Reuters | July 21, 2022 |

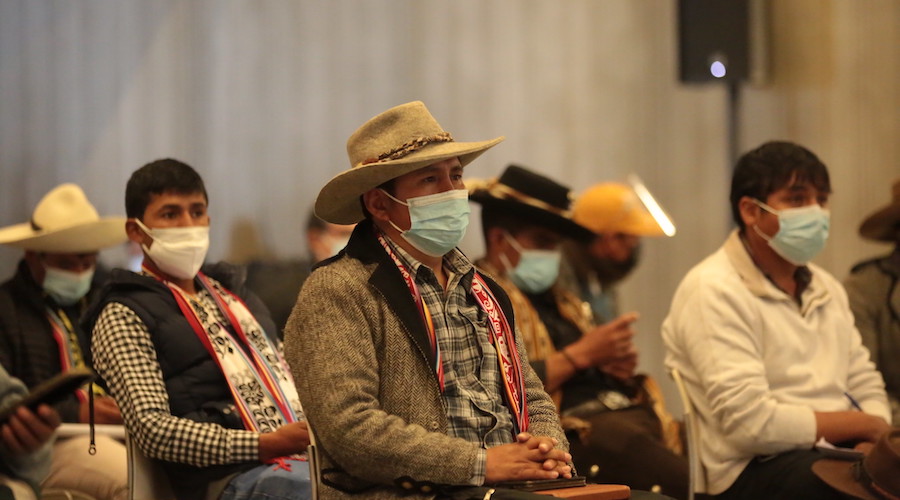

A 2021 meeting with farming communities protesting MMG’s Las Bambas copper mine in Peru. (Reference image by Peru’s Presidency of the Ministers’ Council, Flickr).

A group of indigenous Peruvian communities that have been protesting MMG Ltd’s Las Bambas copper mine said on Thursday there has been no progress after a full month of talks, risking the end of a precarious truce.

“In my community, there is no progress,” said Romualdo Ochoa, the President of the Huancuire community, which is opposing a planned expansion by Las Bambas into its territory. “This is disappointing.”

The remarks took place at a crucial meeting between Huancuire and five other neighboring communities with representatives from the mine and the Peruvian government.

Together, the six communities staged earlier this year the most significant protest in the history of Chinese-owned Las Bambas, forcing the mine to suspend operations for over a month.

The indigenous communities say Las Bambas has not fulfilled all of its commitments with them and also say that the company has failed to benefit them financially.

Las Bambas executive Ivo Zhao said at the meeting that the company is willing to continue the talks. “It is necessary to continue negotiating,” Zhao said.

In June the communities agreed to lift their protest, granting a 30-day truce that ends this week. But the communities suggested at the meeting that they might restart the protest in the next few days.

Las Bambas is one of the world’s largest copper mines, normally accounting for 2% of the world’s supply of the red metal. Peru is the world’s No. 2 copper producer and mining is a significant source of tax revenue.

The suspension of operations at Las Bambas, as well as a separate suspension at Southern Copper Corp’s Cuajone mine this year have weighed on the Peruvian economy, which is already under pressure to meet growth expectations due to falling commodity prices and worries about a worldwide recession.

(By Marcelo Rochabrun and Marco Aquino; Editing by Sandra Maler)

No comments:

Post a Comment