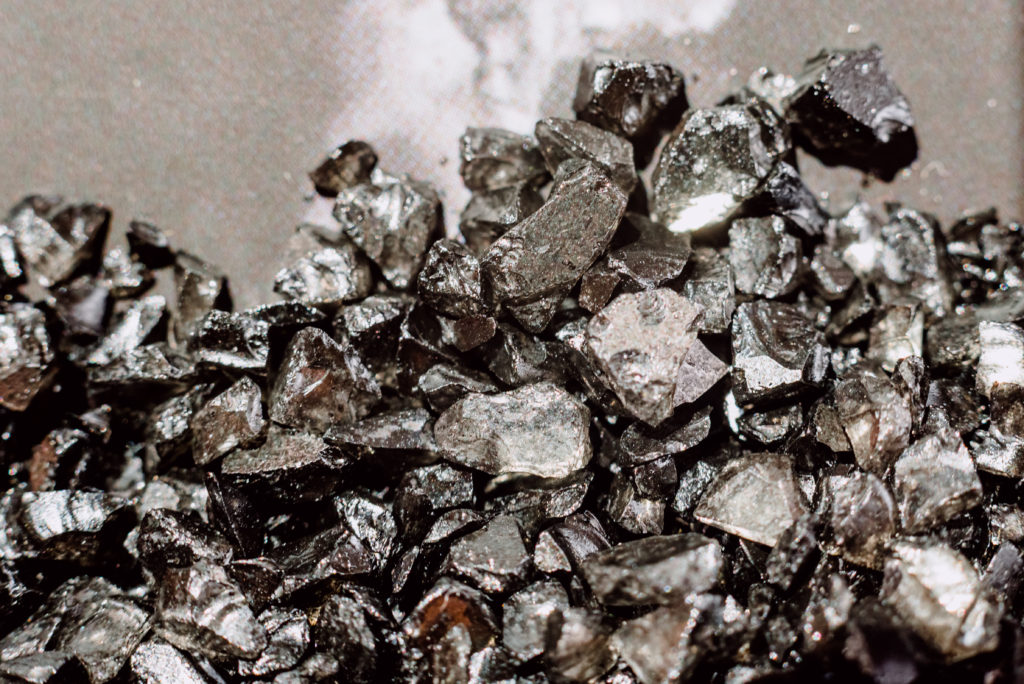

GEMOLOGY

De Beers Merges Two Auctions Amid Slow Market

De Beers has combined its May and July auctions as weak consumer spending in the US and China has dampened manufacturers’ demand for rough.

“This reflects our sustainable and responsible approach to rough-diamond supply and acknowledges the business needs of auctions customers,” a De Beers spokesperson said Tuesday

The miner’s fifth auction of the year was previously set for May 30 to 31, while the sixth edition was supposed to take place from July 4 to 5. The company has not scheduled the new sale and will communicate the date in due course, the spokesperson added. The company holds 10 auction cycles each year.

The change applies to both the interim auctions — sales of smaller and lower-quality goods — and the main auctions, which include rough above 2 carats.

Diamond trading has slowed in recent weeks amid economic caution across the world. Cutting firms in India have reduced polished production and are trying to limit their inventories.

Botswana’s Okavango Diamond Company (ODC), which has access to 25% of goods from the country’s Debswana joint venture with De Beers, saw 62 out of 148 lots go unsold at its May spot auction. ODC had not responded to a request for comment at press time Wednesday.

“The [second] quarter looks bad, but we are all focused on the [JCK Las] Vegas show, and hopefully we will see some kind of demand taking place [ahead of] Christmas and Thanksgiving…that will help the [third] quarter,” commented Vipul Shah, chairman of India’s Gem & Jewellery Export Promotion Council (GJEPC). “China is also very slow, and that is where we’re all feeling the pinch.”

Image: Rough diamonds on display at De Beers in Kimberley, South Africa. Ben Perry/Armoury Films/De Beers

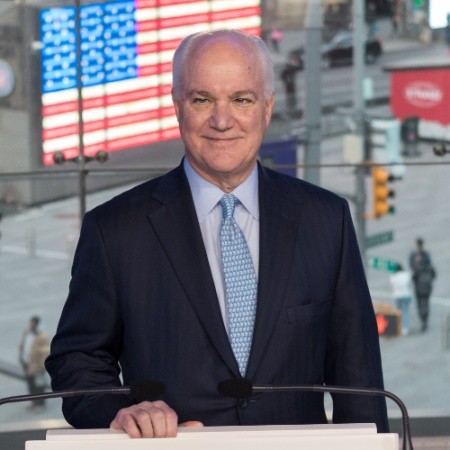

28-Piece JAR Jewelry Collection Sells Out at Christie’s

The largest private collection of jewels by designer JAR to be offered at auction raked in $6.7 million at Christie’s Geneva Wednesday

The top lot of the 28-piece group was a sapphire, spinel and diamond Eye bangle, which pulled in $956,965, more than three times its high estimate, Christie’s said. In total, the Magnificent Jewels auction achieved $45.8 million, with 94% of items finding buyers.

“The Magnificent Jewels sale…reflects the demand for spectacular jewels and colored gemstones, demonstrating the strength of the jewelry market amongst collectors around the world,” said Max Fawcett, head of jewelry for Christie’s in Geneva.

Some 11 lots realized more than $1 million, Christie’s noted. The auction featured jewels from Chaumet, Harry Winston, and other well-known designers and saw participation from bidders in 29 countries. Of those, 38% were located in the Americas, 34% in the Europe, Middle East and Africa region, and 28% in Asia Pacific.

Here are four of the other most valuable items:

Image: The JAR Eye bangle. (Christie’s)

Bulgari Blue Diamond Rakes In over $25 Million

A blue diamond weighing 11.16 carats sold for $25.2 million on Tuesday, becoming the most valuable jewel at this year’s Geneva auctions, according to Sotheby’s.

The Bulgari Laguna Blu, a pear-shaped, fancy-vivid-blue stone, surpassed its $25 million high presale estimate after a four-minute bidding battle between several buyers, Sotheby’s noted. It was the lead item in the Magnificent Jewels and Noble Jewels sale, which realized $85.4 million — Sotheby’s highest total for that auction in five years.

“The sale of the Laguna Blu tops the remarkable performance of our Magnificent Jewels and Noble Jewels sale that saw exceptional colored gemstones, in particular emeralds and yellow diamonds, punch through their high estimates,” said Olivier Wagner, head of jewelry for Sotheby’s Geneva.

These are the other lots rounding out the top 10:

Main image: The Bulgari Laguna Blu diamond. (Sotheby’s)