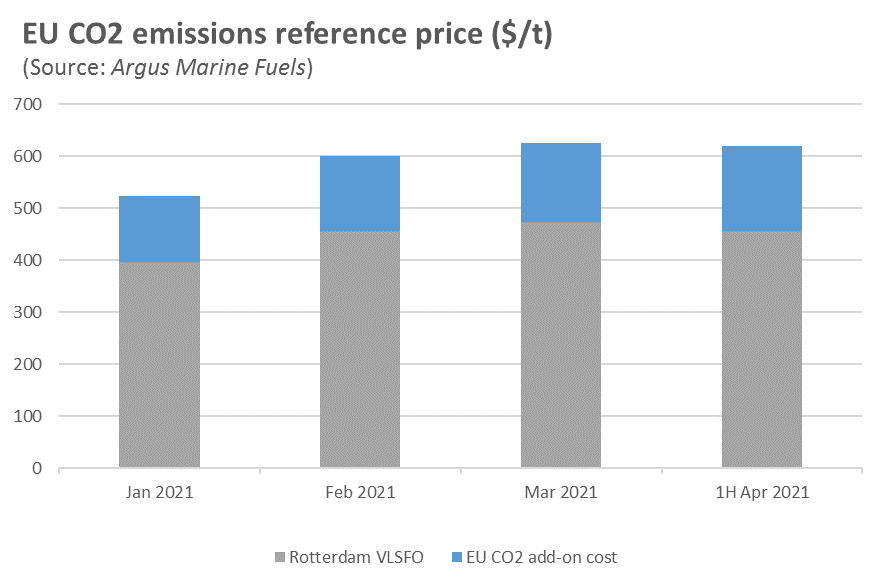

[By PAC Corinne Zilnicki]

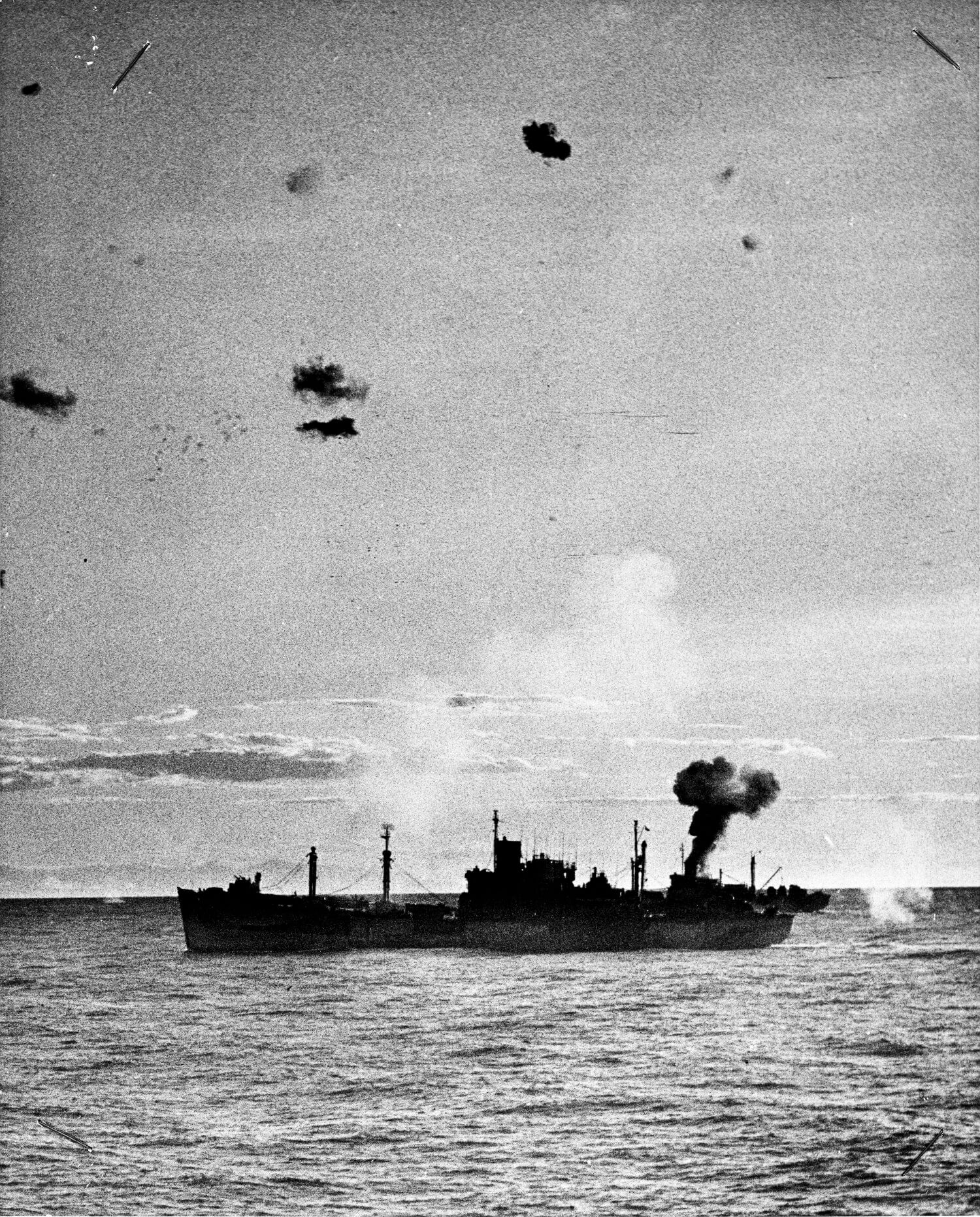

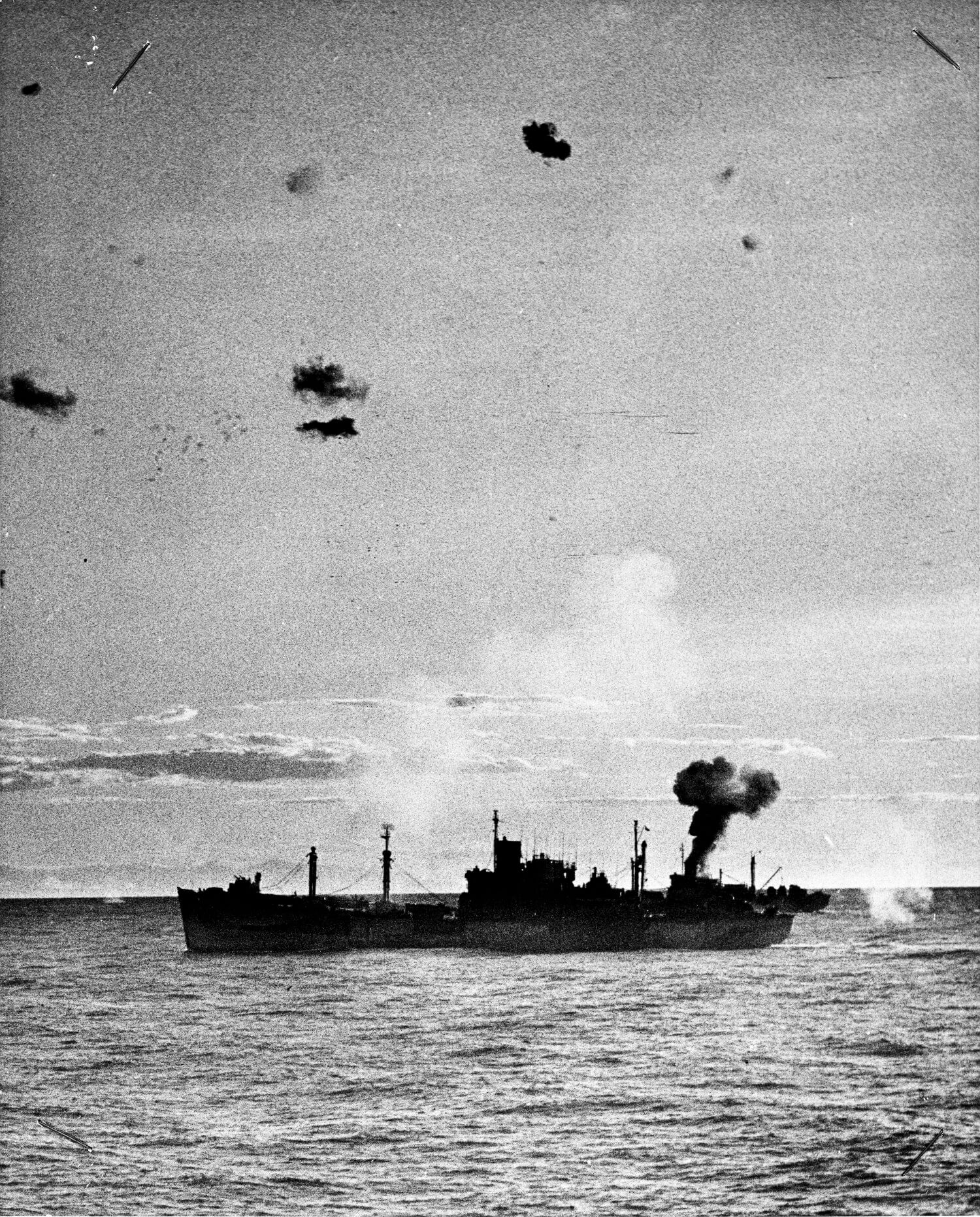

An imposing convoy of warships cut through the waters of the Lingayen Gulf northwest of the Philippines, the ships forming an orderly parade of slow-moving silhouettes. Six hulking transport ships led the charge, followed closely by cargo ships, landing craft and smaller amphibious assault vessels.

It was Jan. 8, 1945, and the Allied forces had been deeply ensconced in the Southwest Pacific theatre of World War II for more than three years.

The convoy made a beeline for Luzon, the largest of the Philippine islands and an invaluable target that would deny Japan passage through the South China Sea. Once captured, Luzon would also grant the Allies access to the capital city of Manila and sheltered anchorage of Manila Bay.

When the warships of Blue Beach Attack Group were only 35 miles from Luzon’s shores, three Japanese aircraft materialized near the rear of the convoy, sweeping suddenly into an attack.

“Planes! They’re coming from the stern!” cried a chorus of voices aboard the USS Callaway, one of the attack transport ships leading the convoy.

Gunners aboard the Callaway had but seconds to react. Coast Guard Seaman First Class Rollin A. Fritch was one of the gunners who immediately leaped into action and peppered the incoming kamikaze aircraft with a hail of 20mm anti-aircraft gunfire. Fritch and his fellow gunners brought down two of the planes, but the third evaded the barrage and plunged down toward the bridge, unswerving in its deadly course.

USS Callaway under attack, Jan. 8, 1945 (USCG)

USS Callaway under attack, Jan. 8, 1945 (USCG)

Even as the kamikaze plane came hurtling toward him, Fritch remained at his post, forfeiting all chance of escape as he continued to fire his weapon. He fought bravely until the very moment the aircraft crashed into the starboard side of the bridge in a burst of flames that rattled the ship to its very keel.

Fritch, along with 28 other members of the crew, died in the fiery explosion.

The deceased from the attack awaiting burial at sea (USCG)

The news of his death deeply affected even the youngest members of his large family back home.

“I was only five years old when he was killed,” said Donna Fuller, Fritch’s niece, now 77 years old. “But I remember that my whole family was devastated. Uncle Rollin was such a sweet, kind person.”

Born in Blue Rapids, Kansas, on May 9, 1920, Rollin Fritch was the youngest in a family of eight children. His parents, Frank and Mary Fritch, owned over 80 acres of farmland and relied on their children to help tend the chickens and grow corn, wheat, and soybeans.

“Times were rough for them,” said Fuller. “It was a hard way to live.”

The family relocated to Pawnee City, Nebraska, and, after high school, Fritch struck out on his own. He moved to Sioux City, Iowa, and was working there at the Cudahy Packing Company plant when he decided to enlist in the U.S. Coast Guard on March 17, 1942.

“I remember he said he enlisted just to do his part,” Fuller recalled. “When he visited us on leave and we saw him in uniform, we were in awe.”

After completing basic training, Fitch served on the Coast Guard Cutter Galatea, whose missions consisted of escorting convoys along the Eastern Seaboard and conducting antisubmarine patrols.

In September 1943, he joined the crew of the USS Callaway and took part in five island invasions in the Southwest Pacific before the Lingayen Gulf assault in January 1945.

Donna Fuller, who avidly gathered and chronicled her family’s history since the late 1970s, was not alone in admiring her uncle’s heroism and valor.

Fritch was posthumously awarded the Purple Heart Medal and the Silver Star Medal, the third-highest decoration a service member can receive. Decades later, Fritch’s ultimate sacrifice received a more lasting tribute.

In November 2014, the Coast Guard announced the names of the ten newest 154-foot Sentinel-Class cutters, also known as Fast Response Cutters. One of them would be homeported in Cape May, New Jersey, and officially commissioned on November 19, 2016. That ship’s name would be Coast Guard Cutter Rollin Fritch.

“It was a complete shock when we found out,” said Fuller, who accepted the role of the cutter’s official sponsor. “To have Uncle Rollin chosen among so many heroes is such an honor.”

“I think it’s fitting that the Coast Guard chose to honor enlisted heroes in such a way,” said Rear Adm. Meredith Austin, commander of Coast Guard District Five in Portsmouth, Virginia. “The enlisted force is what makes up the backbone of the Coast Guard, after all.”

This article appears courtesy of The Long Blue Line and can be found in its original form here.

The opinions expressed herein are the author's and not necessarily those of The Maritime Executive.

USS Callaway under attack, Jan. 8, 1945 (USCG)

USS Callaway under attack, Jan. 8, 1945 (USCG)