The researchers analyzed gems from the Arabian-Nubian Shield and compared them with similar gems from around the globe to find unique characteristics of gems from the region.

By JERUSALEM POST STAFF

Published: AUGUST 4, 2023

Sunrise Ruby and Diamond ring of 25 carats by Cartier and a 90 carat Briolette of India Diamond Necklace by Harry Winston, are seen during a preview of the 700-piece jewellery collection of the late Austrian billionaire Heidi Horten at Christie's before the auction sale in Geneva, Switzerland, May 8

(photo credit: DENIS BALIBOUSE/REUTERS)

Gems have unique elemental compositions that can be used to identify their location of origin, according to a new study published earlier this week found.

The peer-reviewed study, published in the academic journal AIP Advances, recorded how researchers were able to examine the unique elemental compositions to identify ancient trade routes.

What is a gemstone?

A gem, or gemstone, is a piece of mineralized crystal which has been cut and polished. Gems, often appreciated for their beauty, have been harvested from mines and traded throughout the world for thousands of years.

The researchers analyzed gems from the Arabian-Nubian Shield and compared them with similar gems from around the globe by using laser-induced breakdown spectroscopy (LIBS), Fourier transform infrared (FTIR) spectroscopy, and Raman spectroscopy.

An employee shows a large gem-quality diamond named by Russian miner Alrosa after Sputnik-V, a vaccine against the coronavirus disease (COVID-19), in Moscow, Russia February 25, 2021. Picture taken February 25, 2021.

(credit: TATYANA MAKEYEVA/ REUTERS)

By using the aforementioned technologies to review the gems, the researchers identified the elements which caused the gems’ unique colors. The iron content, for example, correlated to the amethysts' purple color.

In the Arabian-Nubian Shield, gemstones are exposed to mineral deposits between the Red Sea in Egypt and Saudi Arabia that originate from the Earth’s earliest geological age. Through looking at the gems’ unique compositions, and where those gems have been found globally, the researchers were able to identify historic trade routes.

"We showed the main spectroscopic characteristics of gemstones from these Middle East localities to distinguish them from their counterparts in other world localities," said author Adel Surour to Science Daily. "

This includes a variety of silicate gems such as emerald from the ancient Cleopatra's mines in Egypt, in addition to amethyst, peridot, and amazonite from other historical sites, which mostly date to the Roman times.

"Gemstones such as emerald and peridot have been mined since antiquity," Surour said. "Sometimes, some gemstones were brought by sailors and traders to their homelands. For example, royal crowns in Europe are decorated with peculiar gemstones that originate from either Africa or Asia. We need to have precise methods to distinguish the source of a gemstone and trace ancient trade routes in order to have correct information about the original place from which it was mined."

By using the aforementioned technologies to review the gems, the researchers identified the elements which caused the gems’ unique colors. The iron content, for example, correlated to the amethysts' purple color.

In the Arabian-Nubian Shield, gemstones are exposed to mineral deposits between the Red Sea in Egypt and Saudi Arabia that originate from the Earth’s earliest geological age. Through looking at the gems’ unique compositions, and where those gems have been found globally, the researchers were able to identify historic trade routes.

"We showed the main spectroscopic characteristics of gemstones from these Middle East localities to distinguish them from their counterparts in other world localities," said author Adel Surour to Science Daily. "

This includes a variety of silicate gems such as emerald from the ancient Cleopatra's mines in Egypt, in addition to amethyst, peridot, and amazonite from other historical sites, which mostly date to the Roman times.

"Gemstones such as emerald and peridot have been mined since antiquity," Surour said. "Sometimes, some gemstones were brought by sailors and traders to their homelands. For example, royal crowns in Europe are decorated with peculiar gemstones that originate from either Africa or Asia. We need to have precise methods to distinguish the source of a gemstone and trace ancient trade routes in order to have correct information about the original place from which it was mined."

Using Gemstones’ Unique Characteristics To Uncover Ancient Trade Routes

AUGUST 1, 2023

AIP ADVANCES

Modern spectroscopy techniques can rapidly identify gemstone origins, distinguish natural from synthetic, and isolate elements that contribute to their quality.

From the Journal: AIP Advances

WASHINGTON, Aug. 1, 2023 – Since ancient times, gemstones have been mined and traded across the globe, sometimes traveling continents from their origin. Gems are geologically defined as minerals celebrated for beauty, strength, and rarity. Their unique elemental composition and atomic orientation act as a fingerprint, enabling researchers to uncover the stones’ past, and with it, historical trade routes.

In AIP Advances, from AIP Publishing, Khedr et al. employed three modern spectroscopic techniques to rapidly analyze gems found in the Arabian-Nubian Shield and compare them with similar gems from around the world. Using laser-induced breakdown spectroscopy (LIBS), Fourier transform infrared (FTIR) spectroscopy, and Raman spectroscopy, the authors identified elements that influence gems’ color, differentiated stones found within and outside the region, and distinguished natural from synthetic.

AIP ADVANCES

Modern spectroscopy techniques can rapidly identify gemstone origins, distinguish natural from synthetic, and isolate elements that contribute to their quality.

From the Journal: AIP Advances

WASHINGTON, Aug. 1, 2023 – Since ancient times, gemstones have been mined and traded across the globe, sometimes traveling continents from their origin. Gems are geologically defined as minerals celebrated for beauty, strength, and rarity. Their unique elemental composition and atomic orientation act as a fingerprint, enabling researchers to uncover the stones’ past, and with it, historical trade routes.

In AIP Advances, from AIP Publishing, Khedr et al. employed three modern spectroscopic techniques to rapidly analyze gems found in the Arabian-Nubian Shield and compare them with similar gems from around the world. Using laser-induced breakdown spectroscopy (LIBS), Fourier transform infrared (FTIR) spectroscopy, and Raman spectroscopy, the authors identified elements that influence gems’ color, differentiated stones found within and outside the region, and distinguished natural from synthetic.

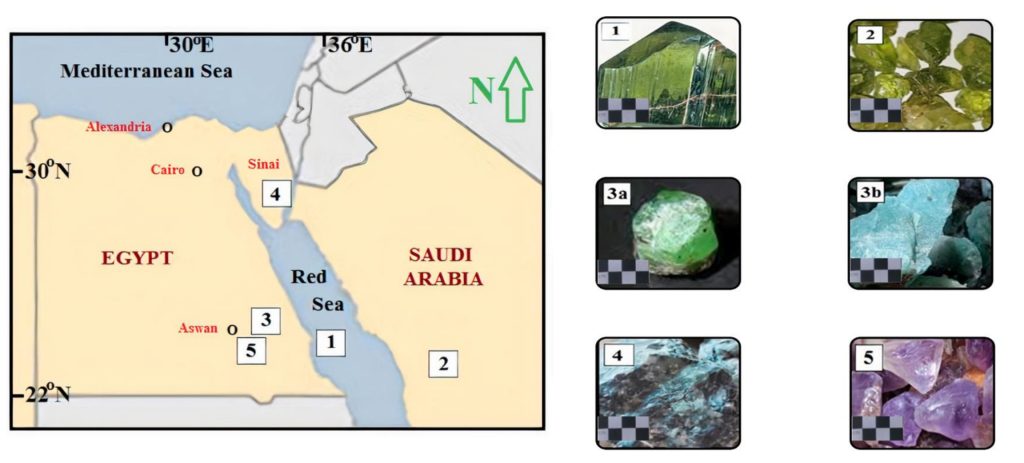

Locations of the investigated gem minerals from Egypt and Saudi Arabia. Scaled photos of colored gem minerals are given. For all, field of view (FOV) = 4 cm. (1) Peridot, Zabargad (St. John’s), off the Egyptian Red Sea coast. (2) Peridot from Harrat Kishb (volcanic field), Saudi Arabia. (3a) Emerald and (3b) Amazonite, Wadi Sikait, Wadi El-Gemal area, Eastern Desert, Egypt. (4) Low-grade emerald (beryl), Wadi Ghazala, Sinai Peninsula, Egypt. (5) Amethyst, Aswan area, Eastern Desert, Egypt. Credit: Khedr et al.

The Arabian-Nubian Shield is an exposure of mineral deposits that sandwiches the Red Sea in current-day Egypt and Saudi Arabia. The deposits date back to the Earth’s earliest geological age, and the precious metals and gemstones have been harvested for thousands of years.

“We showed the main spectroscopic characteristics of gemstones from these Middle East localities to distinguish them from their counterparts in other world localities,” said author Adel Surour. “This includes a variety of silicate gems such as emerald from the ancient Cleopatra’s mines in Egypt, in addition to amethyst, peridot, and amazonite from other historical sites, which mostly date to the Roman times.”

The various spectroscopic techniques they employed revealed different information about the stones. LIBS quickly characterizes chemical composition, while FTIR determines functional groups connected to the structure and indicates the presence of water and other hydrocarbons. Even for chemically identical materials, Raman spectroscopy shows the unique crystalline structure of the gems’ atoms.

The authors identified that iron content correlates to amethysts’ signature purple hue, and other elements such as copper, chromium, and vanadium are also responsible for colorization. A signature water peak exposes lab-grown synthetic gems, which are useful for scientific purposes and identical to natural gems but are less expensive.

Crystalline structure differentiated amazonite beads from Mexico, Jordan, and Egypt.

“Gemstones such as emerald and peridot have been mined since antiquity,” Surour said. “Sometimes, some gemstones were brought by sailors and traders to their homelands. For example, royal crowns in Europe are decorated with peculiar gemstones that originate from either Africa or Asia. We need to have precise methods to distinguish the source of a gemstone and trace ancient trade routes in order to have correct information about the original place from which it was mined.”

Article Title

Characterization and discrimination of some gem silicate minerals adopting LIBS, FTIR and Raman spectroscopic techniques

The Arabian-Nubian Shield is an exposure of mineral deposits that sandwiches the Red Sea in current-day Egypt and Saudi Arabia. The deposits date back to the Earth’s earliest geological age, and the precious metals and gemstones have been harvested for thousands of years.

“We showed the main spectroscopic characteristics of gemstones from these Middle East localities to distinguish them from their counterparts in other world localities,” said author Adel Surour. “This includes a variety of silicate gems such as emerald from the ancient Cleopatra’s mines in Egypt, in addition to amethyst, peridot, and amazonite from other historical sites, which mostly date to the Roman times.”

The various spectroscopic techniques they employed revealed different information about the stones. LIBS quickly characterizes chemical composition, while FTIR determines functional groups connected to the structure and indicates the presence of water and other hydrocarbons. Even for chemically identical materials, Raman spectroscopy shows the unique crystalline structure of the gems’ atoms.

The authors identified that iron content correlates to amethysts’ signature purple hue, and other elements such as copper, chromium, and vanadium are also responsible for colorization. A signature water peak exposes lab-grown synthetic gems, which are useful for scientific purposes and identical to natural gems but are less expensive.

Crystalline structure differentiated amazonite beads from Mexico, Jordan, and Egypt.

“Gemstones such as emerald and peridot have been mined since antiquity,” Surour said. “Sometimes, some gemstones were brought by sailors and traders to their homelands. For example, royal crowns in Europe are decorated with peculiar gemstones that originate from either Africa or Asia. We need to have precise methods to distinguish the source of a gemstone and trace ancient trade routes in order to have correct information about the original place from which it was mined.”

Article Title

Characterization and discrimination of some gem silicate minerals adopting LIBS, FTIR and Raman spectroscopic techniques

Authors

Amal Abdelfattah Khedr, Adel A. Surour, Ahmed El-Hussein, and Mahmoud Abdelhamid

Author Affiliations

Jouf University, Cairo University, Galala University