Video: Why coal companies love bankruptcy

Bloomberg News | December 16, 2022 |

(Image courtesy of the American Thoracic Society).

US coal companies are required by law to clean up their old mines, but a common practice of transferring those mines to smaller operators has left many polluted sites unreclaimed throughout coal country.

In this episode of Bloomberg Storylines we travel to the nation’s coal belt, revealing the environmental wreckage left by mining across wide swaths of land and the damage done to those who live nearby. We also meet one man on a crusade to make those coal companies clean up their mess and never come back.

(By Alan Jeffries)

(Image courtesy of the American Thoracic Society).

US coal companies are required by law to clean up their old mines, but a common practice of transferring those mines to smaller operators has left many polluted sites unreclaimed throughout coal country.

In this episode of Bloomberg Storylines we travel to the nation’s coal belt, revealing the environmental wreckage left by mining across wide swaths of land and the damage done to those who live nearby. We also meet one man on a crusade to make those coal companies clean up their mess and never come back.

(By Alan Jeffries)

World’s coal consumption set to breach new record this year

Bloomberg News | December 16, 2022 |

A coal-fired power station in Nantong, China. (Image by Kristoferb, Wikimedia Commons).

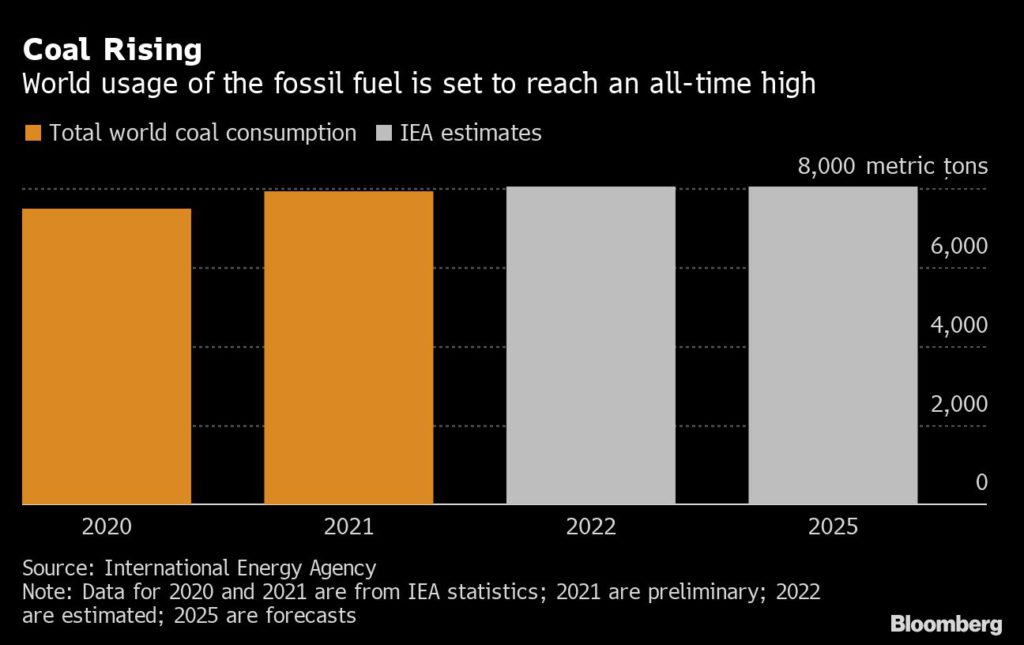

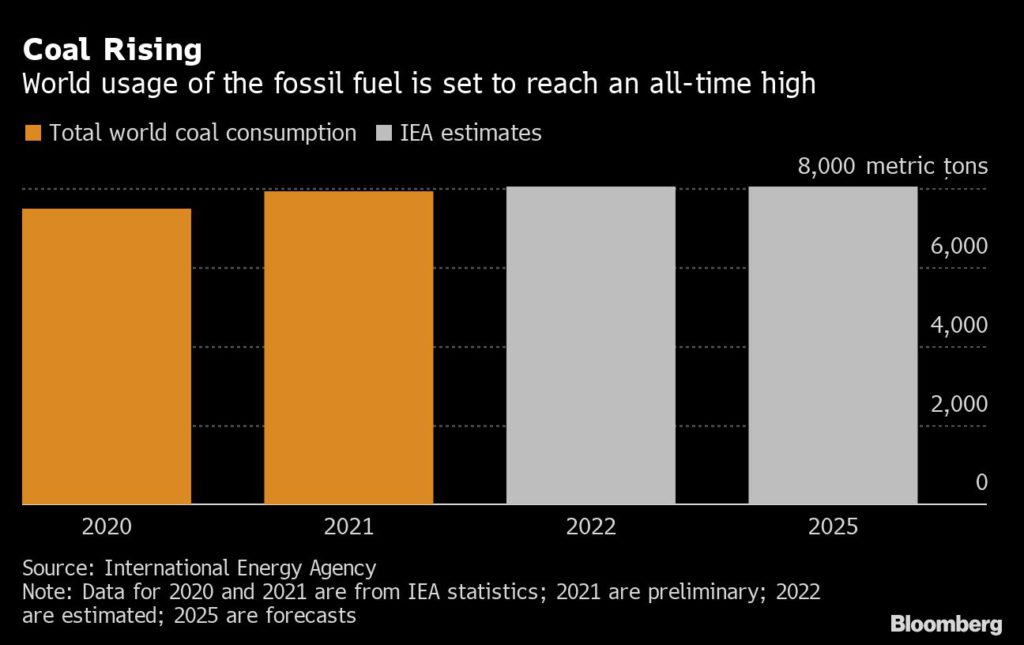

World coal consumption is set to rise to the highest level ever this year despite ambitious global goals aimed at weaning nations off burning the dirty fossil fuel.

Coal usage looks likely to increase by 1.2% in 2022, surpassing 8 billion tonnes in a single year for the first time, according to an International Energy Agency report published Friday. It also said consumption will likely remain at that level until 2025, as declines in advanced economies are offset by demand in emerging Asian markets, such as China and India.

Europe’s heavy reliance on coal this year is largely driven by Russia’s curtailment of gas supplies to the continent, forcing it to draw on other other energy sources. It’s at a time when European leaders are also attempting to shift toward renewables to secure a clean source of power going forward.

The analysis “underlines the urgent need to massively scale up renewable power and energy efficiency so that we cut people’s bills, secure our energy supplies, and keep essential climate targets intact,” Alexandru Mustața, a campaigner at Europe Beyond Coal said.

“Importantly, no European country has revised its plans to phase out coal completely by 2030, and Europe is still on track to be coal free by the end of the decade.”

Bloomberg News | December 16, 2022 |

A coal-fired power station in Nantong, China. (Image by Kristoferb, Wikimedia Commons).

World coal consumption is set to rise to the highest level ever this year despite ambitious global goals aimed at weaning nations off burning the dirty fossil fuel.

Coal usage looks likely to increase by 1.2% in 2022, surpassing 8 billion tonnes in a single year for the first time, according to an International Energy Agency report published Friday. It also said consumption will likely remain at that level until 2025, as declines in advanced economies are offset by demand in emerging Asian markets, such as China and India.

Europe’s heavy reliance on coal this year is largely driven by Russia’s curtailment of gas supplies to the continent, forcing it to draw on other other energy sources. It’s at a time when European leaders are also attempting to shift toward renewables to secure a clean source of power going forward.

The analysis “underlines the urgent need to massively scale up renewable power and energy efficiency so that we cut people’s bills, secure our energy supplies, and keep essential climate targets intact,” Alexandru Mustața, a campaigner at Europe Beyond Coal said.

“Importantly, no European country has revised its plans to phase out coal completely by 2030, and Europe is still on track to be coal free by the end of the decade.”

Canada blocks Glencore’s proposed coal mine project in British Columbia

Reuters | December 21, 2022 |

Near Tumbler Ridge, British Columbia. Stock image.

Canada on Wednesday blocked Glencore Plc’s proposed coal mine project in British Columbia, citing significant environmental damage.

“After careful deliberation, the Government of Canada has determined the significant adverse environmental effects of the proposed Sukunka Coal Mine Project, an open-pit metallurgical coal mine located near Tumbler Ridge, British Columbia, could not be mitigated,” the government said.

(By Kanjyik Ghosh; Editing by Leslie Adler)

Near Tumbler Ridge, British Columbia. Stock image.

Canada on Wednesday blocked Glencore Plc’s proposed coal mine project in British Columbia, citing significant environmental damage.

“After careful deliberation, the Government of Canada has determined the significant adverse environmental effects of the proposed Sukunka Coal Mine Project, an open-pit metallurgical coal mine located near Tumbler Ridge, British Columbia, could not be mitigated,” the government said.

(By Kanjyik Ghosh; Editing by Leslie Adler)

Staff Writer | December 20, 2022 |

The Quintette steelmaking coal mine has been on care and maintenance since 2000.

(Image courtesy of Teck Resources.)

Teck Resources (TSX: TECK.A | TECK.B) (NYSE: TECK), Canada’s largest diversified miner, has reached a deal to sell its closed Quintette steelmaking coal mine to Conuma Resources for $120 million cash.

The asset, in northeast British Columbia, has been shuttered since 2000, after being in operations for 18 years.

Teck said Conuma Resources, a Canadian a steelmaking coal producer, will also pay an ongoing 25% net profits interest royalty once it recovers its investment in Quintette.

The Vancouver-based miner is using strong cash flows from its coal business to expand its copper development, including the Quebrada Blanca Phase 2 (Q2) expansion project in Chile.

Once in operation, Q2 would double Teck’s copper production, extending Quebrada Blanca’s life by 28 years and boosting production to 300,000 tonnes of copper a year from 287,000 tonnes in 2017.

Major steelmakers are starting to move away from coking coal used in blast furnaces and switching to greener alternatives, such as hydrogen.

The International Energy Agency published a report in November that shows “hydrogen-based steelmaking has picked up significant momentum”. According to the agency, the number of steelmakers’ announcements to use such technology tripled over the prior 12 months.

According to the World Steel Association, the industry is responsible for between 7% and 9% of the global emissions created from the burning of fossil fuels.

Teck Resources (TSX: TECK.A | TECK.B) (NYSE: TECK), Canada’s largest diversified miner, has reached a deal to sell its closed Quintette steelmaking coal mine to Conuma Resources for $120 million cash.

The asset, in northeast British Columbia, has been shuttered since 2000, after being in operations for 18 years.

Teck said Conuma Resources, a Canadian a steelmaking coal producer, will also pay an ongoing 25% net profits interest royalty once it recovers its investment in Quintette.

The Vancouver-based miner is using strong cash flows from its coal business to expand its copper development, including the Quebrada Blanca Phase 2 (Q2) expansion project in Chile.

Once in operation, Q2 would double Teck’s copper production, extending Quebrada Blanca’s life by 28 years and boosting production to 300,000 tonnes of copper a year from 287,000 tonnes in 2017.

Major steelmakers are starting to move away from coking coal used in blast furnaces and switching to greener alternatives, such as hydrogen.

The International Energy Agency published a report in November that shows “hydrogen-based steelmaking has picked up significant momentum”. According to the agency, the number of steelmakers’ announcements to use such technology tripled over the prior 12 months.

According to the World Steel Association, the industry is responsible for between 7% and 9% of the global emissions created from the burning of fossil fuels.

.jpg)