Instituting a minimum price for alcohol reduces deaths, hospital stays

IMAGE: BOTTLES OF DISTILLED SPIRITS. view more

CREDIT: RUTGERS CENTER OF ALCOHOL & SUBSTANCE USE STUDIES

PISCATAWAY, NJ - When governments create a minimum price for alcoholic beverages, deaths and hospitalizations related to alcohol use significantly decrease, according to results from a new report in the Journal of Studies on Alcohol and Drugs.

Called "minimum unit pricing," such policies "would result in a substantial and lasting reduction in the harms caused by alcohol in society," says lead researcher Adam Sherk, Ph.D., of the Canadian Institute for Substance Use Research at the University of Victoria in British Columbia, Canada.

"As we continue to weather the COVID-19 pandemic and hear concerns about overwhelming our health care systems, this study shows that a minimum unit price for alcohol would help to free up valuable resources by decreasing alcohol's burden on our health care systems," says Sherk.

Minimum unit pricing strategies set a "floor price" for alcohol sales. Specifically, a standard drink -- defined by pure alcohol content [in Canada and the United States, about the amount of ethanol in a 5% bottle of beer] -- cannot be sold below a predetermined value. Such policies help prevent the sale of cheap drinks with high alcohol content. They tend to have their largest effect on inexpensive spirits and the smallest effect on wine.

Similar pricing strategies have already been implemented with initial success in places such as Scotland, Wales and some provinces in Canada. In their study, Sherk and his colleagues sought to determine the potential effect of minimum unit pricing in Québec, a province that has yet to institute such a policy.

For their research, the investigators used a new, open-access model -- the International Model of Alcohol Harms and Policies (InterMAHP) -- which can be used to estimate alcohol harms in a country or state as well as the potential health impact of alcohol policies designed to limit such harms.

Using this model, Sherk and his colleagues input per capita alcohol use data from the Canadian Institute for Substance Use Research. Further, data about hospitalizations and deaths were obtained from government statistics, as was information about sales of wine, spirits and liqueurs (which are partially controlled by the government in Canada). Information about beer sales was obtained from the market research company Nielsen.

In Québec in 2014, the year analyzed, there were an estimated 2,850 deaths and 24,694 hospitalizations attributable to alcohol use, the researchers found. These included deaths from cancer, cardiovascular conditions, and injuries. The leading causes of hospitalizations from alcohol use were unintentional injuries, psychiatric conditions, cancer, digestive conditions, and communicable disease.

The researchers' modeling determined that, if the province had previously instituted a minimum unit pricing policy of CAD$1.50 per standard drink (about USD$1.12), 169 deaths would have been prevented, a reduction of 5.9 percent. Having instituted a minimum unit price of CAD$1.75 per drink (about USD$1.31) would have prevented 327 deaths, a decrease of 11.5 percent.

Further, a minimum unit pricing policy of CAD$1.50 per drink would have resulted in 2,063 fewer hospitalizations that year (an 8.4 percent decrease). A price of CAD$1.75 would have reduced hospitalizations by 4,014, or 16.3 percent.

But what impact would this pricing have on any purported health benefits of alcohol? Although their data did show that alcohol use was related to decreased hospitalizations for cardiovascular conditions and diabetes, the modeling demonstrated that minimum unit pricing would have prevented even more hospitalizations.

"This report adds to the growing body of evidence that minimum unit pricing policies are an effective way for governments to reduce alcohol-related hospital visits and save lives," says Sherk. "National and jurisdictional governments, including Québec, should consider following the lead of countries like Scotland and implementing these policies."

(To learn more about The International Model of Alcohol Harms and Policies [InterMAHP], visit http://www.

###

Sherk, A., Stockwell, T., April, N., Churchill, S., Sorge, J., & Gamache, P. The potential health impact of an alcohol minimum unit price in Québec: An application of the International Model of Alcohol Harms and Policies. Journal of Studies on Alcohol and Drugs, 81, 631-640. doi:10.15288/jsad.2020.81.631

To arrange an interview with Adam Sherk, Ph.D., please contact Amanda Farrell-Low at farlow@uvic.ca or 250-472-5445.

The Journal of Studies on Alcohol and Drugs (jsad.com) is published by the Center of Alcohol & Substance Use Studies (alcoholstudies.rutgers.edu) at Rutgers, The State University of New Jersey. It is the oldest substance-related journal published in the United States.

To learn about education and training opportunities for addiction counselors and others at the Rutgers Center of Alcohol & Substance Use Studies, please visit https:/

The Journal of Studies on Alcohol and Drugs considers this press release to be in the public domain. Editors may publish this press release in print or electronic form without legal restriction. Please include proper attribution and byline.

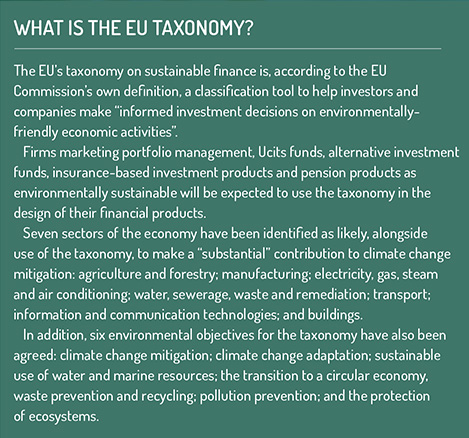

Before the pandemic forced a shift in focus, sustainable investment and the EU’s green agenda was one of the most discussed topics in financial services – and fast becoming an area of fundamental focus for governments and regulatory bodies.

Before the pandemic forced a shift in focus, sustainable investment and the EU’s green agenda was one of the most discussed topics in financial services – and fast becoming an area of fundamental focus for governments and regulatory bodies. Hopes are high that a landmark EU agreement on how to classify green finance will reduce greenwashing and boost sustainable investing. But, asks

Hopes are high that a landmark EU agreement on how to classify green finance will reduce greenwashing and boost sustainable investing. But, asks  The board’s chief executive, Janine Guillot, says that greater consistency of terminology in the sustainable investing space is needed along with “a need to standardise language around corporate disclosure, product design and labelling in the investment process”.

The board’s chief executive, Janine Guillot, says that greater consistency of terminology in the sustainable investing space is needed along with “a need to standardise language around corporate disclosure, product design and labelling in the investment process”. Amundi is jointly backing a programme to help smaller and medium-sized businesses access green finance and says the debt investments involved will lead to higher yields for investors.

Amundi is jointly backing a programme to help smaller and medium-sized businesses access green finance and says the debt investments involved will lead to higher yields for investors. ESG appears to be passing the scrutiny test with more investors perceiving performance merits.

ESG appears to be passing the scrutiny test with more investors perceiving performance merits. Asset managers see governance as their central ESG factor - but environment and social issues are gaining importance, research shows.

Asset managers see governance as their central ESG factor - but environment and social issues are gaining importance, research shows. Millennial investors who would abandon their ideals surrounding sustainable investing would want a return of 21% to “offset any guilt”.

Millennial investors who would abandon their ideals surrounding sustainable investing would want a return of 21% to “offset any guilt”. Legal & General Investment Management says it will hold a “far more extensive” number of companies to account over climate change.

Legal & General Investment Management says it will hold a “far more extensive” number of companies to account over climate change.  High carbon emitting companies have been called on by investment management firms to commit to a net zero future by setting science-based targets.

High carbon emitting companies have been called on by investment management firms to commit to a net zero future by setting science-based targets.