California to Start Phase Out All Diesel Trucks at Ports Next Year

The California Air Resources Board (CARB) approved on April 28 a first-of-its-kind rule that requires a phased transition toward zero-emission medium-and-heavy duty vehicles. Known as Advanced Clean Fleets, the new rule expands on California’s efforts to fully transition the trucks that travel across the state to zero-emissions technology by 2045 and includes provision for the ports and their cargo handling equipment.

Under the new rule, fleet owners operating vehicles for private services such as last-mile delivery and federal fleets such as the Postal Service, along with state and local government fleets, will begin their transition toward zero-emission vehicles starting in 2024. Drayage trucks, including those used to haul containers and freight from the ports as well as rail yards, are among the first to be targeted. Only zero-emission drayage trucks may register with CARB starting January 1, 2024. While there are provisions to phase out older trucks and ensure that operate through their useful life, dryage trucks will need to be zero-emissions by 2035.

The new bill is not entirely unanticipated. California has existing regulations since 2020 which required manufacturers to increase the sale of zero-emission trucks. Increasing numbers of zero-emission vehicles and cargo moves have begun to be introduced at the ports.

The Advanced Clean Fleets rule sets an end to combustion truck sales in 2036, a first-in-the-world requirement. In addition to impacting the trucks moving freight from the ports and rail yards, the new rules include provisions for off-road tractors. This will include vehicles such as cargo movers used in the yards at the ports. Other truck segments also have deadlines ranging from work trucks and day cab tractors must be zero-emission by 2039, and sleeper cab tractors and specialty vehicles must be zero-emission by 2042.

“We have the technology available to start working toward a zero-emission future now,” said CARB Chair Liane Randolph. “The Advanced Clean Fleets rule is a reasonable and innovative approach to clean up the vehicles on our roads and ensure that Californians have the clean air that they want and deserve. At the same time, this rule provides manufacturers, truck owners, and fueling providers the assurance that there will be a market and the demand for zero-emissions vehicles while providing a flexible path to making the transition toward clean air.”

The board says that the move is critical to the health and finances of California. While trucks represent only six percent of the vehicles on California’s roads, CARB reports they account for over 35 percent of the state’s transportation-generated nitrogen oxide emissions and a quarter of the state’s on-road greenhouse gas emissions. CARB projects the new rule to generate $26.6 billion in health savings from reduced asthma attacks, emergency room visits, and respiratory illnesses. Furthermore, fleet owners will save an estimated $48 billion in their total operating costs from the transition through 2050. An analysis of the sales and purchase requirements estimates that about 1.7 million zero-emission trucks will hit California roads by 2050.

Recognizing the scope of the transition that is called for under this rule, CARB notes that they have included transitions. Other fleet owners for example will have the option to transition a percentage of their vehicles to meet expected zero-emission milestones, which CARB says gives owners the flexibility to continue operating combustion-powered vehicles as needed during the move toward cleaner technology. The flexibility is intended to take into consideration the available technology and the need to target the highest-polluting vehicles.

The rule also allows fleet owners to receive exemptions based on available technology to make sure fleet owners continue to replace their older polluting trucks with ones that have the cleanest engines in the nation. CARB reports that there are already about 150 existing medium- and heavy-duty zero-emission trucks that are commercially available in the U.S. today.

As part of the vote, board members also directed staff to coordinate with relevant state agencies on how non-fossil biomethane from sources related to the state’s wastewater and food waste diversion requirements can be used in hard-to-decarbonize sectors as part of the transition. The report will be presented to the board by the end of 2025. The board will use it to consider what actions might be needed to accomplish the transition.

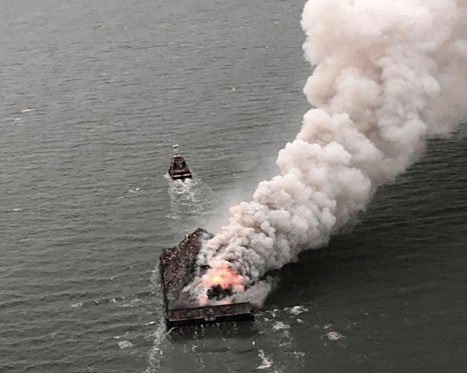

Courtesy Memorial Fire Company

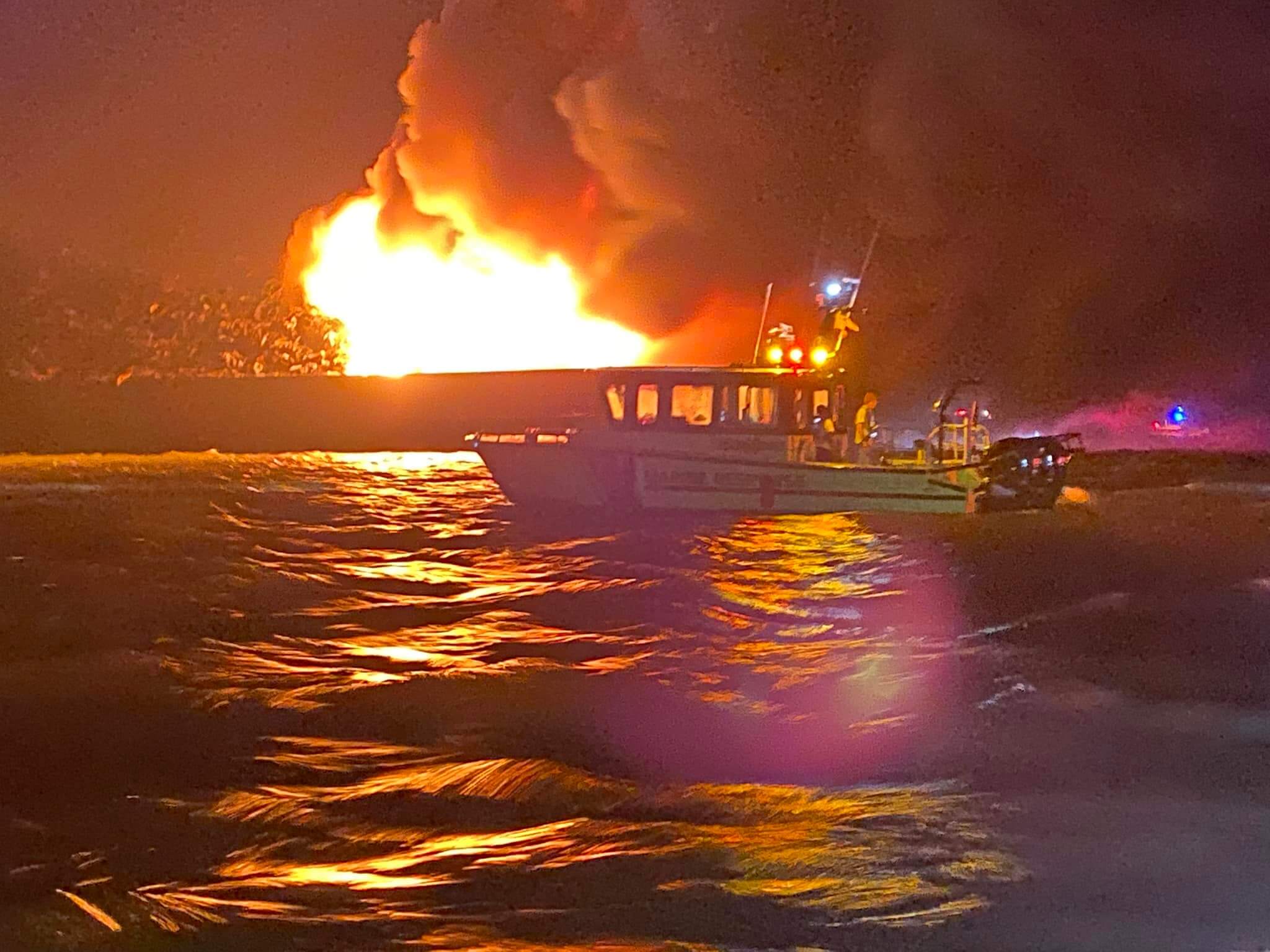

Courtesy Memorial Fire Company