Reuters | March 6, 2023 |

Canada’s Minister of Natural Resources Jonathan Wilkinson. (Image courtesy of Province of British Columbia.)

Canada is working toward easing permitting process for mining companies so that the permitting does not take several years, Natural Resources Minister Jonathan Wilkinson said at the Prospectors and Developers Association of Canada (PDAC) conference in Toronto on Monday.

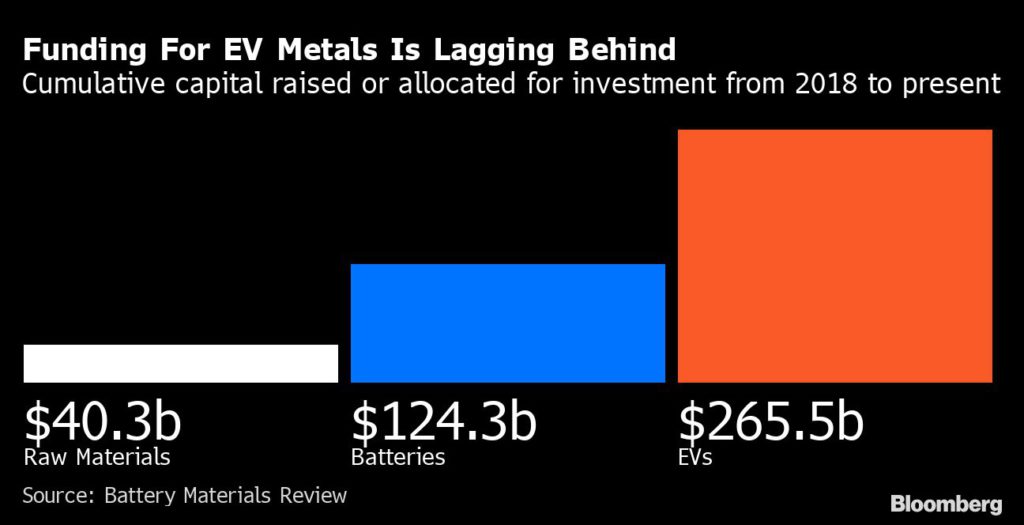

Canada could consider tax reform offering incentives for investment in clean energy – similar to what the United States has done – in its upcoming budget in an attempt to attract investment to its critical minerals sector, Wilkinson said.

“We are reviewing Canada’s regulatory process for clean energy projects including critical minerals,” Wilkinson said.

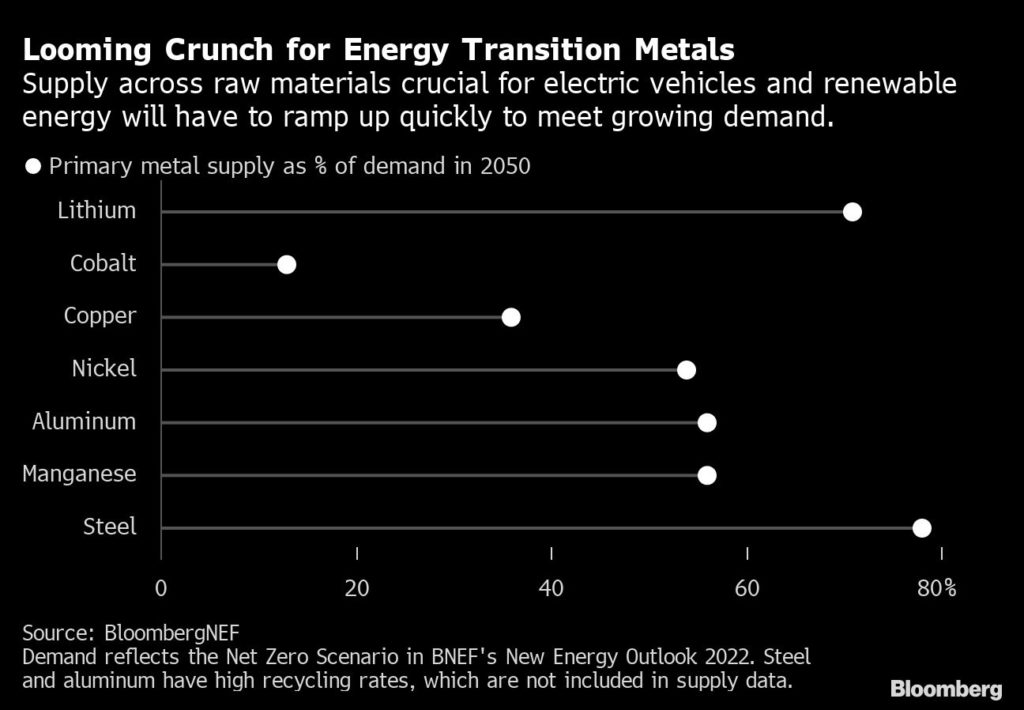

Canada and its allies, in an attempt to rely less on China, have been looking to diversify their supply chains and find local sources for mining and processing critical metals such as lithium.

Citing the incentives for clean energy investments in the $430 billion Inflation Reduction Act in the United States, Wilkinson said Canada needed a similarly competitive tax environment.

At PDAC, one of the largest mining conferences in North America, mining companies are looking for clues on policy, especially as Prime Minister Justin Trudeau’s administration adopts a hawkish stance on China, one of the largest investors in mines around the world.

Some junior mining companies have expressed concerns that Canada’s move to restrict investments from certain countries such as China could hurt their plans.

Industry Minister Francois Philippe Champagne, who was also in attendance, responded that he was not concerned and that a record number of companies were interested in investing in Canada.

“The decision to block the Chinese lithium investments has been well received by our partners and allies around the world.” Champagne said.

(Reporting by Divya Rajagopal in Toronto; writing by Ismail Shakil –Editing by Deepa Babington)