Flooded and forgotten: How Europe's disused coal mines are successfully being used to heat our homes

Abandoned coal mines are providing a surprisingly potent source of zero-carbon energy in Europe.

An old coal mine has been providing an English town with green energy for the last six months.

The ground-breaking project in Gateshead is using the warm water that has filled the tunnels to heat hundreds of homes and businesses in the former coalfield community.

Hailed a success, the UK’s first large-scale network shows the huge potential to be found in the nation’s sprawling warren of old mining tunnels, which sit beneath roughly a quarter of homes.

“What we have in Gateshead is a legacy from the days of the coal mines, which was dirty energy,” says John McElroy, cabinet member for the environment and transport at Gateshead Council. “Now we are leading the way in generating clean, green energy from those mines.”

Following decades of disuse, Britain’s coal mines have gradually flooded. Warmed by the earth, this liquid offers one answer to our renewable energy needs.

With an estimated 2 billion cubic metres of warm water - more than a quarter of the volume of Loch Ness - geologists believe that Britain’s mine shafts hold one of the biggest underused sources of clean energy.

“Recovering heat from mine water below the ground within abandoned coal mines provides an exciting opportunity to generate a low carbon, secure supply of heat, benefitting people living or working in buildings on the coalfields,” says Gareth Farr, head of heat and by-product innovation at the Coal Authority.

The authority owns and manages the disused coal-mining infrastructure on behalf of the UK government.

“With many millions of people living upon abandoned coalfields in Great Britain, the potential for mine water heat could be significant.”

Tapping into the heat from water in the mines has the added benefit of boosting the economies of some of the communities most badly hit by deep coal mining closures in the 1980s. So how does it work exactly, and where is it taking off?

How can flooded mines help to heat homes?

Mine water gets warmer the deeper it goes, as this interactive map of old coal mines from the UK Coal Authority shows. Temperatures typically range from 10 to 20C but can reach up to 45C at depths of 1km - such as the Yorkshire site.

Left to mix with the subterranean rock, the water often contains toxic compounds. But as a thermal source it is a valuable resource that can be harnessed through drilling boreholes which bring it to the surface.

The water is then directed through heat pumps and extractors which compress the liquid, raising it to a much higher temperature before distributing it through heating networks.

Once its heat has been absorbed in surrounding buildings, the water can be poured back into the mine system where it will be warmed up again.

Mine water heat also has the advantage of working all year round. Temperatures aren’t affected by the seasons, and the water can be used to cool homes as well as heat them.

Which UK towns are tapping into the energy source?

Once at the heart of the Industrial Revolution, north-east England is now leading the way on this alternative energy source.

Gateshead Council’s mine water project launched in March 2023 and is now one of the largest in Europe. With government funding, it installed 5km of new heat network pipes, boreholes and a heat pump energy centre capable of producing 6 mega-watts of mine water heat.

This now provides secure, low-carbon heating to 350 high rise homes, a college, art gallery, several office buildings and a large manufacturing site.

The Coal Authority and partners have been researching the potential for recovering low-carbon heat from disused coal mining infrastructure for several years.

Inside a coal mine in the English midlands.Getty Images

The UK Geoenergy Observatory (UKGEOS) based in Glasgow and run by the British Geological Survey, is one of the key research stations for this exploratory field.

After the busy mines of the Scottish city and nearby town of Rutherglen shut, natural floods filled them with water of about 12C. In summer 2021, a dozen boreholes drilled into the site and fitted with hundreds of sensors provided a clearer image of the network of flooded tunnels. They revealed how fast water flows among mines, how warm it is, how quickly it replenishes and reheats.

“The data from these 12 boreholes in Glasgow will help scientists around the world understand the subsurface and geothermal energy better,” said UKGEOS’s Alan MacDonald.

The Glasgow Observatory and another project in Cheshire are part of a £31 million (€37 million) investment by the Department for Business, Energy and Industrial Strategy (BEIS). The funds being devoted to this research show the increasing interest the government is taking in this striking form of geothermal energy.

The European pioneers of geothermal energy

By tapping into its history to create new geo-energy assets, the UK is following in the footsteps of other European countries.

The world’s first mine water power station opened in the Dutch city of Heerlen in 2008. It is now connected to around 500 houses and commercial facilities - cutting the area's carbon emissions from heating by almost two thirds.

A similar project is underway in the rugged Asturias region of northern Spain, where flooded coal shafts are heating (and cooling) a hospital, university and numerous other buildings.

Mine water pumped from underground has significant heating potential across Europe.Coal Authority

"Geothermal energy has given a second life to our coal mines," Asturias's director of energy María Belarmina Díaz Aguado told the BBC.

Countries repurposing their underground reserves are also looking further north, to Iceland, a pioneer of geothermal energy.

But though the first mine water power station is on European ground, the technology was harnessed nearly two decades earlier in Springhill, Nova Scotia.

Synonymous with mining disasters, the Canadian community started using the heat from its dormant coal mines in 1989. One packaging firm in the town now boasts a 100 per cent renewable system, all year round.

A mining site in the Ambler Metal Arctic deposit area in Alaska.Credit...Bonnie Jo Mount/The Washington Post, via Getty Images

A mining site in the Ambler Metal Arctic deposit area in Alaska.Credit...Bonnie Jo Mount/The Washington Post, via Getty Images

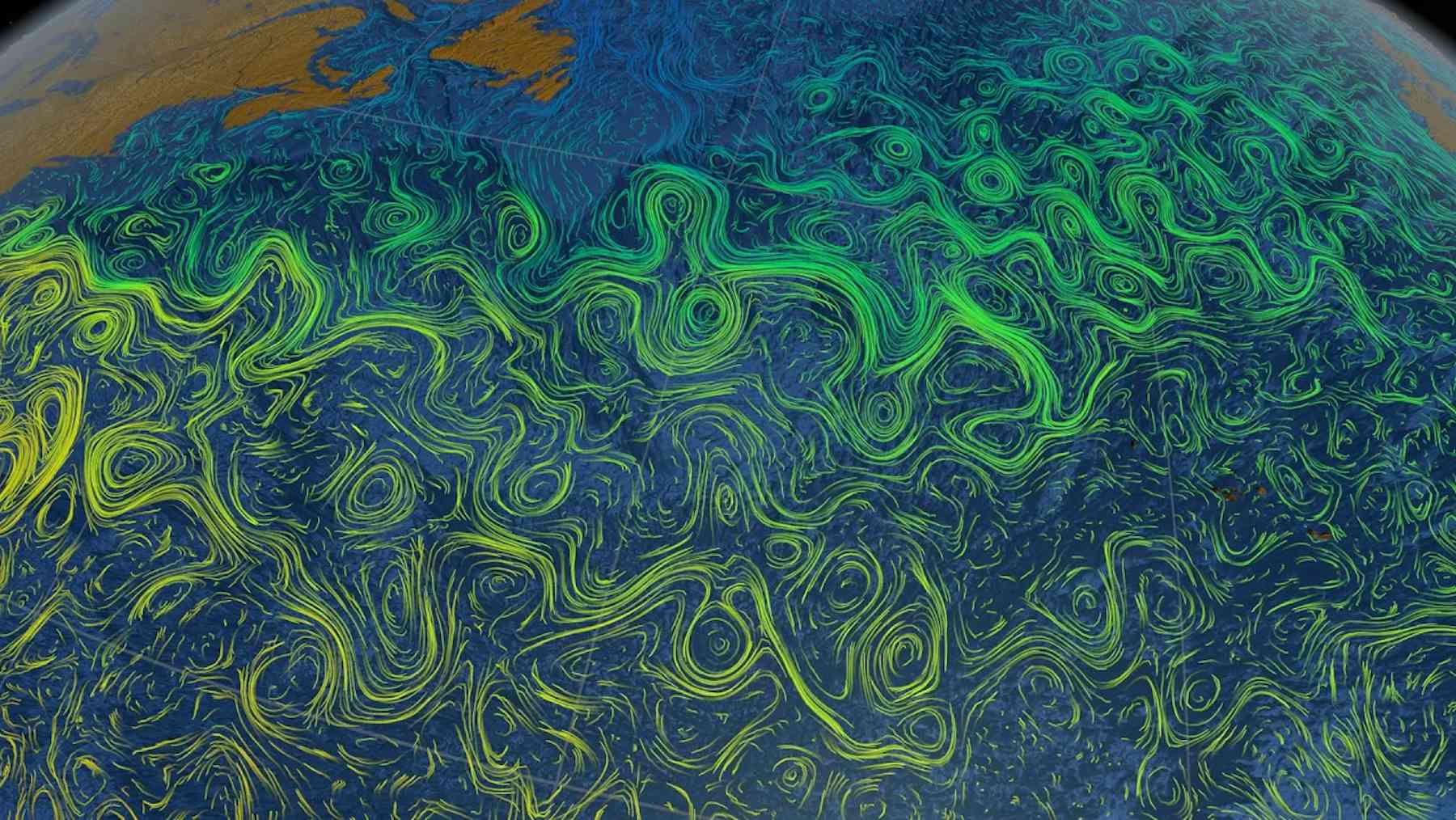

Earth’s oceans are filled with complex network of currents driven by the rotation of the planet. NASA / Goddard Space Flight Center Scientific Visualization Studio

Earth’s oceans are filled with complex network of currents driven by the rotation of the planet. NASA / Goddard Space Flight Center Scientific Visualization Studio