs more and cheaper electric vehicles. Brussels’ decision to impose new tariffs on Chinese-made models will keep prices higher for longer, and act as a deterrent to sales.

The bloc waded into a messy battle over global EV trade on Wednesday, announcing that it will hike tariffs to as high as 48% on vehicles imported from China. In messaging that chimed with the case Washington has been making for months, the European Commission vowed to protect a mainstay industry from what it said were illegal subsidies.

Reactions were swift: this is unhelpful for getting down high EV prices, and may hurt rather than help homegrown companies like Volkswagen AG and Renault SA, as China threatens to retaliate.

“Shielding automakers from competition and stopping consumers from accessing affordable EVs today is not going to help them meet their climate goals, nor will it help their domestic industries,” Aleksandra O’Donovan, who leads BloombergNEF’s Electrified Transport research team, said in an interview. “At the moment, it feels as though the decarbonization targets might not be the priority.”

Europe’s ambitious green goals to phase out sales of new gas guzzlers by 2035 were already under strain. After phenomenal growth, EVs remain too expensive for average consumers from Berlin to Bulgaria. Chinese companies led by BYD Co. and MG maker SAIC Motor Corp. have been gearing up cheaper imports, but with the new levies, prices are set to remain out of reach longer for many potential buyers.

In its annual Electric Vehicle Outlook published Wednesday, BloombergNEF cut its global EV sales projections by 6.7 million vehicles through 2026, seeing a much slower ramp-up than forecast only a year ago. A few Nordic countries and the state of California are the lone places on pace to eliminate passenger vehicle fleet emissions by 2050, BNEF said.

The EU’s tariffs will likely cut imports from China by a quarter, or roughly $4 billion worth of cars, according to Germany’s Kiel Institute for the World Economy.

SAIC stands to be hit the hardest, after the EU deemed the state-run company uncooperative with its probe. The manufacturer started shipping electric MGs into Europe about five years ago and has gained more traction than Chinese brands with cars like the relatively affordable MG4 sedan at €34,990 ($37,960).

BYD’s push to sell its low-cost Seagull city car in Europe as soon as late 2025 for less than €20,000 may now be at risk as well.

The impact isn’t limited to Chinese carmakers. While almost one-fifth of fully electric vehicles sold in the EU last year were made in China, shipments are dominated by Tesla Inc., which imports Model 3 sedans from Shanghai. The share is set to rise to 25% this year, according to lobby group Transport & Environment, with BMW, Volvo Car and Renault also shipping significant numbers of vehicles.

These carmakers will also have to pay up, with those cooperating with the investigation set for a 21% additional levy that takes effect July 4. Tesla and potentially others could see an adjustment based on individual factors.

“This decision for additional import duties is the wrong way to go,” BMW Chief Executive Officer Oliver Zipse said in a statement. “Protectionism risks starting a spiral: tariffs lead to new tariffs, to isolation rather than cooperation.”

China has threatened retaliation across agriculture, aviation and cars with large engines, saying it’s deeply disappointed and firmly opposed to the measures on EVs.

Beijing will nevertheless likely be careful to maintain access to the European market as a lucrative destination for exports. At home, EV makers like Nio Inc. and Xpeng Inc. are struggling with losses amid significant overcapacity.

“Today’s announcement is more likely to accelerate the extent to which Chinese OEMs and suppliers manufacture their products within Europe –- something that we have already started to see,” said Andrew Bergbaum, global co-head of the automotive practice at consulting firm AlixPartners.

Growth Options

Shares of Chinese manufacturers rose on Thursday after investors concluded that the carmakers have several options to keep growing.

Shifting production to Europe will help carmakers recoup some of the lost sales, new markets in the Middle East, Latin America and Southeast Asia could also absorb more EVs as demand grows from a small base.

BYD shares jumped as much as 8.8% in Hong Kong trading Thursday, leading gains among Chinese EV makers.

The EU has made the levies provisional for now, signaling it could adjust course before a Nov. 4 deadline, should further talks produce a negotiated settlement. The bloc’s slide to the political right following this past weekend’s parliamentary elections could also alter the course of events.

“There is now an opportunity to try and hopefully succeed in stopping this spiral that is threatening,” Germany’s Economy Minister Robert Habeck said. “If we enter into a tariff race with China, then the baby would be thrown out with the bathwater.”

--With assistance from Petra Sorge and Jorge Valero.

Thu, June 13, 2024

(Bloomberg) -- The European Union needs more and cheaper electric vehicles. Brussels’ decision to impose new tariffs on Chinese-made models will keep prices higher for longer, and act as a deterrent to sales.

The bloc waded into a messy battle over global EV trade on Wednesday, announcing that it will hike tariffs to as high as 48% on vehicles imported from China. In messaging that chimed with the case Washington has been making for months, the European Commission vowed to protect a mainstay industry from what it said were illegal subsidies.

Reactions were swift: this is unhelpful for getting down high EV prices, and may hurt rather than help homegrown companies like Volkswagen AG and Renault SA, as China threatens to retaliate.

“Shielding automakers from competition and stopping consumers from accessing affordable EVs today is not going to help them meet their climate goals, nor will it help their domestic industries,” Aleksandra O’Donovan, who leads BloombergNEF’s Electrified Transport research team, said in an interview. “At the moment, it feels as though the decarbonization targets might not be the priority.”

Europe’s ambitious green goals to phase out sales of new gas guzzlers by 2035 were already under strain. After phenomenal growth, EVs remain too expensive for average consumers from Berlin to Bulgaria. Chinese companies led by BYD Co. and MG maker SAIC Motor Corp. have been gearing up cheaper imports, but with the new levies, prices are set to remain out of reach longer for many potential buyers.

In its annual Electric Vehicle Outlook published Wednesday, BloombergNEF cut its global EV sales projections by 6.7 million vehicles through 2026, seeing a much slower ramp-up than forecast only a year ago. A few Nordic countries and the state of California are the lone places on pace to eliminate passenger vehicle fleet emissions by 2050, BNEF said.

The EU’s tariffs will likely cut imports from China by a quarter, or roughly $4 billion worth of cars, according to Germany’s Kiel Institute for the World Economy.

SAIC stands to be hit the hardest, after the EU deemed the state-run company uncooperative with its probe. The manufacturer started shipping electric MGs into Europe about five years ago and has gained more traction than Chinese brands with cars like the relatively affordable MG4 sedan at €34,990 ($37,960).

BYD’s push to sell its low-cost Seagull city car in Europe as soon as late 2025 for less than €20,000 may now be at risk as well.

The impact isn’t limited to Chinese carmakers. While almost one-fifth of fully electric vehicles sold in the EU last year were made in China, shipments are dominated by Tesla Inc., which imports Model 3 sedans from Shanghai. The share is set to rise to 25% this year, according to lobby group Transport & Environment, with BMW, Volvo Car and Renault also shipping significant numbers of vehicles.

These carmakers will also have to pay up, with those cooperating with the investigation set for a 21% additional levy that takes effect July 4. Tesla and potentially others could see an adjustment based on individual factors.

“This decision for additional import duties is the wrong way to go,” BMW Chief Executive Officer Oliver Zipse said in a statement. “Protectionism risks starting a spiral: tariffs lead to new tariffs, to isolation rather than cooperation.”

China has threatened retaliation across agriculture, aviation and cars with large engines, saying it’s deeply disappointed and firmly opposed to the measures on EVs.

Beijing will nevertheless likely be careful to maintain access to the European market as a lucrative destination for exports. At home, EV makers like Nio Inc. and Xpeng Inc. are struggling with losses amid significant overcapacity.

“Today’s announcement is more likely to accelerate the extent to which Chinese OEMs and suppliers manufacture their products within Europe –- something that we have already started to see,” said Andrew Bergbaum, global co-head of the automotive practice at consulting firm AlixPartners.

Growth Options

Shares of Chinese manufacturers rose on Thursday after investors concluded that the carmakers have several options to keep growing.

Shifting production to Europe will help carmakers recoup some of the lost sales, new markets in the Middle East, Latin America and Southeast Asia could also absorb more EVs as demand grows from a small base.

BYD shares jumped as much as 8.8% in Hong Kong trading Thursday, leading gains among Chinese EV makers.

The EU has made the levies provisional for now, signaling it could adjust course before a Nov. 4 deadline, should further talks produce a negotiated settlement. The bloc’s slide to the political right following this past weekend’s parliamentary elections could also alter the course of events.

“There is now an opportunity to try and hopefully succeed in stopping this spiral that is threatening,” Germany’s Economy Minister Robert Habeck said. “If we enter into a tariff race with China, then the baby would be thrown out with the bathwater.”

--With assistance from Petra Sorge and Jorge Valero.

Bloomberg Businessweek

The EU slapped massive tariff hikes on China's EV giants. Investors don't seem to care.

The EU slapped massive tariff hikes on China's EV giants. Investors don't seem to care.

Huileng Tan

Thu, June 13, 2024

The European Commission announced additional tariffs on Chinese electric vehicle imports on Wednesday.

The tariffs follow a probe into Chinese subsidies and include up to 48.1% in duties.

Stocks of China's EV makers surged despite the tariffs, driven by perceived manageability.

The European Commission, or EC, announced it will be slapping hefty tariffs on China's electric vehicle imports — but most investors seem unfazed.

On Wednesday, the EC said it will impose tariffs of up to 38.1% on Chinese EV imports from next month — on top of existing 10% duties.

All Chinese EV imports will be subject to additional tariffs from next month, but the commission singled out three major EV makers: BYD, Geely, and SAIC.

BYD will be subject to an additional 17.4% in duties, while Geely will pay an extra 20%. State-backed SAIC will be subject to additional levies of 38.1%.

On Thursday — less than a day after EC dropped its bombshell announcement — the shares of most Chinese EV automakers were up.

EV giant BYD was surging as much as 8.8% in Hong Kong, while Geely gained as much as 2.4%. The shares of EV startups Nio and Li Auto were also higher.

Shanghai-listed SAIC was an outlier in Thursday's Chinese stock rally, declining by as much as 3%.

The unlikely rally for most Chinese EV companies appears to stem from the perception that the European Union's tariffs were "modest," as Vincent Sun, an equity analyst at Morningstar, wrote in a note on Wednesday.

After all, US President Joe Biden's administration is levying a 100% tax on Chinese EVs.

BYD, one of the world's largest EV makers alongside Tesla, would be less impacted by the new EU tariffs than its peers, Bloomberg Intelligence analyst Joanna Chen said on Thursday.

"BYD will likely be able to absorb most of the burden from EU import duties, since its cars carry peer-beating profitability," said Chen.

Even though the market indicates that the EU's tariff hike on Chinese EVs is manageable, Beijing is still extremely displeased.

"I would like to stress that the anti-subsidy probe is typical protectionism," Chinese foreign ministry spokesperson Lin Jian said of the EU's tariffs on Wednesday.

"To levy additional tariffs on EVs imported from China violates market economy principles and international trade rules, disrupts China-EU economic and trade cooperation and the global automotive industrial and supply chains and will eventually hurt Europe's own interests," said Lin.

In recent months, Western countries have been lining up to criticize China for its barrage of cheap exports flooding the world's markets. They say China's dumping and unfair trade practices have hurt their economies.

However, Beijing has consistently pushed back on the West's criticisms. Chinese authorities say the West's accusations are protectionist and aimed at containing China's economic growth.

EU threatens China EVs with tariffs of up to 38%

Mitchell Labiak - Business reporter

Thu, June 13, 2024 a

[Getty Images]

Chinese electric cars may become pricier in the European Union (EU) after politicians called them a threat to its own industry.

It has "provisionally concluded" that Chinese electric vehicle (EV) manufacturers will face tariffs from 4 July "should discussions with Chinese authorities not lead to an effective solution".

The EU's announcement comes as it continues an investigation into what it claims is a flood of cheap, government-subsidised Chinese cars into the trade bloc.

China alleged the tariffs violated international trade rules and described the investigation as "protectionism".

EV makers who co-operated with the investigation, which the EU's governing European Commission launched in October, will face an average 21% duty, while those who did not will face one of 38.1%.

Meanwhile, specific charges will apply to three companies:

BYD: 17.4%

Geely: 20%

SAIC: 38.1%

Non-Chinese car companies who produce some EVs in China, including EU-based ones like BMW, will also be affected.

The commission said Tesla may receive an "individually calculated duty rate" because of a specific request it had made.

These charges would come on top of the current rate of 10% tariff levied on all electric cars produced in China.

The EU's intervention comes after the US made the much bolder move of raising its tariff on Chinese electric cars from 25% to 100% last month.

The decision has drawn criticism not just from China, but also from politicians within the EU and several industry figures.

China's foreign ministry spokesperson Lin Jian said the "anti-subsidy investigation is a typical case of protectionism".

He added that the tariffs might also risk damaging "China-EU economic and trade co-operation and the stability of the global automobile production and supply chain".

The tariffs will apply definitively from November unless there is a qualified majority of EU states - 15 countries representing at least 65% of the bloc's population - voting against the move.

Germany's Transport Minister, Volker Wissing, said it risked a "trade war" with Beijing.

"The European Commission's punitive tariffs hit German companies and their top products," he wrote on X, formerly known as Twitter.

The ACEA, the European Automobile Manufacturers' Association, said that "free and fair trade" was essential in making sure that the European car industry remains competitive.

They added, however, that it was just one piece of the puzzle when thinking about how to boost the adoption of electric cars.

Mercedes-Benz and Stellantis — which owns Citroën, Peugeot, Vauxhall, Fiat, and several other brands — also spoke out, emphasising the importance of free trade.

Stellantis said it does not support measures that "contribute to the world fragmentation [of trade]".

Some EU car companies have called for a bloc-wide industrial policy to deal with global competition.

Last year, more than eight million electric vehicles were sold in China – about 60% of the global total, according to the International Energy Agency’s annual Global EV Outlook.

No comments:

Post a Comment