US Speeds Offshore Wind Farm Development with More Reviews and Tax Guidance

The Biden administration continues to place a high priority on offshore wind as a key part of the country’s renewable energy strategy and is taking steps to support and accelerate the development of the industry. The Bureau of Ocean Energy Management (BOEM) announced plans to start the environmental review for another project while the Treasury Department finally issued long-awaited updates on the tax credits the industry views as essential to its planning.

BOEM reports that it will commence the environmental review of the plan submitted for Vineyard Northeast, the second project from Copenhagen Investment Partners which already has the Vineyard Wind Farm under construction with Avangrid. This second project calls for 2.6 GW of capacity located 29 miles offshore of Nantucket, Massachusetts.

The Vineyard Northeast proposal includes the installation of up to 160 wind turbine generators, up to three electrical service platforms, and one booster station in an adjacent lease area. It also envisions two offshore export cable corridors, one to Connecticut and one to Massachusetts, and associated onshore transmission systems.

This will be the 13th review initiated by the Biden administration and follows an announcement just a week ago to also start the view for Atlantic Shores Offshore Wind, which will be off the coast of New Jersey. Last month, the bureau reported it had completed the review for the New England Wind project to be located offshore Massachusetts, while it is also working on broader reviews for the New York Bight, the Central Atlantic, and now the Gulf of Maine.

The industry has also been calling for clarification and steps to implement the tax credits outlined in the Inflation Reduction Act passed in 2022. Eleven months ago they issued the first rules prompting questions from companies in the wind and other sectors. Ørsted and others cited in 2023 the challenges in gaining the credits as presenting a hurdle or the reason for abandoning some of their planned projects.

The Department of the Treasury today issued the long-awaited guidance for the requirements to gain the bonus under the Inflation Reduction Act for clean energy projects and facilities. Developers can receive a bonus of up to 10 percentage points on top of the Investment Tax Credit and an increase of 10 percent for the Production Tax Credit. The act provides a base 30 percent credit for renewable energy projects.

Saying that offshore wind projects make significant investments and create jobs at eligible ports over the duration of the projects, the guidance provided steps permitting offshore wind facilities to attribute their nameplate capacity to additional property in these ports. The guidance also clarifies details for a project that has multiple points of interconnection.

The Treasury Department says these steps will provide additional support to low-income communities by locating the equipment and jobs in those areas. The guidance was critical to the industry which was seeking additional information on the steps required for these credits.

Hornsea 3 Offshore Wind Farm Will Achieve an Energy Output of 2.9 GW

[By: Sarens]

The new wind farm, located 120 km off the Norfolk coast and 160 km off the Yorkshire coast, will be the single largest offshore wind project in the world with a surface area of 696 km2 and up to 231 turbines.

Sarens will work together with Aibel to assemble the two HVDC converter platforms at the Maptaphut facility in Rayong (Thailand), from where they will be transported to Haugesund to be equipped with Hitachi Energy's latest generation HVDC converter valve technology prior to final completion and commissioning.

The new Hornsea 3 offshore wind farm, located 120 km off the Norfolk coast and 160 km off the Yorkshire coast, will become, once commissioned in 2027, the largest offshore wind project in the world with up to 231 turbines, 696 km2 of occupied area and a clean electricity production of 2.9 GW, which will be enough to supply more than 3.3 million homes in the UK.

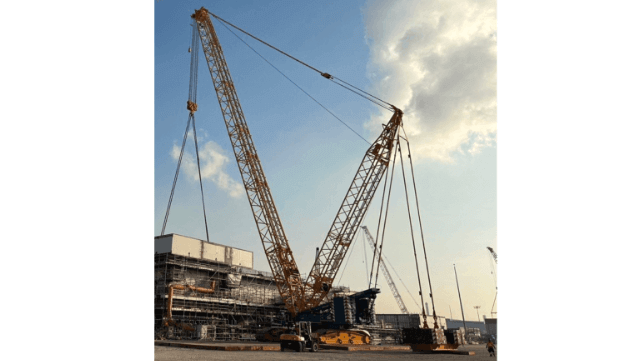

Sarens, world leader in heavy lifting, engineered transport and crane rental, is working with Aibel on the construction of the wind farm's two HVDC (high-voltage direct current) converter platforms at Aibel's facilities in Maptaphut, Rayong (Thailand). These units will be key to ensuring the performance of the wind farm, as they are the units responsible for transmitting large amounts of electricity over long distances, once the electricity produced by the wind turbines has been converted into alternating current.

This new facility, which will be operated by Ørsted, joins the two previous phases, which came on stream in 2019 and 2022 respectively. These two farms already contribute more than 2.5 GW of renewable energy to the UK grid, benefiting nearly 2.5 million homes.

For this operation, scheduled from January 2024 to the first quarter of 2025, Sarens transported two CC2800-1 crane units, each with a capacity of 600 tons, from its facility. Both cranes will collaborate in lifitng Section S210 weighing, 273 tons, and Section S220 weighing ,388.7 tons to their final positions, completing the module. As a preliminary step, the cranes were positioned on steel mats for crawl and stack the section on the surface , ensuring the operation’s security, precise crane movements, and preventing damage to both the material and operators in the vicinity.”.

When the wind farm comes online, Ørsted’s Hornsea trio – comprising Hornsea 1, 2, and 3 – will have a total capacity of in excess of 5 GW, making it the world’s largest operating offshore wind zone. The Hornsea zone will also include Ørsted’s Hornsea 4 project, which could have a capacity of up to 2.6 GW. Hornsea 4 received its development consent order from the UK government earlier in 2023 and is now eligible for forthcoming CfD allocation rounds.

Sarens has extensive international experience in the assembly and maintenance of wind farms. It has participated in various installations in France such as Fécamp, Saint Nazaire, Provence Grand Large in the lifting and transport work for the foundation bases of the new offshore wind farm in Saint Brieuc, located off the Brittany coast. During this project, Sarens successfully transported loads weighing over 1,150 tons. More recently, Sarens has worked in the receiving and loading out the monopiles and transition pieces for 176 turbines for the Coastal Virginia Offshore Windfarm.

The products and services herein described in this press release are not endorsed by The Maritime Executive.

Shell Sells Position in U.S. SouthCoast Offshore Wind JV to Partner

The realignment in the offshore wind sector continues with Shell reporting that it is honing its portfolio. In the latest move, Shell New Energies exited its 50 percent stake in SouthCoast Wind Energy which is in the permitting process for a 2.4 GW wind farm to be located off the coast of Massachusetts. It is the latest step seeing the energy giant reduce its participation in wind energy.

SouthCoast Wind was formed as a 50-50 joint venture in 2018 to develop offshore wind projects with its first lease for a site 30 miles south of Martha’s Vineyard and 23 miles south of Nantucket. The company is a partnership with Ocean Winds North America, which in turn is a partnership between EDP Renewables and ENGIE. When EDPR and ENGIE combined their offshore wind assets and project pipeline to create Ocean Winds in 2019, the company had a total of 1.5 GW under construction and 4.0 GW under development. In addition to SouthCoast Wind, Ocean Winds has Bluepoint Wind in the New York Bight and recently won the lease for Golden State Wind in the first auction for sites offshore from California.

The SouthCoast Wind project is still in the permitting stage with Rhode Island conducting hearings last month. The first phase of the project which would deliver approximately 1.2 GW via an electric grid connection in Massachusetts is targeted for the late 2020s. SouthCoast Wind still developing plans for the second phase of the project.

Shell reports it closed on the sale of its 50 percent interest of SouthCoast Wind to Ocean Winds. No valuation was announced for the shares. Ocean Winds now has 100 percent ownership of SouthCoast Wind, which was formerly known as Mayflower Wind.

"In-line with our Powering Progress strategy, Shell continues to hone our portfolio of renewable generation projects in key markets where we have an advantaged position," said Glenn Wright, Senior Vice President of Shell Energy Americas. "We are grateful to Ocean Winds for their years of partnership within this venture, and continue to seek opportunities to provide more energy, with fewer emissions."

The sale of the asset in the United States follows a similar strategy Shell is deploying globally. Last month the energy giant sold its position in a company working on the development of a wind farm in South Korea. Shell has also exited projects including in September 2022 two planned Irish wind farms. After acquiring French floating wind specialist Eolfi in 2019, Shell was reported in May 2023 preparing to sell the company after Wael Sawan became CEO and said Shell would be focusing on creating greater value for shareholders.

In addition to positions in wind energy in the UK and Norway, Shell is also a partner in New Jersey’s Atlantic Shores Offshore Wind with a 50 percent position. They are working in partnership with EDF Renewables North America for that wind farm project which calls for 1.5 GW of capacity. It is a more advanced project as last week the Bureau of Ocean Energy Management reported it is beginning the environmental review for the proposal.

Shell joins other majors which are also rearranging their positions in offshore wind energy. BP and Equinor ended their partnership splitting their U.S. wind portfolio while U.S. generation company Eversource is selling its project including a deal with partner Ørsted and another deal with private equity investors. The private equity sector is showing an increased interest in offshore wind as the sector matures and the projects have moved closer to construction completing the drawn-out permitting and approval process.