Carbon removal is the latest way to fight climate change — but will it take off in time to save the planet?

Ben Adler

·Senior Editor

Wed, November 22, 2023

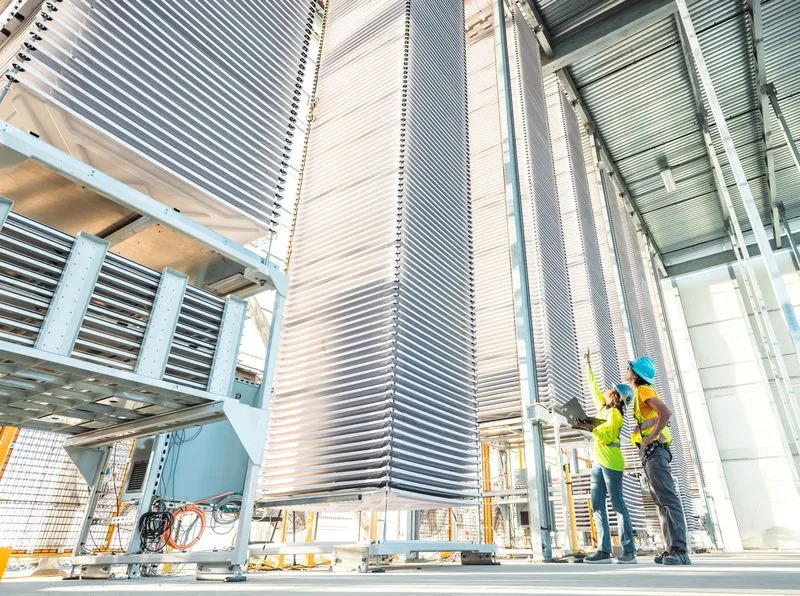

A handful of companies have begun to pull carbon dioxide out of the air and store it underground in an effort to fight climate change. But challenges remain in ramping up the technology to a large enough scale that will make it affordable and effective enough to start to halt the rise of global temperatures.

How carbon removal works

Like giant stationary vacuum cleaners, machines suck CO2 from the air.

At the Orca plant operated by Climeworks in Iceland, the gas is then mixed with water and added to porous rocks underground, where it transforms into carbonate minerals.

At the new Heirloom plant in California, calcium oxide powder is combined with the extracted carbon dioxide to make limestone.

Offsets vs. carbon capture vs. carbon removal

Carbon offsets, like those people buy to mitigate carbon-intensive activities like air travel, claim to reduce CO2 through measures such as protecting forests or planting trees, but many have been exposed for inflating claims of averted emissions.

Carbon capture and storage, or CCS, refers to capturing CO2 emitted from smokestacks.

Carbon removal, known as “direct air capture” or DAC, isn’t tied to an emissions source and can be built anywhere. Unlike offsets, it provides a precise, easily measurable carbon reduction.

“I buy the gold standard of funding Climeworks to do direct air capture that far exceeds my family’s carbon footprint,” Bill Gates said when asked about his private jet use in February.

Ben Adler

·Senior Editor

Wed, November 22, 2023

A handful of companies have begun to pull carbon dioxide out of the air and store it underground in an effort to fight climate change. But challenges remain in ramping up the technology to a large enough scale that will make it affordable and effective enough to start to halt the rise of global temperatures.

How carbon removal works

Like giant stationary vacuum cleaners, machines suck CO2 from the air.

At the Orca plant operated by Climeworks in Iceland, the gas is then mixed with water and added to porous rocks underground, where it transforms into carbonate minerals.

At the new Heirloom plant in California, calcium oxide powder is combined with the extracted carbon dioxide to make limestone.

Offsets vs. carbon capture vs. carbon removal

Carbon offsets, like those people buy to mitigate carbon-intensive activities like air travel, claim to reduce CO2 through measures such as protecting forests or planting trees, but many have been exposed for inflating claims of averted emissions.

Carbon capture and storage, or CCS, refers to capturing CO2 emitted from smokestacks.

Carbon removal, known as “direct air capture” or DAC, isn’t tied to an emissions source and can be built anywhere. Unlike offsets, it provides a precise, easily measurable carbon reduction.

“I buy the gold standard of funding Climeworks to do direct air capture that far exceeds my family’s carbon footprint,” Bill Gates said when asked about his private jet use in February.

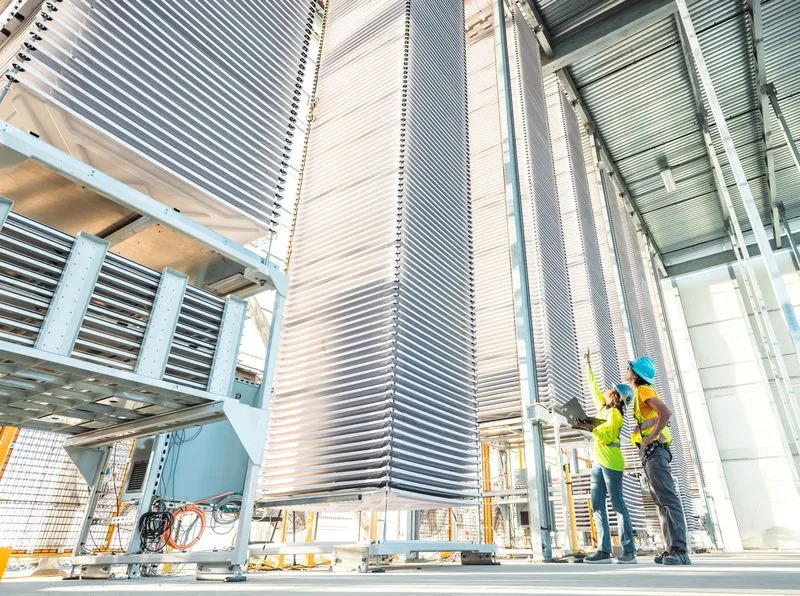

A direct air capture and storage facility operated by the Iceland-based Climeworks company. (Arnaldur Halldorsson/Bloomberg via Getty Images) (Bloomberg via Getty Images)

How to purchase carbon removal

Climeworks sells a range of monthly subscriptions, the cheapest of which costs $28 per month and removes as much carbon every month as roughly 11 grown average trees (20 kg of CO2), and they can create customized plans.

“We wanted to make our technology available to everyone,” Anna Ahn, a spokesperson for Climeworks, told Yahoo News.

The Orca plant removes roughly 4,000 tons of CO2 annually and the service is so popular it is sold out. If you buy a credit from Climeworks, you are prepaying for carbon removal that will occur when a new plant opens next year that will remove 30,000 tons of CO2 per year.

In 2021, the U.S. emitted 6.34 billion metric tons of carbon dioxide equivalents.

Heirloom is selling custom plans, mainly to companies. Both companies also have major corporate customers, including Microsoft.

“Carbon removal can be a lot more expensive than offsets, but what you’re paying for in terms of climate impact is radically different,” Brian Marrs, Microsoft’s senior director of energy and carbon, told the New York Times.

Recommended reading

Reuters: Climate tech company Heirloom opens U.S. commercial carbon capture plant

Independent: Carbon capture startup Climeworks removes CO2 from open air in ‘industry first’

Yahoo News: What Iceland's landmark carbon removal project means for the fight against climate change

Two samples of stones, one without CO2 injection (lower) and one with CO2 injection (upper), from a pilot project lead by ETH Zurich at a power plant near Reykjavik, Iceland. (Anthony Anex/EPA-EFE/Shutterstock) (ANTHONY ANEX/EPA-EFE/Shutterstock)

But will it solve climate change?

Heirloom’s plant removes just 1,000 tons of CO2 per year, about 200 cars’ worth.

Heirloom says it wants to grow to millions of tons annually, and Climeworks says its goal is a gigaton per year by 2050.

Worldwide, scientists project the need for 10 billion gigatons of carbon removal per year by 2050.

Last week, Climeworks announced a partnership with Canadian firm DeepSky to build plants in Canada capable of removing up to 1 million tons per year of CO2, with the first to open before 2030.

The Biden administration has earmarked $3.5 billion for developing direct air capture hubs around the country, with the first grant recipients — a Texas project led by Occidental Petroleum and a Louisiana project from a technology contractor — announced in August.

A flux chamber, used to give a reading of how fast carbon dioxide is being removed from the atmosphere, at the laboratory at Heirloom Carbon in Brisbane, Calif. (Loren Elliott/AFP via Getty Images) (AFP via Getty Images)

Canada is looking at a package of carbon removal subsidies worth $20 billion over five years.

Carbon removal may be impractical because of its high costs: Experts estimate that DAC costs more than $600 per ton of CO2 today and needs to drop below $200/ton by mid-century to adequately address climate change.

Heavy energy demands reduce environmental benefits, unless the electricity used to power carbon removal is all renewable (as it is in Iceland and at the Heirloom plant in California)

Fossil fuel companies could try to remove the carbon they produce to stay in business. ExxonMobil is investing in carbon removal.

Climeworks predicts that the cost will come down as the industry achieves economies of scale, just like the costs of solar energy and battery storage have dropped dramatically.

“There's a big, big scale-up that lies ahead of us,” Ahn said. “And with the scale-up, the costs will also reduce due to economies of scale, due to technology development.”

Why carbon capture is no easy climate solution

Reuters Videos

Wed, November 22, 2023

STORY: As the world tries to avoid a climate catastrophe, technologies that capture carbon dioxide emissions have become central to many countries' climate strategies.

“...need to pursue the new technologies whether it's hydrogen or ammonia, or direct carbon capture...”

“We're working on decarbonisation... we're interested in carbon capture...”

“...essential that in the meantime we deploy the latest carbon capture, use and storage technology...”

So, what’s the state of the carbon capture industry now, and what are the challenges it faces?

The most common form of carbon capture collects the gas from a point source, such as a power plant.

The CO2 can then be moved to permanent underground storage.

Or, more commonly, it’s used for another industrial purpose first.

Currently, most of the CO2 captured this way is injected into oil wells to free trapped oil.

Drillers say this "enhanced oil recovery" method can make petroleum more climate-friendly, but environmentalists say it's counter-productive.

Industry data shows there are over 40 commercial point-source-capture projects operating around the world, with the capacity to store 49 million metric tons of carbon dioxide annually.

That’s about 0.13% of the world’s annual energy- and industry-related CO2 emissions.

Another form of the technology is “direct air capture”.

With some companies trying more creative solutions, like this one using ballooning to capture the gas in high altitudes.

Data from the International Energy Agency shows that only 27 direct air capture hubs have been commissioned globally, capturing just 10,000 metric tons of CO2 a year.

But some 130 facilities are planned around the world, with the U.S. announcing in August, $1.2 billion in grants for two, in Texas and Louisiana.

One key challenge is the tech’s high cost.

The price tag for point-source-capture projects range from $15 to $120 per metric ton of captured carbon.

With direct air capture, it can cost up to $1,000 per metric ton.

Some countries are trying to use public subsidies to get the projects going.

Such as the U.S. Inflation Reduction Act, passed in 2022, that offers tax credits for every ton captured.

The cost is a tough sell when there’s little proof to show the technology is ready to be deployed at scale.

But developers of the tech say funding is crucial to push it further.

Here’s Shashank Samala, CEO of one of the firms that just won a federal grant for a capture hub in Louisiana.

“Two years ago, we were at a petri dish where we were removing grams of CO2 from the air. In two years, we went from grams to kilograms to hundreds of kilograms to tons, to soon hundreds of tons."

Where captured carbon can be stored is limited by geology.

And getting the carbon to storage sites could require extensive pipeline networks, or even shipping fleets, posing potential new obstacles.

Here’s U.S. climate envoy John Kerry summing up the concerns over carbon capture:

"'The jury's out on whether or not you're going to be able to capture enough emissions and contain them, and get the permissions you need to deploy the infrastructure and all the other things. Will it be competitive? Will it come online in time?"

But as countries gather for the 28th United Nations climate change conference, where they will look to hammer out ways to cut carbon emissions, many say it’s important to try every means possible.

Explainer-Why carbon capture is no easy solution to climate change

Wed, November 22, 2023

: View of a model of carbon capture and storage designed by Santos Ltd, at the Australian Petroleum Production and Exploration Association conference in Brisbane

By Leah Douglas

(Reuters) - Technologies that capture carbon dioxide emissions to keep them from the atmosphere are central to the climate strategies of many world governments as they seek to follow through on international commitments to decarbonize by mid-century.

They are also expensive, unproven at scale, and can be hard to sell to a nervous public.

As nations gather for the 28th United Nations climate change conference in the United Arab Emirates at the end of November, the question of carbon capture’s future role in a climate-friendly world will be in focus. Here are some details about the state of the industry now, and the obstacles in the way of widespread deployment:

FORMS OF CARBON CAPTURE

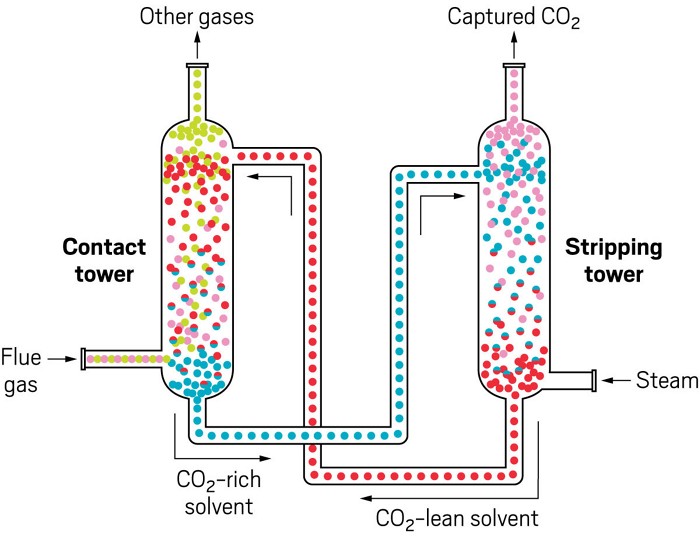

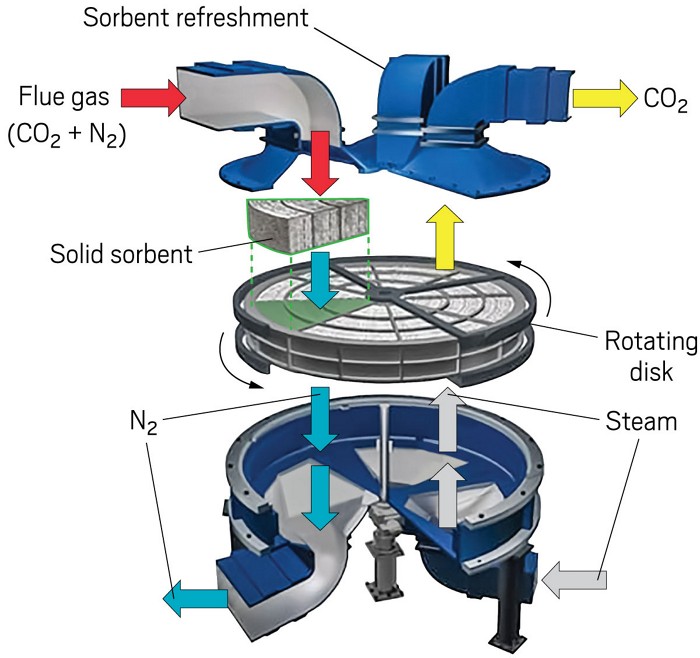

The most common form of carbon capture technology involves capturing the gas from a point source like an industrial smokestack. From there, the carbon can either be moved directly to permanent underground storage or it can be used in another industrial purpose first, variations that are respectively called carbon capture and storage (CCS) and carbon capture, utilization, and storage (CCUS).

There are currently 42 operational commercial CCS and CCUS projects across the world with the capacity to store 49 million metric tons of carbon dioxide annually, according to the Global CCS Institute, which tracks the industry. That is about 0.13% of the world’s roughly 37 billion metric tons of annual energy and industry-related carbon dioxide emissions.

Some 30 of those projects, accounting for 78% of all captured carbon from the group, use the carbon for enhanced oil recovery (EOR), in which carbon is injected into oil wells to free trapped oil. Drillers say EOR can make petroleum more climate-friendly, but environmentalists say the practice is counter-productive.

The other 12 projects, which permanently store carbon in underground formations without using them to boost oil output, are in the U.S., Norway, Iceland, China, Canada, Qatar, and Australia, according to the Global CCS Institute.

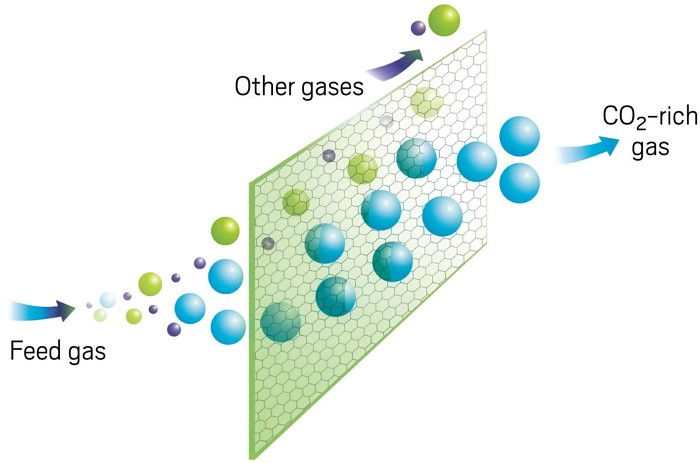

Another form of carbon capture is direct air capture (DAC), in which carbon emissions are captured from the air.

About 130 DAC facilities are being planned around the world, according to the International Energy Agency (IEA), though just 27 have been commissioned and they capture just 10,000 metric tons of carbon dioxide annually.

The U.S. in August announced $1.2 billion in grants for two DAC hubs in Texas and Louisiana that promise to capture 2 million metric tons of carbon per year, though a final investment decision on the projects has not been made.

HIGH COSTS

One stumbling block to rapid deployment of carbon capture technology is cost.

CCS costs range from $15 to $120 per metric ton of captured carbon depending on the emissions source, and DAC projects are even more expensive, between $600 and $1,000 per metric ton, because of the amount of energy needed to capture carbon from the atmosphere, according to the IEA.

Some CCS projects in countries like Norway and Canada have been paused for financial reasons.

Countries including the U.S. have rolled out public subsidies for carbon capture projects. The Inflation Reduction Act, passed in 2022, offers a $50 tax credit per metric ton of carbon captured for CCUS and $85 per metric ton captured for CCS, and $180 per metric ton captured through DAC.

Though those are meaningful incentives, companies may still need to take on some added costs to move CCS and DAC projects ahead, said Benjamin Longstreth, global director of carbon capture at the Clean Air Task Force.

Some CCS projects have also failed to prove out the technology's readiness. A $1 billion project to harness carbon dioxide emissions from a Texas coal plant, for example, had chronic mechanical problems and routinely missed its targets before it was shut down in 2020, according to a report submitted by the project’s owners to the U.S. Department of Energy.

The Petra Nova project restarted in September.

LOCATION, LOCATION, LOCATION

Where captured carbon can be stored is limited by geology, a reality that would become more pronounced if and when carbon capture is deployed at the kind of massive scale that would be needed to make a difference to the climate. The best storage sites for carbon are in portions of North America, East Africa, and the North Sea, according to the Global CCS Institute.

That means getting captured carbon to storage sites could require extensive pipeline networks or even shipping fleets – posing potential new obstacles.

In October, for example, a $3 billion CCS pipeline project proposed by Navigator CO2 Ventures in the U.S. Midwest - meant to move carbon from heartland ethanol plants to good storage sites - was canceled amid concerns from residents about potential leaks and construction damage.

Companies investing in carbon removal need to take seriously community concerns about new infrastructure projects, said Simone Stewart, industrial policy specialist at the National Wildlife Federation.

"Not all technologies are going to be possible in all locations," Stewart said.

(Reporting by Leah Douglas; Editing by Marguerita Choy)

Wed, November 22, 2023

: View of a model of carbon capture and storage designed by Santos Ltd, at the Australian Petroleum Production and Exploration Association conference in Brisbane

By Leah Douglas

(Reuters) - Technologies that capture carbon dioxide emissions to keep them from the atmosphere are central to the climate strategies of many world governments as they seek to follow through on international commitments to decarbonize by mid-century.

They are also expensive, unproven at scale, and can be hard to sell to a nervous public.

As nations gather for the 28th United Nations climate change conference in the United Arab Emirates at the end of November, the question of carbon capture’s future role in a climate-friendly world will be in focus. Here are some details about the state of the industry now, and the obstacles in the way of widespread deployment:

FORMS OF CARBON CAPTURE

The most common form of carbon capture technology involves capturing the gas from a point source like an industrial smokestack. From there, the carbon can either be moved directly to permanent underground storage or it can be used in another industrial purpose first, variations that are respectively called carbon capture and storage (CCS) and carbon capture, utilization, and storage (CCUS).

There are currently 42 operational commercial CCS and CCUS projects across the world with the capacity to store 49 million metric tons of carbon dioxide annually, according to the Global CCS Institute, which tracks the industry. That is about 0.13% of the world’s roughly 37 billion metric tons of annual energy and industry-related carbon dioxide emissions.

Some 30 of those projects, accounting for 78% of all captured carbon from the group, use the carbon for enhanced oil recovery (EOR), in which carbon is injected into oil wells to free trapped oil. Drillers say EOR can make petroleum more climate-friendly, but environmentalists say the practice is counter-productive.

The other 12 projects, which permanently store carbon in underground formations without using them to boost oil output, are in the U.S., Norway, Iceland, China, Canada, Qatar, and Australia, according to the Global CCS Institute.

Another form of carbon capture is direct air capture (DAC), in which carbon emissions are captured from the air.

About 130 DAC facilities are being planned around the world, according to the International Energy Agency (IEA), though just 27 have been commissioned and they capture just 10,000 metric tons of carbon dioxide annually.

The U.S. in August announced $1.2 billion in grants for two DAC hubs in Texas and Louisiana that promise to capture 2 million metric tons of carbon per year, though a final investment decision on the projects has not been made.

HIGH COSTS

One stumbling block to rapid deployment of carbon capture technology is cost.

CCS costs range from $15 to $120 per metric ton of captured carbon depending on the emissions source, and DAC projects are even more expensive, between $600 and $1,000 per metric ton, because of the amount of energy needed to capture carbon from the atmosphere, according to the IEA.

Some CCS projects in countries like Norway and Canada have been paused for financial reasons.

Countries including the U.S. have rolled out public subsidies for carbon capture projects. The Inflation Reduction Act, passed in 2022, offers a $50 tax credit per metric ton of carbon captured for CCUS and $85 per metric ton captured for CCS, and $180 per metric ton captured through DAC.

Though those are meaningful incentives, companies may still need to take on some added costs to move CCS and DAC projects ahead, said Benjamin Longstreth, global director of carbon capture at the Clean Air Task Force.

Some CCS projects have also failed to prove out the technology's readiness. A $1 billion project to harness carbon dioxide emissions from a Texas coal plant, for example, had chronic mechanical problems and routinely missed its targets before it was shut down in 2020, according to a report submitted by the project’s owners to the U.S. Department of Energy.

The Petra Nova project restarted in September.

LOCATION, LOCATION, LOCATION

Where captured carbon can be stored is limited by geology, a reality that would become more pronounced if and when carbon capture is deployed at the kind of massive scale that would be needed to make a difference to the climate. The best storage sites for carbon are in portions of North America, East Africa, and the North Sea, according to the Global CCS Institute.

That means getting captured carbon to storage sites could require extensive pipeline networks or even shipping fleets – posing potential new obstacles.

In October, for example, a $3 billion CCS pipeline project proposed by Navigator CO2 Ventures in the U.S. Midwest - meant to move carbon from heartland ethanol plants to good storage sites - was canceled amid concerns from residents about potential leaks and construction damage.

Companies investing in carbon removal need to take seriously community concerns about new infrastructure projects, said Simone Stewart, industrial policy specialist at the National Wildlife Federation.

"Not all technologies are going to be possible in all locations," Stewart said.

(Reporting by Leah Douglas; Editing by Marguerita Choy)