Study shows real-world effectiveness of Moderna and Pfizer/BioNtech vaccines

Researchers in the United States have conducted a study demonstrating the real-world effectiveness of the recently approved Moderna and Pfizer/BioNtech vaccines at protecting against infection with severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2) – the agent that causes coronavirus disease 2019 (COVID-19).

The team – from Nference in Cambridge, Massachusetts and the Mayo Clinic in Rochester, Minnesota –says the findings are on par with the results reported in large phase 3 randomized clinical trials.

The results showed that the vaccines are effective at both preventing infection and reducing the severity of COVID-19.

Venky Soundararajan and colleagues also demonstrate that vaccination effectively protects individuals at the highest risk of becoming infected with SARS-CoV-2 and experiencing severe disease.

A pre-print version of the research paper is available on the medRxiv* server, while the article undergoes peer review.

The two vaccines are being rolled out across the United States

In 2020, large phase 3 clinical trials demonstrated that the Pfizer/BioNTech BNT162b2 vaccine is 95% effective at preventing symptomatic COVID-19 and that the Moderna mRNA1273 vaccine is 94.1% effective.

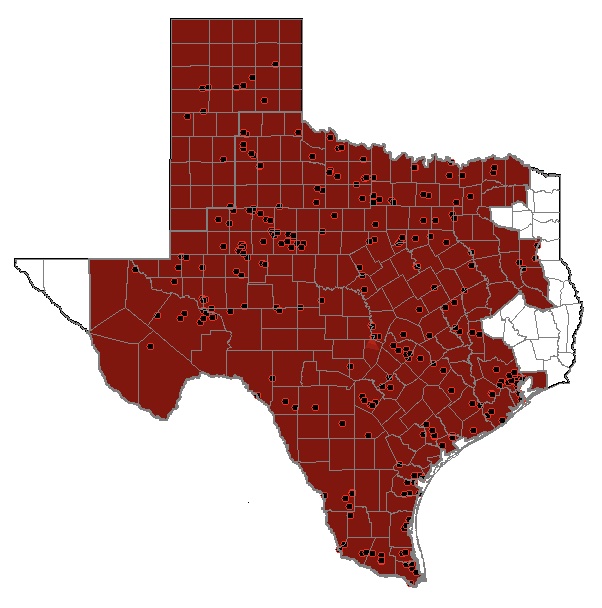

Both of these vaccines are now being rolled-out across the Unites States, with priority given to those at high risk of infection or severe disease.

However, “while these groups were not excluded from the phase 3 trials, vaccine efficacy has not been specifically demonstrated among them,” says Soundararajan and colleagues.

What did the current study involve?

Now, the team has conducted a preliminary assessment of real-world vaccination outcomes in 62,138 individuals within the Mayo Clinic health system (including Arizona, Florida, Minnesota, Wisconsin) between 1st December 2020 and 8th February 2021.

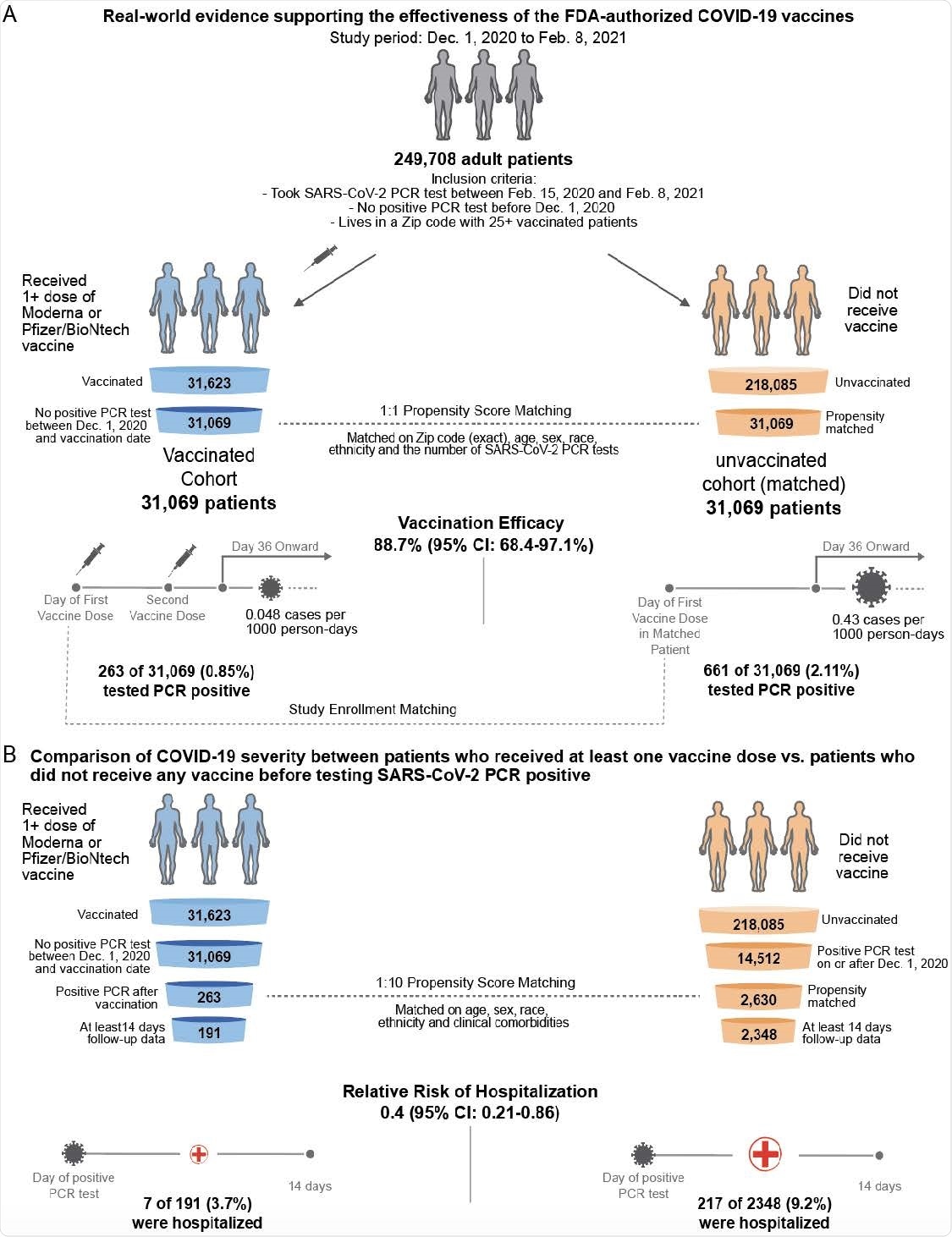

The researchers assessed SARS-CoV-2 positivity and COVID-19 severity among 31,069 individuals who received at least one dose of either the Pfizer/BioNTech BNT162b2 or the Moderna mRNA-1273 vaccine.

To address this shortcoming, the researchers used 1-to-1 propensity score matching to generate a cohort of 31,069 individuals who did not receive a vaccine by the end of the study period.

Vaccine efficacy reached 88.7%

Starting 36 days following study enrollment, the incidence of SARS-CoV-2 positivity among individuals who received two vaccines was 0.048 cases per 1000 person-days, compared with 0.43 cases per 1,000 days among unvaccinated individuals.

This corresponds to a vaccine efficacy of 88.7%, which the team says is in line with the previously reported efficacies.

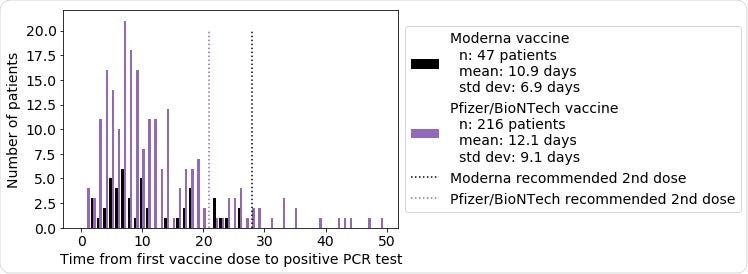

Even in the first seven days following enrollment, the incidence of SARS-CoV-2 positivity was significantly lower among vaccinated individuals than among unvaccinated individuals (0.48 versus 1.0 case per 1,000 days), corresponding to an efficacy of 53.6%.

Efficacy then increased over subsequent weeks and reached its maximum during the sixth week after study enrollment.

How did disease severity compare between the two groups?

Among the vaccinated individuals who tested positive for SARS-CoV-2, the 14-day hospitalization rate was significantly lower than among the unvaccinated individuals who tested positive, at 3.7% versus 9.2%.

On the other hand, ICU admission rates were similar between the two cohorts, at 1.0% versus 1.3%, as were 14-day mortality rates, at 0.0% versus 0.085%.

However, the team says it is worth noting that none of the vaccinated patients who developed COVID-19 have died, including 59 individuals who were followed up for at least 28 days.

“A strong real-world effect” of vaccination

*Important Notice

bioRxiv publishes preliminary scientific reports that are not peer-reviewed and, therefore, should not be regarded as conclusive, guide clinical practice/health-related behavior, or treated as established information.

- Soundararajan V, et al. FDA-authorized COVID-19 vaccines are effective per real-world evidence synthesized across a multi-state health system. bioRxiv, 2021. doi: https://doi.org/10.1101/2021.02.15.21251623, https://www.medrxiv.org/content/10.1101/2021.02.15.21251623v1