CRIMINAL CAPITALI$M

US busts catalytic converter theft ring that extracted metals

Bloomberg News | November 2, 2022

Credit: Adobe Stock

US authorities said they arrested 21 individuals in five states for allegedly participating in a national network that stole thousands of catalytic converters from cars and then sold them to processors to extract precious metals from the devices valued at tens of millions of dollars.

Law enforcement officials also executed 32 search warrants and seized millions of dollars in assets including homes, bank accounts, cash and luxury vehicles, the Department of Justice said Wednesday in a news release. The government is seeking forfeiture of more than $545 million in connection with the case.

“This national network of criminals hurt victims across the country,” FBI Director Christopher Wray said in the statement. “They made hundreds of millions of dollars in the process — on the backs of thousands of innocent car owners.”

Metal thieves in search of platinum, rhodium and palladium have been stealing catalytic converters in ever-greater numbers, sending auto-insurance claims soaring across the country, State Farm said earlier this year. The insurer said it paid $62.6 million for 32,265 catalytic converter theft claims nationally — a 1,173% increase from 2019.

A catalytic converter is an emissions-control device that’s in the exhaust system under many gas-powered vehicles.

The defendants in the theft ring were charged in two separate indictments in California and Oklahoma federal courts.

California has higher emissions standards than the rest of US, so catalytic converters on vehicles registered in the state contain higher concentrations of precious metals, the US said in a court filing in Sacramento federal court.

“Last year approximately 1,600 catalytic converters were reportedly stolen in California each month, and California accounts for 37% of all catalytic converter theft claims nationwide,” said US Attorney Phillip Talbert for the Eastern District of California.

The thieves know which vehicle makes and models contain the most precious metals in the catalytic converters, the government said in the court filing.

“The design of the Toyota Prius and other hybrid vehicles employ a very high concentration of palladium,” the US said. “Therefore, they are targeted by thieves for their high value, specifically the 2004-2009 model years.”

The nine people charged in Sacramento were involved in a conspiracy to ship the stolen catalytic converters from California to DG Auto facilities in New Jersey, where the precious metal powders were extracted and sold for profit, the US said.

DG Auto employees created a pricing application for both Apple and Android platforms that provided real-time pricing information for catalytic converter thieves and their customers, according to the indictment.

A call to DG Auto was forwarded to an answering machine, which said the mailbox was full and couldn’t accept any more messages.

The cases are US v. Khanna, 22-cr-0213, US District Court, Eastern District of California (Sacramento) and US v. Khanna, 22-cr-348, US District Court, Northern District of Oklahoma.

(By Joe Schneider)

Space photovoltaics closer to shining some light on earth

Staff Writer | November 3, 2022 |

An array of small solar panels that are part of the Space Solar Power Project integrate photovoltaics, power transfer circuitry, and incorporate beam steering. (Image courtesy of Caltech).

A team of researchers at the California Institute of Technology is working to deploy a constellation of modular spacecraft that collect sunlight, transform it into electricity, then wirelessly transmit that electricity wherever it is needed—including to places that currently have no access to reliable power.

According to the scientists, harnessing solar power in space relies on breakthrough advances in three main areas:

The first key aspect involves the design of ultralight high-efficiency photovoltaics that are optimized for space conditions and compatible with an integrated modular power conversion and transmission system.

The second area refers to the development of the low-cost and lightweight technology needed to convert direct current power to radio frequency power and send it to earth as microwaves. Despite how it sounds, the process is safe as non-ionizing radiation at the surface is significantly less harmful than standing in the sun. In addition, the system could be quickly shut down in the event of damage or malfunction.

Finally, the third area involves inventing foldable, ultrathin, and ultralight space structures to support the photovoltaics as well as the components needed to convert, transmit, and steer radio frequency power to where it is needed.

The basic unit of the system the researchers envision is a 4-inch-by-4-inch tile that weighs less than a tenth of an ounce. Hundreds of thousands of these tiles would combine into a system of flying carpet-like satellites that, once unfurled, would create a sunlight-gathering surface that measures 3.5 square miles.

“This concept was, in the past, truly science fiction. What made it possible for us to consider taking it from the realm of science fiction to the realm of reality was the combination of developments happening in photovoltaics in Harry Atwater’s lab, in structures in Sergio Pellegrino’s lab, and in wireless power transfer, which is happening in my lab,” Ali Hajimiri, one of the researchers leading the project, said in a media statement.

“We realized that we can now pursue space solar power in a way that is becoming both practical and economical.”

Hajimiri noted that one of the first questions that anyone asks is, “Why do you want to put photovoltaics in space?” To what he replies that in space, where there is no day and night or clouds, it is possible to get about eight times more energy than on earth.

“The vision of this program is to be able to provide as much power as you need, where you need it, and when you need it,” he said.

Progress

In terms of progress toward making this project a reality, the researcher explained that over a period of two years, the group built and demonstrated a prototype tile. This is the key modular element that captures the sunlight and transmits the power.

Through that process, they learned how to design highly integrated and ultralight systems of this sort. They then developed a second prototype, 33% lighter than the first.

A series of tiles are to be mounted on a very flexible structure that can be folded to fit in a launch vehicle. Once deployed, the structure expands, and the tile works in concert and in synchronization to generate energy, convert it, and transfer it exactly where it is needed.

Speaking about the next steps, Hajimiri and his colleagues said that soon, the time to test things outside the lab will come.

“Most spacecraft today have solar arrays—photovoltaic cells bonded to a carrier structure—but not with this type of material and not folded to the dimensions we’ve achieved,” Pellegrino said. “By using novel folding techniques, inspired by origami, we are able to significantly reduce the dimensions of a giant spacecraft for launch. The packaging is so tight as to be essentially free of any voids.”

Five dead after methane leak at ArcelorMittal coal mine in Kazakhstan

Reuters | November 3, 2022

Credit: ArcelorMittal

Five people died and four others were hospitalized after a methane gas leak at an ArcelorMittal coal mine in Kazakhstan on Thursday, the company said.

The company said it was continuing rescue work at the mine in the Qaraghandy region in central Kazakhstan where ArcelorMittal operates the country’s biggest steel mill.

Kazakh news website Zakon.kz quoted regional governor Zhenis Kasymbek as saying that all eight ArcelorMittal mines had halted work for a day.

Prime Minister Alikhan Smailov said a government commission would investigate the incident.

(By Tamara Vaal and Olzhas Auyezov; Editing by Muralikumar Anantharaman and Peter Graff)

Column: Miners are embracing renewables both for cost and image

Reuters | November 3, 2022 |

Chichester Hub, located in the heart of the iron ore-rich Pilbara region. (Image courtesy of Fortescue Metals Group.)

(The opinions expressed here are those of the author, Clyde Russell, a columnist for Reuters.)

One of the unintended side effects of Russia’s invasion of Ukraine is it’s helping drive an accelerated transition to renewable energy solutions in Australia’s vast resources sector.

Diesel prices are close to record highs in Australian dollar terms, and unlikely to ease soon given shortages of the transport fuel created by Europe’s decision to move away from Russian supplies as part of efforts to punish Moscow for its Feb. 24 attack on its neighbour.

Diesel has been the dominant source of power for Australia’s mines, which are often located in remote areas and not connected to major power grids.

Australia is the world’s largest exporter of iron ore, lithium, gold and coking coal, ranks second in thermal coal, fifth in copper and is also a major shipper of nickel and alumina, the base material for aluminium.

It used to be that switching mine sites from diesel to renewable energy solutions was a process largely driven by the increasing need to be seen to be doing something to reach the goal of net-zero carbon emissions, with many mining companies having a target of achieving this by 2050.

But at the IMARC conference in Sydney this week, it was increasingly clear that one of the main drivers for switching to clean energy solutions was their relative cost effectiveness when compared to fossil fuels such as diesel or natural gas.

What mining companies are realising is that there is a rare opportunity to score wins on multiple fronts by moving to renewable energy solutions, such as solar, wind and battery back up.

Firstly is the cost advantage, with renewable power solutions cheaper over the longer term than fossil fuels.

Renewable energy also provides a more fixed cost than fossil fuels, which can suffer from periods of high and sustained volatility, such as the world is currently experiencing.

Secondly, there is the reduction in carbon emissions from mining, which does help companies reach net-zero goals.

It’s worth noting that switching to renewable energy on mine sites really only helps with what are termed Scope 1 emissions, which are those associated with primary production.

Scope 2 emissions involve the supply chain and Scope 3 are those created by end users, such as power plants and steel mills.

Scope 3 emissions are the biggest contributor to most mining companies’ emissions profile, but even reducing Scope 1 emissions will help them in their net-zero goals.

More than image boost

There are also other benefits in embracing renewable technologies.

One example is the reduced need for ventilation in underground mines if the vehicles used to extract ore are battery powered, rather than using diesel engines.

The other benefits include an ability to argue that the industry is moving beyond greenwashing and is actually achieving emission reductions.

This may not be enough to sway mining’s most ardent critics, but it may be enough to help convince skilled young graduates and technicians that there is a future in mining, which is currently battling labour shortages in Australia.

Several participants at IMARC said they were struggling to attract young workers, who cite mining’s poor reputation as something that puts them off joining the industry.

Improving the image of mining as the champion of the energy transition is vital to attracting new entrants to the industry, making a genuine change of attitude and action among mining companies all the more important.

There are some caveats to the Australian experience in powering new mines, and switching older operations, over to renewable power solutions.

The first is that it’s currently extremely hard to go 100% renewable, given the cost in building enough renewable capacity and battery storage to overcome the small number of days when there is insufficient solar, wind and battery back up to keep a 24-hour mining operation going.

James Harman, chief executive officer of renewable energy solutions company EDL, told the conference that the industry needs to “recognise that 100% renewable doesn’t work currently,” but that achieving 80% is both feasible and cost effective.

In practice, this means many mines will operate mainly on renewables, but still maintain diesel generators as back up.

It’s possible to take the figure to 100% renewable if the mine sources sustainable diesel fuels, such as biodiesel, or uses carbon offsets to mitigate any fossil fuel consumption.

Harman also said that his company’s experience is that the pace of switching to renewables is accelerating, and it’s possible that most mines in Australia could be using mainly renewable power within five years, well ahead of those 2050 targets.

(Editing by Kim Coghill)

CRIMINAL CAPITALI$M

Alcoa sent three letters to the LME requesting action on Russian metalReuters | November 3, 2022 |  Credit: Wikimedia CommonsUnited States-based aluminum producer Alcoa wrote to the London Metal Exchange (LME) three times in September and October, asking for a boycott of Russian metal and greater disclosure on how much was in the LME system, the company said.

Credit: Wikimedia CommonsUnited States-based aluminum producer Alcoa wrote to the London Metal Exchange (LME) three times in September and October, asking for a boycott of Russian metal and greater disclosure on how much was in the LME system, the company said. In the letters, seen by Reuters, Alcoa expressed concerns that large amounts of Russian aluminum flowing into LME-registered warehouses could distort the exchange’s aluminum contract by making it reflect the price of unwanted material.While Russia has escaped official sanctions on its aluminum, copper, and nickel of the kind imposed on other sectors following its invasion of Ukraine, some Western companies have stopped accepting Russian metal.These include Alcoa and most of its customers, according to a letter the company sent to the LME dated Sept. 29 and signed by chief commercial officer Kelly Thomas.The letter said that without buyers, more metal made by Russian aluminum producer Rusal could be deposited on the exchange, which functions as a market of last resort, leaving the LME with stocks that Alcoa said many companies and banks may not want to deal with.“As we move into 2023 … it is easy to see a scenario where well over one million metric tons per year of Rusal metal could be put on warrant,” it said. “The LME aluminum contract will be distorted because it will disproportionately reflect the discounted value of the Rusal brand.”Rusal said efforts by its competitor to ban it from the exchange were “clearly for their own benefit”.“There are no plans to deliver aluminum to the exchange, by virtue of a strong sales and order book moving in to 2023,” it said in an emailed statement. “The data and evidence to support this has been provided directly to the LME.”The exchange declined to comment on the letters.The LME, the world’s biggest metals trade venue, asked its users on Oct. 6 if they thought the exchange should ban Russian metal, setting an Oct. 28 deadline for responses. It said last week it could take action on Russian metal if it became a problem, without saying what it would do.Alcoa is one of several US and European metals producers that have lobbied for the LME and Western governments to restrict trade in Russian metal. Some metals consumers have argued against this, saying restrictions would harm them while benefiting non-Russian producers.Letters sent by Alcoa to the LME dated Oct. 18 and Oct. 27 said around 250,000 tonnes of aluminum that entered LME-registered warehouses in October could be Russian, and asked the LME to publish daily disclosures showing how much Russian metal was in its system.Rusal said it was confident that most of the metal delivered to the exchange in October was not Russian. “Suggestions by competitors to the contrary are quite simply false, and damaging to market order,” it said.Alcoa said in its Oct. 27 letter, which was a response to the LME’s request for opinions from the market, that it urged the exchange “to immediately delist all Russian brands, regardless of the production date”.The company has also lobbied the US government to impose restrictions on Russian aluminum, something sources have said the government is considering.(By Peter Hobson; Editing by Jan Harvey)

In the letters, seen by Reuters, Alcoa expressed concerns that large amounts of Russian aluminum flowing into LME-registered warehouses could distort the exchange’s aluminum contract by making it reflect the price of unwanted material.While Russia has escaped official sanctions on its aluminum, copper, and nickel of the kind imposed on other sectors following its invasion of Ukraine, some Western companies have stopped accepting Russian metal.These include Alcoa and most of its customers, according to a letter the company sent to the LME dated Sept. 29 and signed by chief commercial officer Kelly Thomas.The letter said that without buyers, more metal made by Russian aluminum producer Rusal could be deposited on the exchange, which functions as a market of last resort, leaving the LME with stocks that Alcoa said many companies and banks may not want to deal with.“As we move into 2023 … it is easy to see a scenario where well over one million metric tons per year of Rusal metal could be put on warrant,” it said. “The LME aluminum contract will be distorted because it will disproportionately reflect the discounted value of the Rusal brand.”Rusal said efforts by its competitor to ban it from the exchange were “clearly for their own benefit”.“There are no plans to deliver aluminum to the exchange, by virtue of a strong sales and order book moving in to 2023,” it said in an emailed statement. “The data and evidence to support this has been provided directly to the LME.”The exchange declined to comment on the letters.The LME, the world’s biggest metals trade venue, asked its users on Oct. 6 if they thought the exchange should ban Russian metal, setting an Oct. 28 deadline for responses. It said last week it could take action on Russian metal if it became a problem, without saying what it would do.Alcoa is one of several US and European metals producers that have lobbied for the LME and Western governments to restrict trade in Russian metal. Some metals consumers have argued against this, saying restrictions would harm them while benefiting non-Russian producers.Letters sent by Alcoa to the LME dated Oct. 18 and Oct. 27 said around 250,000 tonnes of aluminum that entered LME-registered warehouses in October could be Russian, and asked the LME to publish daily disclosures showing how much Russian metal was in its system.Rusal said it was confident that most of the metal delivered to the exchange in October was not Russian. “Suggestions by competitors to the contrary are quite simply false, and damaging to market order,” it said.Alcoa said in its Oct. 27 letter, which was a response to the LME’s request for opinions from the market, that it urged the exchange “to immediately delist all Russian brands, regardless of the production date”.The company has also lobbied the US government to impose restrictions on Russian aluminum, something sources have said the government is considering.(By Peter Hobson; Editing by Jan Harvey)

CRIMINAL CAPITALI$M

UK court fines Glencore $308 million for bribing its way across AfricaBloomberg News | November 3, 2022  Less than four weeks after South Sudan became an independent country in 2011, a delegation of Glencore Plc traders arrived by private jet in search of oil. They were carrying with them $800,000 in cash to pay bribes.

Less than four weeks after South Sudan became an independent country in 2011, a delegation of Glencore Plc traders arrived by private jet in search of oil. They were carrying with them $800,000 in cash to pay bribes. The revelation was among several detailed in a London courtroom this week that showed how, decades after Glencore founder Marc Rich created the popular image of commodity traders criss-crossing the globe to dispense bribes in exchange for lucrative contracts, remarkably little had changed in the way some traders at the company were doing business.The UK Serious Fraud Office showed how Glencore paid more than $28 million in bribes across five African countries over five years to 2016, using methods that were in some cases carbon copies of deals that Rich had put in place in the 1970s and 1980s. On Thursday, a judge handed down a penalty of £276 million ($308 million) for Glencore’s conduct, on top of around $1.1 billion the company has already paid in related cases in the US and Brazil.Glencore traders hand delivered large quantities of cash to government officials, they sought to profit from political turmoil, and they inserted themselves into government-to-government deals that had been negotiated at preferential rates.In South Sudan, Glencore wasted little time. The east African country became independent on July 9, 2011. By July 21 a Glencore executive — identified by the SFO only as “GE7” and as the company’s Business Ethics Committee member for the London office — was on a plane “to persuade the President of South Sudan and others in government” to give Glencore’s joint venture there a contract to sell its oil.Two other employees arrived in the capital Juba with $800,000 in cash a few days later. They said it was for “opening office in South Sudan, cash for office infrastructure, salaries, cars etc.,” but Glencore’s local agent in fact used some of it to pay bribes, the SFO said.A few months later, the assistant to the President of South Sudan visited Glencore executives in Zurich and London. A Glencore executive withdrew a further $275,000 from the company’s “cash desk” at its Swiss headquarters, and the next day Glencore’s South Sudanese unit was offered an oil deal.Commodity traders have spent years trying to distance themselves from the image of their industry forged in the days of characters like Marc Rich, instead presenting themselves as logistics businesses, moving oil, metals and grain from A to B in response to market signals.But the revelations about Glencore’s trading in Africa come just six months after the London-listed company pleaded guilty in related US cases, while top oil trader Vitol Group admitted to paying bribes in three Latin American countries, and Brazilian prosecutors accused Trafigura Group of involvement in a kickback scheme, in a civil case. Trafigura has denied the allegations.“The extremely sizeable cash sums that were permitted to be withdrawn from the offices in Switzerland, using such spurious descriptions as office expenses, demonstrates the most blatant of conduct,” Judge Peter Fraser said at the Southwark Crown Court on Thursday. “It demonstrates the number of people at Glencore who must have been complicit in this behavior.” An SFO prosecutor said Oct. 24 that as many as 11 former staff were under investigation for criminal wrongdoing.“The corruption described is so brazen. This was less than 10 years ago,” said Alexandra Gillies, author of Crude Intentions, a book about corruption in the oil industry. “It’s critical that the executives and employees involved are held legally accountable. Bribery was clearly an embedded part of the company’s approach to maximizing profits in some of the poorest countries in the world.”At the hearing attended by Glencore’s chair, Kalidas Madhavpeddi, the company’s lawyer said the company “unreservedly regrets the harm caused by these offenses.” Madhavpeddi declined to comment on the proceedings when approached by Bloomberg outside the court.The SFO case outlined how in Nigeria, Glencore paid millions of dollars to an intermediary that were used to bribe officials at the state oil company, using sham contracts to disguise the true purpose of the payments. The Nigerian agent also transported cash by private jet to Cameroon. There a Glencore trader used it to bribe officials at the state oil and gas company and the state refinery.In Malawi, Glencore used a playbook that Rich had pioneered 40 years earlier. In the 1980s, thanks to an enterprising employee who went by the pseudonym Monsieur Ndolo, the trading house inserted itself in a deal between the government of Iran and the government of Burundi, profiting from the interest-free payment terms that Tehran was willing to offer its poorer African ally.In its case summary, the SFO detailed how Glencore had done something similar in a government-to-government oil deal between Nigeria and Malawi. Glencore traders and executives sanctioned bribes to officials at the Nigerian state oil company in order to take “take advantage of the ‘free credit’ benefit inherent in the joint venture agreement,” according to the SFO.The SFO noted that Glencore had anti-corruption policies in place at the time of the wrongdoing, but said “these were largely ignored because corruption was condoned at a very senior level within the company.”(By Jack Farchy and Jonathan Browning, with assistance from Thomas Biesheuvel)

The revelation was among several detailed in a London courtroom this week that showed how, decades after Glencore founder Marc Rich created the popular image of commodity traders criss-crossing the globe to dispense bribes in exchange for lucrative contracts, remarkably little had changed in the way some traders at the company were doing business.The UK Serious Fraud Office showed how Glencore paid more than $28 million in bribes across five African countries over five years to 2016, using methods that were in some cases carbon copies of deals that Rich had put in place in the 1970s and 1980s. On Thursday, a judge handed down a penalty of £276 million ($308 million) for Glencore’s conduct, on top of around $1.1 billion the company has already paid in related cases in the US and Brazil.Glencore traders hand delivered large quantities of cash to government officials, they sought to profit from political turmoil, and they inserted themselves into government-to-government deals that had been negotiated at preferential rates.In South Sudan, Glencore wasted little time. The east African country became independent on July 9, 2011. By July 21 a Glencore executive — identified by the SFO only as “GE7” and as the company’s Business Ethics Committee member for the London office — was on a plane “to persuade the President of South Sudan and others in government” to give Glencore’s joint venture there a contract to sell its oil.Two other employees arrived in the capital Juba with $800,000 in cash a few days later. They said it was for “opening office in South Sudan, cash for office infrastructure, salaries, cars etc.,” but Glencore’s local agent in fact used some of it to pay bribes, the SFO said.A few months later, the assistant to the President of South Sudan visited Glencore executives in Zurich and London. A Glencore executive withdrew a further $275,000 from the company’s “cash desk” at its Swiss headquarters, and the next day Glencore’s South Sudanese unit was offered an oil deal.Commodity traders have spent years trying to distance themselves from the image of their industry forged in the days of characters like Marc Rich, instead presenting themselves as logistics businesses, moving oil, metals and grain from A to B in response to market signals.But the revelations about Glencore’s trading in Africa come just six months after the London-listed company pleaded guilty in related US cases, while top oil trader Vitol Group admitted to paying bribes in three Latin American countries, and Brazilian prosecutors accused Trafigura Group of involvement in a kickback scheme, in a civil case. Trafigura has denied the allegations.“The extremely sizeable cash sums that were permitted to be withdrawn from the offices in Switzerland, using such spurious descriptions as office expenses, demonstrates the most blatant of conduct,” Judge Peter Fraser said at the Southwark Crown Court on Thursday. “It demonstrates the number of people at Glencore who must have been complicit in this behavior.” An SFO prosecutor said Oct. 24 that as many as 11 former staff were under investigation for criminal wrongdoing.“The corruption described is so brazen. This was less than 10 years ago,” said Alexandra Gillies, author of Crude Intentions, a book about corruption in the oil industry. “It’s critical that the executives and employees involved are held legally accountable. Bribery was clearly an embedded part of the company’s approach to maximizing profits in some of the poorest countries in the world.”At the hearing attended by Glencore’s chair, Kalidas Madhavpeddi, the company’s lawyer said the company “unreservedly regrets the harm caused by these offenses.” Madhavpeddi declined to comment on the proceedings when approached by Bloomberg outside the court.The SFO case outlined how in Nigeria, Glencore paid millions of dollars to an intermediary that were used to bribe officials at the state oil company, using sham contracts to disguise the true purpose of the payments. The Nigerian agent also transported cash by private jet to Cameroon. There a Glencore trader used it to bribe officials at the state oil and gas company and the state refinery.In Malawi, Glencore used a playbook that Rich had pioneered 40 years earlier. In the 1980s, thanks to an enterprising employee who went by the pseudonym Monsieur Ndolo, the trading house inserted itself in a deal between the government of Iran and the government of Burundi, profiting from the interest-free payment terms that Tehran was willing to offer its poorer African ally.In its case summary, the SFO detailed how Glencore had done something similar in a government-to-government oil deal between Nigeria and Malawi. Glencore traders and executives sanctioned bribes to officials at the Nigerian state oil company in order to take “take advantage of the ‘free credit’ benefit inherent in the joint venture agreement,” according to the SFO.The SFO noted that Glencore had anti-corruption policies in place at the time of the wrongdoing, but said “these were largely ignored because corruption was condoned at a very senior level within the company.”(By Jack Farchy and Jonathan Browning, with assistance from Thomas Biesheuvel)

Column: Unloved lead gets to join the Bloomberg commodity A-list

Reuters | November 3, 2022 |

Stock image.

Lead will become the 24th commodity to be included in the Bloomberg Commodity Index (BCOM), joining its London Metal Exchange (LME) peers aluminum, copper, nickel, and zinc.

The London three-month lead price jumped almost 10% to $2,019.50 per tonne on Friday’s news, although it’s since pared its gains to a current $1,965.

The reaction is understandable if a little premature. Although lead will have only a 0.936% weighting in the index, the lowest of any of the base metals, it will still translate into fund buying at the start of next year as asset managers adjust to the new weightings.

Perhaps equally important is what inclusion says about a metal widely assumed to be heading for obsolescence as lead-acid batteries succumb to the relentless march of lithium-powered electric vehicles (EV).

The frequent reports of lead’s death, however, continue to be much exaggerated.

Lead’s not dead

It’s not easy being a lead market analyst.

“One of the frustrations (…) is people telling you constantly that lead is dead,” lamented Andrew Thomas, director for zinc and lead at Wood Mackenzie.

However, as he explained at the research house’s LME Week Seminar, what everyone forgets is that of the 80 million passenger vehicles produced last year “just about every single one had a lead-acid battery in them”.

And that includes the eight million electric vehicles produced. In the excitement around new battery metals such as lithium and cobalt, it’s easy to overlook the fact that EVs have a back-up lead battery for safety systems and to power in-car entertainment systems.

Lead-acid batteries need replacing every few years. Given an average vehicle life of 13-14 years, last year’s 80 million vehicles will still be requiring replacement batteries in the early part of the next decade.

Lead’s usage profile is one of unexciting but steady growth, driven by the need to meet demand for replacement batteries in an ever-growing global passenger fleet.

Economic significance

Supply has grown to match demand, global production of refined lead creeping up from under 10 million tonnes in 2010 to 12.38 million tonnes last year, according to the International Lead and Zinc Study Group (ILZSG).

The BCOM looks at five-year averages of exchange liquidity and production data to determine which commodities are included and at what weighting.

The idea is that selected commodities should be both important to the global economy and reflect the value placed on that role by financial markets.

Global lead production has grown sufficiently over the last five years to merit inclusion even though trading liquidity has decreased, according to a statement from Bloomberg.

BCOM determines base metals liquidity with reference to the LME lead contract, which saw volumes fall by 3.8% last year with a further 7.7% decline over the first nine months of this year.

Lead’s performance should be seen in the context of a 4.7% slide in total LME volumes last year and the broader drop in activity following the exchange’s nickel blow-out in March this year.

However, weak trading activity also reflects lead’s unloved status relative to sister metal zinc. LME zinc volumes are more than double those of lead, even though global production of refined zinc was only slightly higher at 13.85 million tonnes last year.

Bumpy ride

With replacement battery demand accounting for around half of global lead usage each year and recycled metal for around 60% of supply, lead’s market dynamics are quite different from the other industrial metals.

Batteries fail in boom times and bad, meaning lead is partly insulated from the economic cycle and has a history of shallower troughs but lower peaks than other LME metals.

The lead market, in other words, can be a bit boring.

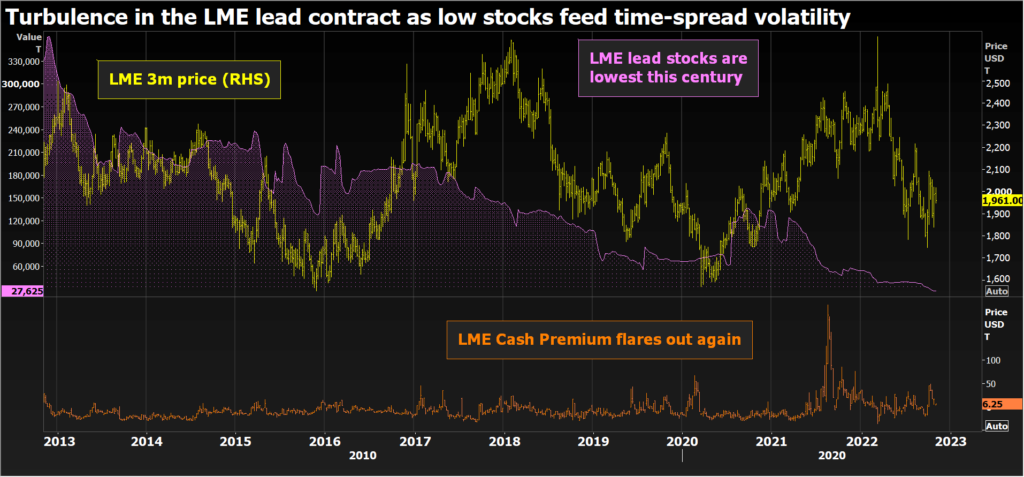

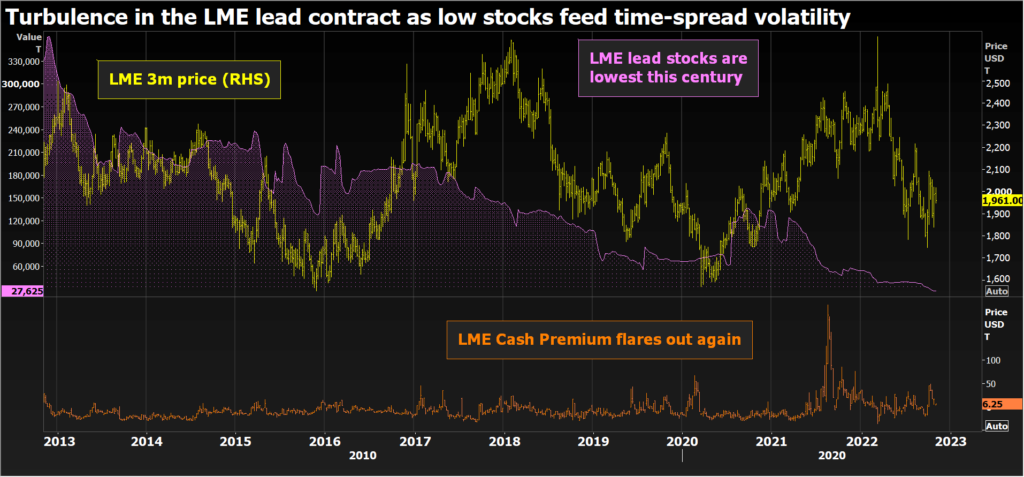

But not right now. It’s ironically going through a bout of turbulence just as it’s about to be elevated to commodity A-list status.

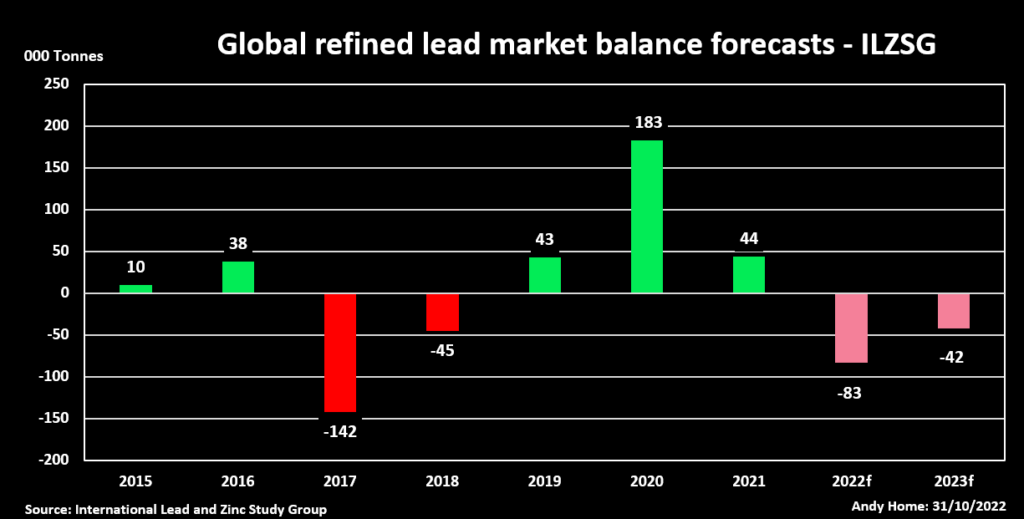

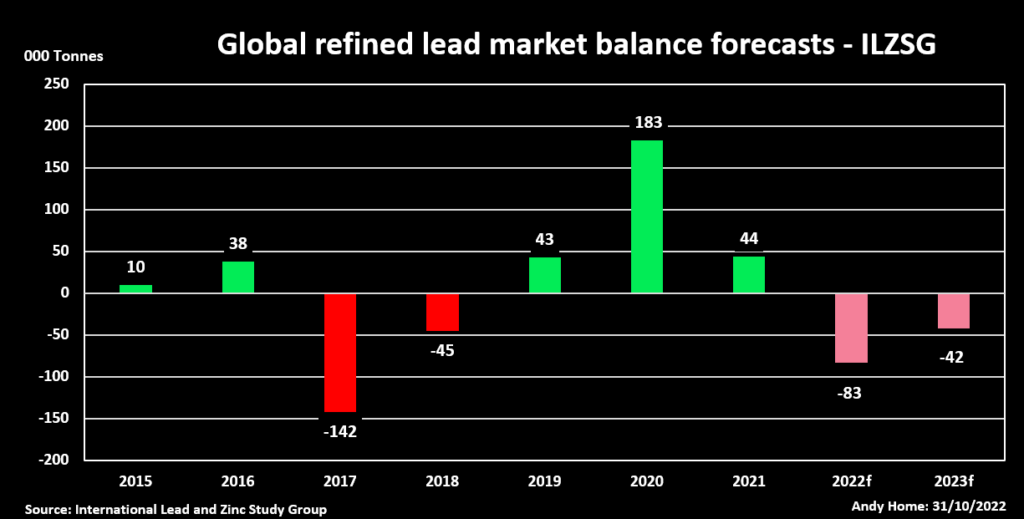

An unusual sequence of smelter disruption will cause global refined output to slide by 0.3% in 2022, according to ILZSG, which was expecting a 1.3% rise as recently as April.

European supply has been hit by the year-long outage due to flooding of Germany’s Stolberg plant, the loss of Russian imports due to sanctions and, most recently, the shuttering of secondary capacity in Italy.

ILZSG also noted falling production in North America, Turkey, South Korea and Australia, where planned maintenance works at Nyrstar’s Port Pirie smelter will halt production for two months in the fourth quarter.

The Group is now forecasting a global supply deficit of 83,000 tonnes this year and another 42,000 tonnes in 2023 before smelters catch up with demand.

LME stocks are super low at 27,625 tonnes, equivalent to less than a day’s worth of global consumption. That’s feeding time-spread tension, the cash premium to three-month metal CMPB0-3 flexing out to $48.50 per tonne last month, the widest it’s been this year.

Physical premiums are at record highs, Fastmarkets assessing that for U.S. Midwest delivery at 22.5 cents per lb (US$496 per tonne) over the LME cash price.

Western shortfall is being met by Chinese exports. China was a consistent net importer over the 2017-2020 period but flipped to net exporter last year to the tune of 93,000 tonnes. Net exports in the first nine months of this year have already almost exceeded that figure at 92,000 tonnes.

The flow of Chinese metal is expected to continue until supply and demand rebalance in Western markets.

These are turbulent times for normally sleepy lead and set an interesting backdrop to the fund buying that will follow the January reweighting.

That buying will also coincide with the northern hemisphere winter, a peak demand season for lead as cold weather makes batteries more prone to failure.

It’s just another distinctive quirk of the metal that refuses to go away.

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

(Editing by Jane Merriman)

Britishvolt says UK’s political turmoil has put off investors

Bloomberg News | November 3, 2022 |

Credit: Britishvolt

Beleaguered battery startup Britishvolt Ltd. blamed the UK’s political chaos for putting off investors but said the cheap pound is now making it an attractive prospect for American investors.

“We’ve had lot of political change and that sort of instability,” said Chairman Peter Rolton, speaking at the site of the company’s proposed factory in Blyth, northern England.

“We lost many investors,” he added. “They were already nervous about the UK.”

Britishvolt was heralded as a key part of the country’s drive toward an electric car manufacturing boom. It planned to produce millions of batteries needed by carmakers ahead of a 2030 deadline for sales of new vehicles that run off fossil fuels.

However, this week it announced short-term bridging finance in a bid to avoid entering administration.

Former Prime Minister Liz Truss’s government triggered a rout on gilts and the pound in September after revealing extensive subsidies for families’ and businesses’ energy use, alongside sweeping, unfunded tax cuts.

Rolton was speaking alongside the opposition Labour Party’s Shadow Business Secretary Jonathan Reynolds who was visiting the site, north of Newcastle.

“It’s the government’s actions with the mini budget that’s made the situation harder for Britishvolt,” Reynolds said. “It’s had an impact on the investability of the UK and how people perceive the UK.”

However, Rolton said sterling’s drop against the dollar had its advantages. “The pound make us a cheap date,” he said. “Investors are thinking ‘hang on a minute we are getting more bang for our bucks’ — so there has definitely been an uptick in interest.”

The less than three-year-old business has the funds to keep it going until early December, while staff have taken a pay cut for November to help it stay afloat.

Rolton said that the company had sought £30 million from the UK government over the weekend, but its request had been rejected. Government funding was key to getting overseas investors to commit funding, Rolton said.

On Wednesday, Bloomberg News reported that Glencore Plc, one of the world’s biggest mining and commodity trading companies, was among lenders that provided less than £5 million in the form of a bridging loan, after the company said it’s pursuing “positive ongoing discussions” with potential funders and has received approaches from “several more international investors in the past few days.”

(By Eamon Akil Farhat and Siddharth Philip)

Equinox Partners launches website with aim to improve board governance in gold mining

Staff Writer | November 3, 2022

Image by Jo Johnston from Pixabay.

Equinox Partners, a long-term value investor, announced Thursday the launch of “Directors Without Stock” to amplify its investment stewardship policy.

The New York-based hedge fund, with over $700 million in total assets under management with more than half in gold and silver junior miners, announced its new investment stewardship policy toward directors of public companies last month. Equinox Partners will vote against directors who have served for two or more years but hold less than two years of director’s fees in the company’s stock.

It sets “a clear, lower-bound for director share ownership,” according to chief investment officer Sean Fieler.

The website lists directors of gold and silver mining companies in the MVIS Global Junior Miners Index (GDXJ) who fail the firm’s stewardship policy and includes the director’s photo, name, company, total shares owned, value of shares owned, annual compensation, ratio of value of shares to compensation, and years on board, Equinox said in a news release.

Key results on the website include:

• Of the 95 gold and silver mining companies in the index with readily available public filings, there were 590 directors, of which 125, or 21%, that failed the Equinox Partners stewardship policy;

• Of those 125 that failed, 37 owned no stock at all;

• Of those 37 that owned no stock, the average board tenure was 8 years; and

• By eliminating the two-year minimum tenure constraint, 311 directors, or 53%, would fail the Equinox Partners policy.

By adopting a clear, lower-bound for director share ownership, Equinox Partners said it is pushing back on the growing indifference of boards to non-executive director stock ownership and the decision of some companies to prohibit non-executive directors from owning stock all together.

Equinox said it believes financially aligned directors are more likely to prioritize returns on and of owners’ capital. In comparison, the Canadian E&P industry is an example of a similar capital-intensive industry that has incentivized more insider ownership and prioritized disciplined capital allocation.

“Directors who lack any meaningful financial alignment with shareholders are going to tend to things that aren’t in the financial best interest of shareholders,” Fieler said in a statement.

“Insider ownership amongst the gold miners is worsening, as passive investors push board turnover that does not always align with the interest of shareholders. We hope our policy and this new site can be a step in a different direction.”

British researchers come up with intelligent design process for furnaces

Staff Writer | November 4, 2022

Smelter. (Image courtesy of Mechatherm International Limited).

Researchers at England’s Aston University and Mechatherm International Limited (MIL) have developed a more intelligent design process for furnaces and ancillary equipment for the global aluminium industry.

According to the academic-industry team, the project has considerably reduced product development time and costs and has a projected annual sales turnover of more than £7.4 million over the next three years.

MIL is a leading provider of casthouse equipment for the aluminium industry. The company currently operates under the challenging circumstances imposed by Brexit and the covid-19 pandemic, which has seen its costs increase over a number of years.

To create further growth, the firm decided it was essential to streamline its engineering practices, resulting in reduced overheads.

Their collaboration with Aston University has allowed them to reach this objective, as it led to the optimization of the company’s automation techniques used in the design of its products.

Feeding an AI system with millions of records of data, the company was able to automate the process of advising furnace operators when action should be taken to maximize a machine’s efficiency. This is particularly useful when the time comes for a furnace to receive or transfer material, as reducing the delays associated with normal operation can increase efficiency.

A simple traffic light system was installed on a new screen giving operators an easy visual to make the choice to attend to the load.

” In technology terms, this would equate to using an offline brain watching and learning how the furnace operates, gauging energy use per cycle and suggesting when the optimum parameters have been met,” a media statement by MIL reads.

The joint project has also resulted in a high level of upfront detailed engineering, but at the fraction of the time and cost.

“This partnership has allowed us to produce a system which has saved time and resources, enabling us additional time to develop innovative solutions for the material recycling market and alternative hydrogen-fueled furnace concepts,” Owen Tollerfield, chief mechanical engineer at Mechatherm International Limited, said in the press brief.

.png)