Northern Miner Staff | August 19, 2021 |

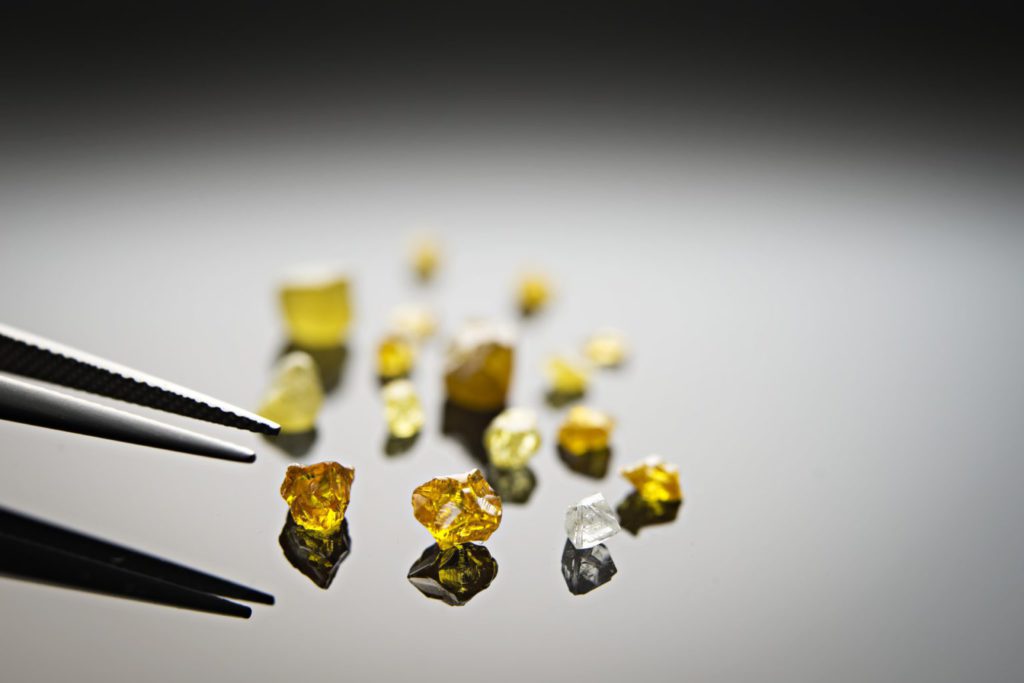

Selection of yellow diamonds recovered from North Arrow Minerals’ Naujaat project in Nunavut. Credit: North Arrow Minerals

North Arrow Minerals (TSXV: NAR) has completed a 2,000-tonne bulk sample from its Naujaat diamond project in Nunavut, a key step toward discovering if the project has enough fancy coloured diamonds – with a high enough value – to justify development.

North Arrow has already delineated a resource for the Q1-4 kimberlite at Naujaat, located only 7 km from tidewater near the community of Naujaat. Q1-4 hosts 48.8 million inferred tonnes grading 53.6 carats per hundred tonnes for 26.1 million carats. The bulk sample is aimed at determining the size distribution and character of a population of potentially high value fancy yellow to orange yellow diamonds found at Q1-4.

North Arrow expects processing of the sample to begin in the fourth quarter.

“Bulk sample collection from the Q1-4 kimberlite is now complete, with field crews having delivered 2,500 bulk sample bags of kimberlite to our laydown near the community of Naujaat,” said Ken Armstrong, president and CEO of North Arrow. “At approximately 2,000 tonnes, the 2,500 bags represent the high end of our anticipated tonnage range for the program and we look forward to loading the sample onto the annual Naujaat sealift in September for shipment to the processing laboratory.”

The C$5.6 million bulk sample program is funded by Burgundy Diamond Mines (ASX: BDM).

While North Arrow has made several diamond discoveries in Canada over the past decade, including the Pikoo discovery in Saskatchewan, it has been difficult to raise funds for exploration.

Last year, the junior signed an option agreement with Burgundy (then known as EHR Resources). In return for funding the bulk sample, Burgundy will earn a 40% interest in Naujaat. If the results are positive, the company can earn another 20% interest by funding a larger, 10,000-tonne bulk sample.

(This article first appeared in The Northern Miner)