First Mining road project put on hold

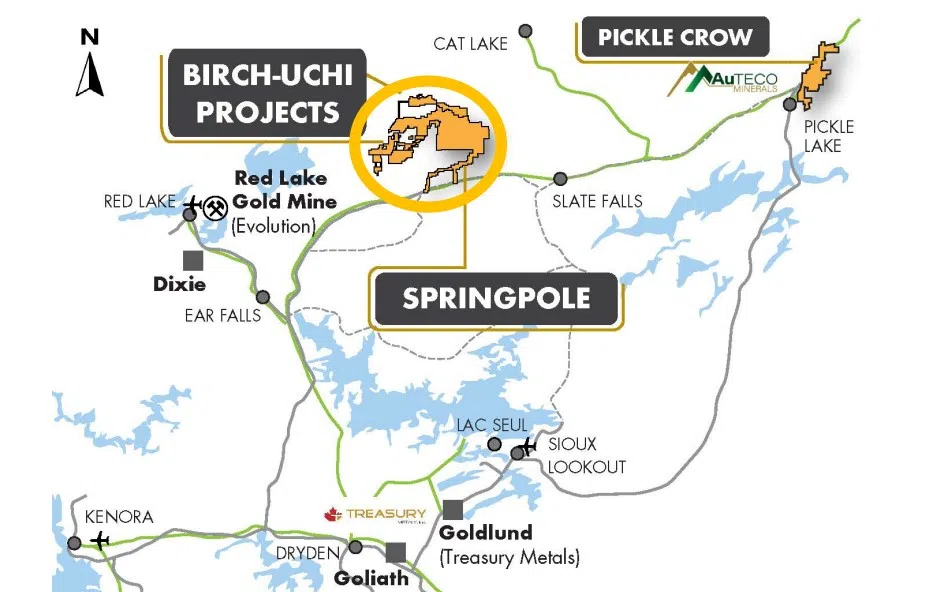

Map courtesy First Mining Gold

The construction of a mining access road near Cat Lake First Nation is now on hold.

A court judge has granted, at the request of the community, an interim order pausing the work by First Mining Gold.

The company received permission from the Ministry of Natural Resources and Forestry to build an 18-kilometre road to its Springpole mining project.

The company wants the road to avoid travel over winter roads.

Since establishing a camp in 2015, First Mining has used an ice road to move supplies and access the site.

It travels 40 kilometres, of which 34 is over ice and half over nearby Birch Lake.

First Mining says there have been several incidents of vehicles breaking through.

Cat Lake objects to the work, saying the Ministry ignored the community’s moratorium on mining exploration and related road work within its traditional territory.

First Mining indicates it proactively engaged with the area’s Indigenous communities over the past year regarding the safety concerns of using the ice road in light of the warm conditions experienced.

Chief Executive Officer Dan Wilton says he is disappointed by the band’s decision but is open to further talks.

“First Mining continues to listen to the concerns of Indigenous communities and is always willing to meet with community leaders to discuss these and any other matters regarding our activities in their traditional territories,” says Wilton in a release.

First Mining adds it has committed significant resources toward consultation efforts with the area’s Indigenous communities and is committed to working with them to understand the potential impacts on their rights and the traditional land users around the exploration Camp.

Gold in the Cold: First Mining's Winter Road Project Faces Legal Challenge in Northwestern Ontario

Discover the ongoing battle between economic development and indigenous rights in northwestern Ontario, as the construction of a winter road to the Springpole Gold Project exploration camp sparks legal resistance from the Cat Lake First Nation.

BNN Correspondents

26 Feb 2024

/bnn/media/media_files/9874d1e57151f4ebd57adc1a829d2335bb8513be0e15efa34b873ce17dc50f18.jpg)

In the heart of northwestern Ontario, a battle unfolds that pits the promise of economic development against the preservation of indigenous rights and environmental integrity. On February 9, 2024, First Mining Gold Corp. received construction permits for a temporary winter road leading to the Springpole Gold Project exploration camp. This development, heralded by some as a step forward in the gold exploration sector, has been met with legal resistance from the Cat Lake First Nation, sparking a conversation that transcends the mere construction of an 18 km pathway through the wilderness.

The Road Not Taken Lightly

The proposed winter road is not just a matter of logistics but a narrative of safety, environmental stewardship, and community engagement. Designed to provide a safer alternative for transporting supplies and personnel, the road aims to mitigate the risks posed by increasingly unreliable ice roads—a consequence of warmer winter conditions. Since 2015, First Mining has operated the remote exploration camp with a commitment to minimizing environmental impact and respecting traditional land use practices. Yet, the road's construction has been paused by an interim stay, following the Cat Lake First Nation's notification of their intent to challenge the permits issued by the Ontario Ministry of Natural Resources and Forestry.

A Legal and Ethical Quagmire

The challenge put forth by the Cat Lake First Nation underscores a complex intersection of legal rights, environmental ethics, and indigenous sovereignty. While First Mining emphasizes its dedication to safety and environmental responsibility, the First Nation's concerns highlight the potential for disruption and the need for thorough consultation and consent processes. This scenario is emblematic of a broader dialogue in Canada and worldwide, where the rights and wishes of indigenous communities are increasingly recognized in the face of industrial expansion.

Looking Forward: Engagement and Resolution

Despite the current legal standoff, First Mining maintains its commitment to ongoing dialogue and engagement with the Cat Lake First Nation and other indigenous communities. The outcome of this situation could set a precedent for how resource exploration companies and indigenous territories can coexist and collaborate. As the legal process unfolds, both parties may find an opportunity to redefine the parameters of mutual respect, environmental stewardship, and economic development in a way that honors the land and its original caretakers.

In this unfolding story of gold, ice, and indigenous rights, the path forward is as much about building bridges of understanding and cooperation as it is about constructing a road through the wilderness. As the case progresses, it will undoubtedly continue to attract attention from those invested in the future of resource exploration, indigenous sovereignty, and environmental preservation in Canada and beyond.

By NNL Digital News Update

-February 23, 2024

Cat Lake First Nation (CLFN) has filed for an injunction in the Divisional Court of Ontario seeking to stop First Mining Gold (FMG) from constructing a new access road using Permits issued by the Ontario Ministry of Natural Resources & Forestry (OMNRF). This is against the wishes of CLFN on whose ]territory the new road is being built. The road construction is underway at a fast pace and Ontario and FMG have refused to stop construction.

The permits allow FMG to construct an 18 km road through Cat Lake’s traditional territory (440 Km NW of Thunder Bay). The successful injunction would halt FMG’s construction until the resolution of Cat Lake’s application for judicial review.

Cat Lake First Nation Chief Russell Wesley stated, “Ontario’s actions here fall far below their constitutional duty to consult and accommodate Cat Lake’s rights.” He went on to say, “Ontario’s decision and actions was made in defiance of a well-documented Moratorium on mining in the Cat Lake Territory and numerous public statements of opposition. Recently, I predicted in media interviews that the OMNRF would issue the permits despite Cat Lake First Nation’s concerns. This has happened, the OMNRF has forced Cat Lake First Nation into the courts.”

Cat Lake First Nation filed documents with the Superior Court of Justice (Divisional Court) in Thunder Bay on Feb 21st, 2024. The injunction would prohibit FMG from taking any steps to construct its proposed road from the end of the Wenasaga Road to its Springpole Gold Project exploration site, pending the resolution of Cat Lake First Nation’s application for judicial review.

Cat Lake has always maintained that it is still considering the development of the Springpole Mine Project in its traditional territory. Before Cat Lake can consent to any development it has consistently sought to better understand the potential impacts of the project on its Aboriginal rights, including the impact on the ability of members to exercise their rights to hunt, fish, and trap in the area, as well as the impact on possible sacred sites, such as pictographs and burial grounds of Cat Lake members and their ancestors. The OMNRF permit approval has significantly destabilized this situation.

Chief Russell Wesley observed, “Once such a road is built—cutting down trees, harming local wildlife habitat used by moose caribou and wolverine, depleting fish stocks, damaging sacred Cat Lake cultural sites, and disturbing Cat Lake burial grounds—such actions, and their harms, cannot be undone. Only the requested orders can prevent such harms until the serious issues in the underlying application are heard on the merits.”

The Chief said, “I am deeply concerned over the obvious prioritization of miner safety and the economic interests of mining companies over the safety and well-being of the Cat Lake community members. The five-year permit granted by MNRF is for the entirely land-based road route in stark contrast to Cat Lake First Nation being accessible by a seasonal winter road with several water crossings, made more dangerous and less predictable by climate change.”

The OMNRF issuance of these permits signals a lack of regard for the community’s voice and raises doubts about the Ontario government’s awareness of free, prior, and informed consent.

Cat Lake never signed any treaty with the Crown relinquishing its Aboriginal title or relinquishing its Aboriginal title or Aboriginal rights. Cat Lake was not a signatory to Treaty 9 in 1905-1906.

“We demand equal treatment and consideration for the well-being of our people as we continue to work towards protecting our rights and land,” Chief Wesley concluded.

Cat Lake First Nation Partners with Finnish Companies for Forest Biomass and Health Diagnostics Initiatives

By Don Huff

THUNDER BAY, Ontario — Cat Lake First Nation signed Memorandums of Understanding (MOUs) with two leading Finnish organizations to collaborate on forest biomass and long-distance healthcare diagnostic initiatives. …The first partnership involves a health diagnostics initiative with 73Health, focusing on deploying advanced remote medical diagnostic solutions for the benefit of remote communities, including Cat Lake First Nation. This initiative is part of 73Health’s expansion plans across North America, with Ontario being a priority location. …The second partnership with Natural Resources Institute Finland (LUKE) aims to advance a Northern Bioeconomy Network, focusing on scientific and academic exchange and the sustainable utilization of forest biomass resources for economic growth. The intent is to complete an ecological and economic master plan within a year. … Minister Graydon Smith said “Funding delivered by the Indigenous Bioeconomy Partnerships stream will ensure Ontario’s growing forest bioeconomy builds prosperity for Indigenous businesses and communities.”

THUNDER BAY, Ontario — Cat Lake First Nation signed Memorandums of Understanding (MOUs) with two leading Finnish organizations to collaborate on forest biomass and long-distance healthcare diagnostic initiatives. …The first partnership involves a health diagnostics initiative with 73Health, focusing on deploying advanced remote medical diagnostic solutions for the benefit of remote communities, including Cat Lake First Nation. This initiative is part of 73Health’s expansion plans across North America, with Ontario being a priority location. …The second partnership with Natural Resources Institute Finland (LUKE) aims to advance a Northern Bioeconomy Network, focusing on scientific and academic exchange and the sustainable utilization of forest biomass resources for economic growth. The intent is to complete an ecological and economic master plan within a year. … Minister Graydon Smith said “Funding delivered by the Indigenous Bioeconomy Partnerships stream will ensure Ontario’s growing forest bioeconomy builds prosperity for Indigenous businesses and communities.”