The Real Reason Washington Wants Venezuela’s Oil

- Venezuelan heavy crude could replace up to 5% of WTI intake at U.S. Gulf Coast refineries, boosting diesel yields and utilization of heavy conversion units.

- China faces higher feedstock costs and financial risk as discounted Venezuelan barrels are redirected toward the U.S., Europe, and India.

- Over the medium term, rising Venezuelan production and easing sanctions could revive domestic refining and reshape global heavy crude flows.

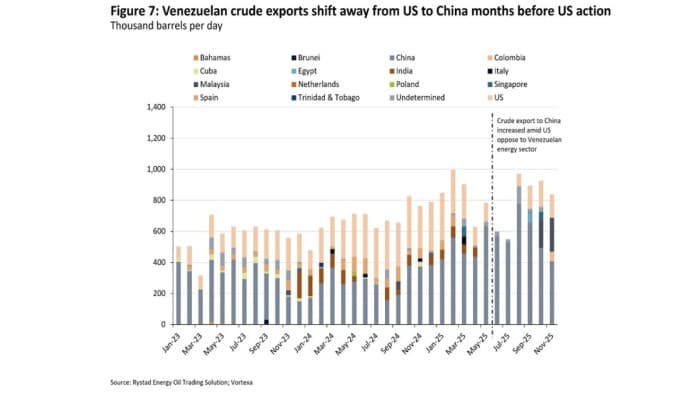

The timeline of the US–Venezuela conflict highlights a long-term strategy centered on securing heavy crude supplies for US Gulf Coast refineries, which are configured to process heavy sour barrels and benefit from Venezuela’s ability to deliver crude over short lead times. This will reduce reliance on Middle Eastern high-sulfur fuel oil (HSFO) for the US. Exports of Venezuela crude are expected to recover slowly toward the US, Europe and India, leaving China disadvantaged, while OPEC+ remains defensive.

US Gulf Coast refineries process nearly 1.45 million bpd of imported crude out of an average 9 million bpd in total refinery runs. With between 400,000 and 500,000 bpd of Venezuelan crude (primarily Merey) expected to be added, nearly 5% of West Texas Intermediate (WTI) crude intake could be replaced by Venezuelan Merey. We used linear programing (LP) modeling (AVEVA) for some Gulf Coast refineries (having coker, catalytic cracker and hydrocracker) to estimate changes in product yields and utilization rates of heavier oil-processing units. The results indicate an average 2% increase in diesel yield, primarily higher utilization of bottom of barrel units, driven by increased utilization of heavy conversion units by almost 2% to 3%.

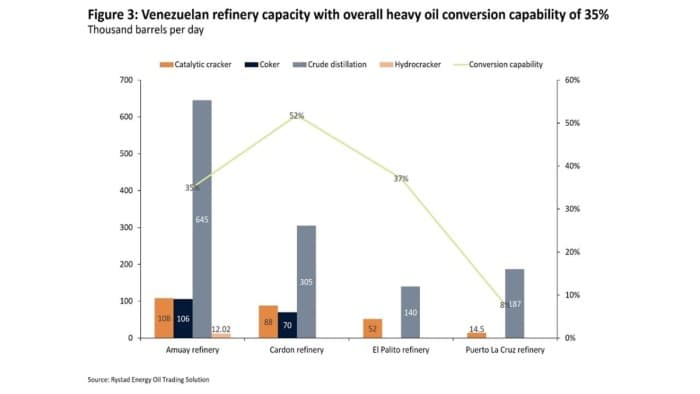

Over the longer term, as Venezuelan crude production just exceeded 900,000 bpd in 2025, with anticipated US capital inflow and a subsequent demand increase, Rystad Energy expects the Venezuelan refining sector – which has 1.2 million bpd of capacity – to start increasing runs within 18 to 24 months. Current run rates are hampered by frequent power disruptions, unplanned outages and improper maintenance of the refineries. We assess that the typical turn-down rate of 60% should be feasible by the middle of next year.

China remains the primary loser in this evolving structure. The loss of heavily discounted Venezuelan crude undermines the economics of independent so-called ‘teapot’ refiners and places approximately $12 billion in oil-backed loans at risk. Although some Middle Eastern HSFO and heavy barrels may now be redirected toward Asia, Chinese refiners still face higher feedstock costs, longer shipping distances and elevated geopolitical risk compared with the Venezuelan barrels they previously imported. India, by contrast, stands out as a structural winner, with complex refineries well suited to heavy sour grades and a renewed opportunity to absorb Venezuelan crude as sanctions ease.

Venezuelan crude accounts for approximately 500,000 bpd of the 15 million bpd in China refinery runs since around 2019, which marked the start of increased US opposition to the Venezuelan energy sector. Chinese refineries processing heavy crudes are typically integrated facilities equipped with heavy bottom-of-the-barrel upgrading units. As a result, the loss of heavy Venezuelan barrels is unlikely to have any noticeable impact on China’s overall product yields, given total refinery runs of around 15 million bpd. While individual refiners processing this crude will need to adjust their crude slate, these changes are not expected to affect aggregate Chinese yields materially.

Disclaimer: The opinions expressed in this article are solely those of the author, and do not necessarily represent the views or beliefs of Rystad Energy.

By Pankaj Srivastava for Rystad Energy

Maduro Redux

The Profanity of Life

Trump’s behavior has triggered a recall of Mario Vargas Llosa’s novel, based partly on his life, Aunt Julia and the Scriptwriter. In the novel, the protagonist’s employer hires an eccentric Bolivian scriptwriter to write soap opera serials. The novel chronicles the scriptwriter’s success and increasing popularity. The soap operas become more bizarre and reflect the scriptwriter’s descent into madness.

From start of his second ascendancy to king of the kingdom, Trump has exhibited a growing intensity of aggrandizement, internalized success that begs greater accomplishment, and escalations in daring episodes, violations of constitutional norms, and profanity of life. Each day, his disregarding the sanctity of life, permitting arbitrary killing, and indicating he will pardon anyone who commits a crime that has his approval, reflects his scriptwriting descent into madness.

Armed groups — National Guards, Homeland Security and its Immigration and Customs Enforcement (ICE), Federal Bureau of Investigation (FBI), and Secret Service — no longer defend the populace, operate in the benefit of the U.S. president, patrol our streets, commit aggressions, defy laws, and operate without constitutional control. There is no defense to the transgressions, except to take up arms against the armed, and no peace loving and country-loving citizen is prepared to do that. The trend is to increased trampling of national and international law, followed by national and international resistance, followed by national and international strife, and escalation of alarming national and international aggressions by a maddening president who holds the code to releasing nuclear-armed missiles.

Complementing a president descending into madness is a large portion of the population exhibiting symptoms of derangement. The lack of concern for the genocide of the Palestinian people, the inertia in protesting the unnecessary killings of unproven drug smugglers, and the slaughter of up to 100 Venezuelans and Cubans to apprehend a country’s leader and satisfy a U.S. court indictment in a case that will not be resolved for years, highlights the deranged thought. Reactions to the recent shooting of Renée Good by an ICE agent emphasize the derangement.

No normal person can consider the shooting of Renee Good as anything but homicide. From the start of the video of the crime scene to its ultimate tragic conclusion, the behavior of the ICE officers was provocation and use of force. Ms. Good was not entirely blocking traffic, drove the car away as the ICE agents wanted, did not steer the car to the agent who deliberately appeared in front of the car, did not hit the agent, and received bullets through the front and side windshields from ICE officer Jonathan Ross, who was never in danger.

The utterances from administration officials — President Trump initially claiming Ross was run over and was in the hospital; Homeland Security Secretary Kristi Noem saying, that the shooting occurred “because Ms. Good was allegedly using her Honda Pilot as ‘a deadly weapon;’” and Vice President JD Vance haranguing in a briefing that, “The reason this woman is dead is because she tried to ram somebody with her car, and that guy acted in self-defense. That is why she lost her life, and that is a tragedy,” are deliberate falsehoods that do not coincide with the facts.

Reading comments to the reports on the incident in Yahoo news, where a large assortment of the comments agree with the administration, is disturbing. Discussion of the shooting on PBS News Hour by political commentator, David Brooks, increased the disturbance. Brooks recited that, in his X account, followers responded to the shooting in accord with their agendas, splitting exactly as their feelings toward the present administration. He declined to voice his own opinion, willing to leave it to history.

Learning that the electorate is guided by agenda and not by reality and facts is disheartening. How can equality, justice, and freedom be achieved in that environment. Not a day of peace for Americans

Here is an interesting deliberation. Compare the murder of Ms. Good to the response by the Chinese military to the famous “Tank man,” who stopped Chinese tanks on the day after the Tiananmen incident and received no known rebuke, physical or otherwise. We also know that if Officer Ross is indicted and convicted, Trump will grant him a pardon, which is chilling. Dispose of anyone who gains the Trump wrath and don’t be concerned; similar to pardons granted other convicted criminals who were on good terms with Trump, you will not serve a day.

Each day brings another conflict between the U.S. populace and U.S. authorities. Trump has already said “he might use the Insurrection Act to deploy troops to Minneapolis.” With 33 Senate seats and all 435 congressional seats up for re-election, his popularity decreasing, and a possibility that a more heavily constituted Democratic congress might be successful in an impeachment vote and in a conviction, an out-of-control Trump might consider the anarchy he is creating as an excuse to control the mid-term congressional elections.

Will Minneapolis, Minnesota be the 21st century Fort Sumter?