ALASKA

BLM drags feet on Ambler Road decision

Announces a six-month delay on permit reevaluation decision

North of 60 Mining News -

Updated 5/25/2023

NANA Corp.

Bornite Camp sits atop a world-class copper-cobalt deposit at the western terminus of the proposed Ambler Road.

Despite the growing calls by Alaska Native tribal and municipal leaders for an expedited review of the Ambler Access Project, the U.S. Bureau of Land Management announced that it will take six extra months for it to complete a supplemental environmental impact statement for the proposed 211-mile road to the Ambler Mining District in Northwest Alaska.

"This unnecessary delay threatens a project that will provide much-needed jobs and economic growth for Alaskans, while also strengthening national security and expediting the transition to a clean energy economy that is supposedly a top priority of the Biden Administration," said Ramzi Fawaz, president and CEO of Ambler Metals, a company that plans to develop a copper-rich mine at the western terminus of the proposed Ambler Road.

Located about 200 miles west of the Dalton Highway, a lone transportation artery that connects Alaska's North Slope with the rest of the state, the Ambler Mining District is rich in high-grade deposits of copper, zinc, cobalt, and other metals critical to a world transitioning to clean energy.

Recognizing the need for surface access to unlock the rich mineral potential in the Ambler District, the U.S. Congress included special provisions in the 1980 Alaska National Interest Lands Conservation Act (ANILCA) that guaranteed the approval of a transportation corridor to this metals-rich region of Northwest Alaska.

Section 201 (4) of ANILCA reads, "Congress finds that there is a need for access for surface transportation purposes across the Western (Kobuk River) unit of the Gates of the Arctic National Preserve (from the Ambler Mining District to the Alaska Pipeline Haul Road) and the Secretary shall permit such access in accordance with the provisions of this subsection."

In 2020, the U.S. Bureau of Land Management and National Park Service, both of which fall under the Interior Department, approved the federal authorizations needed to build a road that would meet the Congressional mandate to provide surface access to the Ambler District.

Early last year, however, BLM suspended the authorizations for further review.

The federal land manager cited a lack of adequate consultation with Alaska tribes and evaluation of potential impacts the road might have on subsistence uses as reasons to remand the previously issued authorizations.

This added review of the Ambler Road permits was originally slated to be finalized with a supplemental environmental impact statement record of decision by the end of this year. On May 19, however, BLM pushed the date for this decision out to mid-2024.

"Until last week's status report, the U.S. Department of the Interior consistently promised a ROD by the end of 2023," Fawaz said. "DOI now states the ROD is expected six months later, with no justification for the delay or assurances that there will be no further slippage."

For an infrastructure project in Alaska, this is roughly equivalent to a one-year delay due to the limited summer field season.

This postponement is frustrating for the Alaska Industrial Development and Export Authority, a quasi-state-owned corporation better known as AIDEA that plans to build the road and recoup the construction and maintenance costs from tolls charged to companies that develop mines in the district.

"This delay not only impacts AIDEA and our partners with additional costs, but it also impacts individuals, communities, and the State who would like to see the economic benefits, future jobs and revenue that come with construction and operation of the road," said Alaska Industrial Development and Export Authority Executive Director Randy Ruaro.

These economic benefits were underscored by the Northwest Arctic and North Slope boroughs in a joint resolution urging the Interior Department to expedite its reevaluation of the Ambler Road permits.

In their joint resolution, these boroughs representing a combined 19 Alaska Native communities across 135,500 square miles of Alaska's northernmost reaches said the Ambler Road and mines it would enable has the potential to create more than 8,700 direct, indirect, and induced construction and operation jobs that would pay nearly $700 million in annual wages.

Alaska Industrial Development and Export Authority

The proposed 211-mile Ambler Road would provide access to the Ambler Metals' Upper Kobuk Mineral Projects and other deposits in the Ambler Mining District of Northwest Alaska.

Arctic, the first mine slated for development in the Ambler District, is expected to produce 1.93 billion pounds of copper, 2.24 billion lb of zinc, 334.8 million lb of lead, 423,000 ounces of gold, and 36 million oz of silver over an initial 13 years of mining.

Ambler Metals, a 50-50 joint venture between Trilogy Metals Inc. and South32 Ltd., is also advancing plans to develop a mine at Bornite, a world-class copper-cobalt deposit that lies on Alaska Native lands owned by NANA Corp.

The wider Ambler District hosts dozens of other deposits and prospects that would provide economic benefits to northern Alaska communities, revenues to the state, and a domestic supply of minerals critical to the U.S. and its transition to clean energy and transportation.

"Interior needs to stop dragging its feet and complete this process and allow this road to be built, as it is already required by federal law," Fawaz added.

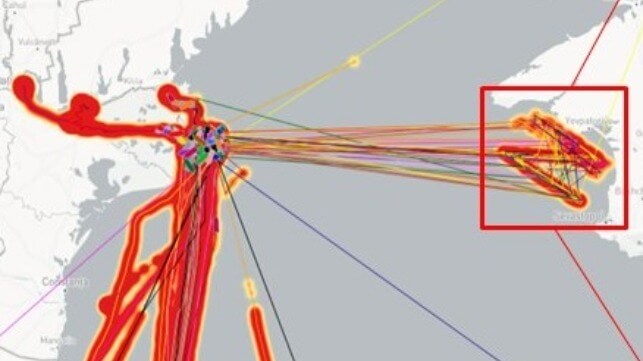

This month, a large number of merchant ships in and around the Bystry Canal region of Ukraine had their AIS locations remotely spoofed to the coastal waters of Russian-occupied Crimea. However, instead of a random pattern or a cluster, the AIS positions form a clear "Z" shape, the de facto symbol of support for the Russian invasion. (This precision AIS spoofing could also be performed in a simpler manner by transmitting false AIS signals, supplementing the ships' accurate AIS transmissions with corrupted duplicates.)

This month, a large number of merchant ships in and around the Bystry Canal region of Ukraine had their AIS locations remotely spoofed to the coastal waters of Russian-occupied Crimea. However, instead of a random pattern or a cluster, the AIS positions form a clear "Z" shape, the de facto symbol of support for the Russian invasion. (This precision AIS spoofing could also be performed in a simpler manner by transmitting false AIS signals, supplementing the ships' accurate AIS transmissions with corrupted duplicates.)