Recently in my posts on CEO's pay, comments have been made to the effect that these fat cats get paid cause they make money for their shareholders. Most of those shareholders are either insiders with the company, ie. the Board members and executive officers, or institutional shareholders, mom and pop investors are relatively small beans in the world of high finance.

Recently in my posts on CEO's pay, comments have been made to the effect that these fat cats get paid cause they make money for their shareholders. Most of those shareholders are either insiders with the company, ie. the Board members and executive officers, or institutional shareholders, mom and pop investors are relatively small beans in the world of high finance.

In the world of casino capitalism corporations are paying out golden parachutes to their CEO's whether they make money or lose it.

Well here is an example of a CEO NOT MAKING MONEY FOR HIS COMPANY BUT GETTING A GOLDEN PARACHUTE.

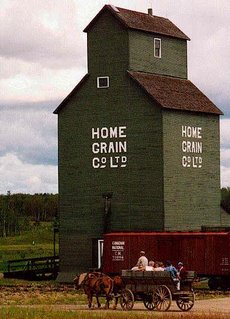

Embattled Home Depot CEO resigns By The Washington Post | January 4, 2007. WASHINGTON -- Embattled Home Depot chief executive Robert Nardelli, under fire from stockholders for earning hundreds of millions at the same time the company's stock fell and market share dropped.

AND HERE IS ANOTHER

Back in April, shareholder groups at Pfizer's annual meeting made it abundantly clear that they'd had enough with the rich payouts to then-CEO Hank McKinnell. Groups, led by the AFL-CIO, staged a raucous protest. As they handed out fliers, chanted, and held up signs to demand McKinnell return part of his pay, an airplane circled the company's annual meeting in Lincoln, Neb., with a banner reading, "Give it back, Hank!" The protesters were upset that one of the top-paid pharmaceutical executives was also going to be granted an $82 million lump sum if he ever stepped down.

But on Dec. 21, Pfizer (PFE) revealed that McKinnell, who did give up the CEO post in 2006, is getting even more money than originally thought. He'll receive a total of $122 million in retirement, as well as deferred compensation worth an additional $78 million.

The sum total of $200 million isn't going over too well among investors. "It's not reasonable to pay someone who failed as CEO this much; he's the poster child for pay-for-failure," says Daniel F. Pedrotty, director of the investment office of the AFL-CIO, whose member unions' funds hold about $568 million in Pfizer shares. "Unfortunately, once you've negotiated this and gotten it wrong, it's hard to fix."

And while the Corporate Bosses make fat salaries off thier losses at the tables of casino capitalism the newest scam, Hedge Funds, rake in even bigger winnings. Tax free of course.

Even these handsome rewards appear almost Spartan compared with the huge fortunes amassed so quickly by those who manage - and collect the fees from - private-equity deals:

In the midst of the junk-bond craze of the 1980s, the $500 million made by Michael Milken on his junk-bond deals was novel and shocking; but now, as hedge and private-equity funds have moved to the Wall-Street mainstream, rewards of such magnitude are closer to the everyday norm. For 2005, the two highest earners are reported to have been Steven Cohen who manages a $6.5 billion pool of assets for wealthy investors in SAC Capital Advisers and Stephen Schwarzman whose Blackstone fund handles private assets of a similar size. The rewards, mostly in cash, for their year’s work are calculated to be $500 million for Cohen and $300 million for Schwarzman. Milken’s takings were so huge that, in his day, it was thought that they must have been ill-gotten. Nothing of the kind is imagined today. “These big paydays are based on performance,” former hedge manager Andy Kessler is reported to have said. “For capitalism, it’s great these guys are taking a piece of the upside and saying we took the risk so we get the reward” (page 436).

Review: Capitalism Unleashed by Andrew Glyn

See

CEO

Criminal Capitalism

Find blog posts, photos, events and more off-site about:

CEO, pay, goldenparachutes, Corporations, fatcats, rich, superrich, America,