Bangladeshi migrants making their way from Libya to Europe are rescued by the crew of the Geo Barents, a rescue vessel operated by Doctors Without Borders in the Central Mediterranean on 12 June 12, 2021. (Ed Ou / The Outlaw Ocean Project)

By Ian Urbina and Joe Galvin

20 Feb 2022 0

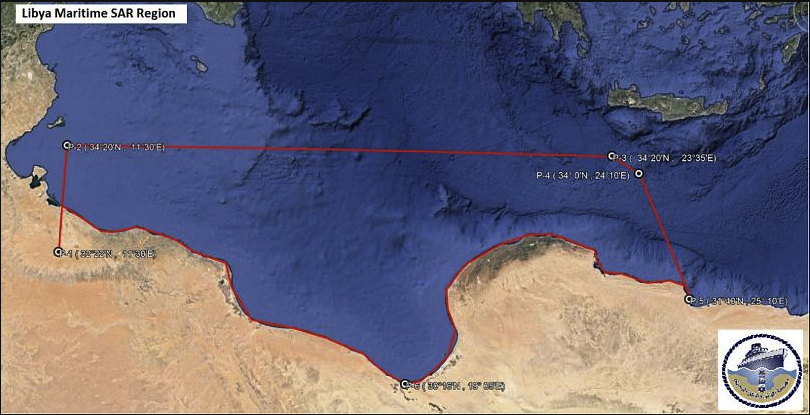

One of the reasons that the coast guard has become so effective in this effort is that in 2018, Libya expanded the reach of its offshore patrols. In receiving UN recognition of an at-sea search-and-rescue zone, Libyan authorities stretched their jurisdiction nearly a hundred miles off of Libya’s coast, far into international waters, and halfway to Italian shores.

The consequence of this expanded zone is that humanitarian boats like those from Doctors Without Borders are prevented from getting to the migrants first to pull them out of the water and then to deliver them to ports of safety, typically in Europe. Instead, with help from EU-funded planes and drones flying above the migrant boats, the Libyan Coast Guard gets to these refugees faster, returning them to prisons in Libya, the country the migrants just fled.

Lawmakers and humanitarian advocates are now posing tough new questions to the European Parliament and the International Maritime Organization (IMO), which is the UN’s maritime agency that formally acknowledged the Libyan search-and-rescue zone. These critics say that the Libyan search-and-rescue zone violates the relevant UN convention and has been used to facilitate a worsening of human rights abuses and violation of the law of non-refoulement, which prohibits the return of people to war zones or other places where they are likely to be tortured or otherwise harmed.

“Are there plans to take the initiative of suspending registration of the Libyan ‘Search-and-Rescue Zone’ at the International Maritime Organization, as it complies neither with international standards nor with individual states’ obligations to respect the right to asylum and the law of the sea?” a group of 18 European lawmakers wrote in May 2021 to the European Parliament.

Under a 1979 UN convention, nations can create their own at-sea search-and-rescue zones, but certain obligations need to be met. For a country to create or expand a search-and-rescue zone it must first “establish rescue coordination centres” that are “operational on a 24-hour basis and constantly staffed by trained personnel having a working knowledge of the English language”. People rescued in the zones must only ever be returned to a port of safety, according to convention rules.

When the IMO acknowledged Libya’s search-and-rescue zone in 2018, these obligations were not met. Libya had no independent rescue coordination centre, staffed 24-hours a day with English-speaking staff, and the country’s ports were not (and are still not) categorised as “places of safety”, according to the United Nations. When migrants are “rescued” or arrested in Libya’s search-and-rescue zone, the coast guard takes them to prisons where the UN has said “crimes against humanity” are happening.

The IMO was by no means the primary architect of the expanded Libyan search-and-rescue zone. That responsibility belongs to the EU and Italy, both of which pushed for its creation while also making clear that the core requirements of the convention were not being met.

In 2016, the Italian Coast Guard was asked by the European Commission to support Libyan authorities in identifying and declaring this zone. In a submission in 2017 to the IMO, Italy made clear that Libya had no rescue coordination centre, instead promising that one would be created. The years passed, and no such centre was built. In 2021, responding to questions in the European Parliament, the European Commission continued to speak of its aspirations to build a “functional rescue coordination centre,” and an internal EU report from January 2022 makes clear the centre is still unable to meet its basic obligations.

Before the IMO announced it, no Libyan search-and-rescue zone officially existed. Italy and independent humanitarian groups predominantly handled the job of tracking migrant boats on the Mediterranean Sea. But the new search-and-rescue zone empowered the Libyan Coast Guard to order ships – whether merchant cargo vessels or humanitarian rescue vessels – to return refugees to the very country they just fled. This raised several legal questions: How can ships be ordered to deliver refugees to ports deemed unsafe? Why would the IMO announce a zone that facilitates such legal violations and fails to meet the conditions of the convention that the IMO is meant to uphold?

“There is the law on one side and the policies in place which are in contradiction,” said Laura Garel, a spokeswoman for SOS Méditerranée, a humanitarian group that operates rescue ships on the Mediterranean.

It is not just in the Mediterranean that this contradiction exists. In a study published in 2017, Professor Violeta Moreno-Lax, a specialist in international migration law, documented how Australia had consistently failed to meet its obligations under the 1979 convention relating to search-and-rescue zones. The study outlines how Australia militarised its response to seaborne migration, focusing on “deterrence, interception and forcible turnbacks of boats” instead of conducting “genuine search-and-rescue missions”, putting it in regular breach of the convention.

In response, the IMO says it has minimal power or responsibility to sanction at-sea search-and-rescue zones. The organisation “does not approve search-and-rescue zones” but merely “disseminates the information”, Natasha Brown, an IMO spokeswoman, wrote to The Outlaw Ocean Project by email. “There is no provision in the search-and-rescue Convention for us to assess or approve the information provided,” she added.

However, the IMO clearly plays some role in deciding whether to announce and recognise these zones. In December 2017, for instance, Libya provisionally withdrew its initial IMO application to determine its zone, “after an implication from the IMO that in the absence of a rescue coordination centre core requirements for the SAR zone were not met,” wrote Peter Muller and Peter Smolinski in the Journal of European Public Policy.

Asked whether for the sake of safeguarding its own reputation and ensuring the convention is not violated, the IMO vets any of the information it receives from countries to verify that the criteria of the convention are met, Brown, the IMO spokeswoman, confirmed that her organisation does “clarify or confirm technical points” before formally announcing a search-and-rescue zone. She added that the convention would need to be amended for the IMO to take a greater role in verifying the information it releases.

In the past, the IMO has taken issue with the organisation or its rules being used in a way that facilitates crimes. In 2015, Koji Sekimizu, the secretary-general of the IMO at the time, made clear that his organisation must help prevent migrants from being sent to ports that are deemed unsafe. During a meeting about migration across the Mediterranean, he emphasised that signatory governments were obliged to coordinate and cooperate with rescue vessels to ensure people rescued at sea were returned to a place of safety.

“These obligations apply regardless of the status of the persons in distress at sea, including potentially illegal migrants,” Sekimuzu said. “These issues are clearly a matter for the International Maritime Organization if they call into question the proper application of international regulations.”

A wide variety of scholars, lawyers, advocates and lawmakers say this is exactly what’s happening: the IMO is enabling the improper “application of international regulations” as well as violations of humanitarian and maritime law. The IMO has the authority and duty to fix the problem by delisting the Libyan search-and-rescue zone, they say, which would prevent IMO complicity in the Libyan Coast Guard claiming extended jurisdiction in the illegal delivery of migrants to places of abuse.

“It is urgent for the IMO, as the UN maritime authority, to remove the Libyan search-and-rescue zone from official records,” said a 2020 letter signed by dozens of EU lawmakers, aid organisations, activists, legal experts and academics. The letter explained that the IMO has created a system that “has been used opportunistically to create a fictional account that allows several states, and the EU, to relinquish their duties under the law of the sea, international, refugee and human rights law.” The letter cites Libya’s status as an unsafe port and the violence committed by the Libyan Coast Guard. It also describes the use of Libya’s expanded search-and-rescue zone to “criminalise” aid groups like Doctors Without Borders that are engaging in legal rescue missions.

“Because we believe that the IMO does not appreciate states using its procedures instrumentally to undermine the law of the sea, maritime safety, human rights and international law, the undersigned ask that formal recognition of the Libyan search-and-rescue zone be revoked,” the letter said. In response to the letter, the IMO wrote that it was “not authorised to remove or deregister” the zone.

Such pressure on the IMO is not just coming from outside the UN. In a 2019 report, the IMO’s sister organisation, the United Nations Human Rights Office, also called on the maritime organisation to take responsibility for its role in facilitating violations by the Libyan Coast Guard. The IMO “should reconsider the classification of the Libyan search-and-rescue zone until such time as the Libya Coast Guard demonstrates it is capable of conducting search-and-rescue operations without putting migrants’ lives and safety at risk,” the UN human rights office wrote.

Since the creation of the Libyan search-and-rescue zone, the Libyan Coast Guard has become far more effective at capturing migrants. In 2021, the Libyan Coast Guard arrested more than 32,000 migrants trying to cross the Mediterranean, up from 11,891 arrested at sea in 2020, according to the UN’s migration agency. These migrants are brought to shore and put in migrant prisons, where myriad abuses occur.

“There are videos of the concentration camps in Libya, the concentration camps of traffickers,” Pope Francis said in a recent television interview, describing as “criminal” the treatment of the refugees crossing the Mediterranean and calling on EU countries to accept more of these migrants.

Because of the IMO’s announcement of the Libyan search-and-rescue zone, Libyan Coast Guard captains can claim – as they routinely do – that they have UN-recognized jurisdiction over the area even though the migrants are typically already in international waters. As a result, merchant ship captains think they are legally required to obey orders from the Libyan Coast Guard to hand over migrants.

However, in doing so, these merchant ship captains are committing a crime, which was made apparent in 2021 by the sentencing to a year in prison of an Italian ship captain who did exactly as he had been told by the Libyan Coast Guard, carrying migrants back to Tripoli in violation of humanitarian law forbidding non-refoulement. This predicament has been created because the Libyan Coast Guard has claimed, with tacit approval from the IMO, broad jurisdiction over much of the Mediterranean Sea.

The IMO has tried to offer useful guidance on these matters to such captains but the organisation has failed to solve the legal contradiction that it helped create. The IMO advises ship captains of their legal requirement to rescue migrants at sea, instructing them to obey the orders given by the country, such as those from Libya, who claim jurisdiction over a search-and-rescue zone. But the same IMO document also says that the migrants must be taken to an officially recognised “place of safety”, which the UN has said Libya is certainly not.

To avoid further abuse of the regulations and for the IMO to play a clearer role in verifying information it publishes tied to search-and-rescue zones, countries that are party to the convention can propose amendments, which are in turn voted on at conferences convened by the IMO. A two-thirds majority of voting countries is required for the amendment to be adopted.

And there is precedence; in her 2017 study, Moreno-Lax notes that as “a result of repeated episodes of non-compliance with search-and-rescue obligations”, the search-and-rescue convention was amended to make clearer countries’ obligations to carry out rescues.

“The IMO needs to stand up to states misusing procedures for instrumental purposes, for the sake of the international legal system as a whole,” said Yasha Maccanico, a researcher from Statewatch, an organisation that monitors civil liberties in Europe. “The Libyan search-and-rescue zone makes a mockery of the law of the sea.” DM