Jody Godoy

Tue, September 13, 2022

Trevor Milton, founder and former-CEO of Nikola Corp.,

By Jody Godoy

NEW YORK (Reuters) -Nikola Corp founder Trevor Milton became a billionaire by lying to investors about the most important aspects of his low-emission vehicle company, a prosecutor told jurors as Milton's fraud trial began on Tuesday.

Prosecutors have said Milton sought to deceive investors about the electric- and hydrogen-powered truck maker's technology starting in November 2019. He left the company in September 2020 after a report by short seller Hindenburg Research called the company a "fraud."

"He lied to dupe innocent investors into buying his company’s stock," Assistant U.S. Attorney Nicolas Roos said in U.S. District Court in New York. "On the backs of those innocent investors taken in by his lies, he became a billionaire virtually overnight."

Milton, 40, has pleaded not guilty to two counts of securities fraud and two counts of wire fraud.

Milton’s attorney Marc Mukasey on Tuesday called the case "prosecution by distortion" and said the entrepreneur sought to express a vision about the future of trucking, not mislead investors.

Milton was "stoked" on the company's plans and had a good faith basis for his statements, Mukasey said. The attorney also took aim at a 2018 video prosecutors later showed jurors of a truck appearing to drive on its own power when it was actually rolling down a hill.

"As far as I know, it's not a federal crime to use special effects in a car commercial," he said.

Prosecutors allege Milton "doubled down" on earlier lies when the company went public. Nikola has said it did not claim the truck was moving under its own power, only that it was "in motion."

Milton's attorneys also have indicated they will argue other top executives at Nikola, including its general counsel, approved of Milton's statements.

U.S. District Judge Edgardo Ramos on Monday oversaw the selection of a panel of 12 jurors and four alternates in federal court in Manhattan.

Milton was indicted last year. Prosecutors said he made false statements about Nikola's progress on developing its technology as the company joined the mounting number of tech and electric vehicle companies going public through special purpose acquisition vehicles or SPACs.

Milton's statements on social media and in podcasts targeted retail investors who piled into the stock market during COVID-19 pandemic-related lockdowns, they said. Milton also stands accused of defrauding the seller of a Utah ranch, who said in a civil lawsuit that he accepted Nikola stock options as part of the purchase price based on the former CEO's claims about the company.

Nikola has spent more than $20 million on Milton's legal defense so far, according to its public filings.

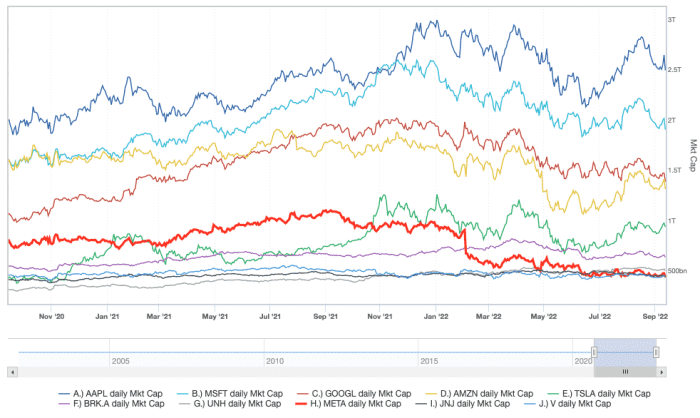

The company went public in June 2020 through a reverse merger with VectoIQ Acquisition Corp. Nikola's market value topped $33 billion that month, but has since fallen below $3 billion.

Nikola agreed in December to pay $125 million to settle U.S. Securities and Exchange Commission's claims that the company defrauded investors by misleading them about its products, technical advancements and commercial prospects.

(Reporting by Jody Godoy and Luc Cohen in New York; Editing by Cynthia Osterman, Jonathan Oatis and David Gregorio)

For many, he’s the worst fraudster since Elizabeth Holmes fooled some of the world’s smartest people with her blood testing company Theranos.

Trevor Milton is due in court today, where he will stand trial for manipulating investors with promises he was the next Elon Musk and his company, Nikola Corp., the next Tesla.

He even duped a gullible General Motors, who signed a partnership just weeks before his elaborate ruse was uncovered.

It wasn’t until Hindenburg Research’s Nate Anderson unveiled nearly two years ago to the day that his fuel cell semi was a sham that the house of cards he so meticulously constructed came crashing down.

The rise of Nikola

First unveiled as a prototype to the public in December 2016, the Nikola One semi truck “dared to reimagine” the modern truck by running on pure hydrogen with only water vapor as a tailpipe emission.

While this technology exists today, it has never been successfully produced and sold at mass scale due to its prohibitive costs. Only Toyota, its partner BMW and Hyundai are still clinging to the technology as an alternative to battery-powered passenger cars.

So when the stock debuted in 2020 via a reverse merger with a blank-check investment vehicle known as a SPAC, investors snapped up shares to get in on the ground floor of the next Tesla. Sure enough, its market cap briefly surpassed that of industry veteran Ford, surging to $34 billion despite Nikola never having brought a single product yet to market.

More lies ensued in the process, as it rushed out announcements it could produce hydrogen cheaper than anyone else, had a game-changing battery technology up its sleeve and would build a new pickup truck called the Badger for the lucrative retail market.

General Motors agreed in September 2020 to a manufacturing partnership receiving 20% of its shares as part of a deal to build its Badger, lifting the value of its stock yet again.

At the time shares in Tesla had begun their unprecedented pandemic surge as many retail investors, in lockdown and working from home, had time and money to spare.

This new class of shareholder believed traditional automakers to be doomed in the long term, saddled with stranded assets like combustion engine plants that would have to be written off, and preferred high-growth startups with lofty dreams.

Milton preyed on this type of investor. "The generation that is investing now cares more about the environmental impact of what you’re doing than they do if you’re six months or eight months from revenue," he told CNBC's Fast Money in June 2020. "They don’t care, they’re like, you know what, you’re changing the world, you’re going to reduce emissions more than anyone else, we’re invested into you.”

When GM signed the deal, CEO Mary Barra failed to properly explain what technology her company was actually securing. Hindenburg Research was convinced GM merely looked to bask in the collective shine of its charismatic founder, “a forward-thinking, fresh, visionary entrepreneur capable of rivaling Elon Musk’s allure.”

Milton's fall

Days later it dropped a bombshell report that the 1,000-horsepower Nikola One truck featured in its promotional video, in reality, had no drivetrain at all and was in fact merely filmed cleverly as it rolled down a hill, documenting a raft of further misstatements that took advantage of investors' willingness to believe.

“Nikola is an intricate fraud built on dozens of lies over the course of its founder and executive chairman Trevor Milton’s career,” Anderson’s professional short-selling firm reported, adding it had “never seen this level of deception at a public company, especially of this size.”

A point-by-point rebuttal promised by Milton never ensued. Instead, all he could offer were half-denials.

Shortly thereafter he stepped down as CEO. In July 2021, the Securities and Exchange Commission filed charges against Milton. That December, Nikola Motors settled out of court with the SEC over fraud charges, agreeing to pay a $125 million fine.

Its stock is currently trading over 5% lower, but it still manages to hold a market cap of $2 billion as the company has finally brought a truck to market, the Nikola Tre. That is, however, largely thanks to the efforts of its partner CNH Industrial, whose Iveco Daily serves as the underlying product.

On Tuesday, Milton will have to answer for his years of deception.