Shopify cuts jobs again, sells most of logistics business to Flexport

, Bloomberg News

May 4,2023

REAL-TIME QUOTE. Prices update every five seconds for TSX-listed stocks

Shopify Inc. is cutting jobs for the second time in 10 months and selling the majority of its logistics business to Flexport Inc. to focus on its core e-commerce platform business.

The moves mean the company will shrink by more than 2,000 people. “I don’t want to bury the lede: after today Shopify will be smaller by about 20 per cent and Flexport will buy Shopify Logistics; this means some of you will leave Shopify today,” Chief Executive Officer Tobi Lütke said in a memo to staff. “I recognize the crushing impact this decision has on some of you, and did not make this decision lightly.”

Shopify soared about 27 per cent to $79.76 as of 10:35 a.m. in Toronto, the biggest intraday rise since 2015.

The company expects to incur severance charges of US$140 million to $150 million. “Our numbers were unhealthy, just like it is in much of the tech industry,” Lütke said. “With the right numbers we’ll fully focus on outcomes and impact.” During a conference call, executives said Shopify has to operate with greater speed and is moving quickly toward its ideal size.

The logistics deal is a big change for the Canadian e-commerce giant, reversing a strategy it had implemented to better compete with Amazon.com Inc. Flexport will acquire most of its fulfillment assets including those of shipping startup Deliverr Inc., which Shopify bought just last year for $2.1 billion.

“We applaud management for making difficult decisions that set the company up better for long-term success, although this is significant pivot,” Baird analyst Colin Sebastian wrote in a note to clients.

Revenue for the period came in at $1.51 billion, beating the $1.43 billion average estimate of analysts surveyed by Bloomberg. Gross merchandise volume, the total value of merchant sales across Shopify’s platforms, was $49.6 billion, above Wall Street projections of $47.7 billion.

Bloomberg Intelligence analyst Anurag Rana:

“Shopify divesting its logistics business is a good strategic move, especially as Amazon.com pushes its ‘Buy with Prime’ program for non-Amazon sellers. This strategy shift, while painful in the short-term due to write-downs and layoffs, will increase the company’s focus on selling more products through its platform. Separately, 1Q results were surprisingly strong with sales 640 bps higher than consensus.”

The Ottawa-based company also gave an outlook for the second quarter, saying it expects revenue to grow at a similar rate to the first quarter growth rate on a year-over-year basis. It also expects to achieve free cash flow profitability for each quarter of 2023.

Shopify bet early in the pandemic that a rapid rise in online shopping, fueled by customers staying home, would become permanent. As that wager soured, Lütke has been forced to retrench. The company cut about 1,000 jobs last summer, raised prices and focused on building out client offerings and its in-house fulfillment network. Shopify had 11,600 employees at the end of 2022.

The company has had to contend with macroeconomic risks, including slower consumer spending and inflationary pressures. Retail sales fell 1.4 per cent in March, according to a preliminary Statistics Canada estimate.

BEARISH OR BULLISH ON SHOPIFY? HERE'S WHAT ANALYSTS SAY

, BNN Bloomberg

MAY 4,2023

Analysts are split on potential upside and downside scenarios for Shopify Inc., following the company’s latest move to reduce staff and offload a significant portion of its logistics business.

On Thursday, the Canadian e-commerce company announced it entered into an agreement where Flexport Inc. will acquire the majority of Shopify’s logistics business. The company also outlined plans to reduce its workforce for the second time in 10 months after previously stating in February that no more staff cuts were imminent.

In a television interview with BNN Bloomberg Thursday, Josh Beck, a managing director Keybanc Capital Markets, outlined the bullish case for the company, while New Constructs Chief Executive Officer David Trainer believes the stock is overpriced.

After Thursday’s announcement, Beck increased the price target to US$65 from US$55 on Shopify shares.

Following Thursday’s announcement, Shopify shares were trading nearly 25 per cent higher just below $80 per share in early-afternoon trading.

THE BULLISH CASE

Beck said the recent move by the Ottawa-based company is a positive sign for the business.

“To me, with them [Shopify] really lightening up on the investment mode and focusing on really what they're best at, which is software, [this] is actually a really encouraging update for them,” he said.

Beck said the recent move reflects what that market wants to see, “which is profitable growth.”

Shopify now faces room to grow its penetration in a multi-trillion-dollar global market, according to Beck.

“As successful as they've [Shopify] been, the penetration is still very low. And they're making really good progress with a lot of new products,” he said.

Shopify also has a “multitude of factors,” that could spur the company’s growth, Beck said.

“Lots of companies are narrow. They may be selling one piece of subscription software, or one piece of fintech or one piece of ad tech, which is pretty narrow,” Beck said.

“What they [Shopify] do is very broad and it gives them a lot of opportunity to have much higher revenue yield over time.”

THE BEARISH CASE

While Beck sees the potential for growth, Trainer said that Shopify shares are overvalued and oftentimes, good companies are not necessarily good equities to own.

He said if you look at underlying expectations that come with a “high $50 stock price,” you “see just how ridiculous the valuation is.”

“To justify a $58 stock price, Shopify has to grow revenue at 25 per cent compounded annually for a decade, while improving its return on invested capital from negative to positive 300 per cent,” he said.

According to Trainer, only a handful of companies have ever been capable of achieving a 300 per cent return on invested capital, with none being able to sustain it.

“So that's what's being priced in, it's good to see them [Shopify] making some moves to rationalize the business because they'd been burning tons of cash flow. They burned $2.8 billion in the past year,” he said.

Many companies completed an initial public offering (IPO) during an era of lower interest rates and “cheap money,” Trainer said adding that these types of organizations are “never really good stewards of capital.”

In May 2015, the Ottawa-based e-commerce company completed its IPO at a price of US$17 per share.

Trainer said he could see more reasonable value in Shopify shares priced around $10, provided the company also improved its profit margins.

“And that would imply, to get the 10 bucks a share…that their [Shopify’s] profit margins would go from negative 10 per cent or so to positive 10 per cent. And grow revenue at consensus rates over the next couple of years, and then about 10 per cent after that,” Trainer said.

'No cuts coming': Shopify president says company has no plans for another layoff

, The Canadian Press

Feb 17, 2023

As a growing number of tech companies carry out successive rounds of layoffs, Shopify Inc.'s president says there are no more cuts in the works for the Ottawa-based e-commerce company.

"There's no cuts coming for us," Harley Finkelstein told The Canadian Press.

"We're in a really good place."

His confidence that the company's reductions are done comes months after Shopify was among the first of the world's tech giants to lay off staff in a summer cut that impacted 1,000 workers — roughly 10 per cent of staff. The company attributed the move to it misjudging the growth of the e-commerce sector.

Since then, few major tech companies have been unscathed by the fading investor exuberance, falling valuations and pressure to reach profitability in the event a predicted recession materializes.

Tech giants as big as Amazon, Meta, Microsoft, Intel and Zoom have culled staff from their workforces along with smaller Canadian brands like Wealthsimple, Lightspeed, Clearco and HootSuite.

After Shopify's cuts, Finkelstein feels the company is at the right size.

"I don't think we are going to grow our head count very much," he said.

"I think we can keep it pretty flat other than maybe a couple of key hires."

Asked what areas might garner hires, he said software and product staff are always in demand because there are fewer of them.

But retaining current staff is just as important. To keep workers, Shopify is leaning on Flex Comp, an initiative which gives staff a “total rewards wallet” and allows them to regularly choose between cash and stock options for their compensation.

It was implemented in the wake of Shopify's layoff and as its stock came under pressure, falling from a 52-week high of $113.43 to a low of $33.

In designing the program, Shopify completed an extensive benchmarking exercise to ensure salaries are competitive, but executives warned Flex Comp will likely weigh on its 2023 outlook.

Historically, allocations staff made sat at around 70 per cent cash and 30 per cent equity, Finkelstein said.

"I think Q4 allocations may be skewed slightly more cash than those levels, but it's sort of expected that it will vary each quarter," he said.

"Cash gives certainty, but if you understand the business, obviously, you know, equity is what a lot of people want because they want to be able to participate in the upside there as well."

The company is also hoping to remain attractive to talent with a "digital by default" focus it adopted in 2020 after chief executive Tobi Lütke declared "office centricity is over."

Since then, most staff have worked remotely and Shopify opted not to move into The Well complex at King Street West and Spadina Avenue in downtown Toronto. The company was initially slated to occupy 254,000 square feet at The Well, with the option to add another 433,752 square feet.

"We don't need that much space given the new digital by design," Finkelstein said.

Now, staff feel like they can move wherever and whenever they want (Finkelstein is in the process of shifting his family to Montreal) and travel on a whim.

For those that want to head into an office, Shopify is maintaining some sites, including one at the King Portland Centre, not far from The Well. Many people gathered at the company's properties in recent weeks when it held a series of summits and hack days. Others joined virtually or invited colleagues living nearby over to their homes.

"They hosted like watch parties... so I actually think it is working really well for us," Finkelstein said.

He credits that flexibility with helping the company appeal to new, prized hires like Jeff Hoffmeister, who led Shopify’s initial public offering and worked for Morgan Stanley since 2000. Hoffmeister joined as chief financial officer but is able to work in New York, where Finkelstein frequently travels.

Around the same time as Hoffmeister joined Shopify, chief technology officer Allan Leinwand announced he will be departing the company with chief executive Lütke to take on some of his responsibilities.

Rather than replace Leinwand, Lütke is now overseeing research and development. He previously stepped in to take over chief product officer Craig Miller's responsibilities, when he left in 2020. At the time, Lütke said there were no plans to replace Miller.

The latest move isn't as big as it may seem to outsiders, Finkelstein said.

"He's been doing this for a long time and now we're just sort of documenting it officially."

This report by The Canadian Press was first published Feb. 16, 2024.

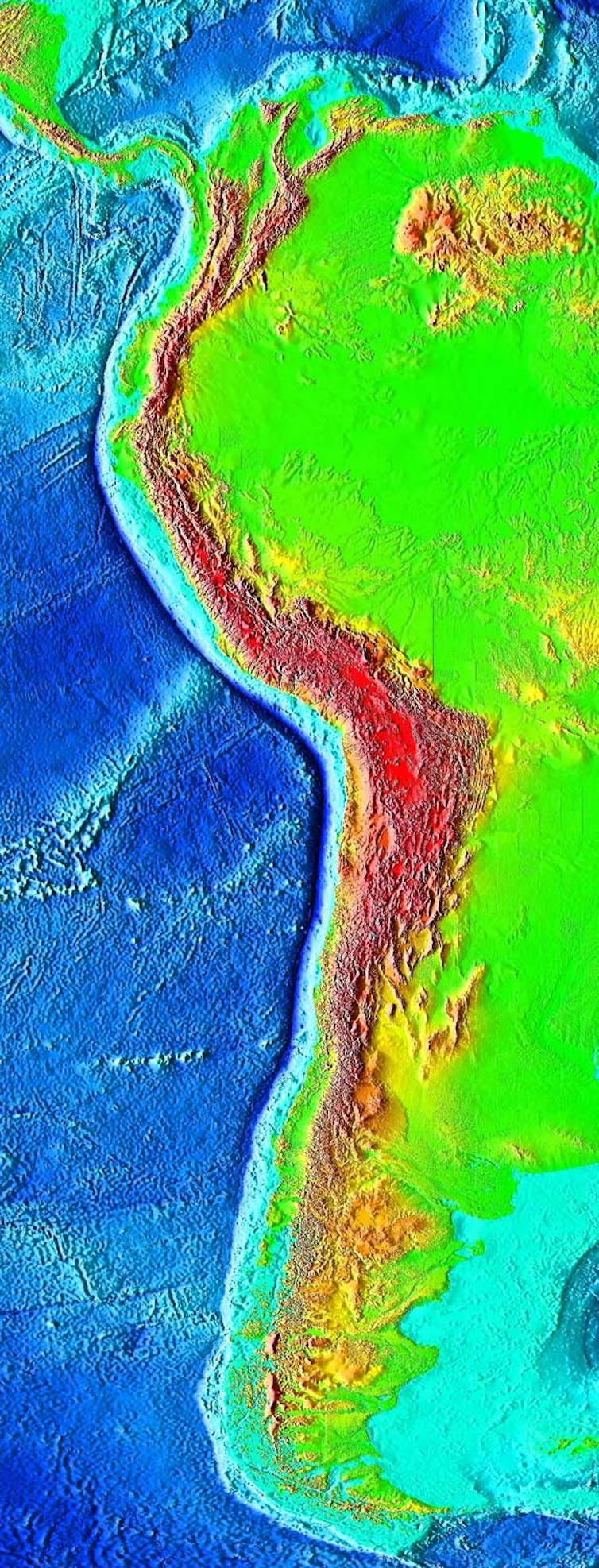

Sometimes called the Peru-Chile Trench, the Atacama Trench is visible in dark blue on this relief map (sea level is green and mountains are red). (Left, NOAA)

Sometimes called the Peru-Chile Trench, the Atacama Trench is visible in dark blue on this relief map (sea level is green and mountains are red). (Left, NOAA)