Thailand blames migrant workers as Covid-19 cases cross 5,000

Thai health officials have reported 548 new cases, almost all of them among migrant workers in the seafood industry in Samut Sakhon province

Thai health officials have reported 548 new cases, almost all of them among migrant workers in the seafood industry in Samut Sakhon province

.

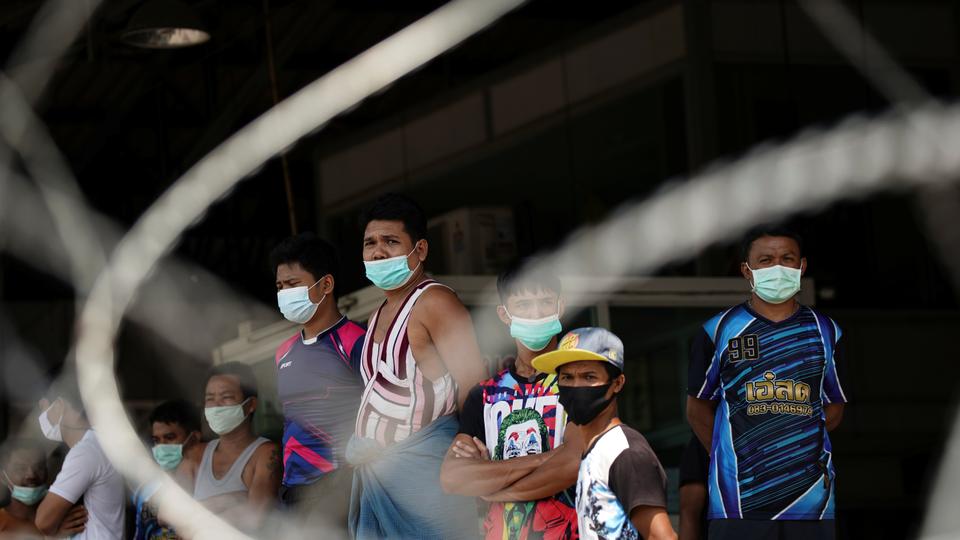

Migrant workers stand in front of a closed shrimp market, amid the coronavirus disease outbreak, in Samut Sakhon province, in Thailand, December 20, 2020. (Reuters)

Thailand’s total number of confirmed coronavirus cases have surged past 5,000 as hundreds of migrant workers tested positive, posing a major challenge for the authorities.

Thailand has been one of several Southeast Asian countries that were faring relatively unscathed by the pandemic.

But on Saturday, health officials reported a daily record of 548 new cases, almost all of them among migrant workers in the seafood industry in Samut Sakhon province, 34 kilometres (21 miles) southwest of Bangkok.

Thai Prime Minister Prayut Chan-ocha said on Monday his government would wait to see how the situation looked in a week’s time before deciding on any special restrictions for New Year’s celebrations.

The new cases in Samut Sakhon, most not exhibiting symptoms, were found by mass testing after a 67-year-old shrimp vendor at a seafood market tested positive for the virus.

The Klang Koong seafood market — one of the country’s largest — and its associated housing were sealed off by razor wire and police guards.

READ MORE: Migrant worker exodus from Thailand over virus lockdown

Night curfew

The province has also imposed a night curfew and other travel restrictions until January 3. Many public places, including shopping malls, schools, cinemas, spas and sports stadiums, have been ordered closed.

Some 360 of the 382 new cases reported Monday were migrant workers in the province, said the Center for Covid-19 Situation Administration. There were 14 other cases defined as locally transmitted and eight found in state quarantine facilities where virtually all people arriving from abroad must stay for two weeks.

Most migrant workers in Samut Sakhon are from neighbouring Myanmar, which has seen a surge in coronavirus cases that began in August. The situation in Myanmar had caused concern among Thai officials, and efforts were made to sharply reduce border traffic.

There was alarm last month when several cases were found among Thai women who had worked in Myanmar and then evaded health controls when returning home to northern Thailand. Several people from the north who recently were in Myanmar and tested positive were tracked only after having already flown to Bangkok.

Thailand has had a total of 5,289 cases, including 60 deaths.

Thailand’s total number of confirmed coronavirus cases have surged past 5,000 as hundreds of migrant workers tested positive, posing a major challenge for the authorities.

Thailand has been one of several Southeast Asian countries that were faring relatively unscathed by the pandemic.

But on Saturday, health officials reported a daily record of 548 new cases, almost all of them among migrant workers in the seafood industry in Samut Sakhon province, 34 kilometres (21 miles) southwest of Bangkok.

Thai Prime Minister Prayut Chan-ocha said on Monday his government would wait to see how the situation looked in a week’s time before deciding on any special restrictions for New Year’s celebrations.

The new cases in Samut Sakhon, most not exhibiting symptoms, were found by mass testing after a 67-year-old shrimp vendor at a seafood market tested positive for the virus.

The Klang Koong seafood market — one of the country’s largest — and its associated housing were sealed off by razor wire and police guards.

READ MORE: Migrant worker exodus from Thailand over virus lockdown

Night curfew

The province has also imposed a night curfew and other travel restrictions until January 3. Many public places, including shopping malls, schools, cinemas, spas and sports stadiums, have been ordered closed.

Some 360 of the 382 new cases reported Monday were migrant workers in the province, said the Center for Covid-19 Situation Administration. There were 14 other cases defined as locally transmitted and eight found in state quarantine facilities where virtually all people arriving from abroad must stay for two weeks.

Most migrant workers in Samut Sakhon are from neighbouring Myanmar, which has seen a surge in coronavirus cases that began in August. The situation in Myanmar had caused concern among Thai officials, and efforts were made to sharply reduce border traffic.

There was alarm last month when several cases were found among Thai women who had worked in Myanmar and then evaded health controls when returning home to northern Thailand. Several people from the north who recently were in Myanmar and tested positive were tracked only after having already flown to Bangkok.

Thailand has had a total of 5,289 cases, including 60 deaths.

Anti-Myanmar hate speech flares in Thailand over virus

By Panarat Thepgumpanat, Shoon Naing and Matthew Tostevin

By Panarat Thepgumpanat, Shoon Naing and Matthew Tostevin

© Reuters/ATHIT PERAWONGMETHA FILE PHOTO: Outbreak of the coronavirus disease (COVID-19) in Thailand

BANGKOK (Reuters) - "Wherever you see Myanmar people, shoot them down," read one Thai comment on YouTube after a surge of coronavirus cases among workers from Myanmar.

The outbreak, first detected at a seafood market near Bangkok, has prompted a flare-up in such online hate speech as well as questions over the treatment of millions of migrant workers in traditionally tolerant Thailand.

"Myanmar people are being labelled for transmitting COVID-19, but the virus doesn't discriminate," said Sompong Srakaew of the Labor Protection Network, a Thai group helping migrant workers.

Shifting sentiment had real consequences, he said, with workers from Myanmar, previously known as Burma, being blocked from buses, motorcycle taxis and offices.

One of the many incendiary comments on social media seen by Reuters called for infected migrant workers to remain untreated and punishment for people that brought them into Thailand.

The rhetoric reflects a global pattern since the start of the pandemic of foreigners being blamed for spreading the virus.

Prime Minister Prayuth Chan-ocha this week said illegal immigration was behind the outbreak in a country that had brought COVID-19 under control, although Thailand's virus task force appealed for sympathy for immigrants.

The independent Social Media Monitoring for Peace group told Reuters it found hundreds of comments classified as hate speech on YouTube with others on Facebook and Twitter.

"The comments included racist language aimed at triggering discrimination and promoting nationalism," said the group's Saijai Liangpunsakul. "We're concerned that online discrimination could translate into further discrimination and even lead to real-world violence."

After Reuters flagged some posts, Facebook said it had removed several for violating hate speech policies.

"We know that hate speech targeted towards vulnerable communities can be the most harmful," a Facebook spokesperson said, saying its technology detected 95% of hate speech.

Facebook came under heavy criticism for the role it played in spreading hate speech that fuelled violence against Rohingya Muslims in Myanmar in 2017 and has since invested in systems that can rapidly detect and remove such content.

Twitter said it was looking into the issue. YouTube did not respond to requests for comment.

Not all the social media traffic has been negative, with some Thais defending the Myanmar workers.

Government spokespeople in Thailand and Myanmar did not respond immediately to requests for comment on hate speech.

'REALLY SAD'

The outbreak was first detected last week at a shrimp market at Samut Sakhon, barely 35 km (20 miles) from central Bangkok. Since then nearly 1,300 infections linked to the market have been found while thousands of people have been quarantined.

"We feel really sad that we Myanmar workers are being blamed," said Nay Lin Thu, a 35-year-old worker from Myanmar who has now volunteered to help others.

"We are told 'this happened because of you Myanmar'. Mostly we do not respond but some of us couldn’t contain their anger."

Officially, Thailand has nearly 1.6 million workers from Myanmar, almost two-thirds of all migrant workers, but the real figure is higher because of illegal immigration. Most migrants are labourers or work in service industries.

"Thai people won't take the jobs they are doing," Taweesin Wisanuyothin, of Thailand's COVID-19 taskforce said as he pleaded for tolerance in a televised broadcast. "Today they are our family... Both Myanmar and Thai people are Buddhists."

Thailand has traditionally been seen as tolerant of foreigners, but a historic enmity has been revived on social media with references to the 18th century destruction by Burmese forces of Ayutthaya, capital of what was then known as Siam.

Myanmar has suffered a much more severe outbreak of coronavirus, with over 2,500 dead from nearly 120,000 confirmed cases compared with 60 fatalities from over 5,800 cases in Thailand.

How the new cases first appeared in Thailand is unclear.

Similar outbreaks among migrant workers living close together in Malaysia and Singapore showed how the virus can spread undetected among healthy young people who show few symptoms. It was first detected in a 67-year-old woman.

Although Thailand reported few local transmissions in recent months, Myanmar had detected cases in citizens returning form Thailand.

"Our judgement is that silent carriers have been present in Thailand," said Sein Htay of the Yangon-based Migrant Worker Rights Network. "Living conditions for Myanmar workers are difficult for social distancing with three or four to a room."

Despite the accusations against Myanmar workers of crossing the border illegally, Thais have done so too.

A previous coronavirus scare flared recently when several Thai women returned home, some using illegal border crossings, after an outbreak at the nightlife spot where they worked in Myanmar.

(Reporting by Shoon Naing in Yangon; Writing by Matthew Tostevin; Editing by Sam Holmes)

BANGKOK (Reuters) - "Wherever you see Myanmar people, shoot them down," read one Thai comment on YouTube after a surge of coronavirus cases among workers from Myanmar.

The outbreak, first detected at a seafood market near Bangkok, has prompted a flare-up in such online hate speech as well as questions over the treatment of millions of migrant workers in traditionally tolerant Thailand.

"Myanmar people are being labelled for transmitting COVID-19, but the virus doesn't discriminate," said Sompong Srakaew of the Labor Protection Network, a Thai group helping migrant workers.

Shifting sentiment had real consequences, he said, with workers from Myanmar, previously known as Burma, being blocked from buses, motorcycle taxis and offices.

One of the many incendiary comments on social media seen by Reuters called for infected migrant workers to remain untreated and punishment for people that brought them into Thailand.

The rhetoric reflects a global pattern since the start of the pandemic of foreigners being blamed for spreading the virus.

Prime Minister Prayuth Chan-ocha this week said illegal immigration was behind the outbreak in a country that had brought COVID-19 under control, although Thailand's virus task force appealed for sympathy for immigrants.

The independent Social Media Monitoring for Peace group told Reuters it found hundreds of comments classified as hate speech on YouTube with others on Facebook and Twitter.

"The comments included racist language aimed at triggering discrimination and promoting nationalism," said the group's Saijai Liangpunsakul. "We're concerned that online discrimination could translate into further discrimination and even lead to real-world violence."

After Reuters flagged some posts, Facebook said it had removed several for violating hate speech policies.

"We know that hate speech targeted towards vulnerable communities can be the most harmful," a Facebook spokesperson said, saying its technology detected 95% of hate speech.

Facebook came under heavy criticism for the role it played in spreading hate speech that fuelled violence against Rohingya Muslims in Myanmar in 2017 and has since invested in systems that can rapidly detect and remove such content.

Twitter said it was looking into the issue. YouTube did not respond to requests for comment.

Not all the social media traffic has been negative, with some Thais defending the Myanmar workers.

Government spokespeople in Thailand and Myanmar did not respond immediately to requests for comment on hate speech.

'REALLY SAD'

The outbreak was first detected last week at a shrimp market at Samut Sakhon, barely 35 km (20 miles) from central Bangkok. Since then nearly 1,300 infections linked to the market have been found while thousands of people have been quarantined.

"We feel really sad that we Myanmar workers are being blamed," said Nay Lin Thu, a 35-year-old worker from Myanmar who has now volunteered to help others.

"We are told 'this happened because of you Myanmar'. Mostly we do not respond but some of us couldn’t contain their anger."

Officially, Thailand has nearly 1.6 million workers from Myanmar, almost two-thirds of all migrant workers, but the real figure is higher because of illegal immigration. Most migrants are labourers or work in service industries.

"Thai people won't take the jobs they are doing," Taweesin Wisanuyothin, of Thailand's COVID-19 taskforce said as he pleaded for tolerance in a televised broadcast. "Today they are our family... Both Myanmar and Thai people are Buddhists."

Thailand has traditionally been seen as tolerant of foreigners, but a historic enmity has been revived on social media with references to the 18th century destruction by Burmese forces of Ayutthaya, capital of what was then known as Siam.

Myanmar has suffered a much more severe outbreak of coronavirus, with over 2,500 dead from nearly 120,000 confirmed cases compared with 60 fatalities from over 5,800 cases in Thailand.

How the new cases first appeared in Thailand is unclear.

Similar outbreaks among migrant workers living close together in Malaysia and Singapore showed how the virus can spread undetected among healthy young people who show few symptoms. It was first detected in a 67-year-old woman.

Although Thailand reported few local transmissions in recent months, Myanmar had detected cases in citizens returning form Thailand.

"Our judgement is that silent carriers have been present in Thailand," said Sein Htay of the Yangon-based Migrant Worker Rights Network. "Living conditions for Myanmar workers are difficult for social distancing with three or four to a room."

Despite the accusations against Myanmar workers of crossing the border illegally, Thais have done so too.

A previous coronavirus scare flared recently when several Thai women returned home, some using illegal border crossings, after an outbreak at the nightlife spot where they worked in Myanmar.

(Reporting by Shoon Naing in Yangon; Writing by Matthew Tostevin; Editing by Sam Holmes)