Nial McGee - The Globe and Mail | November 1, 2023 |

Noront’s Esker Camp at the Ring of Fire. (Image: Noront Resources | Facebook.)

Ottawa is finally getting ready to accept applications for a C$1.5-billion infrastructure fund to support critical minerals mines, with stakeholders in Ontario’s Ring of Fire hoping they will be among the recipients.

Natural Resources Canada announced Tuesday that projects eligible to apply for the new Critical Minerals Infrastructure Fund include clean energy and transportation projects that support critical minerals mines. Eligible recipients include the private sector, the provinces and territories, and Indigenous groups.

CMIF is being set up because the federal government committed to the funding over seven years to support critical minerals infrastructure as part of its April, 2022, budget.

Funds will be made available for early stage projects that are still in the planning and engineering stage, as well as “shovel ready” projects that are nearing construction and have already been permitted. The government said it expects to start taking proposals in the late fall for shovel-ready projects.

Companies can apply for up to C$50-million in funding, while provincial and territorial governments can request up to C$100-million for public projects.

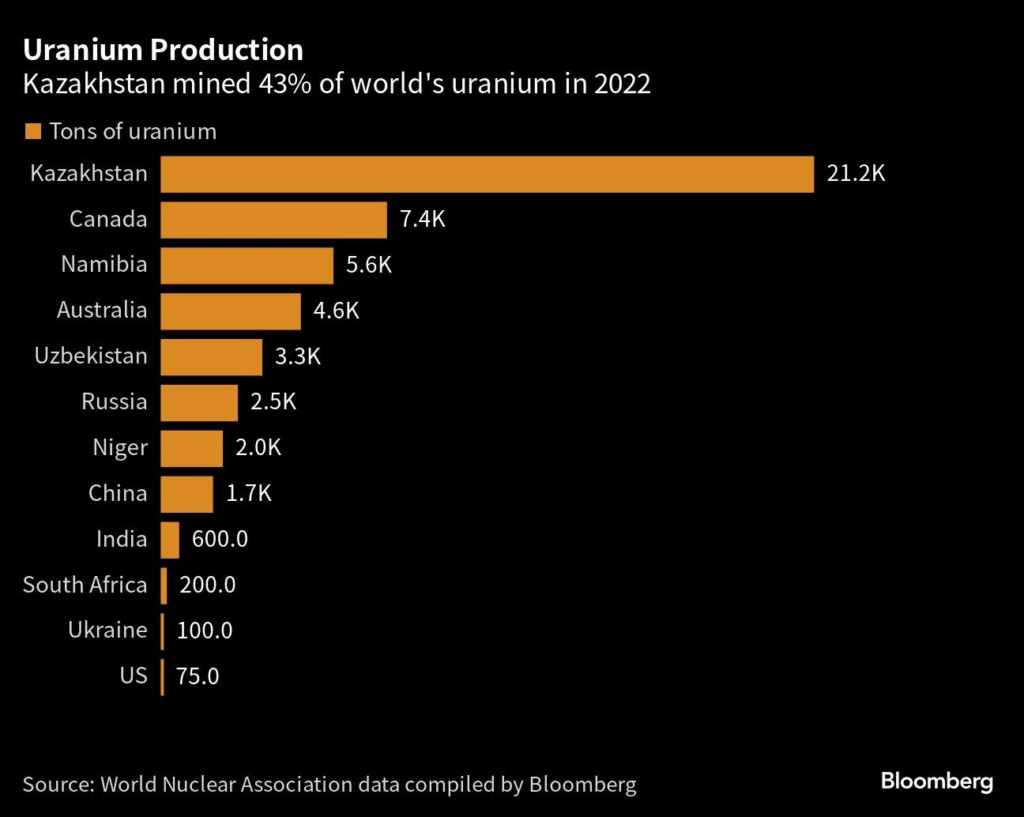

Canada currently has 31 minerals that it has deemed critical, but the federal government has identified six that are a priority: lithium, graphite, nickel, cobalt, copper and rare earth elements. While the country has made huge strides in building out its electric battery manufacturing infrastructure, there are few Canadian companies who mine or refine the critical minerals needed for these factories.

Photinie Koutsavlis, vice-president, economic affairs and climate change with the Mining Association of Canada, said that while the broad strokes of the government’s plan for spending on critical minerals infrastructure appears to be promising, the execution will be crucial. So far, she said, the government has moved slowly on this initiative, as more than 18 months have passed since it was announced.

Moreover, given the narrative the government espouses about how “we need to capture this generational opportunity in critical minerals” and better compete with the United States, which is spending hundreds of billions through the Inflation Reduction Act, the ability to follow through is key, Ms. Koutsavlis said.

“Through the last two budgets, the mining sector has done very well with respect to government announcements, but the execution and the implementation of these programs have been lagging,” she said.

The undeveloped Ring of Fire region in Northern Ontario is one of Canada’s highest profile critical minerals projects with massive infrastructure challenges, and one of many projects that will look for funding from Ottawa as part of CMIF. The Ontario government has already committed to funding $1-billion, or about half of the costs for roads into the Ring of Fire.

Qasim Saddique, principal consultant at Suslop, has been working with Marten Falls of Northern Ontario, which is leading federal environmental impact assessments into proposed roads into the Ring of Fire and co-leading another assessment alongside Webequie First Nation. The roads would connect both the two Indigenous communities and the isolated Ring of Fire mining camp to the provincial highway network some 300 kilometres to the south. The road project was last estimated to cost C$2-billion.

Mr. Saddique said that the two First Nations will be making an application for funding as part of the CMIF, as he concedes that its funding needs are immense.

“This one project would definitely eat up that entire pot,” he said. “Having said that, I do think it’s the largest project of its kind in the country.“

Located 550 kilometres northeast of Thunder Bay, the undeveloped Ring of Fire region has no access to the grid, or road connectivity, meaning that any metals that may eventually be mined there have no way of getting to market.