Historical review shows megadroughts could become permanent in some places due to climate change

A large international team of researchers has found, via historical review, that parts of the planet that now experience occasional megadroughts may be changing to become permanently dry. In their paper published in the journal Nature Reviews Earth & Environment, the group describes the factors guiding their predictions regarding megadrought areas as the planet grows warmer.

As atmospheric carbon increases, scientists around the world are scrambling to predict the environmental changes that are likely to be wrought. In this new effort, the researchers looked at areas that are known to have experienced droughts and sometimes megadroughts in recent history in an effort to predict how they might be impacted by a warming planet.

To gain some perspective on how droughts arise, the researchers looked at descriptions of them over the past 2,000 years around the world. They also looked at other evidence, such as tree rings, stalagmites and other naturally occurring records to learn more about events that led droughts to arise and their duration.

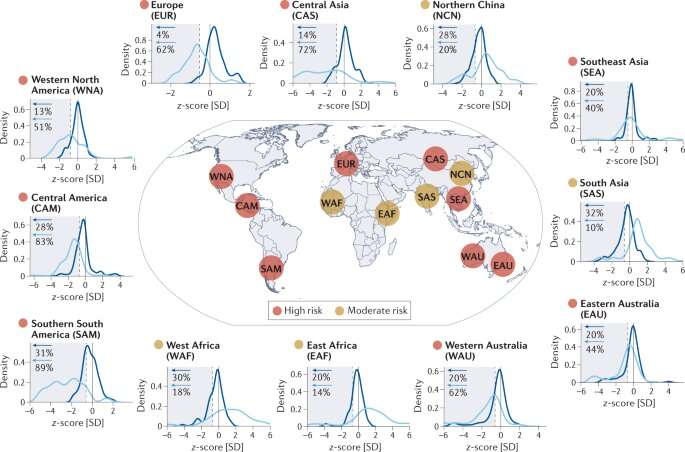

They found that droughts or megadroughts (those that last longer than would be expected) have occurred sporadically over the years on every continent except Antarctica. They also found that most megadroughts came about due to unusual variations in sea surface temperatures. The researchers then made predictions about the likelihood of megadroughts occurring in the future based on both natural and man-made conditions.

The predictions show that the parts of the planet that have been historically prone to droughts or megadroughts are likely to become even more prone to them if conditions in those places grow hotter. This, they note, is because warmer air holds more water. It could also be due to factors such as snowmelt. Warmer temperatures lead to earlier snowmelt and drier soil, which in turn leads to less moisture in the air and therefore less rainfall.

The researchers also note that rising temperatures will likely have an impact on La Niña events, too, leading to decreased rainfall. The end result, they suggest, is some areas likely evolving from drought conditions to permanently dry regions.

Climate model shows drought in North and South America at the same time during La Niña events

More information: Benjamin I. Cook et al, Megadroughts in the Common Era and the Anthropocene, Nature Reviews Earth & Environment (2022). DOI: 10.1038/s43017-022-00329-1

© 2022 Science X Network

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/C2ZAJTRVHEWAOG3IBC3FTJBAIM.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/ZPGGBJXMH3WVOG4ZFA5LCARMXI.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/QAJDY5QYS3YIXRCYDXGLOA4A44.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/4A6JV6D2H3SAM7FLPH4TNOTWXU.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/KJWQWNWW4D4OZ7JX7BA4BWCMJI.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/CN5GSKNAD5CPHKPDKFM3TW2O4M.JPG)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/ZONOF7XZV42RABSPKX4FEHSMLA.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/B7HXIMKVR264CS7TXVD6QEMQ5I.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/6UQTRBW6GDGKNJGNPA624AIAFU.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/E5YLH7VUXFQJRQH6NBKDEL3HZQ.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/OKNDPZPY3UA56HZJ6CTPOT5VZQ.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/ZU3Z3VSIWOJG2FZVVOE2FPXRVU.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/TPLZR2IWLUIA2MZ6OVQVK3KH2A.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/U6N5GDKWXYQMP6T6RMJM2RFZ5E.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/VX6OXPBCAFNJKQKEGVYB2I33VM.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/S3RUC55574BYYXKCN5OFTSNLUQ.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/ALAEMO4E327PXXV6UA2LVCDOJM.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/7KJUEG36EGMXYNO2IYRKIRNIJM.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/4F5VUQJF36DWXZMKJJR37VXEMM.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/ZLNWURFMSUW5XQM45HX4EHTE6E.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/YVQZRUUEB7N4AR3IXJMRDVMFMI.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/EF2452C2UN3GACEYGXEFLVQHUE.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/KRNYPIGBZRQZJTV6JE7RZT6GYY.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/U7YTQK7WDH22X3KWK5WA55G2VQ.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/W4LKSQKCZJGBBXHPW7VLYHROTU.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/F57WT7ZY2Z6JHCBQAJWKBRA5SU.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/3I4ERQYFW4TJEYRHFOFN6FK7LI.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/EVFTUR3HQF35O7CGSJG3YRI5NQ.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/VCXP4KCAFLOOVIZHUSLZKPT4QM.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/X6VK3ZPEUMCPNR5CIDS4RDQDV4.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/RYU4DKOTSV7DENUC2BNL3DBJP4.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/LES3JZP3Y74AT5HISHKV3DMMNE.jpg)

:quality(70):focal(2805x1808:2815x1818)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/OLO6MWJYVZHDHN4A3PFI6IL2HU.jpg)

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/PULHRLCQRHA225WILA5GK4WVNI.jpg)