[By Olive Heffernan]

Norway, renowned for its substantial offshore oil and gas reserves, made a surprise move in 2021 to rebrand itself as an ocean champion. However, this environmental turn is being reversed as the government pursues commercial mining in the country’s extended seabed shelf along with new oil and gas exploration.

When it pledged to sustainably manage 100% of its coastal waters by 2025, Norway encouraged other nations to do the same, through a global initiative it co-chairs called the High-Level Panel for a Sustainable Ocean Economy. By 2022, 17 nations covering 46% of the world’s coastal waters had signed the pact.

Their ambition, to chart a course toward better ocean stewardship, was informed by a two-year scientific review from 250 global experts. The panel also sought advice from more than 135 organisations across industry, finance and civil society.

In a 2020 report, expert advisors to the panel concluded that certain activities, specifically oil and gas exploration and deep-sea mining, were “difficult to align with the definition of a sustainable ocean economy”. They encouraged huge investments in sustainable industries, such as carbon storage and renewable ocean-based energy production.

But, in a departure from this expert advice, Norway is pursuing a strategy of intensified seabed extraction for mineral, oil and gas reserves. In June, the nation approved new permits, worth US$18.5 billion, to expand offshore oil and gas drilling.

In the same month, it also proposed opening up 280,000 square kilometres of its seafloor – an area the size of Ireland and the UK combined – to deep-sea mining, a nascent industry with unknown and potentially disastrous impacts for marine ecosystems.

Six months later, the proposal to progress deep-sea mining was met with cross-party support in the parliament, making Norway the nation most likely to begin commercial extraction of rare metals from the ocean.

Mining the deep

Up until now, no body has succeeded in commercially exploiting deep-sea minerals at scale.

A parliamentary debate on 4 January, followed by a vote, will decide the fate of Norway’s plan. If met with approval, the government will announce specific areas available for exploration for commercial grade ores in 2024. The sites will be scattered in the Barents, Norwegian and Greenland seas.

According to the Ministry of Petroleum and Energy, several Norwegian companies – mostly with expertise in offshore oil and gas exploration – have shown an interest in seabed mining and are likely to apply for exploration licences. The March acquisition by Norwegian start-up Loke Marine Minerals of UK Seabed Resources, a deep-sea mining subsidiary of the US weapons manufacturer Lockheed Martin, makes it another likely applicant for a licence under Norway’s Seabed Minerals Act.

The majority of the proposed mining area is in Arctic waters, where Norway has an extended continental seabed, giving it jurisdiction over these resources, according to Fredrik Myhre, head of oceans for WWF Norway.

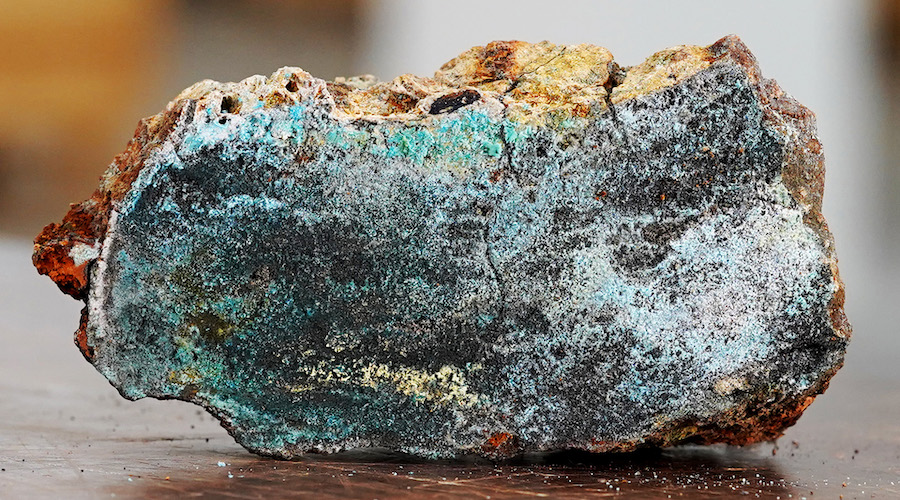

Recent surveys carried out by the Norwegian Offshore Directorate revealed substantial quantities of copper, cobalt, magnesium and rare earth minerals at these locations, in two forms: manganese crusts and inactive hydrothermal vents.

The mineral-rich crusts cover rock formations and accrete over long time periods, while the vent deposits are formed when hot springs rise up through the seafloor and precipitate leached metals and minerals.

Although deep-sea mining technology is still under development in Norway, companies elsewhere have designed mammoth excavators – each around 15 metres long, 4 metres wide, and 270 tonnes – to cut and grind mineral-laden rocks from the seabed.

By mining these resources, the Norwegian government hopes to secure its own supply of the ores needed to build green energy technologies, such as EV batteries, wind turbines and solar panels.

In an email, Norway’s Ministry of Petroleum and Energy said: “Seabed mineral activities must take place in a prudent and safe manner and in due consideration of the environment”.

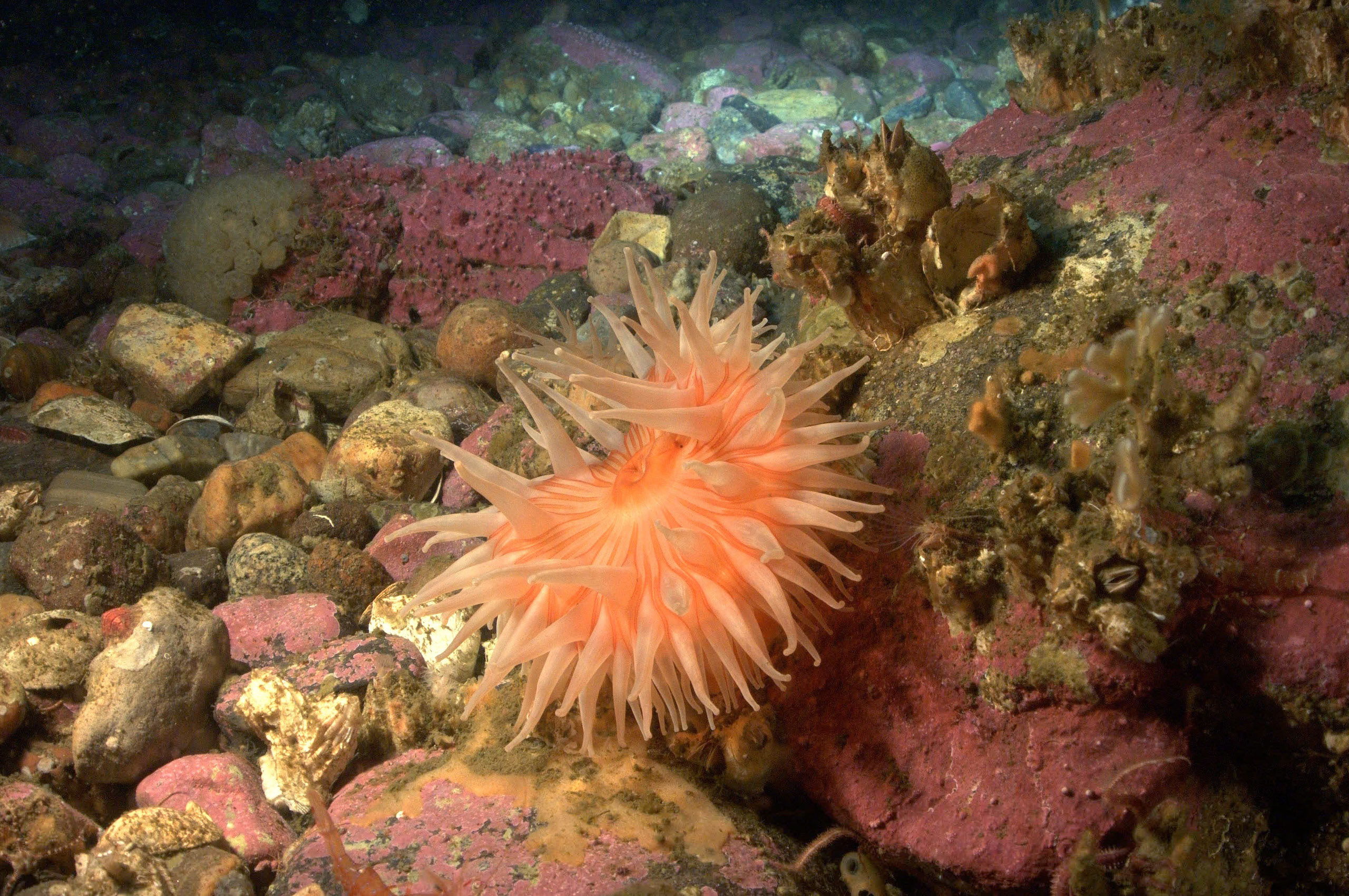

But conservationists say that many of the earmarked sites contain vulnerable ecosystems and species that are likely to be negatively impacted by mining. Daniel Bengtsson for Greenpeace Nordic says that one area, close to Jan Mayen Island in the Arctic, is a well-known biodiversity hotspot. “This is an area where whales migrate, it’s a feeding ground for large marine mammals, it is important for seabirds”, he says. “There’s no doubt that these are sensitive areas”, says Bengtsson, adding that there’s also a growing concern that mining could impact the ocean’s ability to store carbon.

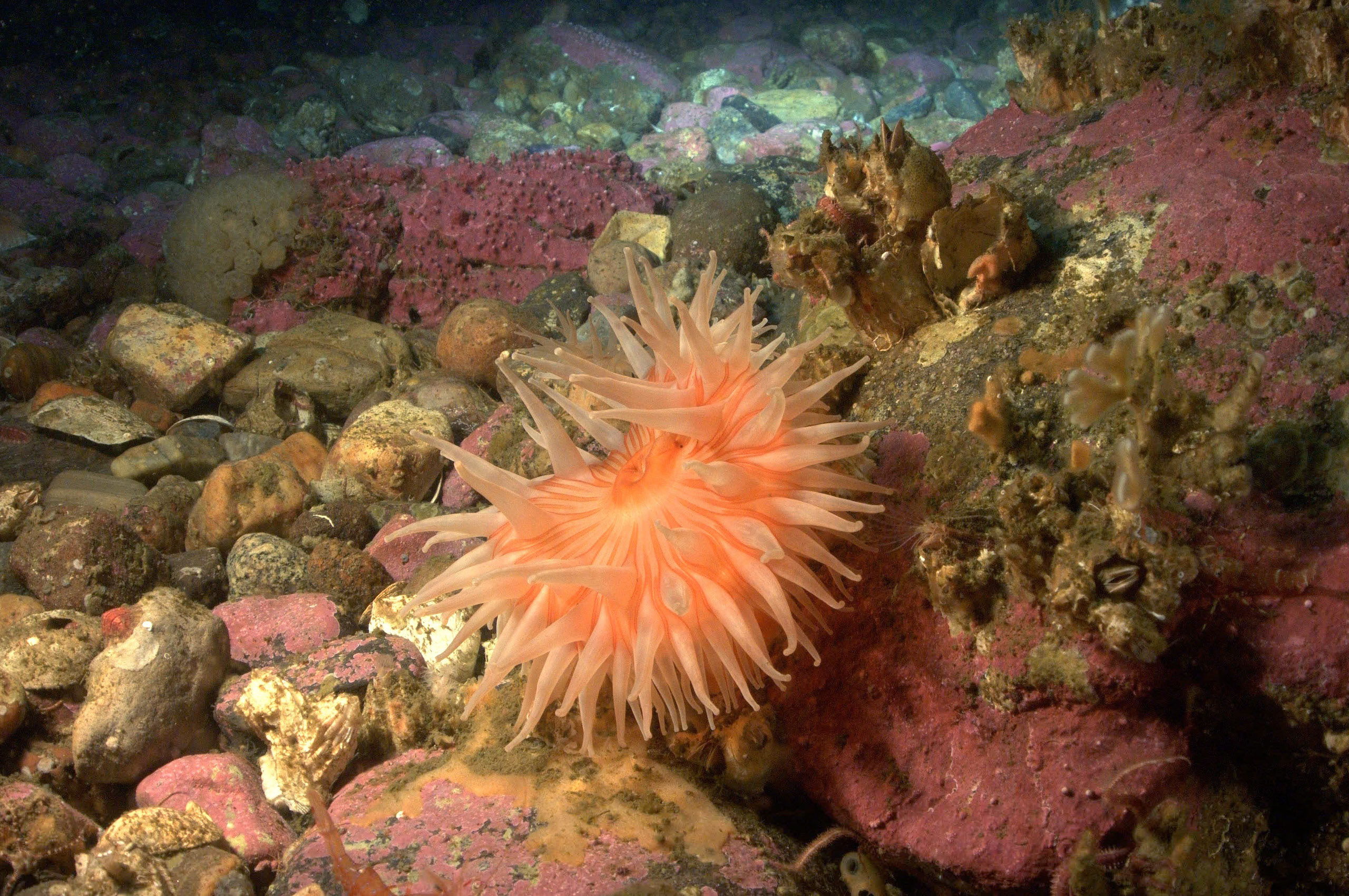

The Norwegian government is currently assessing the sites earmarked for mining to determine whether they contain vulnerable marine ecosystems, a term describing areas of seafloor covered in underwater forests formed by animals such as deep-sea sponges and cold-water corals.

An anemone on the seabed around the island of Svalbard, Norway. The deep sea is believed to be home to hundreds, maybe thousands, of animal and plant species that we know little about. (Image © Gavin Newman / Greenpeace)

If sites earmarked for mining are found to contain such ecosystems – a decision that could be made before the summer – then environmentalists will campaign to have them protected on the basis of their ecological importance.

Myhre of WWF Norway cautions that not enough is known about these areas to even assess the likely damage from mining. “This opening, of such a huge area without knowledge of the deep sea and the ecosystem functions of the deep sea … is the biggest disgrace I’ve seen in Norwegian ocean management in modern times,” he says.

Globally, opposition to deep-sea mining is also mounting. More than 750 scientists, from 44 countries, have voiced their concerns about the environmental impacts, which could include irreversible habitat loss, local extinctions and noise pollution. Sediment kicked up by mining could also enter the water column and negatively impact wildlife and commercial fisheries. At least 20 governments, including Brazil, Canada, the UK, France and Sweden, have called for a global pause in seabed mineral exploitation until further research is carried out, to assess the potential damage to marine life. Several large companies, including BMW, Google and Samsung, have vowed not to use materials sourced from deep-sea mining in their products.

Scientists and policymakers voice dismay

Including the deep-sea mining proposal, Norway’s recent policies on ocean resource exploitation have dismayed the experts who spent months advising the High-Level Panel for a Sustainable Ocean Economy on how to create a sustainable ocean economy.

“I’m pretty angry,” says Henrik Österblom, an environmental scientist at the Stockholm Resilience Centre in Sweden, an expert advisor to the panel. “We were super excited by this opportunity”, he says, but now with “one country working against all the advice they received … it feels like a total waste of time, like we are pawns in somebody else’s political game”.

Vidar Helgesen, who was Norway’s special envoy to the panel and one of its architects, alongside former Norwegian Prime Minister Erna Solberg, says there should have been a formal mechanism to track commitments.

Helgesen, who now works as executive director for the Nobel Foundation, says that he proposed having an independent body make regular assessments of national progress toward the 2025 goal. That suggestion wasn’t taken up by signatory states as some wanted a “softer” approach. A 2022 progress report entitled Tracking Blue reported few tangible outcomes for Norway. The next progress report is due in 2024.

Others share Österblom’s dismay. “The response, unfortunately, has not been at all what I expected,” says Rashid Sumaila, director of the fisheries economics research unit at the University of British Columbia in Vancouver. “There was no commitment to follow through on the science”.

Peter Haugan, a fisheries scientist at the University of Bergen who chaired the panel’s expert group and co-authored the 2020 report, says he “shares the sense of disillusionment” especially with Norway’s recent decisions on oil, gas and mineral extraction.

The nation also falls short on taking steps to protect its own waters. “We really are a massive ocean nation,” says Myhre, referring to the fact that Norway’s ocean area is six times that of its landmass. However, less than 1% of its national waters are highly protected from industrial fishing and other extractive industries.

Elsewhere, Norway has been criticised by environmental groups for continuing to allow ocean dumping of mine waste – a practice outlawed in most other coastal states – and for its planned five-fold increase in salmon farming, an industry accused of high fish mortality and coastal pollution.

Overseas, Norway’s reputation has fared better. In September, it signed the High Seas Treaty, a new UN agreement to protect marine life in waters beyond national control.

Colette Wabniz, an expert adviser to the high-level ocean panel and a marine ecologist at Stanford University, says that Norway should also be commended for funding efforts to improve governance and equity of small-scale fisheries in Tanzania.

Sumaila shares this observation and says that Norway has invested in training many fisheries scientists in Africa. But, says Wabnitz, “Leadership is about walking the talk. It’s unfortunate that Norway is exemplary in some ways elsewhere, but it’s not more exemplary with its own policies at home.”

When asked about the discrepancy between Norway’s commitments as an ocean leader and its current policies, a spokesperson for the Ministry of Foreign Affairs said, by email: “Norway has a long tradition for prudent, responsible, and sustainable resource management”, which it intends to apply to both future oil and gas and mineral extraction.

The spokesperson said: “There will of course be challenges implementing the Ocean Panel’s ambitious agenda, and these challenges will vary between countries”, but added that Norway is fully committed to implementing the panel commitments, and to continuing its leadership role.

Not everyone is convinced, however, that Norway can marry these ambitions. “The things that we are doing now, especially opening the seabed to mining, is really putting the nail in the coffin for Norway as a responsible ocean nation,” says Myhre. “We have to change course, if we are to have sustainable ocean management.”

Olive Heffernan is a freelance science journalist who covers oceans and climate change. You can tweet her at @O_Heffernan and read her latest stories at www.oliveheffernan.com.

This article appears courtesy of China Dialogue Ocean and may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.