Reuters | March 20, 2023 |

Juukan Gorge cave sites seen before the destruction. (Screenshot via YouTube.)

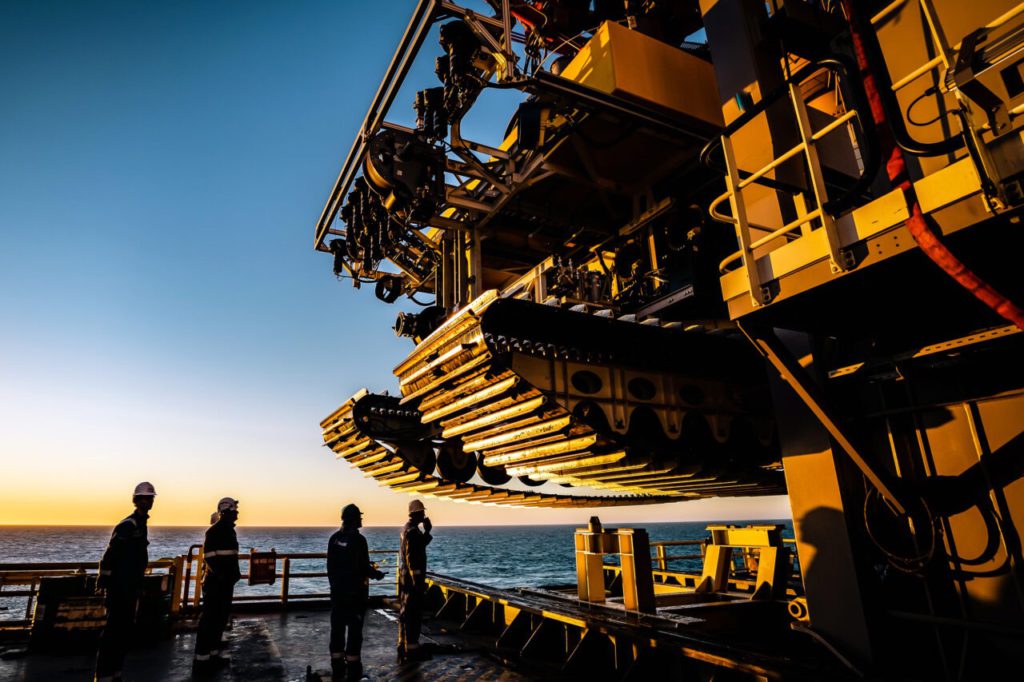

Rio Tinto has more work to do to protect Indigenous cultural heritage at its mines around the world, according to an independent audit of its practices, the world’s biggest iron ore miner said on Monday.

Rio Tinto commissioned the audit as part of a pledge to overhaul its practices after it destroyed culturally significant rock shelters at Juukan Gorge in Western Australia for an iron ore mine in 2020.

The report noted improved practices particularly at Rio’s iron ore operations but found it needed to more consistently meet best practice standards, which includes co-designing mining plans with affected communities, at its other global sites.

At around half of its sites, Rio Tinto either was missing a cultural heritage plan, its plan was out of date or had critical gaps, the report by sustainability consultancy ERM found.

“Consequently, there is a risk that current and emerging impacts to cultural heritage are not being readily identified and/or appropriately managed,” ERM said.

One of the major changes Rio Tinto vowed to make in the wake of the destruction at Juukan Gorge was to ensure project bosses were aware of and responsible for cultural heritage protection on their patch by embedding it into their decision-making process.

The audit also found nearly half of Rio’s assets lacked access to appropriately qualified and experienced cultural heritage expertise within the business. Cultural heritage management should not be contracted out because ownership of decisions should reside at Rio Tinto, ERM said.

The global miner needed to improve and make more consistent its cultural heritage planning around water management and around closure of its operations, it added.

The report followed an audit of 37 Rio Tinto assets. The audit was completed throughout 2021 and 2022 across 20 assets in Australia and 17 assets in other countries where Rio Tinto operates including Canada, South Africa, US and Mongolia.

(By Melanie Burton; Editing by Simon Cameron-Moore)

Related Article: Rio Tinto played down Australian heritage damage at inquiry, aboriginal group says

Cameron Livingstone MNI is the secretary of the

Cameron Livingstone MNI is the secretary of the