USELESS CONTRARIAN PARTY

Alberta's relaxed gathering restrictions will escalate Omicron risk, doctors warn

Indoor gatherings now permitted to include

unvaccinated adults

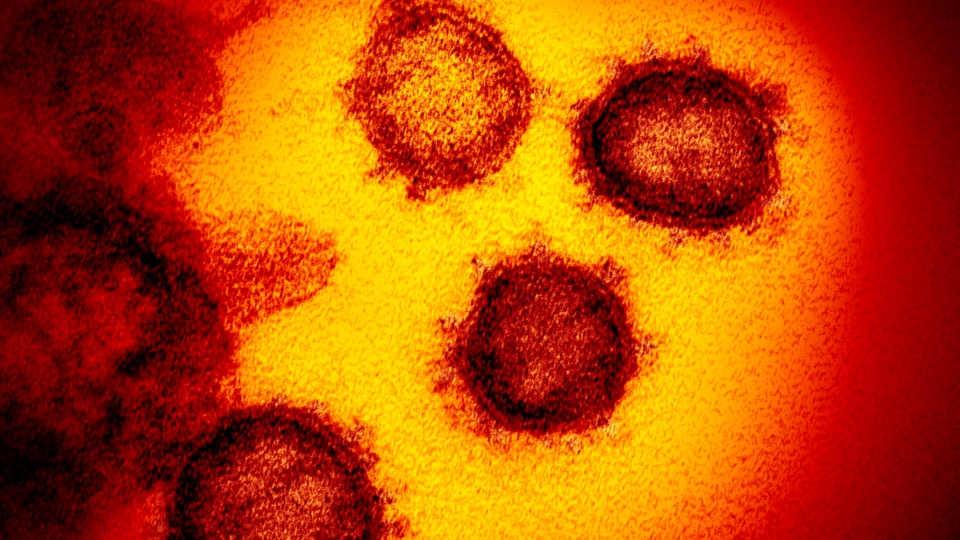

Alberta's decision to permit unvaccinated adults to attend holiday gatherings will allow the Omicron variant to spread rapidly, say doctors on the front lines of the COVID-19 crisis.

"It's a big risk, and I think that it's potentially setting us up for a rapid rise in cases over the holidays like we saw about a year ago," Edmonton emergency physician Dr. Shazma Mithani said Wednesday.

"To me, there is no logical explanation as to why the province would start to allow people who are unvaccinated to gather indoors."

Earlier Wednesday, the province announced changes to gathering restrictions. Unvaccinated adults are now permitted to attend private indoor gatherings of up to 10 adults.

Under the previous rule, people who were unvaccinated could not attend any private indoor gatherings. The new rules lift a restriction that limited indoor gatherings to people from two households.

The province also announced it will expand rapid testing while increasing the availability of vaccine booster shots.

WATCH | Alberta's chief medical officer of health discusses new rules:

Premier Jason Kenney defended the relaxed restrictions as a "reasonable, very modest change."

He said the increased availability of rapid testing kits will allow more families to safely gather over the holidays, and that Alberta's vaccination rate means it is well-positioned to handle the variant.

As of Wednesday, 85 per cent of Albertans aged 12 and older have received at least two doses of vaccine. That equates to 72.3 per cent of the overall population.

Changes send wrong message, experts say

The province's approach demonstrates a failure of leadership in responding to the health crisis, said Dr. James Talbot, Alberta's former chief medical officer of health.

The changes send the wrong message about the dangers of COVID-19, especially with Omicron's ability to evade vaccines and spread rapidly, Talbot said.

It's not really the time to be making tweaks that suggest that this is over.- Dr. James Talbot

"You really want people to stay the course and protect themselves over the holidays. It's not really the time to be making tweaks that suggest that this is over."

The province has not learned from its past mistakes, Talbot said.

"In July, they basically declared it the 'best summer ever' and now there are now 960 Albertans for which it was the last summer ever.

"We now have another variant out there and instead of holding the line or increasing the amount of protection we have, the message they are giving is that it's OK to let your guard down."

Dr. Joe Vipond, an emergency physician in Calgary, said the regulatory changes set the stage for a powerful fifth wave.

WATCH | Provinces sound the alarm over holiday plans as Omicron cases rise:

While increased rapid testing and vaccine boosters will be powerful tools in curbing the spread, cutting back on public health restrictions was ill-timed, Vipond said.

"At a time when we should be tightening restrictions, we're loosening them," he said.

We have not yet learned from our mistakes in this province.-Dr. Joe Vipond

The province should be considering proactive measures to clamp down against Omicron, he said.

"The way to deal with exponential growth is to act early and act hard, and that way you avoid having to put in those stringent restrictions later for longer," he said.

"We have not yet learned from our mistakes in this province."

Dr. Lynora Saxinger, an infectious diseases specialist and associate professor at the University of Alberta, questioned whether rapid testing will be enough to protect Albertans who choose to gather.

The tests are less reliable on people who are not showing symptoms, Saxinger said.

"I wouldn't bet the bank on just doing rapid tests and thinking that's enough to prevent transmission," she said. "I would always see the test as an added layer of protection, not replacing anything."

'Make the selfless decision'

The number of Omicron cases in the province spiked Tuesday, with 60 cases now detected.

Mithani expects that number to rise over the coming weeks.

Rapid tests come with the risk of false negatives, she said, and variants pose an increased risk of breakthrough infections.

She said the unvaccinated should get immunized or accept the consequences of their choices.

"I would encourage them to, you know, make the selfless decision not to engage with other individuals throughout the holiday season, even though the rules allow them to."