History Says It’s Time to Buy Long-Term Bonds as Peak Rates Near

Ye Xie and Liz Capo McCormick

Sat, July 15, 2023 at 2:00 PM MDT·5 min read

(Bloomberg) -- Investors loading up on long-term bonds have history at their back.

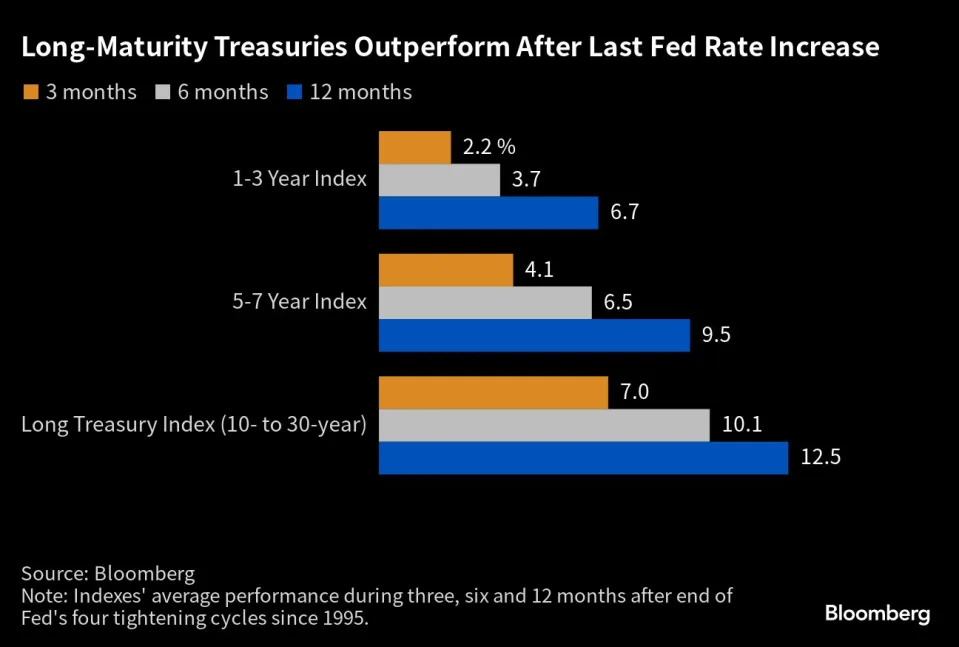

For decades, Treasuries maturing in 10 or more years have consistently outperformed shorter-dated sectors immediately following the last in a series of interest-rate increases by the Federal Reserve. On average, they returned 10% over six months after the fed funds rate peaked.

Of course, only in hindsight is it known whether a rate increase is the last one. But investors have embraced the view that an expected quarter-point hike in the target range for the federal funds rate on July 26 will conclude the epic series that began in March 2022. And surveys by Bank of America Corp. and JPMorgan Chase & Co. have found that investors digesting the price action have jacked up their exposure to long-dated bonds.

“We like the idea of extending and adding duration at this point in the cycle,” said Nisha Patel, a managing director of SMA portfolio management at Parametric Portfolio Associates LLC. “Historically, over previous tightening cycles, yields have tended to decline” during the period between the last hike and the first rate cut, she said.

Bonds this week logged their biggest gains since March — when the failure of several regional banks unleashed haven demand — after a report showed consumer prices increased at the slowest pace in two years. Swap contracts that as recently as last week assigned more than 50% odds to another Fed rate increase after this month repriced that to around 20%, and added to wagers on rate cuts next year.

The sentiment shift kneecapped the dollar, which suffered its biggest weekly loss since November. With the European Central Bank and other major monetary authorities expected to remain in tightening mode, there’s probably more downside in store for the greenback, according to strategists at ING Bank N.V.

In bonds, the biggest moves in yield were in short- and intermediate-maturity tenors where expectations for Fed policy are expressed. The five-year rate tumbled nearly 35 basis points, compared with just 13 basis points for the 30-year.

But long-dated bonds’ greater price sensitivity to a given change in yield means investors can reap bigger rewards. On average, Treasuries maturing in 10 or more years have gained 10% in the six months after a Fed policy-rate peak, compared with 6.5% for bonds maturing between five and seven years and 3.7% for those due within three years, according to data compiled by Bloomberg. In 12 months, the longest-dated bonds returned 13%, outpacing the other sectors.

“There is finally income to be earned in the fixed-income market,” BlackRock President Rob Kapito told analysts Friday, calling the higher yields a “remarkable shift” and a “once-in-a-generation opportunity.”

As an end-of-cycle theme, it’s proven more reliable than wagering on relative changes in yields such as the one that occurred this week as two- to five-year rates dropped more than longer-dated ones, producing a steeper yield curve.

The difference between two- and 10-year yields increased in the six months after the Fed concluded a tightening cycle in December 2018, but it narrowed following the end of one in 2006.

“Going long duration at the end of the hiking cycle is a more consistent trade than the steepener, which is more conditional on a harder landing outcome from the Fed,” Bank of America’s strategists including Mark Cabana and Meghan Swiber wrote in a note.

A Bank of America investor survey conducted monthly since 2004 found that respondents had amassed a record amount of interest-rate risk relative to their benchmarks in June before trimming a bit this month.

“I love duration here,” said Eddy Vataru, a fixed-income manager at Osterweis Capital Management. Inflation, which cooled to 3% last month, its 12th straight drop from a peak of 9.1% last year, has scope to fall below 2%, he said.

To be sure, Fed policymakers remain on guard. Their quarterly forecasts for the policy rate released in June had a median expectation for two additional increases this year. Fed Governor Christopher Waller Thursday said he agreed with that even after the latest inflation reading as the labor market remains very robust.

Even if employment strength induces the Fed to keep tightening beyond July, investors may pile into Treasuries because yields are high enough to be a compelling hedge against a possible recession, said Michael Franzese, head of fixed-income trading for New York-based market-maker MCAP LLC.

“You have a lot of investors looking now to make a bet and buy” if yields move back up, he said. “We may see a wave of new buying coming in, as Treasuries are an asset that could start to accrete really well for investors when the Fed does eventually start cutting.”