How Clean Tech Can Put Shipping on Course for Paris Targets

[By Isabelle Gerretsen]

There is growing consensus that shipping must rapidly decarbonize to keep global warming below the critical threshold of 1.5C, and that switching to green fuels is the best way to achieve this.

Though zero-carbon fuels, such as methanol and ammonia, are on the horizon, they aren’t yet commercially viable or scalable. Decarbonizing shipping will require US$1-1.9 trillion of investment for new infrastructure to generate hydrogen, which can be used to produce ammonia, and is itself widely considered the best of the three future fuels.

While they wait for the arrival of sustainable fuels, what are shipping companies doing in the short-term to cut their emissions and ensure their vessels can carry more goods further, using less fuel?

Many are looking to innovative technologies, including software to increase efficiency and optimize routes, and metal sails to reduce reliance on polluting fossil fuels.

These short-term measures are partly driven by new regulations introduced by the European Union (EU) and the International Maritime Organization (IMO), the UN body responsible for shipping.

Tristan Smith, an expert in shipping and energy at University College London’s Energy Institute, said such measures “are critical for the shipping sector because the transition away from fossil fuels is not on track to happen fast enough to bring absolute emissions down in line with 1.5C-aligned decarbonization.”

“International shipping needs to reduce its emissions intensity by about 40% by 2030, [compared to a] 2018 baseline. Very little emissions intensity reduction in that timescale will come from a switch to other fuels because their supply chains are not mature,” Smith added.

“[Short-term solutions] can significantly reduce the cost of operating on more expensive ammonia, and reduce the pressure on the ramp-up of supply of ammonia in what is already a very challenging timescale,” he said. Most ammonia today is generated in a highly energy-intensive process, which releases large amounts of carbon dioxide and methane. The technology to produce renewable ammonia at scale and store it is not yet available.

New regulations

After many years of dragging its feet, the IMO has finally started introducing regulations to curb shipping emissions.

From the start of this year, shipping companies must monitor and report their vessels’ annual carbon emissions. All ships over 400 gross tonnage must meet a minimum energy efficiency standard. Ships must also prove they are reducing their carbon intensity – a metric that combines greenhouse gas emissions with cargo carried and distance traveled.

According to Smith, the carbon intensity requirement “could be particularly effective at incentivizing a broad range of options for reducing CO2 emissions intensity because it acts on the actual emissions in operation.” However, he said the system “has weak stringency that means compliance can be achieved with minimal changes to current practice, and it has little enforcement mechanism.”

Meanwhile the EU, as part of efforts to reach its 2030 goal of reducing emissions by at least 55%, is introducing an array of new climate, energy and transport laws, including the incorporation of maritime emissions in the bloc’s emissions trading scheme (ETS).

From the start of 2024, all ships transporting goods to and from the EU – regardless of the flag they fly – will be taxed on their emissions.

The inclusion of shipping in the ETS will raise a large pool of funds that the EU can use to accelerate innovation and develop low-carbon fuels and renewable energy infrastructure.

Wind propulsion

The new regulations are driving market demand for carbon-slashing solutions that are currently available, unlike green fuels, said Diane Gilpin, chief executive of the Smart Green Shipping Alliance, a UK-based systems design company.

One such solution is wind-assisted technology. Smart Green Shipping has designed a retrofit for ships looking to decarbonize: automated retractable steel and aluminum sails which allow operators to use wind power instead of fossil fuels for part of their voyage.

“We have to start reducing emissions now,” said Gilpin, noting the warning from UN climate science body the IPCC (Intergovernmental Panel on Climate Change), that to keep the 1.5C goal alive, global emissions will need to peak by 2025, halve by 2030 and reach net zero by 2050. Shipping is not on that trajectory, unless it starts thinking about near-term solutions,” she said.

A pilot project carried out by Smart Green Shipping found that a cargo ship could save 20% in fuel every year when fitted with the sails, on a transatlantic voyage from the US to the UK.

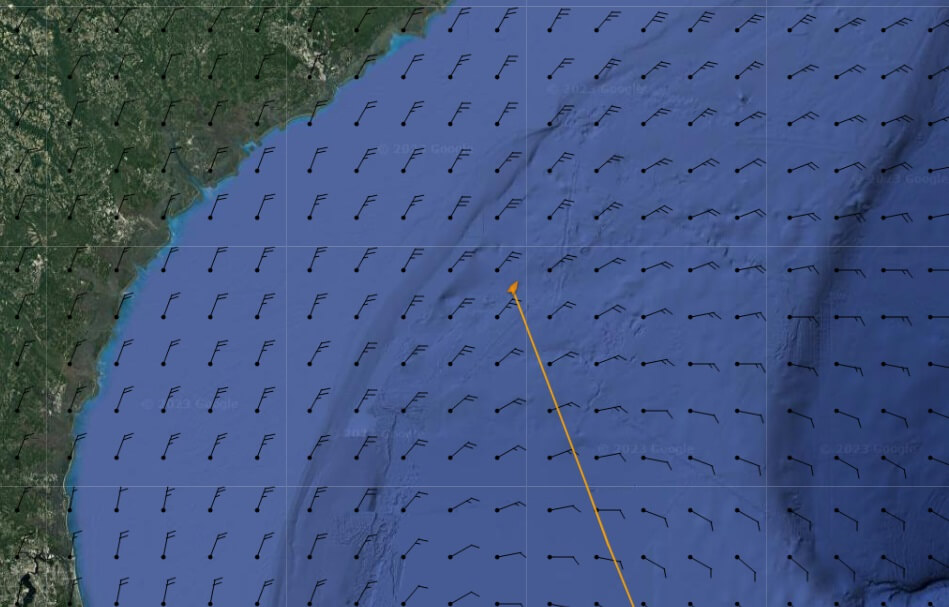

Smart Green Shipping has developed route-planning software that optimizes the use of wind. Gilpin says the sails automatically retract when the wind is too weak and would create drag, or too strong, posing a safety risk.

“The market is really keen on wind, but no one wants to be the first mover,” said Gilpin. “We aim to give the market confidence.” After securing funding from the UK government and private investors, Smart Green Shipping plans to start retrofitting its technology onto ships for commercial demonstration next year, after testing it on land first.

“Wind is seen as a useful, no regrets solution,” said Gilpin. “Because if you put wind on now, you reduce your fossil fuel risk exposure and in future you reduce your demand for an alternative fuel, which will be more expensive and less energy dense.”

Carbon reporting

In anticipation of the new regulations, Berlin-based start-up Zero44 has developed software that provides ship operators with daily reports on their carbon emissions and forecasts of future emissions.

“The ETS is a very immediate challenge for anyone who’s trading in the European Union,” said Zero44’s chief executive Friederike Hesse. “If shipping companies don’t start managing their emissions very consciously, they will have a problem as [the ETS] will have a huge cost effect immediately. They understand that and they’re reacting to it now.”

Under the ETS, the annual operating costs of an average bulk carrier that emits 16,000 tonnes of CO2 per year and trades only between European ports would increase by 1.3 million euros (US$1.4 million) in 2026, according to Hesse.

“The compliance burden is also very high,” she said, explaining that ship operators will need to generate certificates which show how much tax they owe based on their emissions output. “There are lots of accounting and transparency issues,” she said, adding that Zero44 is planning on launching software later this year that will help their customers stay on top of all the ETS requirements.

Zero44 helps shipping companies understand their cost exposure, how the regulations will affect their commercial bottom line, and show them the financial and environmental consequences of their operational decisions, said Hesse. She added that, in the future, the company plans to provide recommendations for their clients to help optimize their voyages and environmental performance.

“A large contribution to efficiency improvement can be achieved if the known and existing solutions, short-term technologies and operational improvements are rolled out more extensively across the fleet during this decade,” said Smith. “Shorter-term solutions that maximize efficiency this decade in line with 1.5C will mean the sector needs roughly 40% less fuel to enable the same amount of trade.”

Isabelle Gerretsen is a freelance journalist based in London who covers climate and environmental issues for a wide range of news outlets including Climate Home News, the BBC and CNN International.

This article appears courtesy of China Dialogue Ocean and may be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

As decarbonization moves higher up the global agenda, navigating the green transition and achieving more sustainable operations is a key priority for the maritime industry. According to the IMO, shipping is responsible for around 2.5% of global greenhouse gas emissions, and if no climate impact mitigation is undertaken, emissions could increase by as much as

As decarbonization moves higher up the global agenda, navigating the green transition and achieving more sustainable operations is a key priority for the maritime industry. According to the IMO, shipping is responsible for around 2.5% of global greenhouse gas emissions, and if no climate impact mitigation is undertaken, emissions could increase by as much as