This rate represented only a slight change from 16% in 1993. It peaked at just over 20% in 1996.

From 1993 to 2004, the proportion of women in low wage jobs remained roughly double that of men. Women are more likely to be in low paid occupations such as clerical, sales and service jobs.

Low wage work was also far more prevalent for those with lower levels of education.

The proportion of youngest workers aged 16 to 24 in low wage jobs was consistently three to four times that of older workers aged 25 to 64. This reflects the tendency of the labour market to reward experience and job tenure.

Those who were not their family's major income earner were not likely to live in a low income family. In 2004, only 3.5% of low wage workers who were not the family's major income earner lived in a low income family.

In contrast, the group of low wage workers who were their family's major or sole income earners (including people living on their own) was seven times more likely (almost 25%) to experience low income.

Among major income earners with a low wage, single people and lone parents experienced the highest rates of low income.

And the Canadian Centre for Policy Alternatives also makes this point in their paper on the need to increase the Minimum Wage in Nova Scotia.

Women, the minimum wage and poverty wages

A disproportionate percentage of minimum wage workers are women (63%)9. This is

confirmed by a Statistics Canada study that found that in 2003, across Canada “women

accounted for almost two-thirds of minimum wage earners, yet they make up just under

half of employeesThe reality is that women continue to disproportionately make lower wages than men. In

2003, 25% of women earned less than $8.33, in contrast, 25% of men earned less than

$10.05. Leaving the minimum wage low puts a higher burden on women than on men.

Lower wages also leave many women dependent upon the male breadwinners in their

households Add to this the reality that women are also usually responsible for

maintaining their households and are the most vulnerable when it comes to getting laid

off and we get a picture of the gendered nature of poverty. We also get an indication of

the need for an increase in the minimum wage to support low income women and

households.Minimum wage and part time work

Minimum wage workers are more likely to find themselves in part-time employment. In

2000, 57.2% of minimum wage workers worked part-time, while only 18.2% of the

overall workforce works part-time. While some workers may chose to work part-time,

others can only find part-time work, are often forced to work at more than one job to

make ends meet. Part-time employment not only tends to pay less but also does not

usually entitle workers to benefits. Another reason for increasing the minimum wage to

support part-time workers is that part-time work is often also short term and

unpredictable. Part-time workers need a minimum wage high enough to allow them not

only to live but to cover costs during the frequent breaks between jobs and during layoffs.

And the statistics show that those who rely on minimum wages, or just above, also rely on Food Banks more than they rely on shopping at Sobeys or Safeways.

Low-income earners are in a different position: Statistics Canada's 1998–99 National Population Health Survey reported that more than 10 percent of Canadians (an estimated 3 million people) were living in food-insecure households. In addition, the Institute for Research on Public Policy reports that food banks, which emerged in the 1980s in Canada, are growing quickly. Some 1800 new food banks opened between 1997 and 2002 (McIntyre 2003, 47). These developments suggest that, far from boosting restaurant and grocery store business, many low-income Canadians rely on charity for part of their food budget, or sometimes do without, as they are unable to fully participate in the market-based food retail sector.

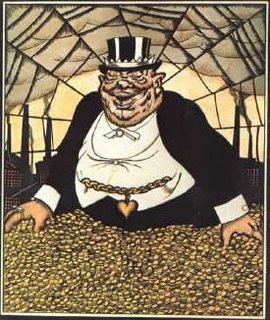

It is this economic imbalance that shows we need not just minimum wages of $10 and hour but we need a social wage to replace the welfare system which is driving the working poor (women, single mothers, in particular) further into poverty.

The hidden faces of Canada's poorWhich is why some insightful feminist bloggers blasted Cherniak over his post.

See:

Wages

Minimum Wage

Social Wage

Jason Cherniak

Find blog posts, photos, events and more off-site about:

Ontario, Canada, NDP, Liberals, minimumwages, wages, social-wage, living-wage, blogs, bloggers, Cherniak,

daycare, childcare, public, Canada, Harper, government, baby, bonus, tax-credit, politcs,

single-mothers, Somalia, immigration, Stats-Canada, Working-Mothers